FourKites

Founded Year

2014Stage

Secondary Market | AliveTotal Raised

$242.9MRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-119 points in the past 30 days

About FourKites

FourKites specializes in supply chain intelligence and offers a platform that provides real-time visibility and execution across various transportation modes. The company's services include tracking multimodal shipments, optimizing inbound logistics, providing order lifecycle insights, managing inventory, and innovating yard logistics. FourKites serves a diverse range of sectors, including food and beverage, retail, consumer packaged goods, chemicals, oil and gas, manufacturing, and pharmaceuticals. It was founded in 2014 and is based in Chicago, Illinois.

Loading...

ESPs containing FourKites

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

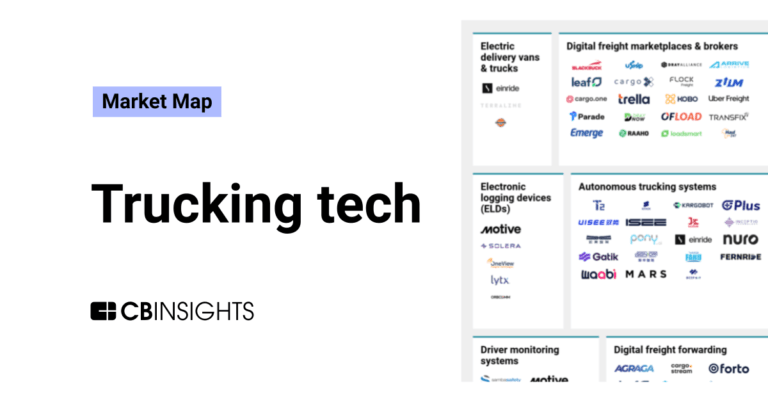

The yard management systems (YMS) market automates and optimizes the movement of trucks, trailers, and cargo within warehouse yards and dock areas. These systems provide real-time visibility into yard operations, automated gate check-in and check-out processes, and dock door scheduling capabilities. YMS solutions integrate with warehouse management systems and transportation management systems to …

FourKites named as Leader among 14 other companies, including SAP, Oracle, and Manhattan Associates.

FourKites's Products & Differentiators

Real-time Visibility

Predictive Visibility and Tracking across all transportation modes. Includes smart notifications/alerts based on ETA confidence levels and business rules.

Loading...

Research containing FourKites

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned FourKites in 7 CB Insights research briefs, most recently on Nov 3, 2025.

