Headway

Founded Year

2019Stage

Series D | AliveTotal Raised

$327.5MValuation

$0000Last Raised

$100M | 1 yr agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+25 points in the past 30 days

About Headway

Headway operates within the mental healthcare sector. It offers a software-enabled network that facilitates therapists' acceptance of health insurance, allowing them to connect with patients through insurance-supported services. It was founded in 2019 and is based in New York.

Loading...

ESPs containing Headway

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The provider discovery platforms market provides digital solutions that help patients find and book medical professionals. These platforms offer a wide range of healthcare services, from primary care to specialized treatments. They provide patients with the convenience of scheduling appointments online, viewing physician profiles, and reading reviews from other patients. By using these platforms, …

Headway named as Highflier among 13 other companies, including Amazon One Medical, Solv, and Kyruus Health.

Loading...

Research containing Headway

Get data-driven expert analysis from the CB Insights Intelligence Unit.

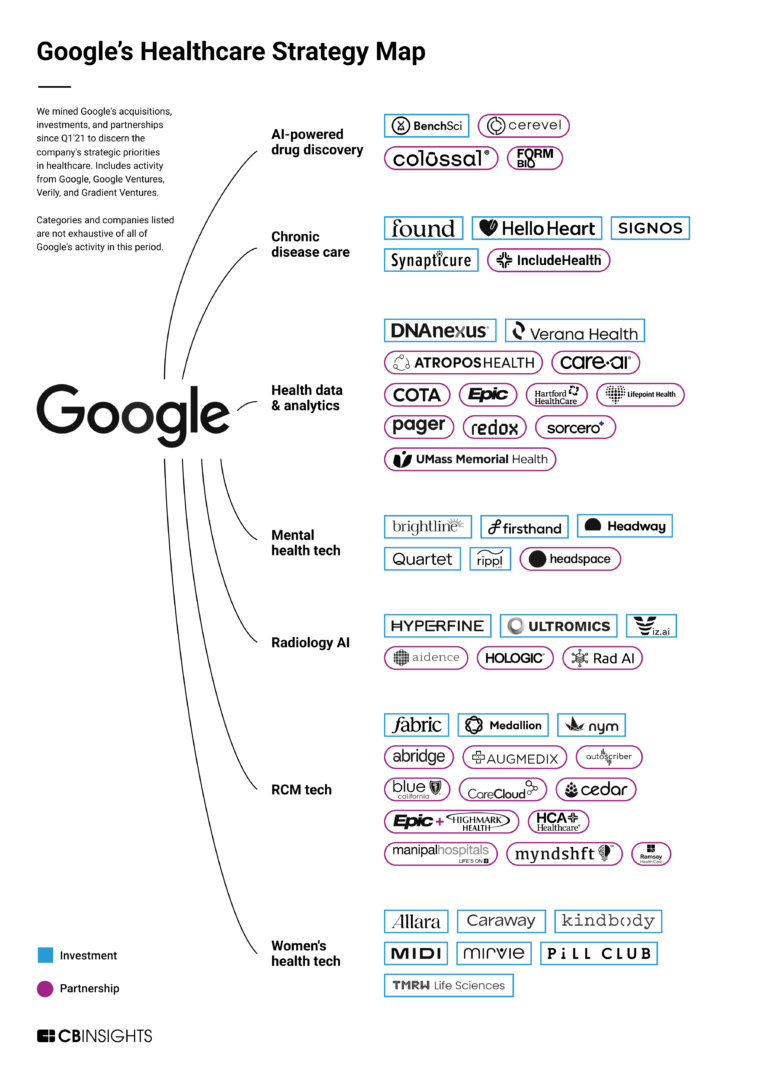

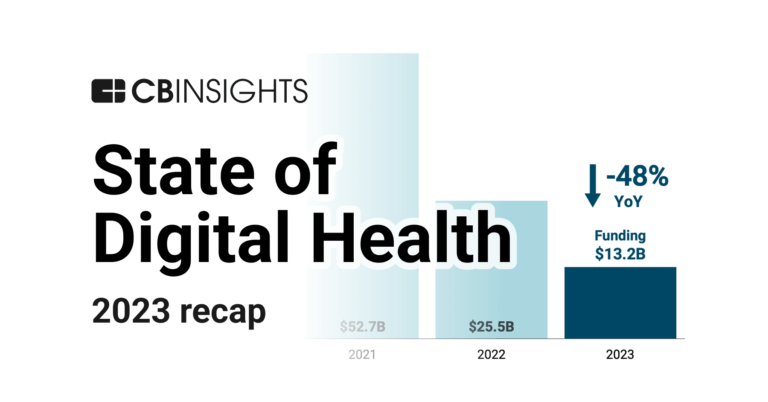

CB Insights Intelligence Analysts have mentioned Headway in 2 CB Insights research briefs, most recently on Apr 25, 2024.

Jan 25, 2024 report

State of Digital Health 2023 ReportExpert Collections containing Headway

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Headway is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,309 items

Digital Health

12,122 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Telehealth

3,123 items

Companies developing, offering, or using electronic and telecommunication technologies to facilitate the delivery of health & wellness services from a distance. *Columns updated as regularly as possible; priority given to companies with the most and/or most recent funding.

