Function Health

Founded Year

2022Stage

Unattributed VC | AliveTotal Raised

$53.1MRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+75 points in the past 30 days

About Function Health

Function Health focuses on providing individuals with access to preventative measures and lab testing. The company offers an annual membership that includes lab tests and insights from medical experts. Function Health operates independently of insurance. It was founded in 2022 and is based in Austin, Texas.

Loading...

ESPs containing Function Health

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

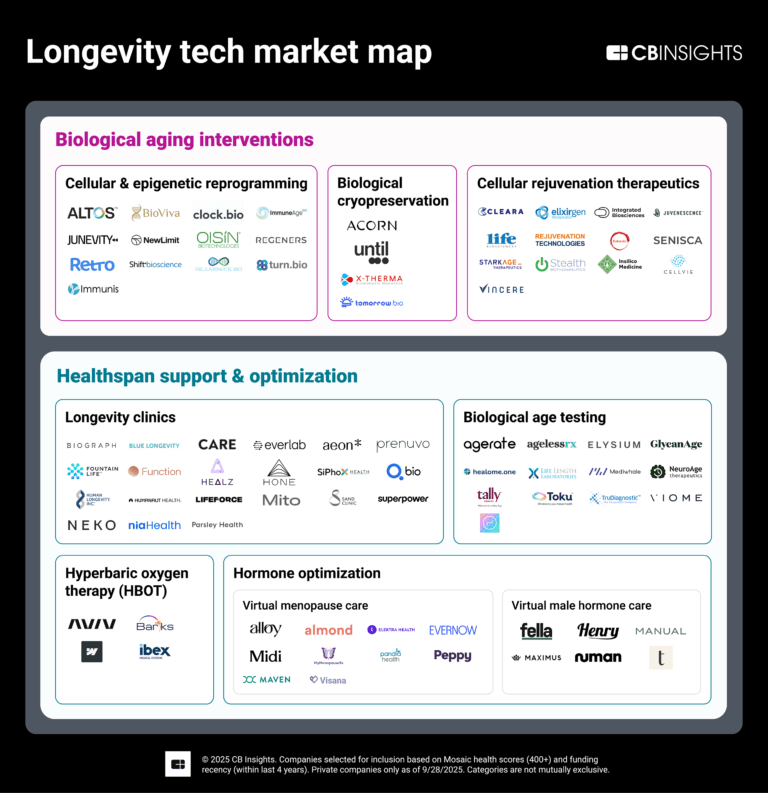

The longevity clinics market leverages advanced screening and diagnostics in a virtual or in-person clinic to provide individuals with proactive insights into their health. These companies focus on early detection, biomarker tracking, and comprehensive lab and/or imaging services that extend beyond routine physicals. By combining clinical-grade testing with personalized interpretation from physici…

Function Health named as Leader among 15 other companies, including Human Longevity, Fountain Life, and InsideTracker.

Function Health's Products & Differentiators

Function Health

Function is the first personalized health platform to include access to 100+ lab tests, helping individuals understand their whole body—from heart and hormones to thyroid, nutrients, toxins, autoimmunity, immunity, and beyond. This amount of testing is five times more lab testing than a typical physical, which averages 19 lab tests and may miss critical aspects of your health. Since its beta in April 2023, Function has welcomed over 150,000 members—people who believe in taking control of their health. In June 2024, Function closed a $53M Series A led by Andreessen Horowitz (a16z) Bio + Health, alongside an incredible group of investors, including people like Kevin Hart and Matt Damon

Loading...

Research containing Function Health

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Function Health in 3 CB Insights research briefs, most recently on Oct 22, 2025.

Oct 22, 2025

The longevity tech market map

Oct 20, 2025 report

Digital Health 50: The most promising digital health startups of 2025

Dec 3, 2024 report

Digital Health 50: The most promising digital health startups of 2024Expert Collections containing Function Health

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Function Health is included in 3 Expert Collections, including Longevity Tech Market Map (Aug 2024).