Nov 3, 2025 report

Tech IPO Pipeline 2026: Book of Scouting Reports

Sep 10, 2025 report

Book of Scouting Reports: Industrial AI Agents & Copilots

Feb 13, 2025

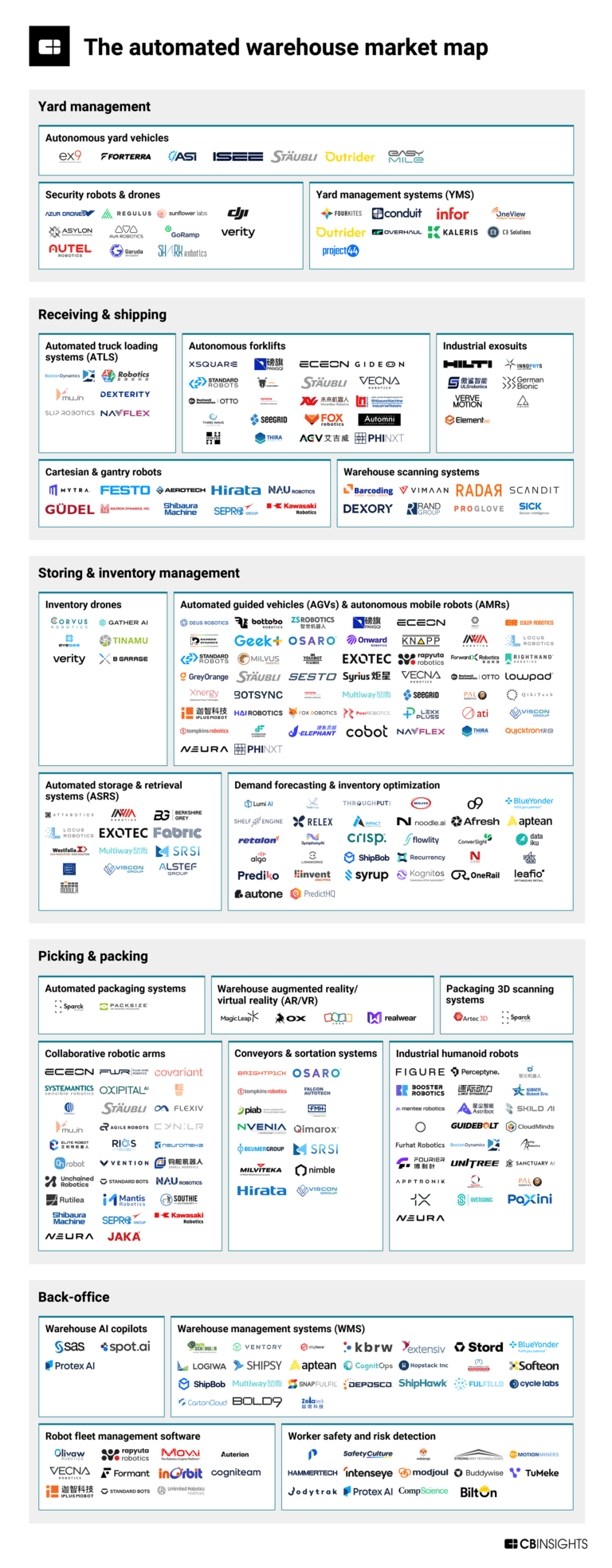

The automated warehouse market map

Feb 23, 2024

The pharma supply chain tech market mapExpert Collections containing FourKites

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

FourKites is included in 6 Expert Collections, including Supply Chain & Logistics Tech.

Supply Chain & Logistics Tech

7,294 items

Companies offering technology-driven solutions that serve the supply chain & logistics space (e.g. shipping, inventory mgmt, last mile, trucking).

Unicorns- Billion Dollar Startups

1,309 items

Artificial Intelligence (AI)

37,333 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Generative AI

2,951 items

Companies working on generative AI applications and infrastructure.

Tech IPO Pipeline

257 items

The tech companies we think could hit the public markets next, according to CB Insights data.

AI agents & copilots

1,771 items

Companies developing AI agents, assistants/copilots, and agentic infrastructure. Includes pure-play emerging agent startups as well as companies building agent offerings with varying levels of autonomy.

FourKites Patents

FourKites has filed 11 patents.

The 3 most popular patent topics include:

- supply chain management

- global positioning system

- artificial intelligence

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

11/24/2021 | 9/5/2023 | Artificial intelligence, Artificial neural networks, Rotating disc computer storage media, Supply chain management, Road transport | Grant |

Application Date | 11/24/2021 |

|---|---|

Grant Date | 9/5/2023 |

Title | |

Related Topics | Artificial intelligence, Artificial neural networks, Rotating disc computer storage media, Supply chain management, Road transport |

