Further AI

Founded Year

2023Stage

Series A | AliveTotal Raised

$30.55MLast Raised

$25M | 1 mo agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+400 points in the past 30 days

About Further AI

Further AI uses artificial intelligence in the commercial insurance sector. It provides assistants that automate document processing and assist with underwriting, claims, and compliance tasks. Its technology addresses challenges in the insurance industry, including increased submission volumes and operational efficiency. Further AI was formerly known as OneHop. It was founded in 2023 and is based in San Francisco, California.

Loading...

Further AI's Products & Differentiators

AI Assistant

FurtherAI is like chatgpt for insurance that can execute end to end workflows like submissions processing, claims intake and more

Loading...

Research containing Further AI

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Further AI in 3 CB Insights research briefs, most recently on Oct 23, 2025.

Oct 23, 2025 report

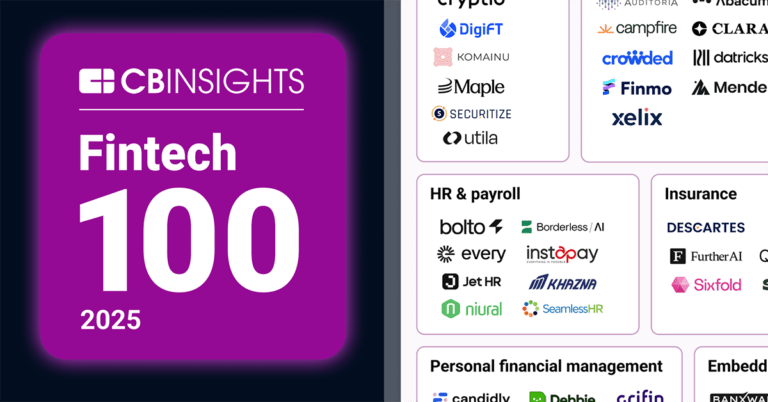

Fintech 100: The most promising fintech startups of 2025

Oct 23, 2025 report

Book of Scouting Reports: 2025’s Fintech 100

Oct 16, 2025 report

Insurtech 50: The most promising insurtech startups of 2025Expert Collections containing Further AI

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Further AI is included in 10 Expert Collections, including Generative AI.

Generative AI

2,951 items

Companies working on generative AI applications and infrastructure.

Artificial Intelligence (AI)

20,894 items

InsurTech NY — Spring Conference 2025

124 items

Sponsors, speaker companies, and startup competition finalists as of 3.19.25

Insurtech

4,636 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,809 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Insurtech 50 2025

50 items

Do not share

Latest Further AI News

Nov 4, 2025

Want unlimited access to top ideas and insights? There were about 65 funding events in the insurtech sector in October 2025, according to a review by Digital Insurance. What follows is a selection of these, focusing on those in the insurtech and property & casualty sectors that are part of the venture-capital financing model. (Other funding events, such as private-equity infusions, are included in the overall count.) A portion of the data was sourced from Crunchbase. Other information, including quotes from investing VCs, comes from company announcements. For our previous edition, These summaries were crafted using AI and then reviewed by the Digital Insurance editorial team. INSTANDA -Type of company: no-code insurance platform -Investors: CommerzVentures, Toscafund, Dale Ventures, former Hiscox CEO Bronek Masojada Tim Hardcastle, CEO and Co-founder of INSTANDA, said in a statement: "This investment reflects both the strength and potential of our platform, our people, and our vision. We are delighted to work with CommerzVentures and leverage their proven expertise in B2B SaaS. With CommerzVentures onboard and continued support from Toscafund and Dale Ventures, we are poised to scale faster, innovate deeper and deliver even greater value to our diverse client base, from leading MGAs to global carriers operating across multiple markets. At the heart of this next phase of innovation, we will further embed data science and AI in our platform for the benefit of our global client community." Liberate - Funding: $50 million Series B on Oct. 15, 2025 - Type of company: the AI company reinventing how insurance carriers and agencies operate and serve their customers - Investors: Battery Ventures, Canapi Ventures, Redpoint Ventures, Eclipse, Commerce Ventures "Our singular focus on the P&C insurance industry, pre-packaged integrations into most major carrier core systems & agency management systems, and emphasis on end-to-end resolution of calls and emails has enabled us to demonstrate real ROI with every carrier and agency we work with," said one of the founders Amrish Singh. Meanwhile - Type of company: Bitcoin life insurance company - Investors: Haun Ventures, Bain Capital Crypto, Pantera Capital, Apollo, Northwestern Mutual Future Ventures, Stillmark "Life insurers have always provided the steady, long-term capital that keeps financial markets moving. We're bringing that same role to Bitcoin—helping families save and protect wealth in BTC, while giving institutions new ways to earn returns and launch bitcoin-indexed products that are compliant and easy to scale. This raise lets us build on what's working and expand it with partners around the world," said Zac Townsend, CEO of Meanwhile. FurtherAI - Type of company: AI for insurance industry - Investors: Andreessen Horowitz, Nexus Venture Partners, Y Combinator "We're grateful to partner with leaders across the industry as they modernize operations," said Aman Gour, co-founder and CEO of FurtherAI. "Insurance is the backbone of the economy, but the people running it have been stuck with outdated tools. With this funding, we're doubling down on building AI workflows that give underwriters, brokers, and claims teams superpowers - freeing them to focus on the work that truly matters." Bluefields - Funding: $15 million on Oct. 29, 2025 - Type of company: a modern Managing General Agent (MGA) platform purpose-built for underserved and complex specialty markets - Investors: Crosslink Capital, Equal Ventures, American Family Ventures, Greenlight Re and others "The most interesting opportunities in insurance aren't in the obvious places—they're in the gaps no one else is solving," said Cam Serigne, founder and CEO of Bluefields. "Bluefields was built to find those markets and bring modern tools and smarter solutions where they've never existed before."

