AI funding in 2025 is on track to double 2024’s record total ($108.0B).

While deals fell in Q3’25, billion-dollar rounds to AI infrastructure players continued to drive the funding surge. But the activity isn’t limited to the largest players: investors are cutting bigger checks across every stage, signaling both conviction in AI’s potential and the high costs of AI development.

Among emerging opportunities, AI agents are a key focus for VCs and enterprises alike, with agent markets leading deal and M&A activity in the quarter.

Below, we break down the top stories from this quarter’s report, including:

- AI deal activity softens, but massive rounds support continued funding boom

- Consolidation remains in full force in the AI market

- Tech market deals highlight AI agent applications, rise of GEO

- The talent premium: AI companies valued at up to ~$100M per employee

Download the full report to access comprehensive CB Insights data and charts on the evolving state of AI across geographies.

AI deal activity softens, but massive rounds support continued funding boom

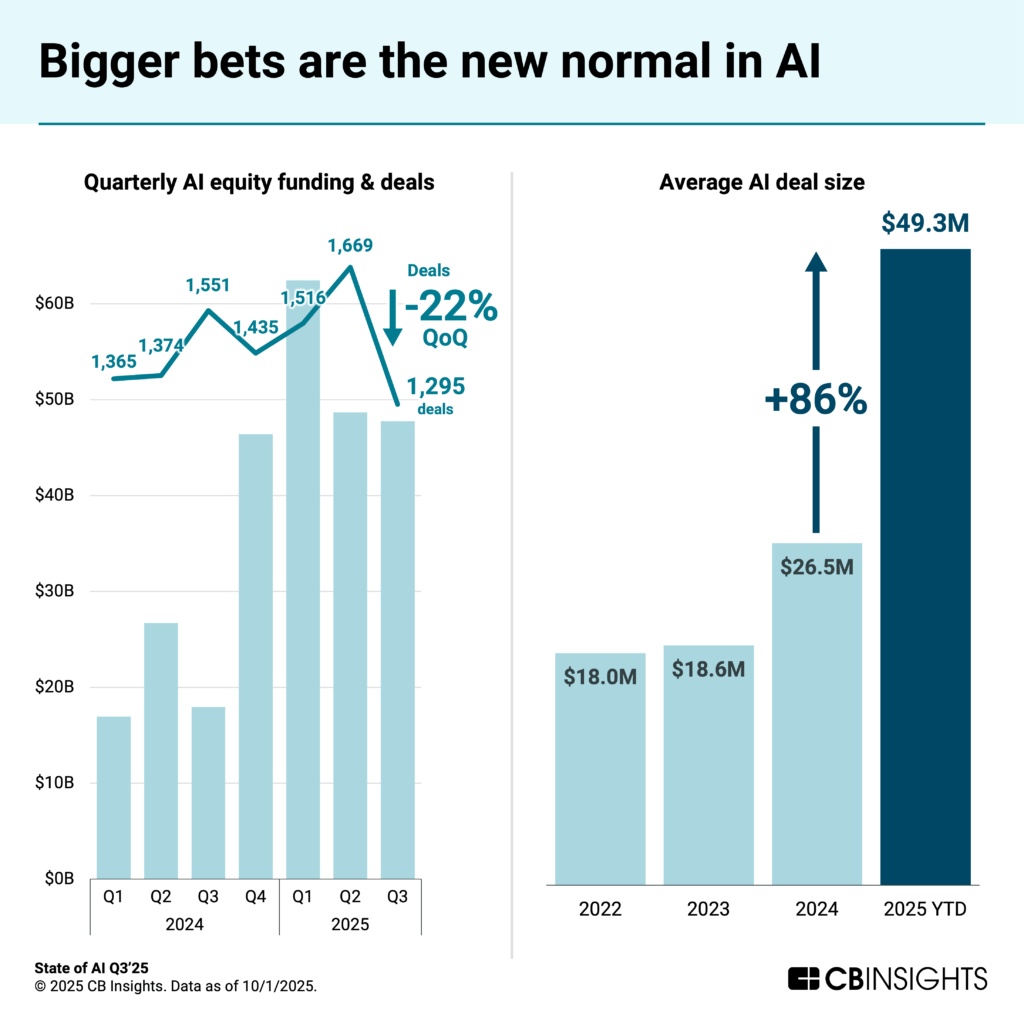

Deals to private AI companies globally fell 22% quarter-over-quarter in Q3’25, but funding remained above $45B for the fourth consecutive quarter.

