Groww

Founded Year

2016Stage

IPO | IPOTotal Raised

$599.89MDate of IPO

11/12/2025About Groww

Groww is a financial services company specializing in investment and trading platforms. The company offers a range of services, including equity trading, direct mutual funds, and investment in US stocks, all through an online platform. Groww provides tools for both systematic investment plans (SIPs) and lumpsum investments, as well as educational resources to empower investors. It was founded in 2016 and is based in Bengaluru, India.

Loading...

Loading...

Research containing Groww

Get data-driven expert analysis from the CB Insights Intelligence Unit.

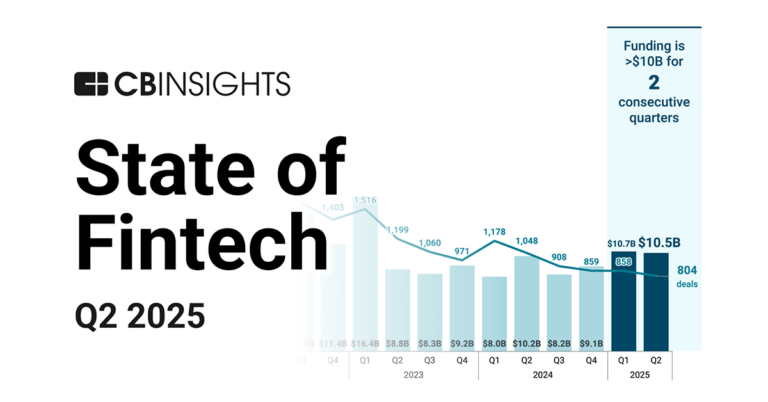

CB Insights Intelligence Analysts have mentioned Groww in 3 CB Insights research briefs, most recently on Jul 17, 2025.

Jul 17, 2025 report

State of Fintech Q2’25 ReportExpert Collections containing Groww

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Groww is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,309 items

Wealth Tech

2,489 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Fintech

14,203 items

Excludes US-based companies

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Tech IPO Pipeline

257 items

The tech companies we think could hit the public markets next, according to CB Insights data.

Latest Groww News

Nov 17, 2025

Busy startup IPO season gives risk investors Rs 15,000 crore in cash exits By Synopsis The busy IPO season of 2025 is handing out some of the biggest returns to venture capital firms that backed these companies early. ET’s calculations show that VC firms have taken exits of around Rs 15,000 cr through recent listings, including Ather Energy, BlueStone, Lenskart, Urban Company, Groww and Pine Labs. ETMarkets.com The busy IPO cycle of 2025 is handing out some of the biggest returns that venture and growth investors have seen in India’s startup ecosystem. The half a dozen new-age companies — Urban Company , Lenskart , Groww , Ather Energy , Bluestone and Pine Labs — that have listed so far this year have collectively unlocked more than Rs 15,000 crore ($1.6 billion) in cash liquidity for their early- and late-stage shareholders, as per ET’s calculations. Beyond the realised gains, investors are also sitting on over $8 billion in mark-to-market value on the shares they continue to hold, buoyed by strong post-listing performance by some of these companies. Silicon Valley’s famed startup accelerator Y Combinator has also raked in multi-fold returns on Groww . It sold around a 2% stake in the firm through the offer-for-sale (OFS) portion of the IPO and is still holding on to around 10% in the firm, which crossed Rs 1 lakh crore in market capitalisation on Friday. New York-based Tiger Global and Palo Alto-headquartered Ribbit Capital have both sold a small part of their shareholding in Groww during the IPO and as per the current market cap of the fintech firm, their stakes are worth Rs 4,726 crore and Rs 11,511 crore, respectively. “These IPOs have given a clear message to global investors that Indian startups can facilitate sizeable exits,” said an early-stage investor who has backed fintech and consumer tech startups. “If there ever was any doubt or question in the minds of large global venture funds, the successful IPOs of startups like Groww have given a larger statement on behalf of the sector.” ETtech Peak XV’s big IPO season Peak XV Partners has taken home the largest cash exits from Groww and Pine Labs, two of its very large bets. Accel, Elevation Capital and SoftBank also liquidated parts of their holdings across Lenskart, Ather, BlueStone and Urban Company at a premium. Between wealth-tech startup Groww and digital payments platform Pine Labs , Peak XV Partners sold shares worth more than Rs 2,000 crore through the OFS process, which lets existing investors sell shares during an IPO. Their remaining stake in the two companies is worth more than Rs 20,000 crore as per closing stock prices on Friday. “Peak XV’s investment in Pine Labs was a unique case of long-term patient capital which is typically unlikely for venture investors, but the returns have been huge as well,” said a senior fintech industry executive and an active angel investor. Peak XV had invested around $35 million in Pine Labs over two or three rounds since first backing it in 2009. It is today sitting on likely gains of over $1 billion, with $575 million already coming in. For Peak XV, the series of cash-outs come at a time when it is in the midst of raising its first independent fund at over $1 billion, after the split from Sequoia Capital in 2023, as reported first by ET in April . The Pine Labs IPO gave partial exit opportunities to two large corporate investors as well: PayPal and Mastercard . However, some of the late-stage backers like Vitruvian Partners and Nordmann Investment are in the red having come in at a $5 billion valuation. Pine Labs took a 40% cut on its private valuation when it fixed the IPO price. SoftBank snagged a multimillion-dollar exit from the eyewear retailer Lenskart. The fund had invested $280 million in the company and its current stake in the firm is valued at more than $1 billion. The Masayoshi Son-led group sold shares of around $200 million through secondary transactions and the OFS component in the IPO. SoftBank’s remaining stake in Lenskart is worth over $1 billion. “We’re in the business of making money, so if incremental IRR (internal rate of return) isn’t attractive, we redeploy, but there’s no mandate to liquidate. We don’t report performance by region, but it’s safe to say India is one of the strongest-performing geographies in the Vision Fund ,” Sumer Juneja, managing partner and head of EMEA and India at SoftBank Investment Advisers, told ET in an interview earlier this month . Strong gains for early backers In the case of Urban Company and BlueStone, early investors including Accel and Elevation Capital generated strong returns. Accel first backed jewellery retailer BlueStone in 2012 and participated in multiple funding rounds for the company since then. The venture capital firm invested a total of Rs 200-215 crore in BlueStone and is sitting on paper gains of six times its investment, including realised and unrealised returns. With Urban Company, where Accel was the earliest institutional backer along with Elevation Capital, the VC fund made paper gains of 29 times its investment of Rs 70-75 crore. Elevation Capital, which ploughed Rs 95-100 crore across various stages in the at-home services platform, meanwhile saw a multiple of 19x on its investment. In the Groww IPO, YC took out Rs 1,054 crore , thereby marking the first such instance of a public market exit for the venture firm in India. Another YC alumnus, ecommerce firm Meesho, is slated for a December IPO at a valuation of $6-7 billion, which could change depending on market conditions. The IPO will see investors including Elevation Capital, Peak XV Partners and Y Combinator sell stakes. Ribbit Capital, an active investor in Indian fintech startups, sold shares worth Rs 1,181 crore in the Groww IPO and has a shareholding worth of Rs 11,511 crore currently. Tiger Global, which was an investor in electric scooter manufacturer Ather, sold shares worth Rs 12.8 crore in the IPO and exited the company fully by selling shares worth Rs 1,204 crore through post-IPO block deals. Add

