Digital health funding and deal volume both declined in Q3’25, extending a downturn that began after a strong first quarter. Deal activity dropped to its lowest level in 5 years as investors became increasingly cautious about where to deploy capital.

The quarter underscored a maturing market focused on proven business models. Mid-stage deals captured their highest share in 5 years as mega-rounds declined sharply. Exit momentum strengthened, with M&A deals reaching multi-year highs. Four new unicorns emerged, all leveraging AI across various applications from drug discovery to clinical documentation.

Key takeaways from the report include:

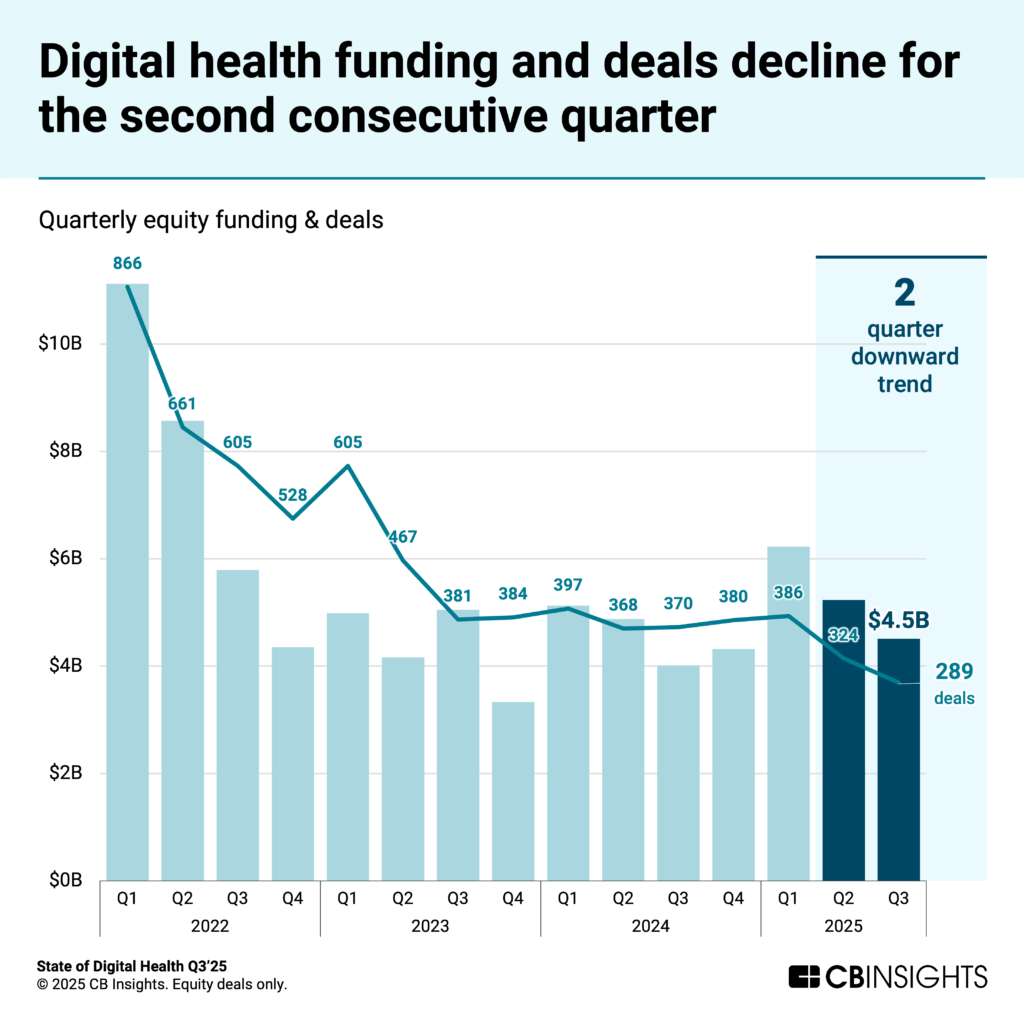

- Funding continued to decline as deal volume hit a 5-year low. Equity funding dropped 14% QoQ to $4.5B, while deal volume declined 11% to 289 deals in Q3’25 — the lowest quarterly total in the last 5 years, according to CB Insights data. Both metrics have declined for 2 consecutive quarters following a strong Q1, with persistent market uncertainty impacting dealmaking activity.

