Investments

311Portfolio Exits

43Partners & Customers

1About Gradient Ventures

Gradient Ventures is a seed fund focused on artificial intelligence within the technology sector. The company provides investments and support to AI startups, maintaining a founder-centric and collaborative approach. It was founded in 2017 and is based in San Francisco, California.

Expert Collections containing Gradient Ventures

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Gradient Ventures in 1 Expert Collection, including Fortune 500 Investor list.

Fortune 500 Investor list

590 items

This is a collection of investors named in the 2019 Fortune 500 list of companies. All CB Insights profiles for active investment arms of a Fortune 500 company are included.

Research containing Gradient Ventures

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Gradient Ventures in 1 CB Insights research brief, most recently on Oct 24, 2024.

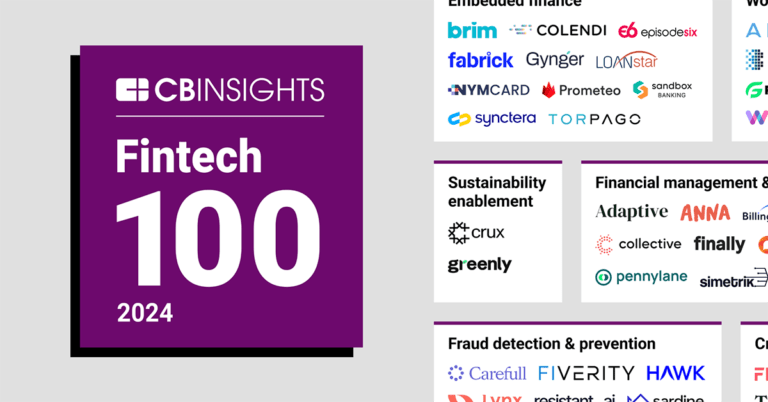

Oct 24, 2024 report

Fintech 100: The most promising fintech startups of 2024Latest Gradient Ventures News

Oct 22, 2025

Israeli startup Anchor Browser , which develops AI agents for performing organizational operations at scale in an internet environment, has emerged from stealth and announced the completion of a $6 million seed financing round. The round was led by Blumberg Capital and Google's Gradient Ventures, which focuses on AI companies. Another prominent investor in the startup is Colin Evans, Director of VC Partnerships and Startups at OpenAI. Anchor Browser was founded in October 2024, and is already running tens of millions of AI agents for dozens of customers. In Israel, it is one of the few startups active in the field of AI infrastructure, and has already signed a significant strategic partnership with Cloudflare (a global leader in verification and bot detection services). The company's founders - Idan Raman (CEO), Dor Dankner (CTO), and Guy Ben Simhon (VP R&D) - are graduates of the IDF 8200 intelligence unit with a rich background in cybersecurity, automation, and development tools from their previous positions at SentinelOne, Noname Security, and BlinkOps. The company has nine employees in its Tel Aviv offices. Some of the recruitment goals are to expand the development center in Israel (the company has begun hiring additional employees) and invest in sales and marketing - mainly in the US market. By 2030, the market for autonomous AI agents is expected to be worth $70 billion. But even though large language models (LLMs) already allow inference and decision-making, AI agents still struggle to operate online - due to fragile scripts, lack of APIs, and dynamic user interfaces (UI). As a result, and despite the race to implement AI in organizations, many of these implementation attempts fail due to the lack of an adequate solution to this problem. This is exactly the solution offered by Anchor Browser, which is one of the only companies on the market offering an innovative platform that turns any web interface into an intelligent access layer for AI systems. Many organizations currently employ entire teams of outsourced employees to perform simple tasks over the internet - critical but repetitive operations such as filling out government forms, tracking orders, entering details, etc. - tasks that until now could not be performed automatically in a stable, secure and efficient way. Anchor Browser's solution enables full automation of these processes through an innovative and groundbreaking approach in the field of AI agents for the browser, and helps organizations perform technological transformation and adopt AI in a smooth and straightforward way - with real value in the real world in the form of substantial cost savings, while increasing the efficiency and performance of the organization. The market has already expressed confidence in Anchor Browser's solution. In addition to the prominent investors who have chosen to invest in the company and its product, the early-stage startup's clients already include leading companies in the field of AI solutions, including Groq, Unify and Browser Use. In addition, Anchor has a number of strategic partnerships with leading companies such as Cloudflare, Coinbase and Groq - in diverse fields such as cybersecurity, data infrastructure and AI-based development tools. Anchor CEO and founder Idan Raman said, "Agentic AI is only as useful as its ability to act in the real world, and in today's enterprise, that means acting on the web. Most of the web is still inaccessible to AI because it wasn't designed for machines. Our mission is to bridge that gap, reliably, securely, and at scale. It amazes us to see how quickly organizations can adopt AI when they focus on making it dead simple - insert AI into existing processes and needs rather than rebuilding the entire org from scratch." Blumberg Capital managing director Bruce Taragin, a Board Member at Anchor added, "We were immediately engaged by the Anchor team - not just their technical depth, but their clarity of vision in a fast-emerging space and commercial grit. As AI agents begin to reshape how software is used, Anchor is enabling developers to interact with the web the way humans do and broadening the reach and utility of AI to an unimaginable scale." Published by Globes, Israel business news - en.globes.co.il - on October 22, 2025. © Copyright of Globes Publisher Itonut (1983) Ltd., 2025.