Digital Health 50

150 items

The winners of the third annual CB Insights Digital Health 150.

a16z Marketplace 100

100 items

Latest Headway News

Oct 30, 2025

Generative AI Fuels Innovation Appetite Speaking at a CISO roundtable during a launch event for the 1Password report, Mark Hazleton, CSO for Formula One racing team Oracle Red Bull Racing, explained the rise of shadow AI was partly due to productivity gains being a top priority for most employee when adopting new tools. He said that workers are “focused on getting the job done, so if we try and restrain them, they will find a way to do what they need to do.” “In F1, if somebody comes up on a Saturday night with a mechanism that’s going to save a second in the race on Sunday, we want to enable them to go forward with it,” he said. The 1Password report found almost half of respondents justified their ‘shadowy’ use of AI tools because of their convenience (45%) and almost as many said they feel more productive when using AI (43%). Breakdown of reasons to use AI without IT approval recorded in the 1Password 2025 Annual Report. Source: 1Password Hazleton also noted that the emergence of generative AI tools has ignited an unheard-of appetite for innovation within the workforce. Susan Chiang, CISO at healthcare firm Headway, added, “Adoption of third-party software recently expanded a lot, but this expansion did not necessarily come with increased awareness of what the potential impact and risks are.” Shadow AI vs. Shadow IT: How Freemium AI Tools Expand Risk Shadow AI stands out from general shadow IT because of the diverse range of tasks employees use AI for. The 1Password report showed that these range from customer call notes to transcribe and summarize (22% of respondents said they use AI for this) to performance reviews of hiring processes (16% of employees use AI in such a way). AI tools are also leveraged for various data analytics use cases, with 16% of respondents using AI to analyze company data and 21% to analyze customer data. Breakdown of the AI use cases recorded in the 1Password 2025 Annual Report. Source: 1Password Chiang explained the rise of shadow AI is connected to the model adopted by general-purpose generative AI tools early on. “Generative AI made the freemium model popular again – and you can already do a lot with a free large language model (LLM) tool, for instance,” she started. “However, while a lot of employees understand the concept of contracts and risks, they don’t necessarily think risk management policies apply to free products.” While the web-based, freemium app approach is prominent with generative AI tools, Brian Morris, VP and CISO at Gray Media, said the same conclusion applies to many shadow IT practices outside of AI tools. “The real number of employees using shadow IT is probably much higher than 52% because we’re not just talking about downloading apps – people use web apps like Grammarly and Monday all the time that expose company data. But because they work through the browser, they don’t really think of them as apps,” Morris explained. AI Governance Best Practices To overcome some of these AI blind spots, the 1Password report recommended a three-step approach for AI governance: Maintain a complete inventory of AI tools in use at your organization and conduct regular audits Establish clear policies, enforce appropriate AI usage and guide users toward safe tools and behaviors Invest in controls to ensure only company-sanctioned AI tools can access company data During the CISO roundtable, Headway’s Chiang also recommended risk-based security teams to not only focus on the highest identified risks, but to also spend time addressing low-to-medium risks that can be quickly addressed so that they don’t get overwhelmed by many issues at the same time. “When it comes to AI, we talk a lot of ‘death by 1000 cuts,’ with many low to medium risks that are worth investing in and could be easily resolved by implementing education and awareness processes,” she explained. The 1Password 2025 Annual Report is based on an online survey distributed by PureSpectrum among 5200 knowledge workers in Canada, France, Germany, Singapore, the UK and the US. You may also like

Headway Frequently Asked Questions (FAQ)

When was Headway founded?

Headway was founded in 2019.

Where is Headway's headquarters?

Headway's headquarters is located at 85 Delancey Street, New York.

What is Headway's latest funding round?

Headway's latest funding round is Series D.

How much did Headway raise?

Headway raised a total of $327.5M.

Who are the investors of Headway?

Investors of Headway include Accel, Thrive Capital, Andreessen Horowitz, Spark Capital, Forerunner Ventures and 15 more.

Who are Headway's competitors?

Competitors of Headway include Slingshot AI, Wysa, Grow Therapy, Tava Health, Array Behavioral Care and 7 more.

Who are Headway's customers?

Customers of Headway include Aetna, Cigna and Optum.

Loading...

Compare Headway to Competitors

Octave provides mental health care through in-person and virtual therapy services across various sectors. The company offers individual, couples, and family therapy, and serves individuals seeking mental health support, as well as couples and families, by connecting them with a network of therapists. It was founded in 2018 and is based in San Francisco, California.

Talkiatry operates as a mental health practice that offers virtual psychiatry services for various psychiatric conditions. The company provides online assessments, medication management, and therapy for conditions such as anxiety, depression, bipolar disorder, obsessive–compulsive disorder (OCD), post-traumatic stress disorder (PTSD), and attention deficit hyperactivity disorder (ADHD). Talkiatry serves individuals seeking mental health care that is covered by insurance. It was founded in 2019 and is based in New York, New York.

Alma provides services for insurance acceptance and in-network care for therapists, along with business tools for their practice. Alma serves the mental health care sector, connecting therapists with insurance partners. It was founded in 2018 and is based in Brooklyn, New York.

Brightside Health focuses on providing mental health care services. It offers online treatment for a range of mental health conditions, including anxiety, depression, insomnia, post-traumatic stress disorder (PTSD), and more, utilizing a combination of licensed psychiatric providers and therapy techniques. Brightside Health was formerly known as Good Measure. The company was founded in 2017 and is based in San Francisco, California.

Wellnite Health is a company that provides mental healthcare services. Their offerings include therapy sessions, mental health tracking tools, and emotional well-being insights. Wellnite serves individuals seeking mental health support and organizations looking to provide mental health services to their employees. It was founded in 2019 and is based in San Francisco, California.

Anise Health offers online interventions, including tele-mental health services, tailored to acknowledge cultural contexts and intersectional needs. Anise Health primarily serves the Asian community, providing treatment plans and matching clients with providers. It was founded in 2021 and is based in New York, New York.

Loading...