Hozon Auto

Founded Year

2014Stage

Bankrupt/Admin | BankruptTotal Raised

$5.097BRevenue

$0000About Hozon Auto

Hozon Auto develops and manufactures electric vehicles within the automotive industry. The company offers a range of electric vehicles equipped with autonomous driving technology, safety monitoring, and battery protection systems. It was founded in 2014 and is based in Putuo District, China. In May 2025, Hozon Auto filed for bankruptcy.

Loading...

Loading...

Research containing Hozon Auto

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Hozon Auto in 1 CB Insights research brief, most recently on Mar 12, 2024.

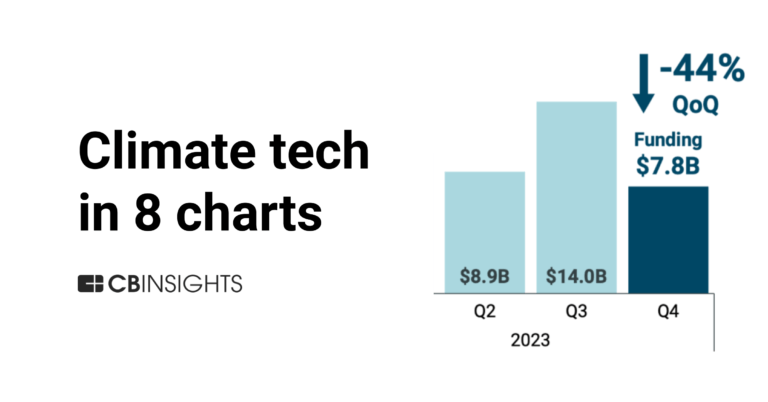

Mar 12, 2024

Climate tech in 8 charts: 2023Expert Collections containing Hozon Auto

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Hozon Auto is included in 3 Expert Collections, including Auto Tech.

Auto Tech

4,189 items

Companies working on automotive technology, which includes vehicle connectivity, autonomous driving technology, and electric vehicle technology. This includes EV manufacturers, autonomous driving developers, and companies supporting the rise of the software-defined vehicles.

Unicorns- Billion Dollar Startups

1,309 items

Tech IPO Pipeline

257 items

The tech companies we think could hit the public markets next, according to CB Insights data.

Latest Hozon Auto News

Oct 28, 2025

In Depth: China’s Growing Trade of Unused ‘Used’ Cars Threatens Automakers’ Global Expansion 00:00 Listen to the full version At a glance, selling more cars overseas seems like the obvious solution for a Chinese automaker squeezed between government incentives to boost sales and production, and a cutthroat domestic market locked in an ongoing price war. The problem is that formally exporting new cars from China is a complicated, expensive undertaking. It requires dealerships to be open, logistics chains to be established and after-sales services to be guaranteed, all of which drive up the cost of selling the vehicles abroad. China’s government also imposes strict requirements on new car exports — only a car’s manufacturer or authorized exporters can obtain a license to do so. You've accessed an article available only to subscribers Subscribe to both Caixin Global and The Wall Street Journal — for the price of one. RELATED Share this article DIGEST HUB Explore the story in 30 seconds Chinese "zero-mileage used cars" exports surged to 440,000 in 2024, up from 15,000 in 2021, exploiting regulatory loopholes to bypass new car export costs and restrictions. The grey market practice faces criticism for eroding profits, damaging brand reputation abroad, and creating after-sales service problems, prompting regulators to consider stricter policies. Industry experts suggest addressing domestic overcapacity and price distortions, with the expectation that legitimate exports will replace grey market trade as the market matures. AI generated, for reference only Explore the story in 3 minutes At first glance, Chinese automakers seeking relief from a saturated, competitive domestic auto market might see expanding overseas sales as the solution. However, exporting new vehicles is complex and costly, involving the establishment of dealership networks, logistics, after-sales service, and strict government licensing only available to manufacturers or authorized exporters [para. 1][para. 2]. In 2021, some companies spotted a loophole—exporting new vehicles as "used." This approach, involving "zero-mileage used cars," circumvents many formal requirements, lowers costs, and enables cars that are new except in name to be sold abroad at substantial discounts yet still with healthy profits. This strategy has grown so common that about 80% of China’s used-car exports in 2024 fell into this category, totaling nearly 440,000 vehicles, a dramatic rise from just 15,000 in 2021. Projections for 2025 exceed 500,000 units [para. 3][para. 5]. This boom has prompted regulatory scrutiny, as authorities recognize that the practice distorts sales data, undermines the international reputation of Chinese auto brands, and spreads the fiercely competitive dynamics of the domestic market overseas [para. 6]. The Chinese government is tightening export rules, with a new policy requiring pure electric vehicles to obtain the same export licenses as traditional and hybrid vehicles from January 2025. However, critics worry the policy does not explicitly address "zero-mileage used cars," allowing the practice to persist and potentially undermine regulatory effectiveness [para. 8][para. 10]. The loophole is rooted in longstanding industry practices, where dealerships would buy new cars to inflate their sales targets and earn bonuses, later selling them as "used" to exporters. This practice initially expanded rapidly in Russia following the exit of Western automakers after the 2022 invasion of Ukraine, then spread to Southeast Asia, the Middle East, and Africa, lured by the potential to sell vehicles at two to three times their Chinese market price. It is fueled by domestic price wars and government incentives for new-energy vehicles, such as tax exemptions and subsidies [para. 13][para. 16][para. 19]. However, the practice has sparked criticism within the industry. Executives from leading automakers have labeled the proliferation of "unused used" cars as chaotic and damaging, particularly for brands that have invested in overseas presence and formal export channels. These legitimate exporters cannot compete with the lower prices of zero-mileage used cars, hurting their margins and market position. Yet, for smaller, financially strained automakers, this trade offers a crucial revenue stream amid domestic overcapacity and falling profits, often encouraged by local subsidies geared toward sustaining production lines [para. 21][para. 23][para. 24][para. 26][para. 27]. Overseas, the influx of these vehicles has intensified price competition, eroded margins, and raised concerns about after-sales service—often non-existent for grey-market exports—leading to dissatisfied customers and reputational risk for all Chinese brands due to the difficulty in distinguishing among manufacturers. Foreign markets, such as Russia and the UAE, have begun to push back, with complaints of market disruption and tax evasion, and some have blocked registrations of unauthorized vehicles [para. 29][para. 31][para. 33][para. 35][para. 37][para. 39]. Regulators are considering various measures to close loopholes, including delaying the transfer of ownership after registration, administrative export limits, and further verification requirements. Industry groups advocate for a cautious approach, recalling the damaging loss of consumer trust and market share suffered by Chinese motorcycle exporters in Southeast Asia during the 1990s [para. 41][para. 44][para. 48]. Experts agree that the underlying issue is structural overcapacity and artificial incentives in China’s domestic market. They recommend gradually reducing subsidies and tax breaks while developing transparent, large-scale used-car platforms based on international best practices. As the market matures, most believe the grey-market exports will naturally decline, making way for a more sustainable and reputable Chinese presence in global auto markets [para. 52][para. 54][para. 58][para. 61][para. 63][para. 65]. AI generated, for reference only Who’s Who Great Wall Motor Co. Ltd. Great Wall Motor Co. Ltd. (601633.SH) is a Chinese automaker. Its chairman, Wei Jianjun, has publicly criticized the "zero-mileage used car" trade, referring to it as a "chaotic situation." This indicates the company's opposition to the practice of exporting new cars as second-hand vehicles to circumvent regulations. Chery Automobile Co. Ltd. Chery Automobile Co. Ltd. executives have publicly criticized the practice of exporting new cars as "zero-mileage used cars," urging regulators to ban it. They view this grey market activity as "harmful to everyone" because it undermines automakers committed to establishing formal sales channels and providing after-sales services abroad. Volkswagen AG Volkswagen AG asked the UAE to block the registration of unauthorized Chinese-made ID-series EVs, leading to significant losses for traders. This action was taken due to concerns that "zero-mileage used cars" were disrupting local markets and evading taxes. Neta Auto Neta Auto, a new-energy startup, faced restructuring during 2025 according to the article. This resulted in stalled operations in Thailand, leading to unpaid bills for dealers and a lack of after-sales service for customers. This situation is highlighted as an example of reputational risks for Chinese brands abroad. AI generated, for reference only What Happened When By 2016: Japanese brands regained a 95% share of Vietnam’s motorcycle market, with Chinese models accounting for less than 1%. 2021: Some Chinese companies exploited a loophole to export new vehicles as second-hand cars, launching the practice of 'zero-mileage used cars'. In 2021:

Hozon Auto Frequently Asked Questions (FAQ)

When was Hozon Auto founded?

Hozon Auto was founded in 2014.

Where is Hozon Auto's headquarters?

Hozon Auto's headquarters is located at No. 452 Daduhe Road, Putuo District.

What is Hozon Auto's latest funding round?

Hozon Auto's latest funding round is Bankrupt/Admin.

How much did Hozon Auto raise?

Hozon Auto raised a total of $5.097B.

Who are the investors of Hozon Auto?

Investors of Hozon Auto include Contemporary Amperex Technology, Guoxuan High-Tech, NLTH, Dayone Capital, Shenzhen Capital Group and 18 more.

Who are Hozon Auto's competitors?

Competitors of Hozon Auto include WM Motor and 1 more.

Loading...

Compare Hozon Auto to Competitors

Geely Holding Group is an automotive group that operates in vehicle manufacturing and technology. The company produces various vehicles, including new energy vehicles, and participates in the development of vehicle networking and autonomous driving technologies. It serves the automotive market with a focus on sustainable development. It was founded in 1986 and is based in Hangzhou, China.

Li Auto offers the design, development, manufacturing, and sales of smart electric vehicles within the automotive industry. It offers electric SUVs that feature an internal combustion engine range extender, advanced battery systems, a smart cockpit, and autonomous driving capabilities. It was formerly known as Chehejia. It was founded in 2015 and is based in Beijing, China.

WM Motor engages in the design and manufacturing of electric vehicles. It provides two vehicle platforms: software-defined vehicles (STD) and PL. The company was founded in 2016 and is based in Shanghai, China. In October 2023, WM Motor filed for bankruptcy.

NIO operates as a company involved in the design, development, and sale of electric vehicles within the automotive industry. The company provides a variety of electric sport utility vehicles (SUVs) and sedans, featuring technologies such as autonomous driving and battery swapping services. NIO serves the electric vehicle market with a focus on innovation It was founded in 2014 and is based in Jiading, China.

Xpeng (HKSE: 9868.HK) operates as a technology company that focuses on the future of transportation within the automotive industry. The company offers a range of electric vehicles designed to provide a more convenient and enjoyable travel experience. Xpeng's products cater to the electric vehicle market with smart features and sustainable energy solutions. It was founded in 2014 and is based in Guangzhou, China.

Shanghai New Power Automobile Technology specializes in the manufacture and sale of diesel engines within the automotive and industrial sectors. The company's diesel engines are designed for use in commercial vehicles, construction machinery, small and medium-sized ships, and electrical generator sets. Shanghai New Power Automobile Technology was formerly known as Shanghai Diesel Engine. It was founded in 1947 and is based in Shanghai, China.

Loading...