Gradient Ventures Investments

311 Investments

Gradient Ventures has made 311 investments. Their latest investment was in Digitail as part of their Series B on November 10, 2025.

Gradient Ventures Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

11/10/2025 | Series B | Digitail | $23M | No | Atomico, byFounders, Five Elms Capital, Partech, and Undisclosed Investors | 2 |

10/26/2025 | Seed VC | truthsystems | $4M | Yes | Andreessen Horowitz, Eli Brown, F-Prime Capital, Harshita Arora, Kaz Nejatian, Kent Wakeford, Lauren Wagner, Lightspeed Venture Partners, Ooshma Garg, Pear VC, Silver Circle, The LegalTech Fund, WndrCo, and Y Combinator | 3 |

10/22/2025 | Seed VC | Anchor | $6M | Yes | 2 | |

9/8/2025 | Seed VC | |||||

8/1/2025 | Seed |

Date | 11/10/2025 | 10/26/2025 | 10/22/2025 | 9/8/2025 | 8/1/2025 |

|---|---|---|---|---|---|

Round | Series B | Seed VC | Seed VC | Seed VC | Seed |

Company | Digitail | truthsystems | Anchor | ||

Amount | $23M | $4M | $6M | ||

New? | No | Yes | Yes | ||

Co-Investors | Atomico, byFounders, Five Elms Capital, Partech, and Undisclosed Investors | Andreessen Horowitz, Eli Brown, F-Prime Capital, Harshita Arora, Kaz Nejatian, Kent Wakeford, Lauren Wagner, Lightspeed Venture Partners, Ooshma Garg, Pear VC, Silver Circle, The LegalTech Fund, WndrCo, and Y Combinator | |||

Sources | 2 | 3 | 2 |

Gradient Ventures Portfolio Exits

43 Portfolio Exits

Gradient Ventures has 43 portfolio exits. Their latest portfolio exit was Mentum on October 29, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

10/29/2025 | Acquired | 3 | |||

10/28/2025 | Acquired | 3 | |||

10/3/2025 | Acquired | 6 | |||

Gradient Ventures Partners & Customers

1 Partners and customers

Gradient Ventures has 1 strategic partners and customers. Gradient Ventures recently partnered with Parker Remick on .

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

Vendor | United States | 1 |

Date | |

|---|---|

Type | Vendor |

Business Partner | |

Country | United States |

News Snippet | |

Sources | 1 |

Gradient Ventures Team

6 Team Members

Gradient Ventures has 6 team members, including current Founder, Managing Partner, Anna Patterson.

Compare Gradient Ventures to Competitors

BootstrapLabs is the Venture Capital Group of Ares Management, and operates as a firm that focuses on applied artificial intelligence across various sectors. The firm provides seed-stage investments and acts as a lead investor, offering follow-on funding during growth stages to support founders. BootstrapLabs concentrates on AI applications in areas such as the future of work, mobility, health, financial infrastructure, digital infrastructure, and energy/climate solutions. It was founded in 2008 and is based in San Francisco, California.

Greylock Partners focuses on early-stage investments in the technology sector. The company provides funding to artificial intelligence (AI)-focused companies at the pre-seed, seed, and Series A stages. Greylock Partners offers a company-building program to support pre-idea and pre-seed founders in developing their startups. It was founded in 1965 and is based in Menlo Park, California.

Bessemer Venture Partners operates in the technology sectors and supports entrepreneurs in building companies. The company provides funding and guidance to startups at various growth stages, particularly in the enterprise, consumer, and healthcare areas. Its investment portfolio includes sectors such as artificial intelligence (AI) and machine learning (ML), biotechnology, cloud computing, consumer products, cybersecurity, fintech, and vertical software. It was founded in 1911 and is based in San Francisco, California.

Zetta Venture Partners focuses on venture capital investments in the AI sector, specifically targeting startups within the intelligent enterprise software industry. The company provides funding to startups that develop software to analyze and predict outcomes. Zetta primarily invests in companies that create AI applications and infrastructure. It was founded in 2013 and is based in San Francisco, California.

NexaTech Ventures is a venture capital firm focused on AI and technology innovation within the investment sector. It offers strategic funding, equity investments, mentorship, technical support, and human resources development to early-stage and growth-stage AI companies. It primarily serves the technology startup industry emphasizing AI-driven companies. It was founded in 2024 and is based in London, United Kingdom.

Bertelsmann Investments operates as an investment platform in the venture capital industry. The company partners with entrepreneurs and venture funds to offer financial backing and assistance for business development across different stages and sectors. Bertelsmann Investments also participates in incubation efforts and buy-and-build strategies through its program, Bertelsmann Next. It was founded in 2016 and is based in Gutersloh, Germany.

Loading...