Flowdesk

Founded Year

2020Stage

Line of Credit | AliveTotal Raised

$232MLast Raised

$100M | 5 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+72 points in the past 30 days

About Flowdesk

Flowdesk offers a digital asset trading and technology firm that focuses on market making and Over-the-Counter (OTC) trading in the cryptocurrency financial services sector. It provides liquidity services and trading analytics to its clients. It serves token issuers, exchanges, and institutions in the digital asset market. It was founded in 2020 and is based in Paris, France.

Loading...

Loading...

Research containing Flowdesk

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Flowdesk in 2 CB Insights research briefs, most recently on Jul 10, 2025.

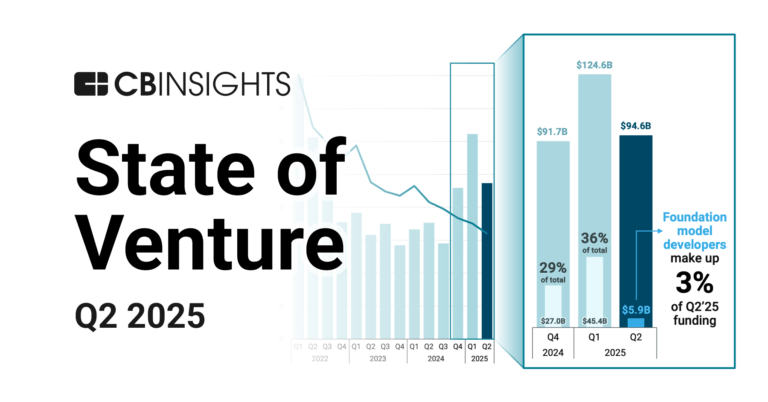

Jul 10, 2025 report

State of Venture Q2’25 Report

May 29, 2025

The stablecoin market mapExpert Collections containing Flowdesk

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Flowdesk is included in 3 Expert Collections, including Blockchain.

Blockchain

9,963 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech

14,203 items

Excludes US-based companies

Stablecoin

471 items

Latest Flowdesk News

Nov 7, 2025

DeFi lenders are deleveraging but not retreating, with borrowing demand for majors like SOL and BTC staying firm and yields compressing across Maple and JitoSOL. (Piret Ilver/Unsplash) What to know: Stream Finance disclosed a $93 million loss amid a $20 billion crypto crash, causing lenders to reassess risks. Despite market turbulence, borrowing demand for major cryptocurrencies remains strong, driven by hedging and funding strategies. Yields in low-risk lending pools have compressed but remain stable, with defensive positioning prevalent in the market. Stream Finance's recent disclosure of a default and $93 million loss, combined with October's $20 billion crypto crash , has left digital-asset lenders scrambling to unwind risk while keeping credit lines robust, according to a new note from Flowdesk. Flowdesk says leverage is getting reduced as traders reassess counterparties, but credit hasn’t frozen. Borrowing demand for SOL, XLM, ENA, APT and BTC remains “robust,” Flowdesk wrote, mostly tied to hedging and funding strategies rather than directional bets. STORY CONTINUES BELOW Flowdesk’s credit desk said it has observed “deleveraging flows as counterparties reposition and reassess amid recent price action,” noting that while capital is rotating out of riskier pools, “a few counterparties have stepped in to add leverage at current levels, focused on majors.” “Overall, rates and yields have compressed across the board, with widespread defensive positioning and many participants sidelined, awaiting a clearer market rebound,” the firm wrote. The question is: when will this market rebound? CryptoQuant says the market is flashing bearish warning signs like it did in 2022. If that crystal ball proves right, the coming weeks could put more pressure on funding rates and further compress yields across DeFi credit pools, bringing them closer to what treasuries earn.

Flowdesk Frequently Asked Questions (FAQ)

When was Flowdesk founded?

Flowdesk was founded in 2020.

Where is Flowdesk's headquarters?

Flowdesk's headquarters is located at 231 Rue Saint-Honoré, Paris.

What is Flowdesk's latest funding round?

Flowdesk's latest funding round is Line of Credit.

How much did Flowdesk raise?

Flowdesk raised a total of $232M.

Who are the investors of Flowdesk?

Investors of Flowdesk include Two Prime Lending, Eurazeo, ISAI, Cathay Innovation, BlackRock and 19 more.

Loading...

Loading...