GoCardless

Founded Year

2011Stage

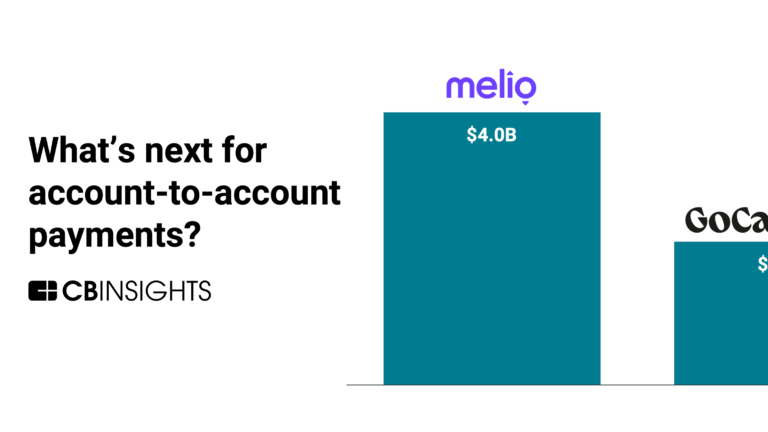

Series G | AliveTotal Raised

$529.32MValuation

$0000Last Raised

$312M | 4 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-50 points in the past 30 days

About GoCardless

GoCardless provides online payment processing solutions for various business sectors. The company offers services for one-off, recurring, and invoice payments, including options for subscriptions, installments, and automated payment collection. GoCardless serves sectors that require payment processing and management, such as e-commerce, real estate tech, and cloud computing. It was founded in 2011 and is based in London, United Kingdom.

Loading...

GoCardless's Product Videos

ESPs containing GoCardless

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The open banking solutions market provides secure and reliable data sharing between financial institutions and third parties through APIs. These solutions enable businesses to access financial data and initiate payments with customer permission. Companies in this market offer products for account aggregation, payment initiation, data enrichment, risk assessment, and compliance with open banking re…

GoCardless named as Highflier among 15 other companies, including Plaid, Fiserv, and TrueLayer.

GoCardless's Products & Differentiators

GoCardless Payments

GoCardless is the world’s largest direct bank pay network, processing over $30bn in payments every year. We enable businesses to collect payments directly from their customers bank accounts without the need for card network intermediaries. Operate globally, but feel local with bank debit payment options in over 30 countries, including the UK (Bacs Direct Debit), Eurozone countries (SEPA), the USA (ACH), Canada (PAD), Australia (BECS) and New Zealand (PaymentsNZ). Manage your payments from a single platform, customizable to match your needs - whether you’re a small business or global enterprise. It’s time to say goodbye to cards for good.

Loading...

Research containing GoCardless

Get data-driven expert analysis from the CB Insights Intelligence Unit.

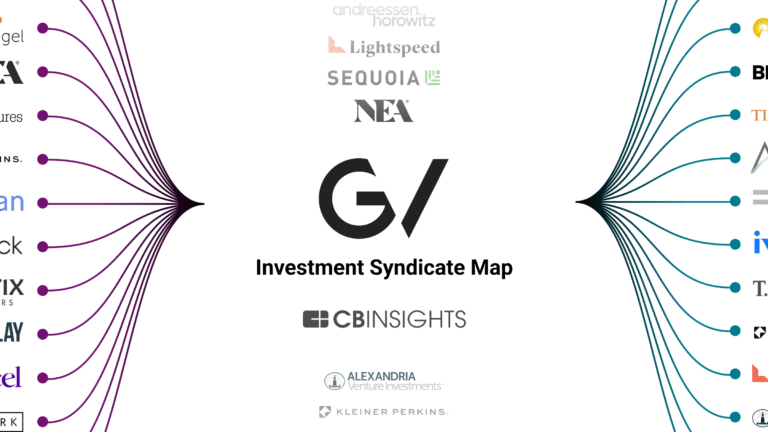

CB Insights Intelligence Analysts have mentioned GoCardless in 6 CB Insights research briefs, most recently on Aug 23, 2024.

Expert Collections containing GoCardless

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

GoCardless is included in 9 Expert Collections, including Restaurant Tech.

Restaurant Tech

1,075 items

Hardware and software for restaurant management, bookings, staffing, mobile restaurant payments, inventory management, cloud kitchens, and more. On-demand food delivery services are excluded from this collection.

