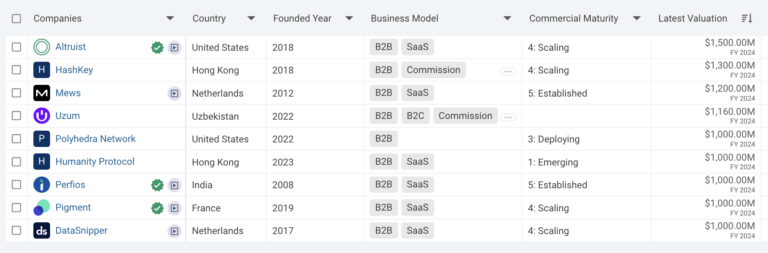

HashKey

Founded Year

2018Stage

Series A - II | AliveTotal Raised

$130MLast Raised

$30M | 9 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-34 points in the past 30 days

About HashKey

HashKey is a financial intermediary company that provides digital asset trading services. The company offers quant trading strategies, prime brokerage, and an OTC trading platform that includes market-making, arbitrage, treasury services, and research. HashKey serves the stock market and digital asset market sectors. It was founded in 2018 and is based in Central, Hong Kong.

Loading...

Loading...

Research containing HashKey

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned HashKey in 1 CB Insights research brief, most recently on Aug 23, 2024.

Expert Collections containing HashKey

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

HashKey is included in 3 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,309 items

Fintech

14,203 items

Excludes US-based companies

Blockchain

8,887 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Latest HashKey News

Nov 6, 2025

HashKey and Kraken Form Partnership on Institutional Tokenised Assets Collaboration targets cross-border digital finance and tokenisation in Asia-Pacific HashKey and Kraken have announced a strategic partnership to promote institutional adoption of tokenised assets. The collaboration aims to combine both firms’ expertise and resources to drive innovation, expand market growth, and develop tokenised real-world asset opportunities across the Asia-Pacific region. Both companies bring established credibility in the global crypto ecosystem, a strong commitment to regulatory compliance, and a shared objective of broadening institutional and retail engagement in digital assets. Recognising the growing opportunity to connect traditional finance with digital assets and unlock institutional capital for tokenisation, HashKey and Kraken will explore collaboration in several key areas. The partnership will focus on developing institutional-grade on-chain products across Western and Asian markets, supporting ecosystem growth through developer engagement and regulatory dialogue, and conducting joint marketing initiatives to raise awareness of tokenised assets as part of a diversified investment portfolio. Dr. Xiao Feng said Dr Xiao Feng, Executive Director, Chairman, and CEO of HashKey Group. “By aligning Kraken’s institutional capabilities with HashKey’s infrastructure and regulatory expertise in multiple jurisdictions, we’re setting the stage for more robust cross-border collaboration in this evolving space.” Arjun Sethi, Co-CEO of Kraken, added: Arjun Sethi “The tokenisation of financial products represents a major evolution in market infrastructure. Our collaboration with HashKey reflects our shared interest in accelerating institutional participation globally, particularly in markets where clear regulatory frameworks and strong infrastructure are emerging.” Over time, the partnership is expected to facilitate smoother capital flows between major financial regions and support the development of interoperable infrastructure for digital finance.

HashKey Frequently Asked Questions (FAQ)

When was HashKey founded?

HashKey was founded in 2018.

Where is HashKey's headquarters?

HashKey's headquarters is located at 8 Connaught Place, Central.

What is HashKey's latest funding round?

HashKey's latest funding round is Series A - II.

How much did HashKey raise?

HashKey raised a total of $130M.

Who are the investors of HashKey?

Investors of HashKey include Gaorong Capital, OKX Ventures and Trade Finance TechChallenge.

Loading...

Loading...