H2O.ai

Founded Year

2012Stage

Series E - II | AliveTotal Raised

$246.12MValuation

$0000Last Raised

$100M | 4 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-39 points in the past 30 days

About H2O.ai

H2O.ai specializes in generative artificial intelligence (AI) and machine learning. It provides a comprehensive AI cloud platform for various industries. The company offers a suite of AI cloud products, including automated machine learning, distributed machine learning, and tools for AI-driven data extraction and processing. H2O.ai caters to sectors such as financial services, healthcare, insurance, manufacturing, marketing, retail, and telecommunications. H2O.ai was formerly known as 0xdata. It was founded in 2012 and is based in Mountain View, California.

Loading...

H2O.ai's Product Videos

ESPs containing H2O.ai

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

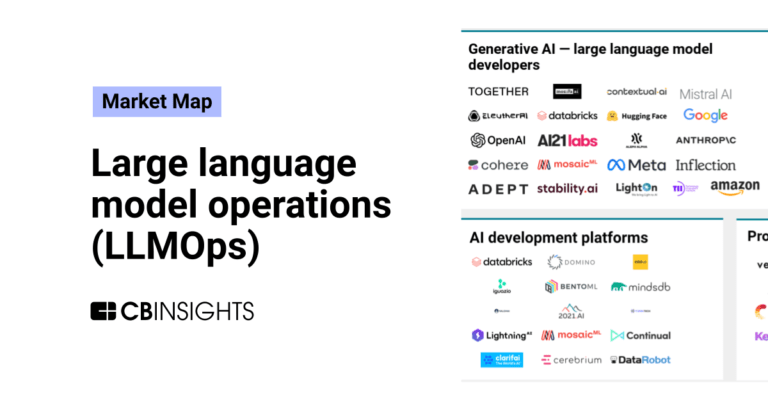

The large language model (LLM) application development market provides frameworks, tools, and platforms for building, customizing, and deploying applications powered by pre-trained language models. Companies in this market offer solutions for fine-tuning models on domain-specific data, creating prompt engineering workflows, developing retrieval-augmented generation systems, and orchestrating LLM-p…

H2O.ai named as Outperformer among 15 other companies, including Databricks, Cohere, and LangChain.

H2O.ai's Products & Differentiators

h2oGPTe Agentic AI

h2oGPTe Agentic AI converges generative AI and predictive with purpose-built SLMs The industry’s first multi-agent Generative AI platform to bring together the strengths of Generative AI and Predictive AI with airgapped, on-premise deployment options.

Loading...

Research containing H2O.ai

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned H2O.ai in 7 CB Insights research briefs, most recently on Jul 2, 2024.

