Mesh

Founded Year

2020Stage

Series B - II | AliveTotal Raised

$114.25MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+59 points in the past 30 days

About Mesh

Mesh focuses on financial connectivity, specifically within the cryptocurrency sector. It offers services that facilitate transfers and payments of digital assets from various exchanges and wallets without the need to leave the user's platform. It primarily serves sectors such as neobanks, personal finance and investing, and both centralized and decentralized finance. It was formerly known as Front Financing. The company was founded in 2020 and is based in San Francisco, California.

Loading...

Mesh's Products & Differentiators

Front Score

proprietary algorithm that scored both individual stocks and your aggregated portfolios-similar to a FICO score that gives you health score of your portfolio

Loading...

Research containing Mesh

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Mesh in 3 CB Insights research briefs, most recently on May 29, 2025.

May 29, 2025

The stablecoin market map

May 23, 2025 report

Book of Scouting Reports: Stablecon 2025

Aug 14, 2024

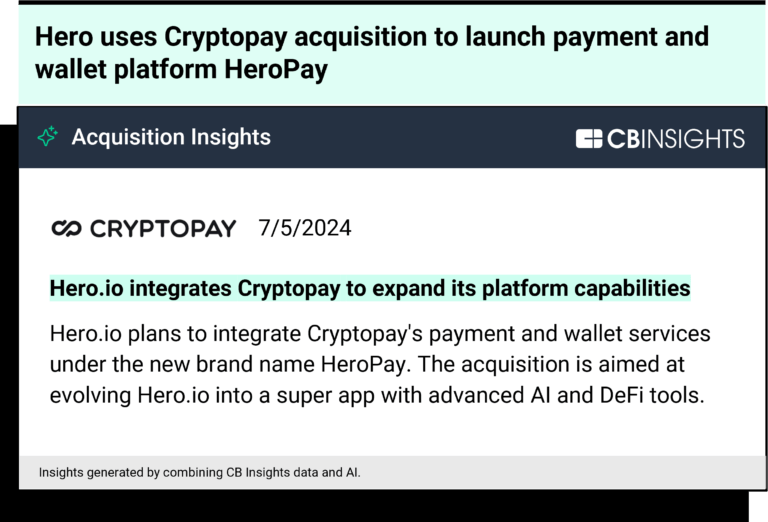

Crypto is showing signs of life in paymentsExpert Collections containing Mesh

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Mesh is included in 4 Expert Collections, including Blockchain.

Blockchain

9,320 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech

9,809 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Payments

3,277 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Stablecoin

471 items

Latest Mesh News

Nov 5, 2025

Bybit Pay, the payment arm of the world's second-largest crypto exchange, has launched in Sri Lanka amid rising interest in digital payments. The rollout includes 100 merchant activations across the country, including 50 physical point-of-sale systems and 50 digital integrations, according to a recent announcement Partnering with Ceylon Cash through its CeyPay platform, Bybit Pay aims to connect Sri Lankan businesses to the growing global network of digital asset payments. Sri Lanka's Digital Boom Sets the Stage for Crypto Payments Sri Lanka's high mobile penetration rate of over 130% and rapid digital adoption make it a promising testing ground for crypto-enabled commerce. With tourism rebounding and local demand rising for faster, cheaper payment methods, Bybit sees an opportunity to offer businesses a practical alternative to traditional financial rails. “Sri Lanka's combination of tech-forward consumers, substantial international tourism, and diverse merchant landscape creates ideal conditions for crypto payment adoption,” said Nazar Tymoshchuk, Regional Manager at Bybit. “This rollout is part of Bybit Pay's commitment to helping make payments painless, efficient, and borderless for as many people as possible.” Bybit Pay's platform allows merchants of any size to accept digital assets easily, with settlement options in either crypto or fiat. Its main selling points include instant proof-of-payment, ultra-fast settlement, and lower transaction costs compared to legacy systems. The company also promises strong fraud protection and compliance standards to boost merchant trust. ‼️ RIPPLE HOLDS CLEAR ADVANTAGE OVER STELLAR, ALGORAND, AND SWIFT IN BLOCKCHAIN PAYMENTS‼️ Ripple's advantage comes from being the ONLY platform that unites real time settlements, digital asset custody, and stablecoin liquidity in ONE SYSTEM.✅ While Stellar, Algorand, and… pic.twitter.com/t9xdEXK0xf The launch comes as cryptocurrency is not legal tender or regulated in Sri Lanka According to directions No. 03 of 2021 under Foreign Exchange Act, No. 12 of 2017, Electronic Fund Transfer Cards (EFTCs) such as debit cards and credit cards are not to be used for payments related to cryptocurrency transactions. Payments Companies Push into Crypto In May, crypto payments platform Mesh unveiled its Apple Pay integration , which allows merchants partnered with Mesh to accept crypto payments via Apple Pay. Mesh's partnership with Apple Pay came as payments companies continue to expand into digital assets. In April, global payments giant Stripe said it is developing a U.S. dollar-backed stablecoin aimed at companies operating outside the United States, United Kingdom, and Europe. The announcement came after Stripe's regulatory approval to acquire Bridge, a stablecoin payments network designed to rival traditional banking systems and SWIFT-based transfers. Earlier this year, Jack Dorsey, former Twitter CEO and outspoken Bitcoin advocate, publicly urged Signal Messenger to integrate Bitcoin for peer-to-peer (P2P) payments. Dorsey's call was echoed by David Marcus, former president of PayPal and current CEO of Lightspark, who stated that “all non-transactional apps should connect to Bitcoin.” The comments reflect a growing sentiment among Bitcoin advocates to reposition BTC not just as a store of value, but as a practical payment tool. More recently, Singapore-based payments company Triple-A announced plans to integrate PayPal's stablecoin into its list of supported tokens for customer payments. Even companies like PayPal have entered the space , launching their own stablecoins and offering yield incentives to holders.

