Flexe

Founded Year

2013Stage

Series D | AliveTotal Raised

$262.55MValuation

$0000Last Raised

$119M | 4 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-31 points in the past 30 days

About Flexe

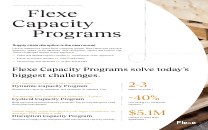

Flexe focuses on omnichannel logistics. It offers technology-powered logistics programs that help solve challenges in distribution, capacity, fulfillment, and same-day delivery. Its services primarily cater to the e-commerce and retail sectors. It was founded in 2013 and is based in Seattle, Washington.

Loading...

Flexe's Product Videos

ESPs containing Flexe

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The on-demand warehousing & fulfillment market provides flexible, short-term warehousing and fulfillment solutions without long-term contract commitments. It addresses the challenges of space shortage, seasonal demand fluctuations, and inflexible contracts in traditional warehousing by offering pay-as-you-go models and rapid deployment. The market leverages technology platforms to connect companie…

Flexe named as Highflier among 15 other companies, including ShipBob, Deliverr, and Stord.

Flexe's Products & Differentiators

Dynamic Distribution

Extend distribution networks in the midst of dynamic customer and business demands.

Loading...

Expert Collections containing Flexe

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Flexe is included in 5 Expert Collections, including Store tech (In-store retail tech).

Store tech (In-store retail tech)

1,840 items

Companies that make tech solutions to enable brick-and-mortar retail store operations.

Supply Chain & Logistics Tech

6,027 items

Companies offering technology-driven solutions that serve the supply chain & logistics space (e.g. shipping, inventory mgmt, last mile, trucking).

Unicorns- Billion Dollar Startups

1,297 items

Conference Exhibitors

5,302 items

Retail Tech 100

100 items

The most promising B2B tech startups transforming the retail industry.

Flexe Patents

Flexe has filed 5 patents.

The 3 most popular patent topics include:

- supply chain management

- distribution (business)

- manufacturing

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

9/9/2022 | 11/12/2024 | Application programming interfaces, Supply chain management, Systems engineering, Distribution (business), Software testing | Grant |

Application Date | 9/9/2022 |

|---|---|

Grant Date | 11/12/2024 |

Title | |

Related Topics | Application programming interfaces, Supply chain management, Systems engineering, Distribution (business), Software testing |

