iCapital

Founded Year

2013Stage

Unattributed - III | AliveTotal Raised

$1.549BValuation

$0000Last Raised

$820M | 4 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+80 points in the past 30 days

About iCapital

iCapital focuses on alternative investments within the financial services industry. The company provides tools and solutions that assist in the incorporation of alternative assets into investment strategies for financial advisors, wealth managers, and asset managers. iCapital's platform offers management capabilities for education, transactions, data analytics, and client support during the investment lifecycle. It was founded in 2013 and is based in New York, New York.

Loading...

ESPs containing iCapital

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The alternative investment product platforms market provides the infrastructure through which wealth managers, independent broker-dealers, RIA aggregators, financial advisors, banks, and trust companies can provide accredited investors and qualified purchasers access to alternative asset classes, strategies, and investment products. These include private equity, private credit, hedge funds, real e…

iCapital named as Leader among 12 other companies, including CAIS, Securitize, and YieldStreet.

Loading...

Research containing iCapital

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned iCapital in 6 CB Insights research briefs, most recently on Oct 7, 2025.

Oct 7, 2025 report

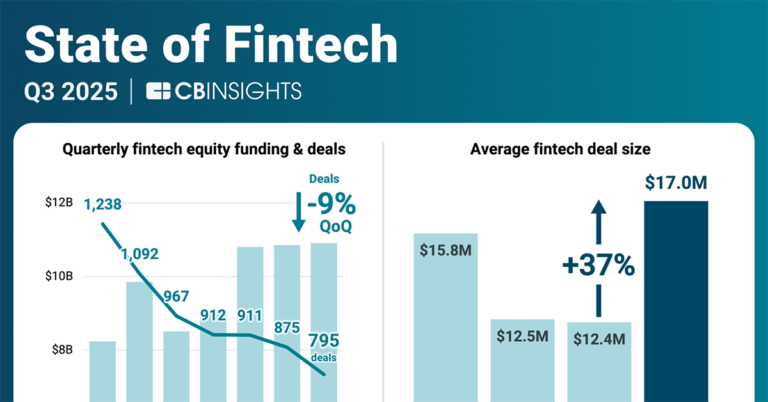

State of Fintech Q3’25 Report

Aug 11, 2025 report

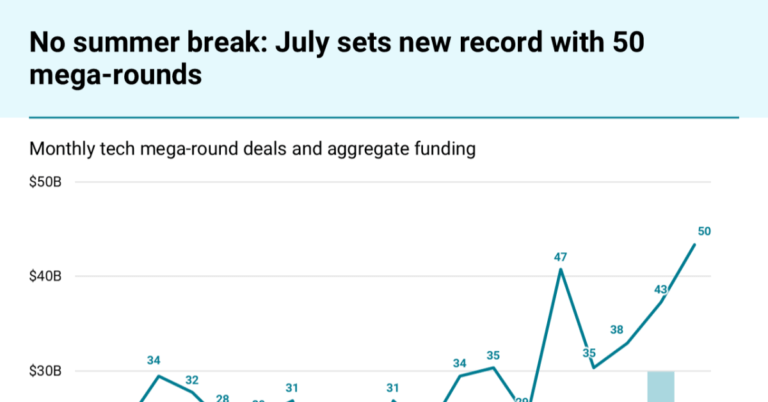

No summer break for AI: July 2025 hits 50 mega-rounds and 7 new unicorns

Expert Collections containing iCapital

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

iCapital is included in 6 Expert Collections, including Real Estate Tech.

Real Estate Tech

2,494 items

Startups in the space cover the residential and commercial real estate space. Categories include buying, selling and investing in real estate (iBuyers, marketplaces, investment/crowdfunding platforms), and property management, insurance, mortgage, construction, and more.

Unicorns- Billion Dollar Startups

1,309 items

Wealth Tech

2,723 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Capital Markets Tech

1,184 items

Companies in this collection provide software and/or services to institutions participating in primary and secondary capital markets: institutional investors, hedge funds, asset managers, investment banks, and companies.