Mesh Frequently Asked Questions (FAQ)

When was Mesh founded?

Mesh was founded in 2020.

Where is Mesh's headquarters?

Mesh's headquarters is located at 2325 3rd Street, San Francisco.

What is Mesh's latest funding round?

Mesh's latest funding round is Series B - II.

How much did Mesh raise?

Mesh raised a total of $114.25M.

Who are the investors of Mesh?

Investors of Mesh include Moderne Ventures, Overlook VC, PayPal Ventures, Uphold, SBI Investment and 45 more.

Who are Mesh's competitors?

Competitors of Mesh include Kraken, Keabank, Atom Finance, Bitwala, Blockmate and 7 more.

What products does Mesh offer?

Mesh's products include Front Score and 3 more.

Loading...

Compare Mesh to Competitors

Metallicus works as a company building a digital asset banking network using blockchain technology. Its offerings include digital asset banking services, a stablecoin index treasury called Metal Dollar and a proprietary blockchain named Proton that allows for payment solutions. Metallicus serves individual users, corporations, and banks seeking integration with digital assets and blockchain. It was founded in 2016 and is based in San Francisco, California.

Blockchain.com specializes in blockchain technology and cryptocurrency-related solutions. The company offers a platform where users can buy, sell, and swap cryptocurrencies like Bitcoin and Ethereum, as well as earn rewards on their cryptocurrency assets. It also provides a cryptocurrency wallet for the self-custody of digital assets and an exchange for trading in fiat currencies. It was founded in 2011 and is based in London, United Kingdom.

Crypto.com provides services for buying, selling, and trading cryptocurrencies, as well as decentralized finance services like staking and various crypto financial products. The company serves individuals and businesses involved in cryptocurrency transactions and investments. Crypto.com was formerly known as Monaco. It was founded in 2016 and is based in Singapore.

SCB 10X is the technology investment arm of SCBX Group, focusing on value creation through thinking and innovation in the financial services industry. The company provides venture capital investments, operates tech labs, and conducts research and development to explore innovations. SCB 10X serves the fintech, blockchain, and AI sectors, investing in startups to drive growth. It was founded in 2020 and is based in Bangkok, Thailand. SCB 10X operates as a subsidiary of Siam Commercial Bank.

CoinZoom is a fintech company that provides a cryptocurrency debit card enabling users to spend their crypto and cash, buy, sell, and trade cryptocurrencies. The company serves individuals interested in incorporating cryptocurrency into their financial transactions. It was founded in 2018 and is based in Salt Lake City, Utah.

CoinDCX is a cryptocurrency exchange that provides access to virtual digital assets. The company offers a platform for trading cryptocurrencies and complies with regulatory guidelines. CoinDCX also engages in Web3 project investments and educational initiatives related to decentralized technologies. It was founded in 2018 and is based in Mumbai, India.

Loading...