Status | Grant |

Latest Flexe News

Oct 1, 2025

It will grow to $220.96 billion in 2029 at a compound annual growth rate (CAGR) of 14.0%. ” — The Business Research Company LONDON, GREATER LONDON, UNITED KINGDOM, October 1, 2025 / EINPresswire.com / -- "Get 30% Off All Global Market Reports With Code ONLINE30 – Stay Ahead Of Trade Shifts, Macroeconomic Trends, And Industry Disruptors What Is The Expected Cagr For The On-Demand Warehousing Market Through 2025? The size of the on-demand warehousing market has seen significant expansion in the last few years. With an expected growth from $114.50 billion in 2024 to $130.92 billion in 2025, it boasts a compound annual growth rate (CAGR) of 14.3%. The impressive growth observed in the past years is credited to factors such as the escalation in peak-season and omnichannel fulfillment challenges, evolving consumer demand for speedy delivery, a greater necessity for geographic accessibility to customers, spiraling cost burdens on stationary warehousing, and a surge in the use of adaptable logistics technology or platforms. The market size of on-demand warehousing is predicted to experience substantial expansion in the subsequent few years. The projection is for growth to reach $220.96 billion in 2029, with a compound annual growth rate (CAGR) of 14.0%. This positive outlook for the forecast period is credited to a heightened interest from third-party logistics providers and adaptive models, an increased customer inclination towards pay-per-use business models, the escalating globalization of supply chains, amplified requirement for returns management and reverse logistics, and the rise of small and medium-sized businesses' involvement in e-commerce. Noteworthy trends during the forecast period consist of advancements in supply chain visibility tools, the amalgamation of digital platforms and marketplaces, the advent of technology-enabled automation and robotics, progress in data analytics and predictive modelling, improvements in cloud-based warehouse management systems, and the incorporation of blockchain technology. Download a free sample of the on-demand warehousing market report: https://www.thebusinessresearchcompany.com/sample.aspx?id=27682&type=smp What Are The Key Factors Driving Growth In The On-Demand Warehousing Market? The surge in e-commerce is projected to fuel the expansion of the on-demand warehousing market in the future. E-commerce refers to the online transaction of goods or services, facilitated by digital platforms and e-payment systems. Its growth is attributable to the rise in smartphone and internet usage, enabling consumers to easily browse, select, and buy products at their convenience. On-demand warehousing services aid in this e-commerce wave by providing adaptable, short-term storage and order fulfillment solutions, facilitating businesses to swiftly scale operations and cater to altering customer requirements without long-term warehouse obligations. For example, as per the Census Bureau, a US government organization, in February 2025, e-commerce sales in the fourth quarter (Q4) of 2024 saw a boost of 9.4% in comparison to the same duration in 2023. This rise exceeded the overall growth of retail sales at 3.8% and constituted 16.4% of the total retail sales. Thus, the progression of e-commerce is catalyzing the development of the on-demand warehousing market. What Are The Top Players Operating In The On-Demand Warehousing Market? Major players in the On-Demand Warehousing Global Market Report 2025 include: • Allcargo Logistics Ltd. • Emiza Supply Chain Services Pvt. Ltd. • ShipMonk Inc. • Xpressbees Logistics Pvt. Ltd. • ShipBob Inc. • Stord Inc. • Red Stag Fulfillment LLC • Flexe Inc. • Murphy Warehouse Company Inc. • Extensiv Inc. What Are The Key Trends Shaping The On-Demand Warehousing Industry? Key players in the on-demand warehousing market are innovating with strategies such as real-time inventory visibility to streamline warehouse operations, boost supply chain competency, cut down storage expenses, and ensure swift and precise order delivery. The strategy of real-time inventory visibility implies the capacity to instantly track and oversee stock levels at all sites, facilitating efficient inventory management through precise, current insights. To illustrate, Kinaxia Logistics Limited, a warehousing and transportation services organization based in the UK, rolled out a countrywide on-demand warehousing service in June 2024. This service equips retailers, manufacturers, wholesalers, and importers with a flexible and expandable solution for the effective storage and shipment of goods during high-demand seasons, promotional activities, or immediate storage requirements. With its seamless integration with customer systems and adjustable order call-offs at the SKU or pallet level, this launch has bolstered Kinaxia's end-to-end logistics provision, fusing warehousing, e-commerce fulfillment, and countrywide distribution into a robust, efficient and customer-focused solution. Comprehensive Segment-Wise Insights Into The On-Demand Warehousing Market The on-demand warehousing market covered in this report is segmented 1) By Service Type: Storage And Warehousing, Fulfillment And Distribution, Inventory Management, Transportation And Logistics, Packaging And Labeling 2) By Warehouse Type: Dry Storage, Cold Storage, Climate-Controlled Storage 3) By Deployment Mode: Cloud-Based, On-Premises 4) By Enterprise Size: Small And Medium Enterprises, Large Enterprises 5) By Industry Vertical: Manufacturing, Retail And E-commerce, Healthcare, Food And Beverage, Automotive, Other Industry Verticals Subsegments: 1) By Storage And Warehousing: Cold Storage, Bonded Warehousing, General Warehousing, Automated Warehousing, Specialized Warehousing 2) By Fulfillment And Distribution: Order Fulfillment, Last Mile Delivery, Cross Docking, Pick And Pack, Reverse Logistics 3) By Inventory Management: Stock Auditing, Demand Forecasting, Replenishment Management, Safety Stock Management, Inventory Tracking 4) By Transportation And Logistics: Freight Management, Route Optimization, Fleet Management, Shipment Tracking, Third Party Logistics 5) By Packaging And Labeling: Custom Packaging, Standard Packaging, Label Printing, Barcode Labeling, Eco Friendly Packaging View the full on-demand warehousing market report: https://www.thebusinessresearchcompany.com/report/on-demand-warehousing-global-market-report Global On-Demand Warehousing Market - Regional Insights In the On-Demand Warehousing Global Market Report 2025, North America ranked as the dominant region for 2024. It is anticipated that the Asia-Pacific region will experience the most rapid growth in the forecast period. The report encompasses regions including Asia-Pacific, Western Europe, Eastern Europe, North America, South America, the Middle East, and Africa. Browse Through More Reports Similar to the Global On-Demand Warehousing Market 2025, By The Business Research Company Specialized Warehousing And Storage Global Market Report 2025 https://www.thebusinessresearchcompany.com/report/specialized-warehousing-and-storage-global-market-report Warehousing And Storage Global Market Report 2025 https://www.thebusinessresearchcompany.com/report/warehousing-and-storage-global-market-report General Warehousing And Storage Global Market Report 2025 https://www.thebusinessresearchcompany.com/report/general-warehousing-and-storage-global-market-report Speak With Our Expert: Saumya Sahay Americas +1 310-496-7795 Asia +44 7882 955267 & +91 8897263534 Europe +44 7882 955267 Email: saumyas@tbrc.info The Business Research Company - www.thebusinessresearchcompany.com Follow Us On: • LinkedIn: https://in.linkedin.com/company/the-business-research-company Oliver Guirdham The Business Research Company info@tbrc.info Visit us on social media: LinkedIn Facebook X Legal Disclaimer: EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Flexe Frequently Asked Questions (FAQ)