Taken together, these trends indicate how top-heavy the AI venture funding landscape has become.

The average deal size in 2025 YTD is $49.3M — up 86% from 2024. In the last 4 quarters, mega-rounds ($100M+ deals) have accounted for 75%+ funding. The average since 2021 (up to Q3’24) is 53%.

At the same time, check sizes are trending bigger at the median across every stage this year. For example, the median early-stage deal is $3.4M in 2025 YTD, up from $2.5M in 2024.

Investors are funneling capital into fewer, larger bets on perceived AI winners, driven by the massive infrastructure costs and competitive dynamics of foundation model development.

In Q3’25, there were 6 $1B+ rounds alone. The top 3 deals went to LLM developers — Anthropic ($13B, Series F), OpenAI ($8.3B, PE), and Mistral AI ($1.5B, Series C) — reflecting the high cost of frontier model development. While OpenAI hit $12B in annualized revenue in July 2025, it’s projecting roughly $8B in cash burn this year per reports.

Other infrastructure players like Nscale (AI data centers, $1.1B Series B) and Groq (AI inference processors, $750M, Series E) were also in the top 10. The raises are indicative of the growth and attention technologies enabling AI are receiving, with earnings call mentions of data centers hitting record levels in Q3’25 and AI training & inference chips on track for record equity deal & funding activity this year.