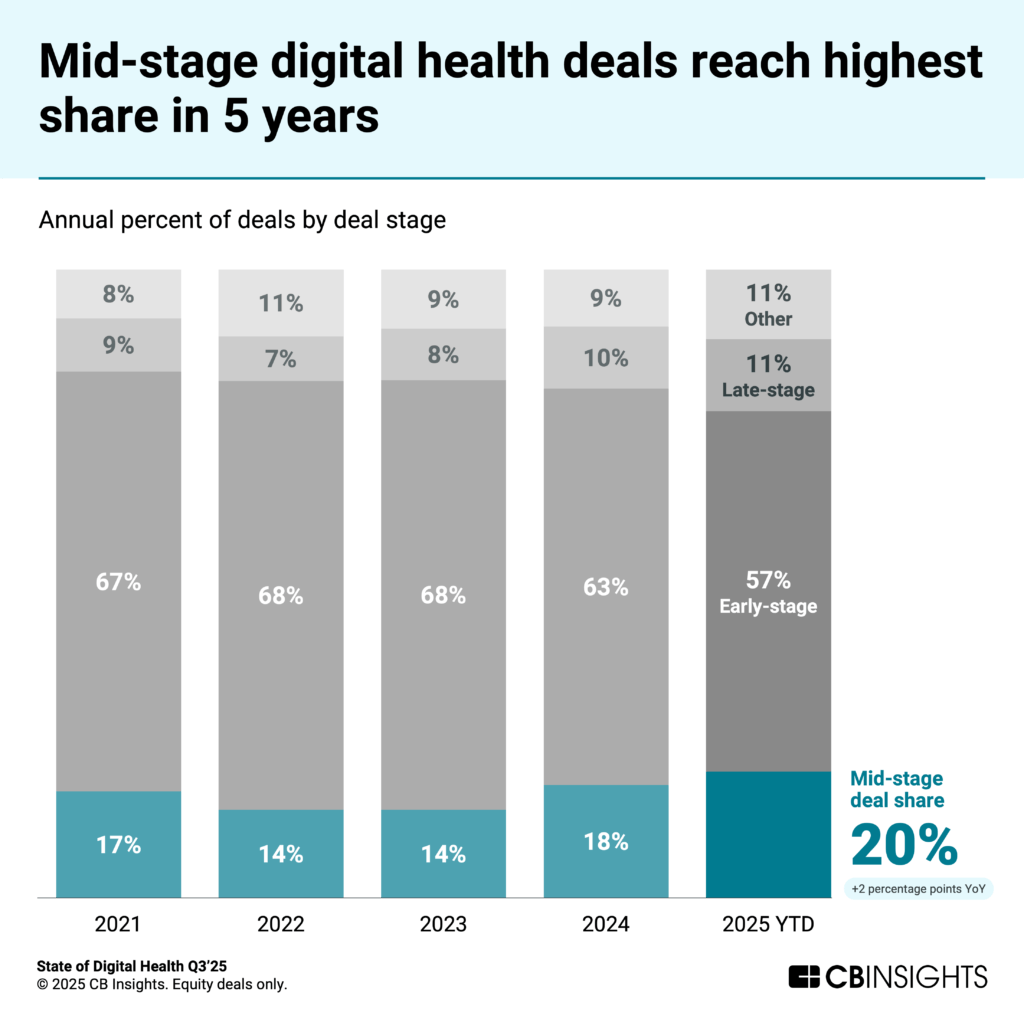

- Mid-stage deals reached their highest share in 5 years. Mid-stage deals hit 20% in 2025 YTD, up from 18% in 2024. Early-stage deals dropped to 57% from 63%, reflecting investor preference for companies with established business models. Annual median funding is up across all stages, with mid-stage deals rising to $23M in 2025 so far compared to $18.6M in 2024, and late-stage deals reaching $47.5M from $32M.