Longevity Tech Market Map (Aug 2024)

64 items

Digital Health

12,122 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Digital Health 50

100 items

Function Health Patents

Function Health has filed 3 patents.

The 3 most popular patent topics include:

- acneiform eruptions

- calcium channel blockers

- data management

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

12/11/2019 | 2/7/2023 | Skin care, Cosmetics, Dietary supplements, Machine learning, Cosmetics brands | Grant |

Application Date | 12/11/2019 |

|---|---|

Grant Date | 2/7/2023 |

Title | |

Related Topics | Skin care, Cosmetics, Dietary supplements, Machine learning, Cosmetics brands |

Status | Grant |

Latest Function Health News

Nov 6, 2025

using celebrity stories to sell prescription drugs and preventive scans to millions. Why is the FDA allowing it? And why are venture-backed founders turning medicine into marketing? Yet while traditional pharma can't hand out branded pens — and must disclose every side effect when using a celebrity in an ad — digital-first health companies are handing out endorsement deals with almost no oversight, positioning celebrities as their new marketing reps. Ro , the telehealth company behind the latest GLP-1 craze , recently enlisted Serena Williams as a global ambassador for its weight-loss program — just months after striking distribution deals with Eli Lilly and Novo Nordisk Prenuvo, the $2,500 full-body MRI startup, touts investors Cindy Crawford and Rande Gerber as proof of its wellness-elite appeal. Function Health, which sells $500 annual blood panels, regularly name-drops backers like Matt Damon, Pedro Pascal, and the Hemsworth brothers in press coverage. And Superhuman, a longevity platform, leans heavily on its association with investor Vanessa Hudgens. The celebrity ties themselves aren't remarkable — what's notable is how loudly these brands flex them. In a crowded health-tech market, investor star power has become its own form of performance marketing, engineered to project trust, relevance, and social clout. None of these celebrities shape product or strategy — they shape perception. In health-tech, where differentiation is scarce, fame itself has become the feature. They're hardly alone. Hims & Hers has used influencer-driven campaigns to sell tele-prescribed hair-loss and sexual-health medications. Teladoc has employed athlete endorsements to promote its chronic-care services. Even legacy consumer brands are entering the telehealth fray. WeightWatchers , once synonymous with in-person diet programs and frozen meals, is now reinventing itself as a prescription weight-loss platform — partnering with Amazon Pharmacy to deliver GLP-1 drugs directly to consumers. For Amazon, which already owns One Medical , the move signals an ambition to capture the cultural moment around GLP-1s — and the WeightWatchers audience that now wants faster, pharmaceutical results than calorie-counting can deliver. Telehealth has undoubtedly expanded access and convenience for millions — but the marketing that now surrounds it raises a deeper question: who's setting the guardrails? It's not just marketing — it's medicine's identity crisis. From peptides to MRIs, from GLP-1s to longevity panels, startups are collapsing the boundary between health and consumer culture . Each sells clinical or quasi-clinical services directly to consumers, yet their growth playbooks resemble sneaker drops or skincare launches more than scientific enterprises. They trade on fame, relatability, and aspirational wellness, not peer-reviewed evidence. In doing so, they reveal a deeper tension: the collision between venture-scale growth incentives and the ethical foundations of evidence-based care. From Care to Clout: How Celebrity Became Telehealth's Growth Strategy When Serena Williams or Cindy Crawford talks about health, markets listen. That's precisely why startups court them — not for their medical expertise, but for their cultural reach. Ro's partnerships with Williams and Charles Barkley reframed prescription drugs as aspirational rather than clinical. In interviews, Ro's CEO Zachariah Reitano praised Williams's courage in “changing the narrative” around GLP-1s, positioning her personal use story as empowerment, instead of advertisement. Today's “celebrity medicine” ecosystem includes: • Ro — GLP-1 prescriptions and celebrity campaigns (Serena Williams, Charles Barkley). • Function Health — longevity lab panels backed by high-profile investors. • Lifeforce — hormone and peptide programs co-founded by Tony Robbins. • Prenuvo — luxury full-body MRIs marketed through A-list testimonials. Studies show celebrity endorsements can increase purchase intent for health products , while factual medical information often fails to change behavior — proof that influence now outperforms evidence in health decision-making (PubMed and Journal of Health Communication, 2022 For venture-backed telehealth companies, celebrity partnerships offer a shortcut through the hardest part of the business model: trust and acquisition. Telehealth is a crowded field, and