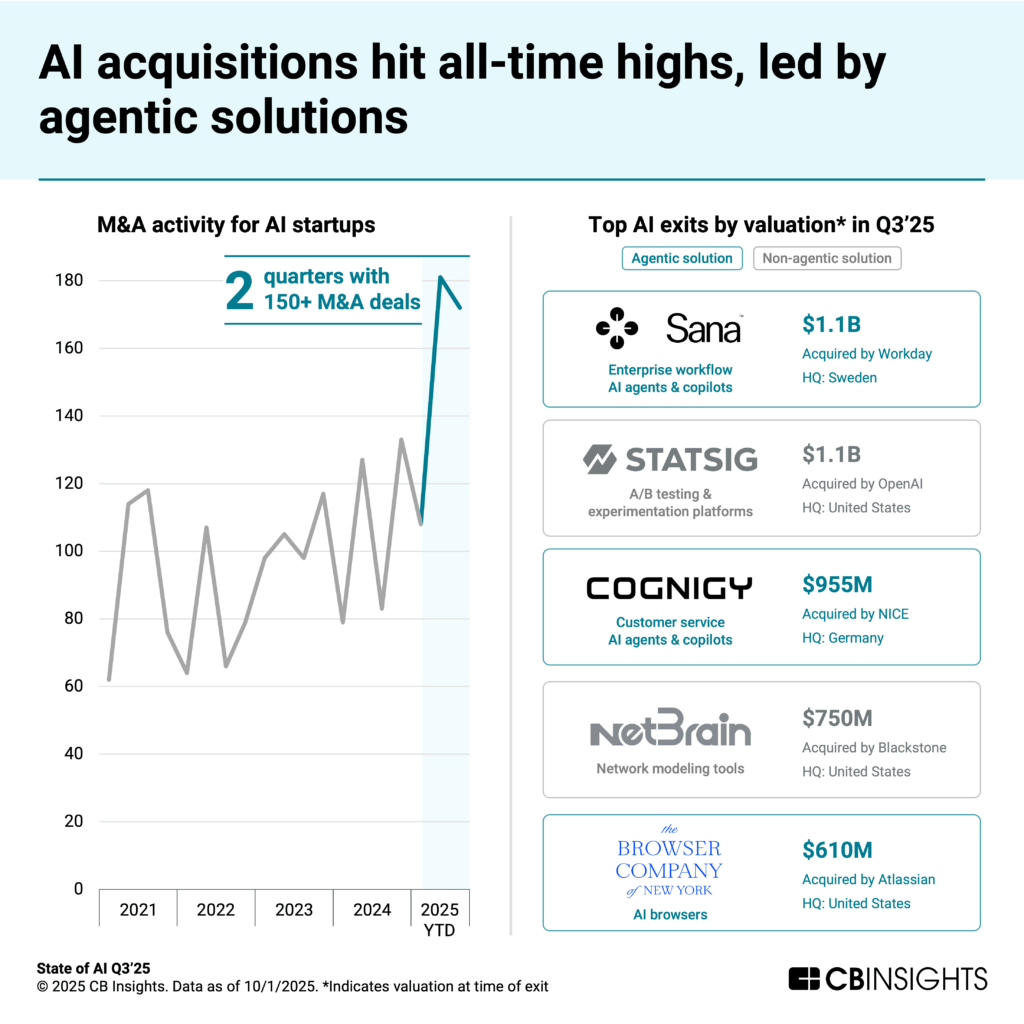

Consolidation remains in full force in the AI market

The AI market is a hotbed for M&A activity.

Q3’25 marks the second highest quarter on record for AI startup M&A (172 deals), following Q2’25 (181 deals). The US continues to gain share, with startups based in the country accounting for 59% of total exits, the highest share since Q2’21.

Three of the top 5 exits in the quarter were related to AI agents:

- Workday acquired Sana Labs, a company focused on enterprise workflows, for $1.1B.

- NiCE acquired customer support startup Cognigy for $955M.

- Atlassian acquired The Browser Company, the maker of the Arc and Dia AI browsers, for $610M.

The activity signals enterprise software incumbents are looking to buy their way into accelerating their AI roadmaps. Workday was the second most active acquirer in the quarter with 3 acquisitions (behind Salesforce, with 4 acquisitions). The HR & finance software company also picked up agent builder Flowise and AI-powered recruiting platform Paradox.

Meanwhile, Meta made its first publicly disclosed acquisitions since 2022, acquiring voice AI startups Play AI and WaveForms AI.

Other notable top exits include AI security companies Lakera (acquired by Check Point for $300M) and Prompt Security (acquired by SentinelOne for $250M-$300M). Generative AI is expanding attack surfaces, driving large cyber players to opt for M&A to more quickly integrate AI security features into existing offerings.

Both Lakera and Prompt Security were founded less than 5 years ago, far “younger” than the average time to exit of 9.7 years in the quarter, underscoring how rapidly AI security has become mission-critical.

Review the AI security startups that are ripe for acquisition next in this brief.

