Immutable

Founded Year

2018Stage

Series C - II | AliveTotal Raised

$272.74MRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-41 points in the past 30 days

About Immutable

Immutable is a company that operates within the blockchain gaming and NFT sectors, focusing on Web3 technology. The company provides products for NFT ownership and trading, game development, and player experience. Immutable serves the blockchain gaming industry, offering tools and infrastructure for developers to create Web3 games. Immutable was formerly known as Fuel Games. It was founded in 2018 and is based in Sydney, New South Wales.

Loading...

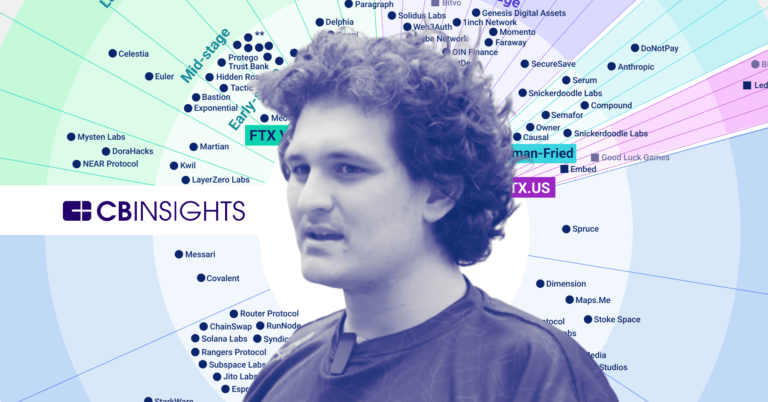

ESPs containing Immutable

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The layer-2 blockchain scaling solutions market offers solutions for customers who want to scale their decentralized applications on blockchain platforms. These solutions allow customers to take the majority of their traffic off the main blockchain, resulting in faster transactions and lower costs. By using these solutions, customers can achieve their goals of using decentralized blockchain ledger…

Immutable named as Leader among 15 other companies, including Polygon, Caldera, and Offchain Labs.

Loading...

Research containing Immutable

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Immutable in 1 CB Insights research brief, most recently on Nov 17, 2022.

Expert Collections containing Immutable

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Immutable is included in 3 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,309 items

Blockchain

14,099 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Gaming

5,684 items

Gaming companies are defined as those developing technologies for the PC, console, mobile, and/or AR/VR video gaming market.

Latest Immutable News

Nov 12, 2025

The drop is happening because of the general fear among investors. A crypto market crash is happening today, Nov. 12, with most tokens being in the red. Bitcoin price crashed below $103,000, while most tokens were down by over 5%. Starknet (STRK) tokens dropped by 16% in the last 24 hours, while Zcash, Internet Computer, Pump, and Filecoin plunged by over 13%. Other top laggards in the crypto industry were coins like Immutable, Ethena, Arbitrum, Official Trump, and Uniswap, which plunged by over 10% in the last 24 hours. Crypto market crash caused by profit-taking and panic selling One of the top reasons why the crypto market crash is crashing today is that investors are simply taking profit after a strong rally recently. A closer look at the top laggards mentioned above shows that they were the top gainers recently. Starknet was the best gainer on Monday even as investors waited for its large token unlock. Zcash price has made headlines as it jumped from $30 to over $700 in less than a month, leading to more demand for privacy tokens like Dash and Monero. It is now plunging as investors start to book profits and as it enters the distribution phase of the Wyckoff Theory. Uniswap price was also the top gainer this week after the developers announced a large-scale token burn initiative. WLFI token also jumped after a major Donald Trump victory in the US, where he secured a vote to reopen the government without making major concessions to the Democrats. Crypto crash happening as liquidations rise The crypto market crash is happening because of the rising liquidations, which caught many bulls off guard. Bitcoin positions worth over $115 million were liquidated in the last 24 hours. Ethereum, Zcash, and Solana positions worth over $26 million were liquidated in this period. Over 150,000 traders were wiped out. A liquidation is a situation where an exchange closes long positions once a certain level, known as a margin call, is reached. It normally leads to more selling pressure in the market. Crypto traders have good memory and many of them remember what happened on October 11 when over 1.6 million traders were wiped out in a single day, losing over $20 billion. Since then, many of these trades have remained in the sidelines as they fear being wiped out again. A good example of this is the futures open interest and the funding rate. Open interest in the futures market has plunged to $142 billion, down from over $250 billion a month ago. Bitcoin's interest has moved from $94 billion in October to $68 billion today. The same is happening among other tokens in the crypto industry. Most importantly, the funding rate for most cryptocurrencies has remained flat in the past few days as activity in the futures market waned ETF demand has deteriorated The other main reason why the crypto market crash is happening is that ETF demand has crashed in the past few weeks. Data shows that Bitcoin ETFs have had just $1.5 million in inflows this week after they shed $1.2 billion last week. They had shed $798 million in assets a week before. Ethereum ETFs have had no inflows this week after they shed $504 million last week. These ETFs have shed about $2 billion in assets in the last few weeks. This is a sign of low demand in the market. The same is happening among Digital Asset Treasury companies, which have largely stopped buying as their stock prices plunged. While Strategy is still buying, other companies like GameStop and MetaPlanet have largely paused as their NAV multiples fall. Another reason for the crypto crash is the correlation with the stock market, which plunged on Tuesday, with companies like NVIDIA and CoreWeave leading the way. Facebook Twitter LinkedIn Reddit WhatsApp Telegram More Related news Crypto market crash: top reasons Bitcoin and altcoins are going down Finance Magnates London Summit 2025 returns, uniting global financial services leaders Cardano launches card with Wirex to turn ADA into a real-world payment asset KuCoin launches institutional division to bridge traditional finance and digital assets SoFi Technologies launches SoFi Crypto, a one-stop crypto platform for consumers