Jul 2, 2024 team_blog

How to buy AI: Assessing AI startups’ potential

Sep 29, 2023

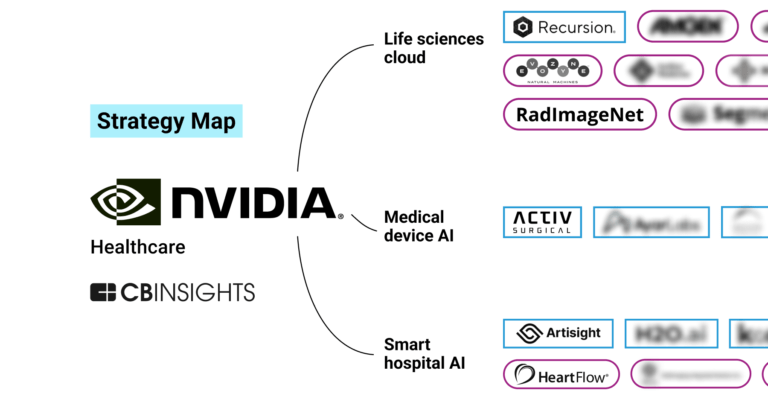

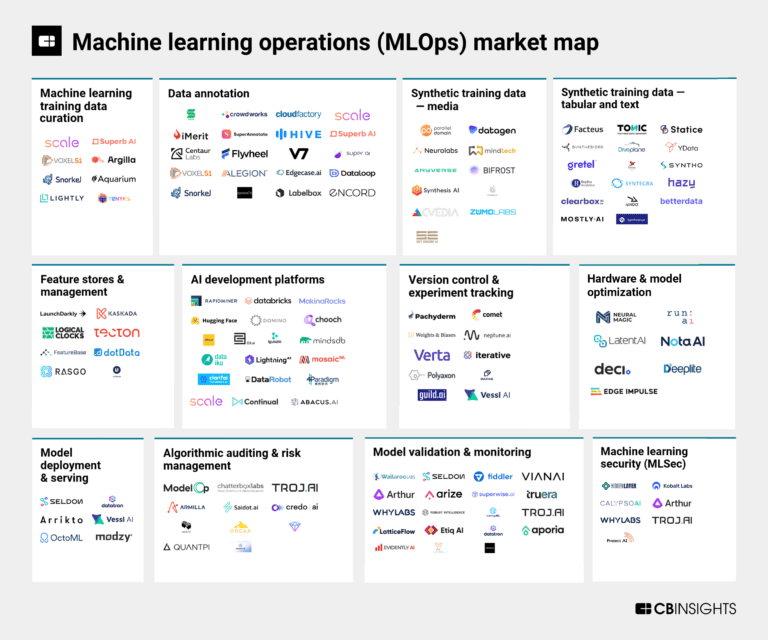

The machine learning operations (MLOps) market mapExpert Collections containing H2O.ai

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

H2O.ai is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,309 items

Regtech

1,453 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

AI 100 (All Winners 2018-2025)

200 items

Artificial Intelligence (AI)

37,333 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Conference Exhibitors

5,302 items

Fintech

9,809 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

H2O.ai Patents

H2O.ai has filed 12 patents.

The 3 most popular patent topics include:

- machine learning

- artificial intelligence

- classification algorithms

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

4/21/2023 | 10/15/2024 | Machine learning, Diagrams, Complex analysis, Scientific modeling, Artificial intelligence | Grant |

Application Date | 4/21/2023 |

|---|---|

Grant Date | 10/15/2024 |

Title | |

Related Topics | Machine learning, Diagrams, Complex analysis, Scientific modeling, Artificial intelligence |