Status | Grant |

Latest FourKites News

Oct 24, 2025

Digital logistics is democratic logistics Copied For years, the logistics industry has been dominated by major global operators with deep capital reserves, vast networks, and proprietary technology. Smaller freight forwarders, transport companies, and 3PLs were often left competing on price alone, constrained by manual workflows and limited visibility. That imbalance is changing fast. Digitalisation is dismantling the barriers that once favoured scale over agility. Affordable, cloud-based logistics systems, AI-driven visibility tools, and digital freight platforms are enabling smaller logistics firms to compete - and often outperform - their larger counterparts. For logistics professionals, this shift isn’t just about technology adoption. It’s about redefining competitiveness. The winners of tomorrow’s logistics landscape won’t necessarily be the biggest - they’ll be the most connected, the most data-driven, and the most responsive. Digital Freight Marketplaces: Expanding Access to Global Trade One of the clearest signs of democratisation in logistics is the rise of digital freight marketplaces. Platforms like Freightos, Flexport, and Convoy give smaller logistics providers direct access to global cargo demand without needing massive sales teams or legacy networks. Through these platforms, smaller players can quote instantly, manage shipments digitally, and access transparent rate benchmarking. The technology automates key functions - documentation, tracking, and performance analytics - that were once handled manually or via expensive enterprise systems. The impact is huge: small forwarders and carriers can now compete for international shipments on equal terms with multinational operators. They can also leverage marketplace data to refine pricing strategies, forecast capacity, and identify profitable lanes - all through real-time analytics that used to be out of reach. Digital marketplaces are effectively transforming capacity into a digital commodity. For smaller operators, this means visibility and access—not just in local markets, but on a global scale. Cloud Automation: Unlocking Efficiency Without Heavy Infrastructure For smaller logistics companies, operational efficiency has always been the biggest constraint to scale. Managing freight documents, billing, customs, and customer communication manually eats into margins and limits growth. Cloud automation is changing that equation. Platforms like ShipBob and Project44 allow logistics SMEs to manage orders, inventory, and shipments through unified dashboards. With automated workflows and integrated communication, teams can handle higher shipment volumes with fewer resources. Cloud-based Transportation Management Systems (TMS) now provide capabilities - route optimisation, carrier selection, predictive ETAs - that used to require significant investment in IT infrastructure. For instance, Transporeon’s TMS enables real-time freight visibility and automated rate management accessible from any device. By digitising core operations, smaller logistics firms can operate lean while maintaining the same performance standards as large-scale providers. The result is a new kind of competitiveness: low-overhead, high-efficiency logistics operations that thrive on flexibility and responsiveness. Data Intelligence: Giving Smaller Firms Strategic Insight Logistics professionals know that visibility isn’t just about tracking, it’s about insight. For smaller players, the ability to access and interpret supply chain data used to be limited. Today, AI-driven analytics tools are levelling that field. Solutions like FourKites and Overhaul use machine learning to predict disruptions, estimate arrival times, and identify inefficiencies. This kind of intelligence, previously locked within enterprise-grade control towers, is now accessible via subscription-based platforms. Smaller 3PLs and carriers can use these insights to improve on-time performance, allocate resources efficiently, and proactively manage exceptions. The shift from reactive to predictive logistics management allows smaller firms to offer the kind of reliability and transparency that customers increasingly demand. In practical terms, this means a regional freight company can now deliver the same data visibility and service reporting as a multinational, without building a proprietary analytics team. Interoperability: Collaboration Through Integration One of the most powerful outcomes of digitalisation is interoperability. Open APIs and integration tools now allow even small logistics providers to connect seamlessly with partners, customers, and software ecosystems. Platforms like CargoWise exemplify this shift. By integrating customs compliance, accounting, warehouse management, and shipment tracking into a single digital environment, smaller operators can provide end-to-end visibility and compliance at a fraction of the traditional cost. This interconnectedness fosters collaboration rather than competition. Smaller firms can plug into digital supply chain ecosystems, share data in real time, and participate in larger logistics networks without losing autonomy. The ability to integrate digitally means smaller logistics providers can act as agile extensions of global supply chains—offering local expertise and flexibility, supported by enterprise-grade technology. Agility as the New Competitive Advantage Digitalisation is redefining what it means to be competitive in logistics. Scale still matters, but agility is emerging as the true differentiator. Smaller firms, empowered by digital tools, can adapt faster to market shifts, regulatory changes, and customer expectations. When a major disruption occurs - a port strike, a sudden demand surge, or a regulatory update - digitally enabled small operators can reroute, reprice, or reallocate capacity in hours, not days. They can deliver custom solutions where larger enterprises are bound by complex hierarchies and slower decision-making. Digitalisation is, in effect, democratising logistics by shifting the balance of power toward the agile and the connected. The Takeaway For logistics professionals, the message is clear: digitalisation is no longer a luxury - it’s the foundation of competitiveness. Cloud technology, data analytics, and digital platforms are giving smaller logistics companies access to tools that once required enterprise-level investment. The playing field is being levelled, and the rules of the game are changing. Success in the logistics sector will no longer depend on who has the most trucks, warehouses, or global offices - it will depend on who can move the fastest, see the furthest, and connect the smartest. Digitalisation isn’t just modernising logistics - it’s democratising it. And the small players who embrace it today are poised to shape the industry’s next chapter.

