Gem

Founded Year

2017Stage

Series C | AliveTotal Raised

$146MValuation

$0000Last Raised

$100M | 4 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-34 points in the past 30 days

About Gem

Gem is a recruiting platform that provides tools for talent acquisition teams across various industries. The platform includes sourcing, scheduling, and analytics, all integrated to improve recruiter productivity and reduce time-to-hire. Gem serves the human resources and talent acquisition sectors, providing solutions for startups, growth-stage companies, and enterprise-level organizations. It was founded in 2017 and is based in San Francisco, California.

Loading...

Loading...

Research containing Gem

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Gem in 1 CB Insights research brief, most recently on Aug 7, 2024.

Aug 7, 2024

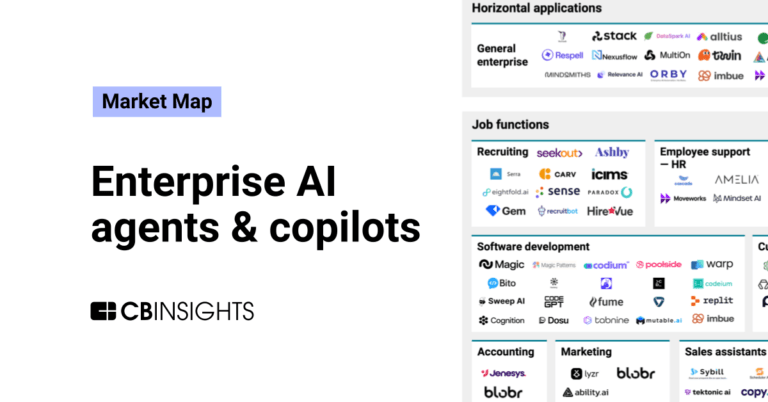

The enterprise AI agents & copilots market mapExpert Collections containing Gem

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Gem is included in 6 Expert Collections, including HR Tech.

HR Tech

6,260 items

The HR tech collection includes software vendors that enable companies to develop, hire, manage, and pay their workforces. Focus areas include benefits, compensation, engagement, EORs & PEOs, HRIS & HRMS, learning & development, payroll, talent acquisition, and talent management.

Unicorns- Billion Dollar Startups

1,297 items

Artificial Intelligence (AI)

37,333 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Generative AI

2,951 items

Companies working on generative AI applications and infrastructure.

AI Agents & Copilots Market Map (August 2024)

322 items

Corresponds to the Enterprise AI Agents & Copilots Market Map: https://app.cbinsights.com/research/enterprise-ai-agents-copilots-market-map/

AI agents & copilots

1,771 items

Companies developing AI agents, assistants/copilots, and agentic infrastructure. Includes pure-play emerging agent startups as well as companies building agent offerings with varying levels of autonomy.