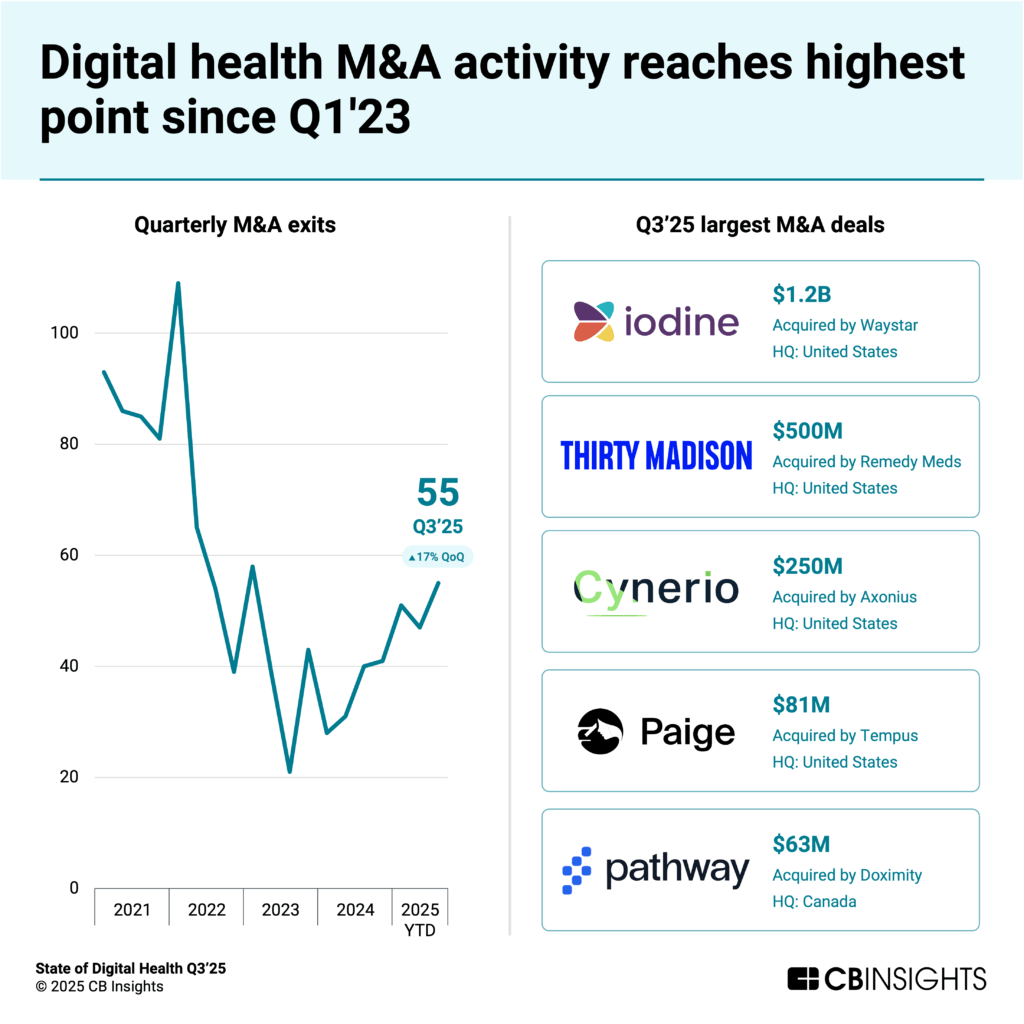

- M&A activity surged to 55 deals — the most since Q1’23. Exit activity strengthened with 55 M&A deals, the highest quarterly total in over 2 years, signaling significant market consolidation. Three of the top 5 acquisitions involved AI companies with proprietary datasets. Four IPOs occurred, 3 of which were medtech companies, demonstrating strong public market appetite for medical device innovations.