Tech market deals highlight AI agent applications, rise of GEO

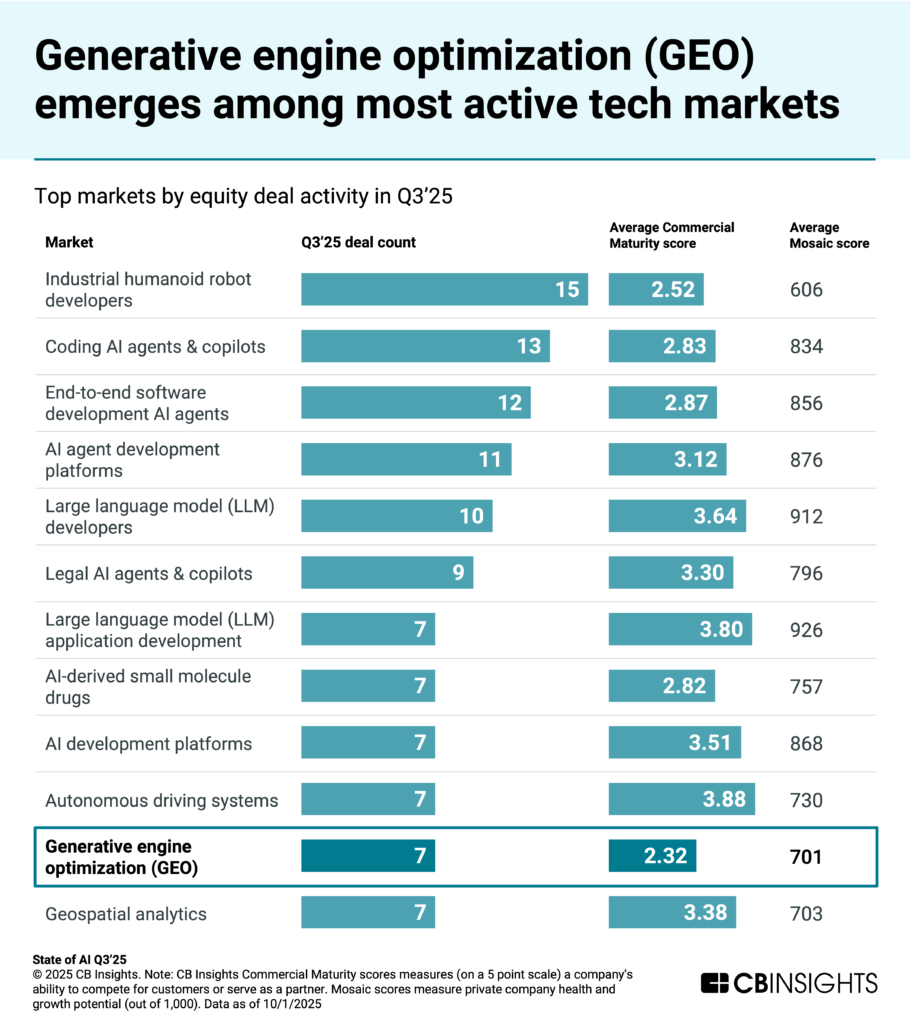

Among the 1,500+ tech markets that CB Insights tracks, those in the chart below saw the greatest number of AI deals in Q3’25 (note: companies may appear in multiple markets).

Industrial humanoid robot developers and coding AI agents & copilots remained at the top, while LLM developers also climbed back up in the rankings from Q2’25.

One notable rising market is generative engine optimization (GEO), which refers to tools that help brands optimize their visibility in AI search platforms like ChatGPT and Perplexity. This emerging category (the most nascent in the list based on CBI Commercial Maturity scores) addresses the shift toward shopping and discovery happening on top of LLM interfaces.

OpenAI’s September 2025 launch of in-platform shopping capabilities in ChatGPT underscores this trend, establishing AI platforms as new commerce channels requiring specialized optimization strategies.

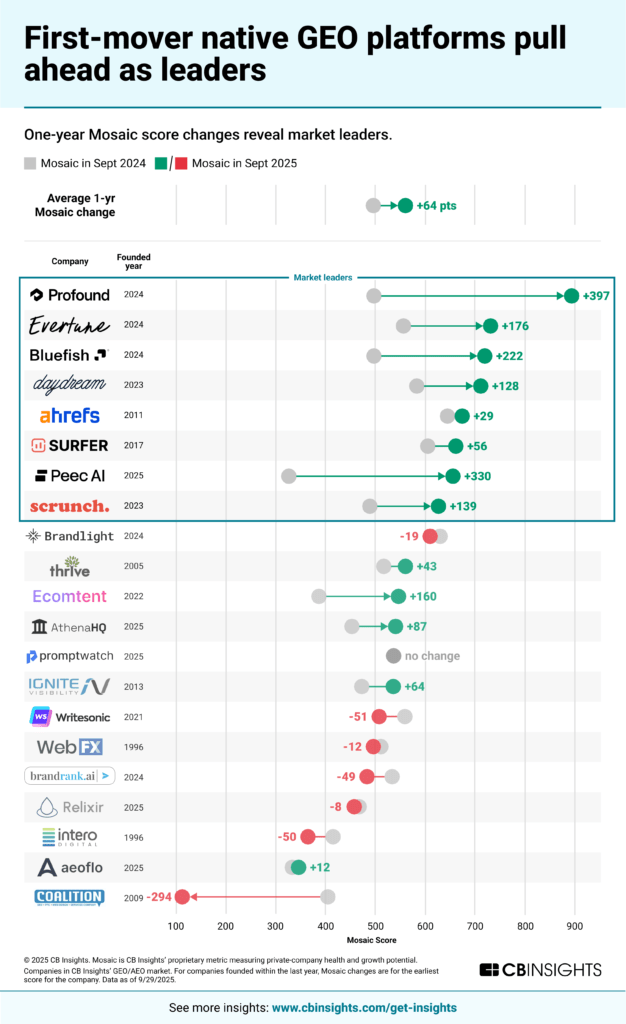

Using CB Insights’ Mosaic score — which measures private company health and predicts likelihood of success — we analyzed more than 20 GEO companies, ranking them by 1-year Mosaic score growth to identify the fastest-rising vendors.

See the GEO partners best positioned to help brands win in AI search here.

