Investments

71Portfolio Exits

1Funds

4About Hitachi Ventures

Hitachi Ventures operates as the global venture capital arm of Hitachi Group. It scouts for startups in industries of strategic relevance for Hitachi, such as healthcare, environment, and future social businesses. It invests invest in Europe, Israel, and North America. It was founded in 2019 and is based in Munich, Germany.

Research containing Hitachi Ventures

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Hitachi Ventures in 1 CB Insights research brief, most recently on Aug 7, 2025.

Aug 7, 2025

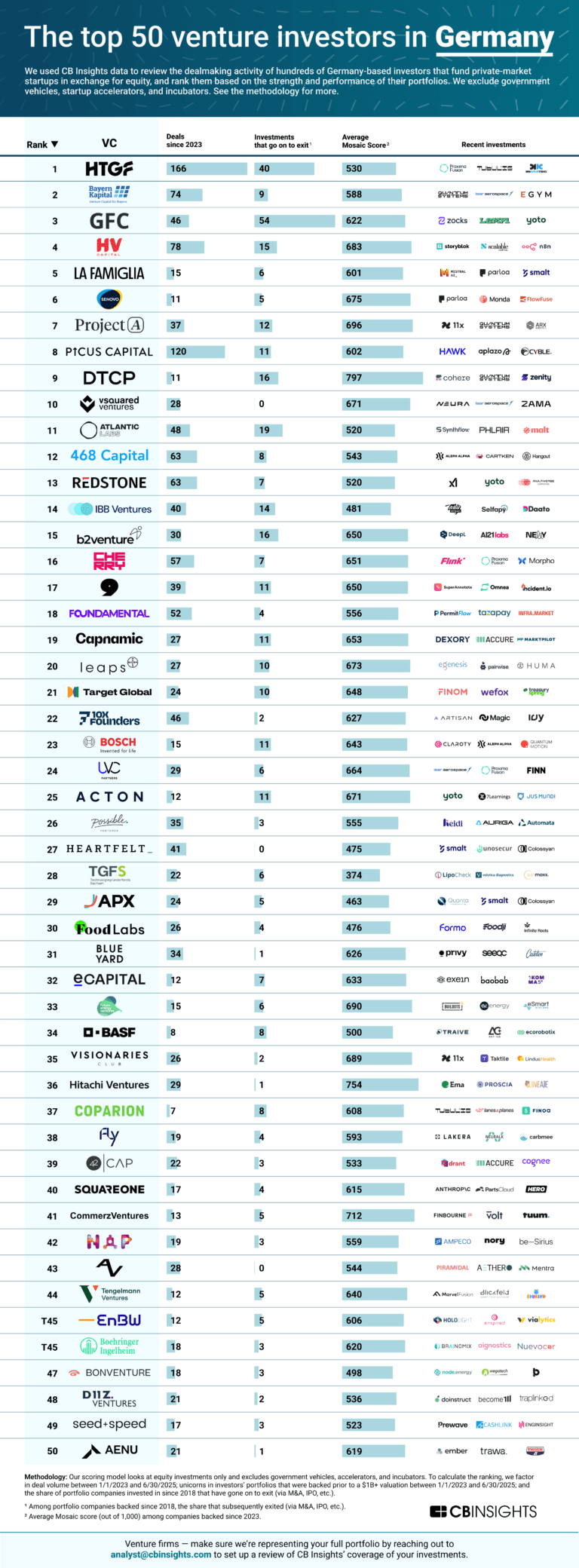

The top 50 venture investors in GermanyLatest Hitachi Ventures News

Oct 23, 2025

Raghavan joins Hitachi’s corporate VC unit Oct 23, 2025 • Robert Lavine Divya Raghavan has departed from NGP Capital after four years to invest in software, data and AI on behalf of electronics producer Hitachi. Hitachi Ventures has hired Divya Raghavan as a principal at its Silicon Valley office. Hitachi Ventures’ main office is led by CEO Stefan Gabriel in Germany but it also maintains an eight-strong team in Silicon Valley under president and partner Pete Bastien, which Raghavan will join to focus on software, data and AI infrastructure startups. Raghavan held the same position at NGP Capital, the VC firm backed by telecoms equipment producer Nokia, having joined in 2021. She was one of GCV’s Rising Stars in 2024 . “I am incredibly grateful to the team at NGP Capital for their encouragement and mentorship over the years,” Raghavan said in a LinkedIn post. “I am looking forward to backing early-stage founders building the next generation of infrastructure and platforms.” At NGP Capital Raghavan led investments in document collaboration software provider Coda, which was acquired by Grammarly in late 2024, as well as data security platform Immuta, valued at $1bn in its most recent round. Robert Lavine

Hitachi Ventures Investments

71 Investments

Hitachi Ventures has made 71 investments. Their latest investment was in Infravision as part of their Series B on November 03, 2025.