Status | Grant |

Latest H2O.ai News

Nov 11, 2025

WILMINGTON, DE, UNITED STATES, November 10, 2025 / EINPresswire.com / -- According to a new report published by Allied Market Research Decision Intelligence Market Size, Share, Competitive Landscape and Trend Analysis Report, by Component (Platform, Solutions, Services), by Deployment Mode (On-premise, Cloud), by Enterprise Size (Large Enterprise, Small and Medium-sized Enterprises (SMEs)), by Industry Vertical (Energy and Utilities, BFSI, IT and Telecom, Government, Healthcare, Manufacturing, Retail and Consumer Goods, Others): Global Opportunity Analysis and Industry Forecast, 2021 - 2031, The global decision intelligence market was valued at USD 9.8 billion in 2021, and is projected to reach USD 39.3 billion by 2031, growing at a CAGR of 15.2% from 2022 to 2031. The global decision intelligence market is witnessing rapid expansion as organizations increasingly integrate artificial intelligence (AI), machine learning (ML), and data analytics to enhance decision-making processes. Decision intelligence bridges human expertise and data-driven insights, allowing enterprises to make faster, more accurate, and more strategic choices in complex business environments. As companies face growing data volumes and competitive pressures, the adoption of decision intelligence solutions helps transform raw data into actionable intelligence. These systems are revolutionizing industries such as finance, healthcare, retail, and manufacturing by optimizing operations, reducing risks, and improving overall business performance. Download PDF Brochure: https://www.alliedmarketresearch.com/request-sample/A53623 Market Dynamics Drivers: One of the key drivers of the decision intelligence market is the growing need for data-driven decision-making across organizations. Enterprises are shifting from intuition-based management to insights derived from advanced analytics and AI technologies. Technological Advancements: The increasing integration of AI, ML, natural language processing (NLP), and cloud computing is enhancing decision intelligence platforms. These technologies allow for predictive and prescriptive analysis, enabling businesses to anticipate outcomes and automate strategic responses. Opportunities: Expanding adoption in small and medium-sized enterprises (SMEs) presents significant growth opportunities. Cloud-based deployment models and affordable AI platforms are making decision intelligence accessible to a broader business audience, especially in emerging economies. Challenges: Despite its advantages, data quality issues, lack of skilled professionals, and privacy concerns continue to hinder market adoption. Organizations often struggle to integrate disparate data sources effectively, which limits the accuracy of insights. Trends: A major trend shaping the market is the rise of augmented analytics and AI-assisted decision-making. These technologies simplify complex data interpretation and empower non-technical users to make informed decisions with ease, driving widespread acceptance across sectors. Connect to Analyst: https://www.alliedmarketresearch.com/connect-to-analyst/A53623 Segment Overview The decision intelligence market is segmented by component (platforms, solutions, services), deployment mode (cloud, on-premises), organization size (SMEs, large enterprises), and industry vertical (BFSI, healthcare, retail, IT & telecom, manufacturing, and others). Among these, the cloud-based segment is projected to witness the highest growth due to its scalability, cost-effectiveness, and ease of integration with existing enterprise systems. Based on deployment mode, the on-premise segment held the largest share of the decision intelligence market in 2021 and is expected to maintain its dominance throughout the forecast period. This is attributed to the increasing preference among end users for on-premise deployment due to its practical functionality, enhanced control, and extensive customization options. However, the cloud segment is projected to record the fastest growth in the coming years, driven by the rising adoption of cloud data warehouses and cloud-based decision intelligence solutions. Cloud platforms offer high scalability and flexibility, enabling numerous concurrent users to access and analyze data efficiently. Regional Analysis Region-wise, North America dominated the decision intelligence market in 2021 and is expected to maintain its lead during the forecast period, driven by the widespread adoption of advanced technologies such as AI, machine learning, intelligent applications, and natural language processing that enhance data analytics and decision-support systems. However, Asia-Pacific is projected to register the fastest growth, fueled by the increasing presence of data scientists, engineers, and large-scale AI/ML and automation initiatives, as enterprises in the region increasingly adopt engineered decision-making to achieve consistent and data-driven business outcomes. For Purchase Inquiry: https://www.alliedmarketresearch.com/purchase-enquiry/A53623 Key players profiled in decision intelligence industry include Google LLC, Oracle Corporation, Microsoft Corporation, Board International, Metaphacts GmbH, H2O.ai, International Business Machines Corporation, Intel Corporation, Diwo.ai, and Clarifai, Inc.. Market players have adopted various strategies, such as product launches, collaboration & partnership, joint ventures, and acquisition to expand their foothold in the decision intelligence industry. Key Findings of the Study • By component, in 2021, the platform segment was the highest revenue contributor to the market, during the forecast period. However, the solution segment is estimated to reach $13,476.88 million by 2031, , with an 17.0% impressive CAGR. • By deployment model, the on-premise segment is estimated to reach $24,746.63 million by 2031, with an 14.4% impressive CAGR, during the forecast period. However, cloud segments are expected to witness approximately 16.7% CAGRs, respectively, during the forecast period respectively. • Region-wise, the decision intelligence market growth was dominated by North America. However, Asia-Pacific and Europe are expected to witness a significant growth rate during the forecasted period. David Correa Allied Market Research email us here Visit us on social media: LinkedIn Facebook YouTube X Legal Disclaimer: EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

H2O.ai Frequently Asked Questions (FAQ)

When was H2O.ai founded?

H2O.ai was founded in 2012.

Where is H2O.ai's headquarters?

H2O.ai's headquarters is located at 2307 Leghorn Street, Mountain View.

What is H2O.ai's latest funding round?

H2O.ai's latest funding round is Series E - II.

How much did H2O.ai raise?

H2O.ai raised a total of $246.12M.