customer acquisition costs (CAC) can devour margins. A recognizable face collapses the distance between brand and believer — creating a perception of legitimacy even when the science is thin. Celebrity is the new credential. In a crowded market, fame becomes the feature. It provides instant social proof in a market where every company is selling the same promise — better health, faster. But that logic runs counter to how science-based medicine operates. Evidence-based care depends on reproducibility, data, and physician oversight — not celebrity validation. When medicine is packaged as a lifestyle product, the standard shifts from efficacy to influence. The VC Strategy Driving Celebrity Medicine Behind the scenes, this isn't just about brand-building — it's about balance sheets. Most telehealth companies raised money in the zero-interest era of 2020–2022 and now face slowing growth, FDA scrutiny, and rising patient skepticism. Celebrities become marketing arbitrage: a high-reach, high-emotion, “earned media” engine that drives virality in a sector historically starved of it. Celebrity deals compress CAC, boost conversion, and generate earned media — three levers that matter when paid channels saturate and growth stalls. It's the same playbook used by wellness and beauty brands for years — except now it's being applied to prescription drugs, diagnostic imaging, and laboratory testing. And that shift carries consequences. Celebrity storytelling can normalize medicalization, and it reframes risk-based interventions as aspirational choices — which can distort how the public perceives safety, eligibility, or need. The Cultural Shift: From Medicine to Membership The GLP-1 boom didn't just create a new class of drugs — it commercialized medicine itself, transforming clinical care into a subscription-based business built on vanity, virality, and venture-scale growth. The global GLP-1 market, now valued at roughly $65.8 billion , is projected to soar past $324 billion by 2035 , expanding at a 17% CAGR as weight-loss and metabolic therapies redefine modern healthcare. The U.S. medical weight-loss market alone now exceeds $33.8 billion , more than doubling since 2022 — with telehealth platforms capturing a rapidly expanding share. Within that, a new subsector has emerged: telehealth-delivered GLP-1 care, an estimated $6.9 billion market that's swelling as digital platforms turn prescription drugs into subscription products. For venture-backed startups, GLP-1s aren't just a medical breakthrough — they're a recurring-revenue engine with lifestyle appeal. Because most insurers still refuse to cover GLP-1s for weight loss, these services have morphed into luxury lifestyle offerings — marketed through celebrity endorsements to affluent consumers who can afford to pay cash. The framing is aspirational rather than clinical, positioning pharmacology as status. And yet the FDA's absence in regulating this marketing shift has allowed the line between healthcare and high-end consumerism to blur even further. Every influencer testimonial becomes a micro-ad campaign. Every celebrity “health journey” becomes viral content. A subscription to semaglutide isn't framed as treatment — it's framed as transformation. This convergence of medicine, media, and marketing is deliberate. GLP-1 telemedicine companies aren't just competing for patients — they're competing for desirable subscribers: affluent, image-driven consumers likely to stay in monthly programs and share their experience online. Influencer aesthetics and celebrity cachet attract that segment, even as clinical nuance gets lost in translation. GLP-1s are no longer just drugs — they're a cultural product now, sold through influence instead of evidence. When Health Becomes a Lifestyle Product The problem isn't just telehealth — it's the consumerization of medicine itself. From GLP-1 prescriptions to longevity scans, health services are being sold like products, not care. Function Health and Prenuvo illustrate the two ends of this new spectrum. Function Health markets longevity lab panels as a gateway to “optimization,” turning diagnostics into an annual subscription. Prenuvo, meanwhile, packages full-body MRI scans as a form of preventive luxury — a $2,500 check-up marketed through A-list testimonials about early detection and self-care. According to Radiology Today, radiologists warn that full-body MRIs c an generate false positives in up to of scans , leading to unnecessary biopsies, costs, and anxiety — a risk rarely mentioned in marketing. Neither company is overtly deceptive, but both recast medical screening as a lifestyle purchase, one designed to inspire FOMO rather than facilitate clinical oversight. This is the logical endpoint of medicine's media makeover. What began as telehealth convenience has evolved into a consumer movement where diagnostics, hormones, and peptides are marketed with the same aesthetic as skincare or fitness — personalized, premium, and shareable. The Ethical and Regulatory Gray Zone While telehealth has delivered real benefits — from chronic disease management