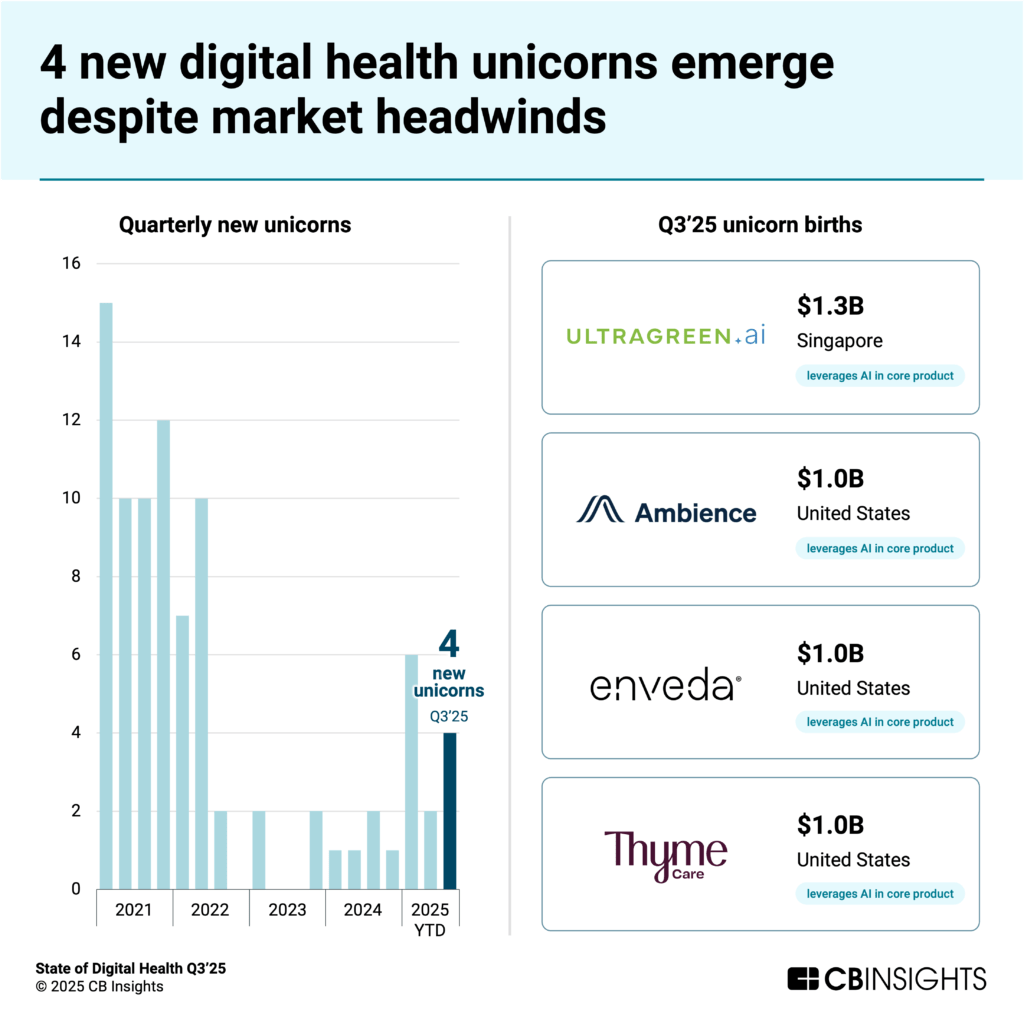

- All 4 new unicorns provide AI-enabled solutions. Four new unicorns were born in Q3’25 (3 in the US, 1 in Asia), doubling the count from Q2’25. All four of these unicorns leverage AI in their core products, from life sciences platforms like Enveda (drug discovery) to clinical tools like Ambience (clinical documentation) and UltraGreen (fluorescence-guided surgery).