Who are the investors of H2O.ai?

Investors of H2O.ai include Nexus Venture Partners, Wells Fargo Strategic Capital, NVIDIA, Celesta Capital, Capital One Ventures and 21 more.

Who are H2O.ai's competitors?

Competitors of H2O.ai include Dataiku, Domino, Fractal, Centific, Glean and 7 more.

What products does H2O.ai offer?

H2O.ai's products include h2oGPTe Agentic AI and 2 more.

Loading...

Compare H2O.ai to Competitors

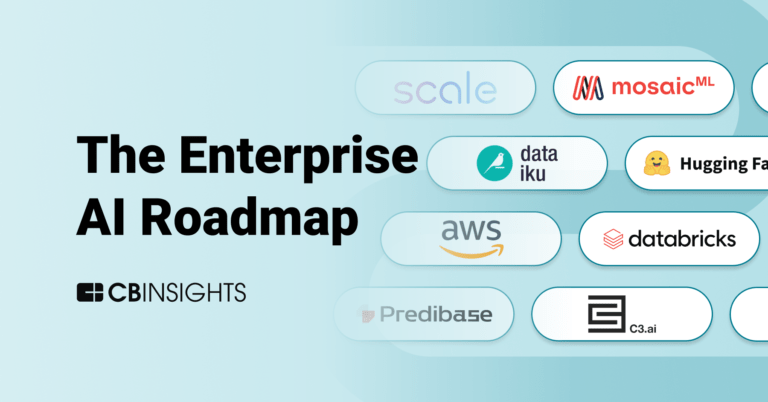

DataRobot provides artificial intelligence (AI) applications and platforms within the enterprise AI suite and agentic AI platform domains. Its offerings include a suite of AI tools that integrate into business processes, allowing teams to manage AI, along with AI governance, observability, and foundational tools. It serves sectors including finance, supply chain, energy, financial services, government, healthcare, and manufacturing, and collaborates with NVIDIA and SAP. It was founded in 2012 and is based in Boston, Massachusetts.

Dataiku specializes in Artificial Intelligence (AI) and analytics, offering a platform for enterprises to build, deploy, and manage Artificial Intelligence (AI) projects. The company provides tools for machine learning, data preparation, analytics, and governance for Artificial Intelligence (AI). It serves industries including banking, life sciences, manufacturing, and retail. It was founded in 2013 and is based in New York, New York.

Domino operates in the enterprise Artificial Intelligence (AI) platform sector, providing a platform for building, deploying, and managing AI models. It focuses on collaboration, governance, and cost reduction. It serves sectors that utilize model-driven business strategies, including life sciences, financial services, manufacturing, and insurance. It was founded in 2013 and is based in San Francisco, California.

IBM Watson Group focuses on artificial intelligence (AI) and hybrid cloud solutions within the technology sector. The company offers generative AI experiences, AI-powered cybersecurity, and post-quantum cryptography standards, as well as services in AI and machine learning, analytics, compute and servers, databases, DevOps, IT automation, quantum computing, and security and identity. IBM Watson Group's products and services are primarily utilized by various sectors, including the sports industry, cybersecurity, and enterprise IT infrastructure. It is based in New York, New York.

Alteryx focuses on enterprise analytics, providing a platform for data analysis across various environments. The company offers an analytics platform that can be deployed on-premises, in hybrid, or cloud environments, allowing organizations to automate analytics and improve decision-making processes. Alteryx primarily serves sectors that require data analytics to improve revenue, manage costs, and mitigate risks. Alteryx was formerly known as SRC. It was founded in 1997 and is based in Irvine, California.

Abacus.AI offers generative artificial intelligence (AI) technology and the development of enterprise AI systems and agents. It offers products including AI super assistants, machine learning operations, and applied AI research, aimed at enhancing predictive analytics, anomaly detection, and personalization. It primarily serves sectors that require advanced AI solutions, such as finance, healthcare, and e-commerce. It was formerly known as RealityEngines.AI. It was founded in 2019 and is based in San Francisco, California.

Loading...