Immutable Frequently Asked Questions (FAQ)

When was Immutable founded?

Immutable was founded in 2018.

Where is Immutable's headquarters?

Immutable's headquarters is located at 77 King Street, Sydney.

What is Immutable's latest funding round?

Immutable's latest funding round is Series C - II.

How much did Immutable raise?

Immutable raised a total of $272.74M.

Who are the investors of Immutable?

Investors of Immutable include Framework Ventures, Fabric Ventures, Prosus Ventures, King River Capital, AirTree Ventures and 32 more.

Who are Immutable's competitors?

Competitors of Immutable include Polygon and 2 more.

Loading...

Compare Immutable to Competitors

Solv Protocol specializes in decentralized asset management and liquidity infrastructure within the blockchain sector. The company offers a platform for yield generation through PoS staking, restaking, and delta-neutral trading strategies across various digital assets including BTC, ETH, and stablecoins. Solv Protocol's services cater to the decentralized finance (DeFi) ecosystem. It was founded in 2020 and is based in Road Town, Virgin Islands (British).

nobank is a platform that provides wallet services focusing on blockchain technology and digital asset management. The company offers a service that enables applications to integrate blockchain functionality with reduced coding requirements, providing features such as account abstraction, social and authenticator recovery, and a customizable wallet application. Nobank primarily serves companies looking to incorporate web3 capabilities into their products without the intricacies of traditional blockchain interactions. It was founded in 2022 and is based in Zug, Switzerland.

MetaMask is a self-custodial wallet that serves as a gateway to blockchain applications and web3. The company provides a platform for users to manage digital assets, including a key vault and token wallet, along with tools for decentralized applications. MetaMask also offers resources and support for developers and institutions building on blockchain technology. It is based in San Francisco, California.

Thirdweb is a full-stack, open-source web3 development platform that operates within the blockchain technology sector. The company provides a suite of tools for creating, deploying, and managing smart contracts, as well as connecting applications to decentralized networks. Thirdweb's offerings cater to various sectors, including the gaming industry and blockchain networks, by providing solutions for integrating web3 into games and offering all-in-one development tools for chains. It was founded in 2020 and is based in San Francisco, California.

AlphaTrue specializes in providing strategic solutions and services within the blockchain industry. The company focuses on enhancing customer experience, developing advanced products, and improving clarity and efficiency in management processes. AlphaTrue primarily caters to businesses looking for expertise in blockchain technology and decentralized finance. It was founded in 2021 and is based in Ho Chi Minh City, Vietnam.

The Binary Holdings provides web3 infrastructure focusing on the telecommunication and banking sectors. The company offers web3 solutions that integrate into telecom and banking applications to improve user interactions, retention, and average revenue per user (ARPU). The Binary Network, a native Layer 2 solution, facilitates web3 interactions for a large user base and is supported by the $BNRY utility token, which functions as a reward and transaction medium within the ecosystem. It was founded in 2022 and is based in Dubai, United Arab Emirates.

Loading...