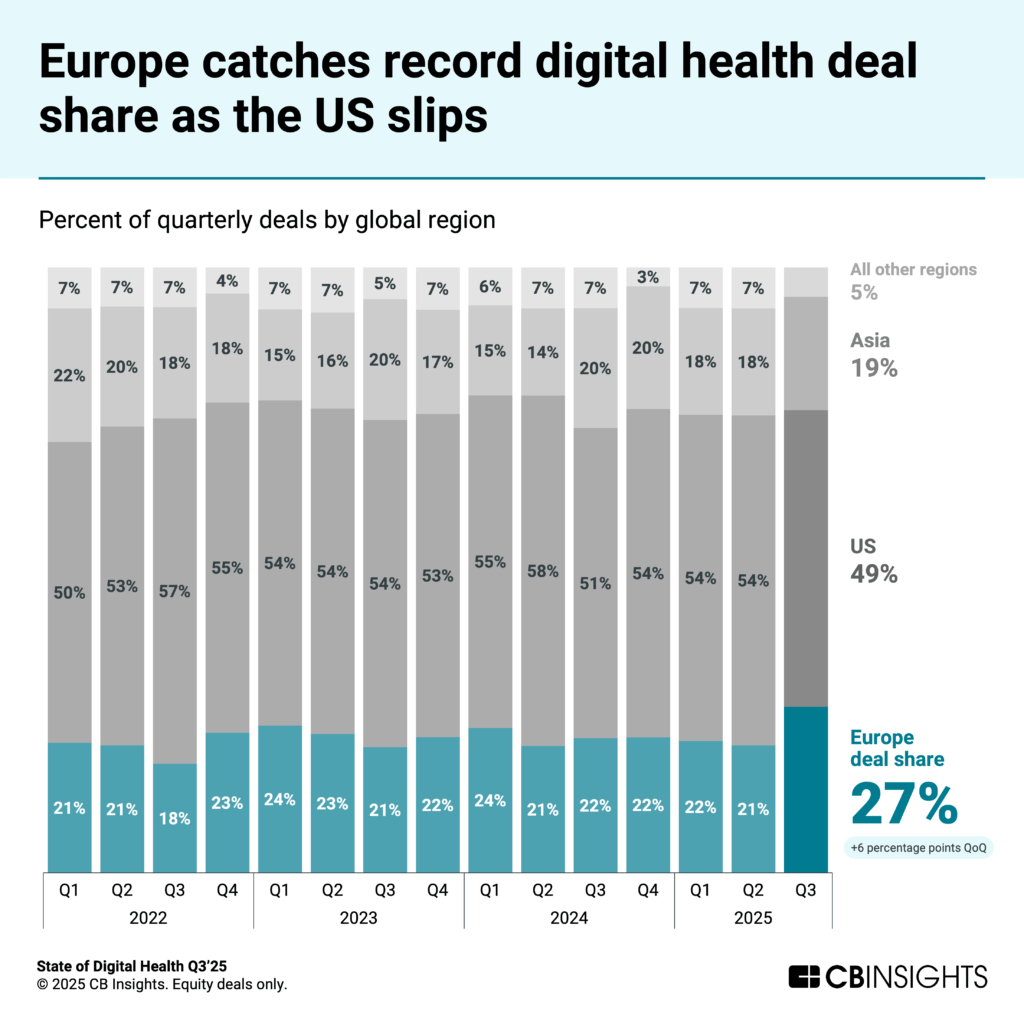

- Europe reached a new high in deal share while US saw a decline. Europe-based digital health companies captured 27% of global deal share — the highest in 5 years — with its annual median deal size rising to $4.1M YTD (from $3.4M in 2024). Meanwhile, US deal share fell to 49% — the lowest since Q4’21 — though its median deal size remained strong at $9.5M YTD compared to $6.5M in 2024.

We dive into the trends below.

Download the full report to access comprehensive data and charts on the evolving state of digital health.

Funding continued to decline as deal volume hit a 5-year low

Digital health equity funding dropped 14% QoQ in Q3’25, while deal volume fell 11% to its lowest level in 5 years with 289 deals.

The continued deal activity decline reflects broader trends across the venture ecosystem, where deal volume fell to its lowest level since Q4’16. Both funding and deal volume have now declined for two straight quarters since Q1’25.

Mega-rounds ($100M+) made up just 34% of total funding, down sharply from 47% in Q2’25. The 9 mega-rounds this quarter totaled $1.5B, compared to 10 deals worth $2.5B in the previous quarter. Top deals this quarter included value-based kidney care platform Strive Health ($300M Series D) and clinical workflow tools Ambience ($243M Series C) and OpenEvidence ($210M Series D).

Despite the pullback in mega-rounds, annual average and median deal sizes continue to rise. The median deal size is $6M in 2025 YTD, up from $5M in 2024, while the average deal size also climbed to $21.5M from $16.3M. This signals that while fewer deals are getting done, investors are writing larger checks to companies they back.

Mid-stage deals reached their highest share in 5 years

Investors are shifting their focus toward more mature companies. Mid-stage deals captured 20% of all digital health deals in 2025 YTD, up from 18% in 2024 — the highest proportion in 5 years. The shift signals investors’ growing preference for companies with established revenue streams and proven market traction.

Early-stage deals declined to 57% of total activity in 2025 YTD, down from 63% in 2024. Late-stage deals held relatively steady at 11%, up slightly from 10% the previous year.