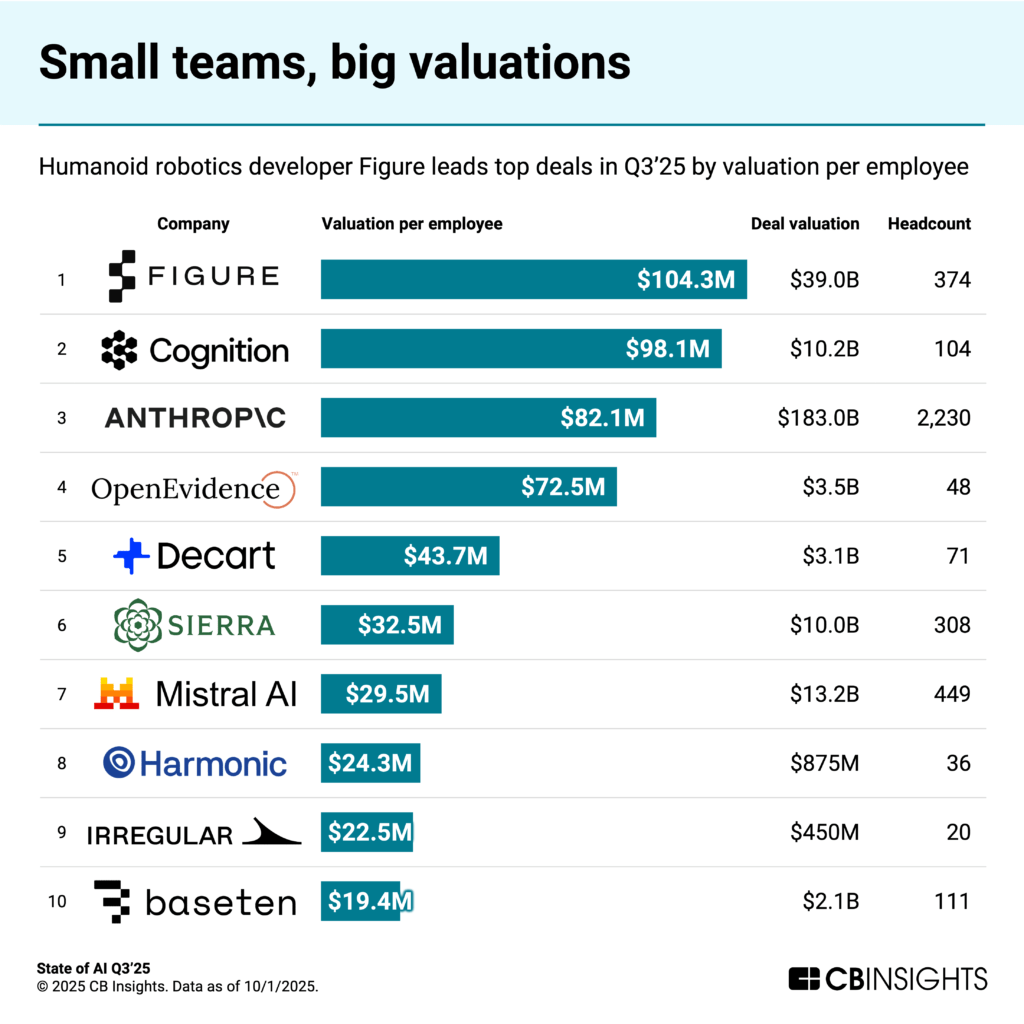

The talent premium: AI companies valued at up to ~$100M per employee

AI companies with lean headcounts and breakthrough potential are attracting sky-high valuations.

Humanoid robotics developer Figure leads the pack in Q3’25 at $104.3M per employee on a $39B valuation, despite reporting no revenue last year (though projecting $9B by 2029). Cognition follows with $98.1M per employee, based on its $10.2B valuation. While the coding AI agent startup has $150M+ in ARR (following its acquisition of Windsurf), this indicates a lofty revenue multiple of ~68x.

Others topping the quarter’s valuation-per-employee list span the AI model (Anthropic, Mistral AI, Decart, Harmonic), infrastructure (Baseten), and application layers (OpenEvidence, Sierra, Irregular).

Whether these valuations prove prescient or overextended will largely depend on whether these companies can deliver on ambitious revenue projections in the years ahead.

RELATED RESOURCES FROM CB INSIGHTS:

- State of Venture Q3’25 Report

- State of Fintech Q3’25 Report

- State of AI Q2’25 Report

- State of Digital Health Q2’25 Report

- State of Tech Exits H1’25