Hitachi Ventures Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

11/3/2025 | Series B | Infravision | $91M | Yes | 2 | |

9/24/2025 | Series A | Amplio Technologies | $11.1M | Yes | 2 | |

9/11/2025 | Series B | RegScale | $30M | Yes | Ankona Capital, M12, SineWave Ventures, SYN Ventures, and Washington Harbour Partners | 2 |

8/19/2025 | Series B | |||||

7/29/2025 | Series B |

Date | 11/3/2025 | 9/24/2025 | 9/11/2025 | 8/19/2025 | 7/29/2025 |

|---|---|---|---|---|---|

Round | Series B | Series A | Series B | Series B | Series B |

Company | Infravision | Amplio Technologies | RegScale | ||

Amount | $91M | $11.1M | $30M | ||

New? | Yes | Yes | Yes | ||

Co-Investors | Ankona Capital, M12, SineWave Ventures, SYN Ventures, and Washington Harbour Partners | ||||

Sources | 2 | 2 | 2 |

Hitachi Ventures Portfolio Exits

1 Portfolio Exit

Hitachi Ventures has 1 portfolio exit. Their latest portfolio exit was SOPHiA Genetics on July 23, 2021.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

7/23/2021 | IPO | Public | 12 |

Date | 7/23/2021 |

|---|---|

Exit | IPO |

Companies | |

Valuation | |

Acquirer | Public |

Sources | 12 |

Hitachi Ventures Fund History

4 Fund Histories

Hitachi Ventures has 4 funds, including Hitachi Ventures Fund II.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

10/4/2021 | Hitachi Ventures Fund II | $150M | 1 | ||

Hitachi Ventures Fund III | |||||

Hitachi Ventures Fund I | |||||

Hitachi Ventures Fund IV |

Closing Date | 10/4/2021 | |||

|---|---|---|---|---|

Fund | Hitachi Ventures Fund II | Hitachi Ventures Fund III | Hitachi Ventures Fund I | Hitachi Ventures Fund IV |

Fund Type | ||||

Status | ||||

Amount | $150M | |||

Sources | 1 |

Hitachi Ventures Team

2 Team Members

Hitachi Ventures has 2 team members, including current Chief Executive Officer, Managing Director, Stefan Gabriel.

Compare Hitachi Ventures to Competitors

Intel Capital focuses on venture capital investment within the technology sector, specifically targeting early-stage startups. The company provides financial backing and support to companies involved in cloud computing, silicon technology, device innovation, and frontier technologies. Intel Capital primarily serves the technology ecosystem, investing in ventures within the computing domain. It was founded in 1991 and is based in Santa Clara, California.

Next47 focuses on investing in early and expansion-stage companies within the technology sector. The firm specializes in providing capital, domain expertise, and strategic resources to founders developing software as a service (SaaS), artificial intelligence (AI), and enterprise solutions. Next47 primarily serves the technology startup ecosystem, offering support to companies that are innovating and creating new categories in enterprise technology. Next47 was formerly known as Siemens Venture Capital. It was founded in 2016 and is based in Palo Alto, California.

Google Ventures operates as a venture capital firm investing in various sectors, including life sciences, consumer, enterprise, cryptocurrency, climate, and frontier technology. The firm provides financial backing and resources to startups and connects them with Google. It was founded in 2009 and is based in Mountain View, California.

Bosch Venture operates as a venture capital firm focused on early-stage companies in the technology sector. It provides financial investment and mentorship. It was founded in 2007 and is based in Gerlingen-Schillerhohe, Germany.

Toyota Ventures operates as an early-stage venture capital arm of Toyota, focusing on frontier and climate technologies. The company invests in artificial intelligence, autonomy, mobility, robotics, cloud technology, smart cities, digital health, fintech, materials, and climate technologies aimed at carbon neutrality. Toyota Ventures provides support to its portfolio companies, utilizing Toyota's expertise and resources. Toyota Ventures was formerly known as Toyota AI Ventures. It was founded in 2017 and is based in Los Altos, California.

Allumia Ventures operates as a healthcare venture capital firm investing in digital health and technology-enabled healthcare services. The company seeks to align with its limited partners and serves sectors requiring healthcare ecosystem solutions. Allumia Ventures was formerly known as Providence Ventures. It was founded in 2015 and is based in Seattle, Washington.

Loading...