Fintech

9,809 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest iCapital News

Nov 14, 2025

Brookfield announced its private wealth platform has partnered with iCapital to launch a new interactive asset allocation tool for financial advisors and their clients. Powered by iCapital Architect, “Alts Allocator” utilizes three research-based high-net-worth investor profiles to illustrate how adding alternative investments to a traditional 60/40 portfolio can “enhance diversification and improve potential investment outcomes.” The “Alts Allocator” model analysis is built upon three alts investor personalities: Traditionalist, Emerging Adopter, and Alts Champion, which were developed through “data from Brookfield’s Alts Institute Alternative Investing Survey.” Users can then opt to create custom portfolios from asset classes, “including infrastructure, real estate , private equity, and private credit, and compare them to the benchmark of their choice.” This launch comes at a time when advisor interest in alternatives is said to be growing steadily. According to iCapital’s advisor survey , the vast majority or “96% of advisors plan to maintain or increase their allocation to alternatives this year.” “Alts Allocator” is designed to meet this “demand by helping advisors model the potential impact of alternatives in client portfolios with greater clarity and confidence.” John Sweeney, CEO of Brookfield’s private wealth business, said that equipping advisors with the resources they need “to meaningfully engage clients around alternative investing is critical.” Their Alts Institute research study revealed that investors “increasingly view alternatives as an essential part of a portfolio strategy and believe that having an alternatives allocation may contribute to long-term outcomes compared to a traditional portfolio.” ‘Alts Allocator’ gives advisors a way to acceass the benefits of alternatives while also “meeting clients where they are.” iCapital Architect—the portfolio construction tool powering “Alts Allocator”—is part of iCapital’s modular suite of solutions “built to simplify the integration of alternative investments.” Architect reflects iCapital’s commitment to delivering data -driven tools that elevate the advisor experience and foster “client engagement.” Via its collab with Brookfield, iCapital continues to “help wealth managers navigate complexity, educate their clients, and support the integration of alternatives in client portfolios.” Dan Vene, Co-Founder and Co-Head of iCapital Solutions at iCapital said that powered by Architect, ‘Alts Allocator’ helps advisors “evaluate the impact of allocating to alternatives in client portfolios —enabling them to assess asset performance with precision, make recommendations, and engage in … insight-driven conversations that … drive better outcomes.” The launch of “Alts Allocator” is part of an initiative by The Alts Institute to arm advisors with the tools and resources “needed to take advantage of the opportunities in alternatives.” The Alts Institute includes a library of foundational alternatives content, marketplace insights and research from Brookfield. It is intended to help advisors build client confidence in alternatives and “deepen conversations around investing needs and motivations.” Sponsored Links by DQ Promote

iCapital Frequently Asked Questions (FAQ)

When was iCapital founded?

iCapital was founded in 2013.

Where is iCapital's headquarters?

iCapital's headquarters is located at 60 East 42nd Street, New York.

What is iCapital's latest funding round?

iCapital's latest funding round is Unattributed - III.

How much did iCapital raise?

iCapital raised a total of $1.549B.

Who are the investors of iCapital?

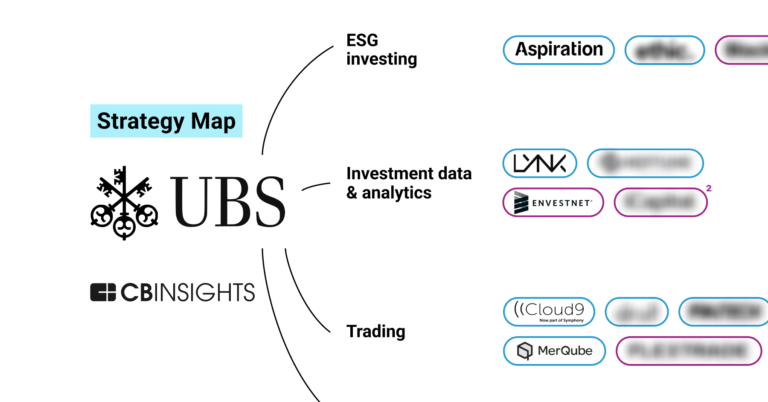

Investors of iCapital include UBS, Temasek, Bank of New York Mellon, SurgoCap Partners, T. Rowe Price and 31 more.

Who are iCapital's competitors?

Competitors of iCapital include Lynk, Addepar, Enfusion, Linqto, Carbon Equity and 7 more.

Loading...

Compare iCapital to Competitors

Moonfare specializes in providing access to private equity investments through its digital platform. The company offers a range of services, including the ability to invest in individual funds, a diversified portfolio of funds, a private market ELTIF strategy for suitable investors, and a secondary market for buying and selling allocations before maturity. It was founded in 2016 and is based in Berlin, Germany.

CAIS is a fintech company that focuses on transforming the world of alternative investing. The company provides a platform that connects independent financial advisors with alternative asset managers, enabling them to transact alternative investments and structured notes at a large scale. The company primarily serves the financial advisory sector and the alternative asset management industry. It was founded in 2009 and is based in New York, New York.

Carta provides tools for private equity and venture capital within the financial services industry. The company offers a fund administration platform that includes services such as capitalization table management, valuations, tax compliance, and equity program management for private businesses. It serves the private capital market, including investors, limited partners, and portfolio companies. Carta was formerly known as eShares. It was founded in 2012 and is based in San Francisco, California.

Canoe Intelligence provides alternative investment data management within the financial technology sector. The company offers cloud-based solutions that facilitate document collection, data extraction, and data science initiatives, allowing financial institutions to process complex investment documents. Canoe's technology is utilized by institutional investors, asset servicers, capital allocators, and wealth managers to manage their data workflows. It was founded in 2017 and is based in New York, New York.

Titanbay is a company that focuses on facilitating investment in private markets. The company's main service is to identify and provide access to top-tier private market funds, enabling investors to build diversified private market portfolios on their platform. Titanbay primarily sells to sectors such as private banks and wealth managers, individual professional investors, and institutional and family office investors. It was founded in 2019 and is based in Luxembourg.

Orion Advisor Technology specializes in providing comprehensive software solutions for financial advisors within the wealth management sector. The company offers a suite of products that facilitate portfolio accounting, client relationship management, and trading, as well as tools for risk assessment, regulatory compliance, and financial planning. Orion Advisor Technology was formerly known as Orion Advisor Services. It was founded in 1999 and is based in Omaha, Nebraska. Orion Advisor Technology operates as a subsidiary of Orion.

Loading...