Unicorns- Billion Dollar Startups

1,309 items

Fintech 100

1,247 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

SMB Fintech

1,648 items

Payments

3,277 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

14,203 items

Excludes US-based companies

Latest GoCardless News

Nov 14, 2025

The initiative aims to help local teams focus less on late payments and more on building community and healthy habits through sport. GoCardless works together with County FAs to power accessibility, diversity, and inclusion in the game. Supporting football communities Football clubs in these counties can use the company's Direct Debit features for recurring payments, helpful in use cases such as collecting subscriptions, and pairing them to Open Banking payments to take one-time transactions, like tournament registration fees and payment of red and yellow cards. The GoCardless platform helps clubs automate collections, gain better visibility of their funds, and predict future income while keeping costs down by avoiding cards and their associated fees. This allows more money to be used for the game, which leads to more financial certainty for the clubs and more opportunities for players. As per the partnerships, the Girls Coaching Centre will be renamed the GoCardless Girls Coaching Centre, with a new GoCardless Hardship Fund offering financial bursaries to low-income GCC players. In Northumberland, the company will support St Peter's Sports Hub with workshops for coaches in disability games. The Surrey FA has GoCardless sponsoring the Women's Cup and Discriminated Background Cup, while the headquarters of Sussex FA will be renamed the GoCardless Stadium. The company deepened its collaborations with FAs in the last year, expanding its alliance with Kent FA by becoming the Official County Cups Sponsor for the adult competitions. Last year, the fintech also joined forces with Total Grassroots and kit manufacturer Kelme to boost financial sustainability for local clubs. Six more County FA partnerships are projected to be announced in the coming months. By optimising their payment processes, GoCardless offers clubs, their staff, and volunteers more time to focus on making a positive impact. For more information about GoCardless, please check out their detailed profile in our dedicated, industry-specific Company Database.

GoCardless Frequently Asked Questions (FAQ)

When was GoCardless founded?

GoCardless was founded in 2011.

Where is GoCardless's headquarters?

GoCardless's headquarters is located at 65 Goswell Road, London.

What is GoCardless's latest funding round?

GoCardless's latest funding round is Series G.

How much did GoCardless raise?

GoCardless raised a total of $529.32M.

Who are the investors of GoCardless?

Investors of GoCardless include Permira, BlackRock, Accel, Balderton Capital, Notion Capital and 28 more.

Who are GoCardless's competitors?

Competitors of GoCardless include DRUO, PayNearMe, Worldpay, Satispay, Clip and 7 more.

What products does GoCardless offer?

GoCardless's products include GoCardless Payments and 4 more.

Who are GoCardless's customers?

Customers of GoCardless include Docusign and Gravity Active Entertainment.

Loading...

Compare GoCardless to Competitors

Lemonway is a payment institution that specializes in providing payment processing and wallet management solutions for marketplaces, crowdfunding platforms, and e-commerce websites. The institution offers a modular payment system that enables clients to handle transactions, from collection to disbursement, with a focus on KYC/AML regulatory compliance. Lemonway primarily serves the e-commerce industry, crowdfunding platforms, and other online marketplaces. It was founded in 2007 and is based in Paris, France.

Cellulant develops an electronic payment service connecting customers with banks and utility services to create a payment ecosystem. It offers a single application program interface payments platform that provides locally relevant and alternative payment methods for global, regional, and local merchants. Its platform enables businesses to collect payments online and offline while allowing anyone to pay from their mobile money, local and international cards, and directly from their bank. It was founded in 2004 and is based in Nairobi, Kenya.

Previse specializes in financial transaction analytics and AI-driven insights within the fintech industry. The company offers a platform that connects, matches, and monitors data to provide insights for businesses. Previse's solutions cater to enterprises, financial institutions, and fintechs, focusing on automating payment processes, managing credit risk, and improving decision-making. It was founded in 2016 and is based in London, England.

ToneTag provides contactless payment solutions using soundwave technology in the financial technology sector. The company offers services including voice-assisted payments, digital billing, and merchant payment solutions. ToneTag serves sectors such as retail, food and beverage, and banking. ToneTag was formerly known as Naffa Innovations. It was founded in 2013 and is based in Bengaluru, India.

TouchBistro focuses on providing an all-in-one point of sale (POS) and restaurant management system in the restaurant industry. The company offers a range of services, including front-of-house, back-of-house, and guest engagement solutions, which help restaurateurs streamline their operations, manage their menu, sales, staff, and more. Its services are designed to increase sales, improve guest experiences, and save time and money. It was founded in 2011 and is based in Toronto, Canada.

PayNearMe is a technology company that operates within the financial services industry, providing a payment processing platform. The platform is designed to accept payments and manage exceptions. PayNearMe serves sectors such as auto and consumer lending, tolling, iGaming, Buy Here Pay Here, banks and credit unions, and mortgage servicing. PayNearMe was formerly known as Handle Financial. It was founded in 2009 and is based in Santa Clara, California.

Loading...