to rural access — its rapid commercialization has blurred the line between patient care and consumer marketing. Telehealth's growth has outpaced the laws that govern it. The FDA regulates pharmaceutical advertising, but it doesn't directly oversee how telemedicine platforms market or prescribe drugs — especially when those platforms blur the line between clinical care and lifestyle branding. That leaves telehealth companies — which now combine prescribing, fulfillment, and brand storytelling — operating between categories. A preteen could steal her parent's credit card and easily obtain a GLP-1 prescription from some platforms that don't require a face-to-face video call or verified ID. Oversight remains minimal, even as prescriptions surge. The gray area widens with peptides and hormones, the next frontier of tele-longevity. Unlike GLP-1s, most peptides aren't FDA-approved drugs — but they're far from supplements. They exist in a regulatory limbo: too potent to be sold as dietary products, yet too unregulated to be treated as medicine. Compounding pharmacies can legally prepare them under a clinician's direction, but many telehealth startups stretch that rule by marketing peptides as “research” or “optimization” therapies, often fulfilled through offshore or loosely monitored partners. Inside the Oversight Gap In Telehealth These products bypass traditional insurance and reimbursement pathways, enabling direct-to-consumer sales that look more like e-commerce than clinical care. Pharma has lawyers checking every comma of its ads. Telehealth startups have influencers. When companies use celebrity credibility instead of clinical evidence, it blurs not only the line between wellness and medicine — but between legality and legitimacy.Ro, for instance, can spotlight Serena Williams's personal experience with GLP-1s without naming a specific drug or dosage, sidestepping the FDA's “fair balance” rule that governs pharmaceutical ads. Function Health can post celebrity testimonials about “taking control of your health” without referencing lab precision or clinical outcomes. And Prenuvo can flood Instagram with A-list testimonials about longevity — without addressing the medical reality of false positives and unnecessary follow-up scans. None of this technically violates the rules — because those rules were written for pharma, not for a new class of platforms that straddle medicine, media, and consumer tech. From GLP-1s to Longevity: The Next Wave of Celebrity Medicine The celebrityification of telehealth extends far beyond GLP-1s. A new class of longevity and hormone-optimization startups—many of them venture-backed and celebrity-adjacent—are selling peptides, testosterone, and anti-aging protocols through the same direct-to-consumer playbook. Lifeforce , co-founded by Tony Robbins, offers hormone and peptide programs alongside telemedicine consults and at-home blood tests. Superhuman , backed by actress and entrepreneur Vanessa Hudgens, takes a similar approach—using influencer visibility to position peptide-based wellness and coaching as part of a lifestyle movement rather than a medical practice. These platforms present prescription-adjacent therapies as lifestyle upgrades, not medical interventions—a subtle linguistic shift that allows them to operate outside traditional FDA advertising rules while leaning on celebrity trust as the new credential. It's the same playbook that turned GLP-1s from a diabetes treatment into a cultural symbol of transformation—only now it's being applied to the broader promise of longevity on demand. The FDA Gap: Where Telehealth Slips Through the Cracks The FDA's jurisdiction traditionally covers drug labeling and advertising , not the marketing of a platform or medical service. That's why telehealth startups — which present themselves as “care delivery” or “wellness enablement” platforms — often fall outside those boundaries, even when they prescribe or distribute regulated drugs. The result is a system where traditional pharma is hyper-regulated for transparency and risk disclosure, while digital-first startups can operate with influencer-style freedom. Telehealth lives in a gray zone because it's both healthcare and marketing. When you use a celebrity to sell the idea of a drug, not the drug itself, you're not technically breaking the law — but you're breaking the spirit of it. That spirit matters. The PhRMA Code was designed to restore public trust after decades of excess — golf trips, luxury dinners, and branded swag. Today's digital-era equivalent isn't a steak dinner; it's a TikTok clip of a celebrity explaining why they chose a telehealth platform for weight loss. The medium has changed. The influence hasn't. Cultural Influence vs. Clinical Oversight The danger isn't just regulatory — it's psychological. When a celebrity shares their “health journey,” it carries a halo of authenticity that traditional pharma marketing can't match. But unlike a physician's endorsement, that influence is unchecked by medical ethics. In the past, the industry worried about sales reps buying physicians' loyalty. Now