When was Flexe founded?

Flexe was founded in 2013.

Where is Flexe's headquarters?

Flexe's headquarters is located at 4786 1st Avenue South, Seattle.

What is Flexe's latest funding round?

Flexe's latest funding round is Series D.

How much did Flexe raise?

Flexe raised a total of $262.55M.

Who are the investors of Flexe?

Investors of Flexe include Redpoint Ventures, Prologis Ventures, Activate Capital, Tiger Global Management, Madrona Venture Group and 15 more.

Who are Flexe's competitors?

Competitors of Flexe include Packsmith, Waresix, Ware2Go, Stord, Locad and 7 more.

What products does Flexe offer?

Flexe's products include Dynamic Distribution and 4 more.

Loading...

Compare Flexe to Competitors

Stord is a commerce enablement platform that provides omnichannel fulfillment and shipping solutions within the logistics and supply chain industry. The company offers software tools, including order management and warehouse management systems, to assist with operations and the pre-purchase and post-delivery consumer experience. Stord serves direct-to-consumer (DTC) and business-to-business (B2B) sectors with a focus on health and beauty, nutrition and supplements, and apparel and accessories. It was founded in 2015 and is based in Atlanta, Georgia.

Everstox focuses on providing B2B and e-commerce logistics solutions in the consumer goods industry. The company offers a range of services, including fulfillment of direct-to-consumer and B2B orders, shipping services, and warehousing services. Its services are primarily targeted towards e-commerce brands and enterprises. It was founded in 2019 and is based in Munich, Germany.

Flowspace is an e-commerce logistics and fulfillment company that specializes in providing cloud-based software and services for brands. The company offers a suite of tools for inventory management, order management, and network optimization to streamline fulfillment operations. Flowspace primarily serves the e-commerce industry, enabling brands to meet customer expectations for fast and efficient delivery. It was founded in 2017 and is based in Los Angeles, California.

Warehowz specializes in on-demand warehousing within the logistics technology sector. The company offers a cloud-based platform that matches businesses seeking warehouse space with those that have available capacity, streamlining storage and fulfillment contracts and facilitating efficient inventory and shipment management. Warehowz primarily serves industries such as trucking & logistics, retail, e-commerce, and more, providing flexible warehousing solutions to a diverse range of sectors. It was founded in 2017 and is based in Richmond, Virginia.

Waresix is a logistics integrator that specializes in land transportation and integrated logistics services. The company offers a suite of services, including domestic freight handling, land transportation, and integrated warehouse and terminal logistics. Waresix primarily serves businesses requiring logistics and supply chain management solutions. It was founded in 2017 and is based in Jakarta Selatan, Indonesia.

Darkstore is a delivery fulfillment platform that provides eCommerce companies and brands with affordable, on-demand, last mile delivery. Retailers use Darkstore to fulfill their orders for 1-hour and same-day delivery and have them delivered ultra fast to customers by last mile delivery companies like Deliv, UberRUSH and others.

Loading...