Latest Gem News

Oct 14, 2025

MIAMI Oct. 14, 2025 /PRNewswire/ -- The 2025 Standalone Talent Acquisition Technology Value Matrix highlights a market that continues to deliver measurable ROI by improving recruiter efficiency, reducing time-to-hire, and elevating the candidate experience. Despite consolidation across the broader HCM landscape, standalone TA platforms remain essential due to their agility and ability to integrate with enterprise systems, job boards, and HCM suites to close functional gaps. AI is now embedded across the TA lifecycle, moving from basic skill matching and job description generation toward agentic automation that targets repetitive administrative work. Automated interview scheduling, candidate matching, and career site chatbots are freeing recruiters to focus on relationship-building while reducing operational costs. These investments are producing direct returns through faster hiring cycles and higher-quality candidate engagement. "Standalone talent acquisition solutions that apply automation intelligently are delivering measurable ROI through faster hiring and reduced recruiter workloads," said Evelyn McMullen , Research Manager at Nucleus Research. "By streamlining repetitive tasks, these platforms allow recruiters to focus on higher-value candidate engagement and strategic decision-making." A growing concern, however, is candidate fraud , particularly in industries with high-volume hiring. Vendors are responding with deeper identity verification and fraud detection capabilities that balance automation with compliance and trust. This focus is expanding as new AI governance regulations take shape, driving vendors to embed more robust controls into their platforms. As organizations compete for scarce talent, standalone TA vendors are differentiating by combining AI-driven efficiency with transparent, candidate-centered design. The result is a more intelligent, secure, and efficient recruiting ecosystem that delivers measurable business value across industries. Leaders in the Value Matrix excel in both functionality and usability, offering comprehensive solutions that deliver high ROI and support large-scale adoption. Leaders in this year's Value Matrix include ClearCompany, Eightfold, Greenhouse, iCIMS, Rival, and Zoho Recruit. Expert vendors offer deep, specialized functionality suited for complex or niche requirements. These include Beamery, Jobvite, Lever, Phenom, and SmartRecruiters. Accelerators focus on usability and ease of deployment, providing simpler solutions that enable quick adoption with less complexity. This year's Accelerators are Daxtra, hireEZ, JobSync, Paradox, and Plum. Core Providers offer essential, reliable functionalities, ideal for organizations with basic needs. This year's Core Providers are Gem, HireVue, JazzHR, Veritone Hire, and Workable. To download the full 2025 Standalone Talent Acquisition Technology Value Matrix, click here About Nucleus Research Nucleus Research is the recognized global leader in ROI technology research. Using a case-based approach, we provide research streams and advisory services that allow vendors and end users to quantify and maximize the return from their technology investments. For more information, visit NucleusResearch.com or follow our latest updates on LinkedIn. View original content to download multimedia: https://www.prnewswire.com/news-releases/nucleus-research-releases-2025-standalone-talent-acquisition-technology-value-matrix-302583221.html SOURCE Nucleus Research

Gem Frequently Asked Questions (FAQ)

When was Gem founded?

Gem was founded in 2017.

Where is Gem's headquarters?

Gem's headquarters is located at 1 Post Street, San Francisco.

What is Gem's latest funding round?

Gem's latest funding round is Series C.

How much did Gem raise?

Gem raised a total of $146M.

Who are the investors of Gem?

Investors of Gem include Accel, Greylock Partners, Sapphire Ventures, ICONIQ Capital, Meritech Capital Partners and 6 more.

Who are Gem's competitors?

Competitors of Gem include Findem, Ashby, Yello, hireEZ, Beamery and 7 more.

Loading...

Compare Gem to Competitors

Kula is a recruiting platform that focuses on streamlining the hiring process for businesses. The company offers services including applicant tracking, candidate sourcing, hiring process analytics, and AI-powered tools for recruitment efforts. Kula serves the recruitment and human resources sectors, providing tools that integrate into existing workflows to improve efficiency and decision-making. It was founded in 2021 and is based in Walnut, California.

Fountain provides frontline workforce management solutions within the human resources technology sector. It has a platform designed for the hiring, onboarding, and retention processes for businesses, utilizing tools for recruitment, candidate assessments, and compliance. Fountain serves industries that typically have high workforce demands, including retail, manufacturing, logistics, and hospitality. It was founded in 2014 and is based in San Francisco, California.

JobScore is a platform focused on talent acquisition and recruiting within the HR technology sector. The company provides services that include applicant tracking, candidate pipeline management, and analytics. JobScore's solutions are intended for HR professionals, recruiters, and hiring teams, offering tools for job posting, resume parsing, interview scheduling, and compliance management. It was founded in 2004 and is based in San Francisco, California.

Sense operates in the recruitment industry, providing talent engagement solutions. The company has a platform designed to automate recruiting workflows, manage talent relationships, and facilitate candidate matching through communication channels. Sense serves sectors including financial services, healthcare, logistics, manufacturing, retail, staffing, and technology. It was founded in 2016 and is based in San Francisco, California.

Greenhouse specializes in hiring software solutions and operates within the technology and human resources sectors. The company offers a range of products that assist with recruiting and onboarding, aiming to streamline the hiring process and improve efficiency. Its tools help businesses source talent, conduct structured interviews, and onboard new hires. Greenhouse was formerly known as Dajoco. It was founded in 2012 and is based in New York, New York.

Dover specializes in recruitment technology and services within the human resources sector. The company provides a suite of tools for sourcing candidates, managing applicants, and streamlining the hiring process. Dover's advanced services cater to companies looking to intensify their hiring efforts. It was founded in 2019 and is based in San Francisco, California.

Loading...