the risk is reversed: VC-backed startups are buying public trust through celebrity intimacy. It's particularly acute in areas like GLP-1s and advanced imaging, where treatments are complex, risks are real, and follow-up care is critical. A single endorsement can blur the distinction between lifestyle enhancement and medical necessity — turning medicine into a consumer decision guided by aspiration, not diagnosis. “In longevity, the majority of consumers base decisions on popularity and promise. Who tells them they have a bespoke solution which can unlock an extra 10 years, who claims to have produced a new molecule that will reverse skin and cellular aging, who holds the longevity pill. If you're listening to someone like Andrew Huberman, you're in the clear. But if you're listening to someone who believes more in the marketing than in the science, you're in trouble. We can't burden consumers with credentialing every claim; it's far too easy as humans to be enchanted by the sexy and shiny, while ignoring what might be less intoxicating on the surface but in reality far realer.” — Joshua Herring, President and CEO, Longevity Science Foundation The celebrityization of medicine doesn't just sell products. It sells perception — and that can change what people think health is. The Reality Behind Celebrity Medicine To understand how we got here, you have to start with the mania. GLP-1 drugs like Ozempic, Wegovy, and Mounjaro didn't just spark a medical revolution — they ignited a cultural one. For VC-bacled startups, the combination of medical legitimacy, subscription economics, and vanity appeal created the ultimate flywheel. Each new celebrity “ambassador” fuels the perception that these drugs are not only effective but aspirational — a modern wellness rite of passage rather than a tightly controlled prescription therapy. Venture capitalists like the economics: recurring revenue, DTC margins, and a culturally viral product that sells itself. But the more medicine behaves like a brand, the more it starts to inherit the same moral hazards as beauty and wellness — industries that have long blurred the boundary between health and aspiration. The Double Standard: Why Supplements Get a Pass — and Telehealth Shouldn't That boundary is what makes celebrity spokespeople in telemedicine particularly egregious. In supplements and wellness — sectors often described as the “Wild West” — celebrity endorsement has been normalized, if not expected. Gwyneth Paltrow can sell vitamins, and Tom Brady can market hydration powders, because supplements fall under the Dietary Supplement Health and Education Act (DSHEA) , which leaves oversight largely to manufacturers. But telemedicine isn't a supplement. It's regulated care — often involving prescription drugs, diagnostics, and clinical follow-up. When a celebrity becomes the face of a medical platform, the credibility of science is leveraged for marketing, yet the scrutiny of medicine doesn't always follow. The FDA has long turned a wary eye to the supplement industry's unverified claims but stopped short of serious reform. That same permissiveness is now seeping into digital health, where startups cloak medical interventions in the aesthetics of wellness — glossy campaigns, influencer testimonials, and the illusion of clinical endorsement. It's the consumerization of medicine without the guardrails of medicine — a dangerous convergence of Silicon Valley speed, celebrity influence, and regulatory gray zones. The Trust Reckoning: Who Regulates Medicine When Everyone's an Influencer? The next phase of digital health will test whether innovation can coexist with integrity. If celebrity influence continues to shape how Americans access drugs and diagnostics, the FDA will face mounting pressure to expand its jurisdiction — or risk repeating the same laissez-faire oversight that let the supplement market spiral into pseudoscience. As venture capital continues to chase recurring revenue and virality, regulators and clinicians will have to decide whether medicine remains a public trust — or becomes just another category of content. “From a business growth perspective, in the short term this fame-centric marketing makes a lot of sense, particularly in spaces as noisy as digital and tele-health: break into the market, build brand, and your ARR piles up. Some companies have every right to promote their products when they truly deliver optimized results. Others building business models without the purest intention in delivering on the promise of ‘better health' fragment the ecosystem, and certainly do not — what's very clearly missing are guardrails. If they're built, though, that actually incentivizes companies to build better outcome-focused products, with the promotional activity as their reward for doing so.” — Joshua Herring, CEO and President, Longevity Science Foundation Because in medicine, the celebrities may draw attention, but they don't confer credibility. Real health innovation will begin when the FDA treats telehealth marketing with the same scrutiny as pharmaceutical advertising.