FourKites Frequently Asked Questions (FAQ)

When was FourKites founded?

FourKites was founded in 2014.

Where is FourKites's headquarters?

FourKites's headquarters is located at 110 North Wacker Drive, Chicago.

What is FourKites's latest funding round?

FourKites's latest funding round is Secondary Market.

How much did FourKites raise?

FourKites raised a total of $242.9M.

Who are the investors of FourKites?

Investors of FourKites include Fabrica Ventures, Mitsui, FedEx, Harvard Business School Alumni Angels Association, Hyde Park Venture Partners and 21 more.

Who are FourKites's competitors?

Competitors of FourKites include Vector, Overhaul, Arteria, BuyCo, Shippeo and 7 more.

What products does FourKites offer?

FourKites's products include Real-time Visibility and 4 more.

Who are FourKites's customers?

Customers of FourKites include Cardinal Health and ['Unknown'].

Loading...

Compare FourKites to Competitors

project44 specializes in the logistics and transportation industry, offering a platform, provides real-time tracking and management of shipments across multiple modes. The company's services cater to various sectors, including automotive, chemical, food and beverage, manufacturing, life sciences, and retail. It was founded in 2014 and is based in Chicago, Illinois.

Tive specializes in supply chain visibility solutions within the logistics and transportation sectors. The company offers products such as trackers and passive loggers that monitor the location and condition of shipments, including factors like temperature, humidity, and shock. It primarily serves industries such as food and beverage, high-value goods, life sciences, and transportation and logistics. It was founded in 2015 and is based in Charlestown, Massachusetts.

Arviem is a provider of real-time cargo tracking and monitoring services in the supply chain industry. The company offers solutions for location tracking and environmental condition monitoring of cargo. Arviem primarily serves stakeholders in the supply chain, including cargo owners and manufacturers, with a focus on sectors that handle high-value or sensitive goods. It was founded in 2008 and is based in Baar, Switzerland.

Cargo Cube, formerly known as Evertracker, is involved in global supply chain management within the logistics industry. The company offers services that include forecasting estimated arrival times and identifying potential disruptions. Cargo Cube also provides tools for calculating CO2 and greenhouse gas emissions for each component of the supply chain. It was founded in 2014 and is based in Schwerin, Germany.

Blue Yonder focuses on digital supply chain management and omni-channel commerce fulfillment. It offers a range of services, including supply chain planning, merchandising and space planning, order management, resource management, warehouse management, and transportation management, primarily serving sectors such as retail, consumer industries, automotive and industrial, high-technology and semiconductor, and third-party logistics. Blue Yonder was formerly known as JDA Software. It was founded in 1985 and is based in Scottsdale, Arizona.

FolioX specializes in AI-driven supply chain operations within the heavy fuel and chemical retail and wholesale sector. Its platform offers agents that utilize machine learning, parameter space search, and multiagent reinforcement learning to improve logistics, booking, and dispatch processes. FolioX also provides voice-driven operations control and data integration to create a unified system for fuel and chemical logistics networks. It was founded in 2025 and is based in Nigeria.

Loading...