Deal sizes are up across all stages in 2025. The annual median for mid-stage rounds is $23M YTD, up from $18.6M in 2024 — a 24% increase. Late-stage deals climbed even more dramatically to $47.5M, compared to $32M in 2024, representing a 48% jump. These increases reflect investors concentrating capital in companies that have demonstrated product-market fit and sustainable growth trajectories.

M&A activity surged to 55 deals—the most since Q1’23

Exit activity strengthened significantly in Q3’25, with 55 M&A deals — the highest quarterly total in over 2 years. The surge signals increased market consolidation as larger healthcare players and strategic acquirers shop for proven technologies and market share.

Three of the top 5 acquisitions by valuation involved AI-enabled companies with proprietary models trained on valuable datasets. Iodine Software was acquired by Waystar for $1.2B, bringing clinical intelligence capabilities trained on data representing over a third of US inpatient discharges. Paige, an AI pathology platform with a dataset of more than 25M digitized pathology slides, was acquired by Tempus for $81M. Pathway, which claims one of the largest structured datasets in medicine, was acquired by Doximity for $63M to enhance its AI capabilities for providers’ clinical workflows.

Four IPOs occurred this quarter, matching Q2’25’s total. Notably, 3 of the 4 IPOs were medtech companies — HeartFlow ($1.5B valuation), Carlsmed ($398M), and CapsoVision ($232M) — demonstrating robust public market appetite for medical device innovations.

The combination of rising M&A activity and steady IPO flow demonstrates that exit pathways are opening for digital health companies, providing crucial validation for the sector after years of constrained liquidity.

All 4 new unicorns are AI-powered solutions from drug discovery to clinical tools

Four new unicorns emerged in Q3’25 — 3 in the US and 1 in Asia — doubling the count from Q2’25. All 4 leverage AI in their core products, spanning various applications from drug discovery to clinical workflows. It underscores how AI has become essential infrastructure for healthcare & life sciences companies.

The new billion-dollar companies include:

- Singapore-based UltraGreen (valuation: $1.3B) develops an AI-enabled fluorescence-guided surgery platform that provides real-time data during procedures.

- Enveda (valuation: $1B) uses AI to analyze natural molecules for drug discovery.

- Ambience (valuation: $1B) offers AI-powered clinical documentation and medical coding to improve provider workflows.

- Thyme Care (valuation: $1B) develops a cancer care navigation platform that uses AI to power insights for oncologists’ workflows.

Despite overall funding declines, these valuations demonstrate that AI-enabled solutions addressing critical workflows — from reducing clinician burden to accelerating drug discovery — continue to attract significant investor conviction.

Europe hit a record deal share while the US slipped to a 4-year low

Geographic shifts in digital health dealmaking became pronounced in Q3’25, with Europe capturing 27% of global deal share—the highest in nearly 5 years. Meanwhile, US deals declined to 49%, the lowest share since Q4’21. Asia held steady at 19% this quarter compared to 18% in Q2’25.

Europe’s momentum extends beyond deal volume. The region’s annual median deal size rose to $4.1M in 2025 YTD, up from $3.4M in 2024 — a 21% increase. The top deals in this region in Q3’25 emphasized solutions spanning imaging and diagnostics (Ultromics, Cyted Health), drug discovery (Charm Therapeutics, Alchemab Therapeutics), and connected care (ViCentra, Sunrise). 6 out of the top 10 deals went to UK-based companies.

Despite declining deal share, the US continues to command significantly larger deal sizes. The US median reached $9.5M in 2025 YTD compared to $6.5M in 2024 — a 46% increase. This suggests US investors are writing fewer but substantially larger checks, concentrating capital in higher-quality opportunities.

Asia’s deal activity held steady at 19% in Q3’25 compared to 18% the previous quarter. While early- and mid-stage deal share declined in Asia, late-stage deal share has slightly increased to 14% in 2025 YTD. By comparison, late-stage deals only made up 6% in 2022 and have continued to rise since, marking the investors’ cautious approach. The top deals of the quarter were in medtech, including surgical tools (UltraGreen, Ronovo Surgical) and monitoring wearables (Respiree).

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign up for a free trial to learn more about our platform.