Function Health Frequently Asked Questions (FAQ)

When was Function Health founded?

Function Health was founded in 2022.

Where is Function Health's headquarters?

Function Health's headquarters is located at 600 Congress Avenue, Austin.

What is Function Health's latest funding round?

Function Health's latest funding round is Unattributed VC.

How much did Function Health raise?

Function Health raised a total of $53.1M.

Who are the investors of Function Health?

Investors of Function Health include Bossa Invest, Next Sparc, Redpoint Ventures, Zac Efron, Colin Kaepernick and 29 more.

Who are Function Health's competitors?

Competitors of Function Health include Superpower and 7 more.

What products does Function Health offer?

Function Health's products include Function Health.

Loading...

Compare Function Health to Competitors

InsideTracker integrates biomarker data from blood, DNA, activity trackers, and user-generated demographic information to create science-backed recommendations to optimize healthspan. Its technology combines machine learning and computational biology. The company serves clients in the healthcare sector. It was founded in 2009 and is based in Cambridge, Massachusetts.

Mito Health specializes in advanced health screening and analytics within the healthcare industry. The company offers a health screening service that analyzes over 67 biomarkers to assess risks for various diseases and provides personalized health plans with AI technology. Mito Health primarily serves individuals seeking to optimize their health and longevity. It was founded in 2023 and is based in Singapore.

Levels is a health technology company. The company offers a platform that integrates with continuous glucose monitors (CGMs) to provide real-time blood sugar data and personalized insights to help users optimize their nutrition, sleep, and exercise. Levels primarily serve individuals seeking to improve their personal health and wellness through data-driven insights. It was founded in 2019 and is based in New York, New York.

RxFood provides AI-driven personalized nutrition within the healthcare sector, emphasizing dietary management. The company offers dietary assessments and supports changes to assist patients in achieving medical goals, especially in chronic disease management. RxFood serves clinicians, dietitians, hospitals, and patients by providing nutritional insights and recommendations. It was founded in 2017 and is based in Toronto, Ontario.

Maximus focuses on hormone optimization and men's health. The company offers a range of services, including testosterone improvement protocols, weight management programs, and hair regrowth treatments, all prescribed by doctors and backed by clinical studies. Maximus primarily serves the healthcare industry, providing telemedicine services for men seeking to improve their health and wellness. Maximus was formerly known as Actualize. It was founded in 2020 and is based in Santa Monica, California.

Brightseed operates in biosciences and artificial intelligence (AI) within the health sector. The company has an (AI) platform, used for the discovery and validation of bioactive compounds and the formulation of health-related ingredients. Brightseed's products are aimed at companies in the dietary supplement, food & beverage consumer packaged goods, specialty nutrition, and medical food industries. It was founded in 2017 and is based in South San Francisco, California.

Loading...