Further AI Frequently Asked Questions (FAQ)

When was Further AI founded?

Further AI was founded in 2023.

Where is Further AI's headquarters?

Further AI's headquarters is located at 128 King Street, San Francisco.

What is Further AI's latest funding round?

Further AI's latest funding round is Series A.

How much did Further AI raise?

Further AI raised a total of $30.55M.

Who are the investors of Further AI?

Investors of Further AI include Y Combinator, Nexus Venture Partners, Xceedance, Pioneer Fund, Converge and 7 more.

Who are Further AI's competitors?

Competitors of Further AI include Indico Data, Ema, Outmarket, Gradient AI, CLARA Analytics and 7 more.

What products does Further AI offer?

Further AI's products include AI Assistant and 1 more.

Loading...

Compare Further AI to Competitors

mea is a technology company that focuses on the insurance sector. It provides AI-driven data processing and underwriting solutions. The company offers a platform that automates the submission and claims processes for insurers, managing data ingestion, compliance checks, and document processing with generative AI. It serves insurers, brokers, and managing general agents (MGAs). It was founded in 2021 and is based in London, United Kingdom.

Carpe Data provides predictive data analytics and artificial intelligence solutions for the insurance industry. The company offers services for fraud detection, claims processing, and small commercial underwriting using data science techniques and AI. Carpe Data serves the insurance sector with products aimed at improving the efficiency and accuracy of claims and underwriting operations. It was founded in 2016 and is based in Santa Barbara, California.

FilingRamp is a company that focuses on the insurance filing process and data accessibility within the insurance sector. The company offers solutions for the filing submission and approval process, provides data analytics, and enables collaboration among insurance professionals. FilingRamp serves the insurance industry, offering tools that integrate with existing systems for compliance. It was founded in 2018 and is based in New York, New York.

Roots specializes in AI-driven solutions for the insurance industry, focusing on automating underwriting, claims, and policy servicing processes. The company offers an AI agent platform that supports insurance operations through data extraction, processing, and workflow orchestration. Roots primarily serves the insurance sector, providing tools that enhance operational efficiency and accuracy for insurers. The company was formerly known as Roots Automation. It was founded in 2018 and is based in New York, New York.

Hyperscience provides enterprise artificial intelligence (AI) infrastructure software focused on hyperautomation. The company automates and orchestrates end-to-end processes to utilize back-office data and documents. Its solutions aim to improve decision-making and customer experiences. It was founded in 2014 and is based in New York, New York.

Instabase provides a platform for analyzing and structuring unstructured data from various operational systems and data stores across multiple industries. It enables businesses to automate document processing workflows and build applications with a low-code approach. It serves sectors such as financial services, insurance, healthcare, and the public sector, with a focus on operational efficiency and customer experience. It was founded in 2015 and is based in San Francisco, California.

Loading...