Groww Frequently Asked Questions (FAQ)

When was Groww founded?

Groww was founded in 2016.

Where is Groww's headquarters?

Groww's headquarters is located at Sarjapur Main Road, Bellandur, Bengaluru.

What is Groww's latest funding round?

Groww's latest funding round is IPO.

How much did Groww raise?

Groww raised a total of $599.89M.

Who are the investors of Groww?

Investors of Groww include ICONIQ Capital, GIC, Satya Nadella, Y Combinator, Peak XV Partners and 22 more.

Who are Groww's competitors?

Competitors of Groww include StockGro, Bachatt, ET Money, Finguru, Kuvera and 7 more.

Loading...

Compare Groww to Competitors

Cube Wealth is a wealth management app that provides investment processes for professionals. The company offers investment advisory services, access to asset classes, and tools for retirement and investment planning. Cube Wealth serves individuals looking for investment options and financial management without the complexity of traditional financial terminology. It was founded in 2016 and is based in Mumbai, India.

Zerodha is an online brokerage platform that facilitates stock trading and investing across various financial instruments. The company offers services including trading in stocks, derivatives, mutual funds, ETFs, bonds, and more, through its platforms and apps. Zerodha primarily serves the retail and institutional broking sectors within the financial services industry. It was founded in 2010 and is based in Bengaluru, India.

Smallcase is a financial technology company that provides investment products and platforms for the capital markets industry. The company offers services including smallcases, which are portfolios of stocks and other securities for individual investors. smallcase serves the capital markets industry and individual investors seeking investment tools and insights. It was founded in 2015 and is based in Bangalore, India.

InCred Wealth is a wealth management company that provides financial services in the investment and banking sectors. The company offers investment solutions, portfolio management, wealth transfer and estate planning, as well as investment banking services. InCred Wealth serves individuals and corporations seeking wealth management and investment strategies. It was founded in 2019 and is based in Mumbai, India.

INDmoney is a financial services platform that specializes in investment management and advisory services. The company offers a comprehensive suite of products that enable users to track their investments, plan financial goals, and invest in a variety of instruments, including stocks, mutual funds, and fixed deposits. It was formerly known as INDwealth. It was founded in 2018 and is based in Gurgaon, India.

Upstox is an online trading platform that specializes in stock market trading and investment services. The company offers a range of financial products, including demat and trading accounts, mutual funds, IPO applications, and tools for tax planning and investment calculations. Upstox provides a technology-driven trading experience with access to various markets such as equities, futures and options, commodities, and currencies. It was founded in 2009 and is based in Mumbai, India.

Loading...