JPMorgan Chase announced plans to commit $1.5T over the next 10 years as part of its Security and Resiliency Initiative, including up to $10B in direct equity investments, to support the US’s move towards greater national security.

As global competition intensifies and supply chains fracture, the ability to deploy capital into technologies that make the US more self-reliant, adaptive, and secure has become a national priority.

JPMorgan Chase’s initiative is designed to meet that moment, representing both a financing bonanza for US-based companies across the 27 strategic sub-areas identified by the banking giant and a capital deployment challenge.

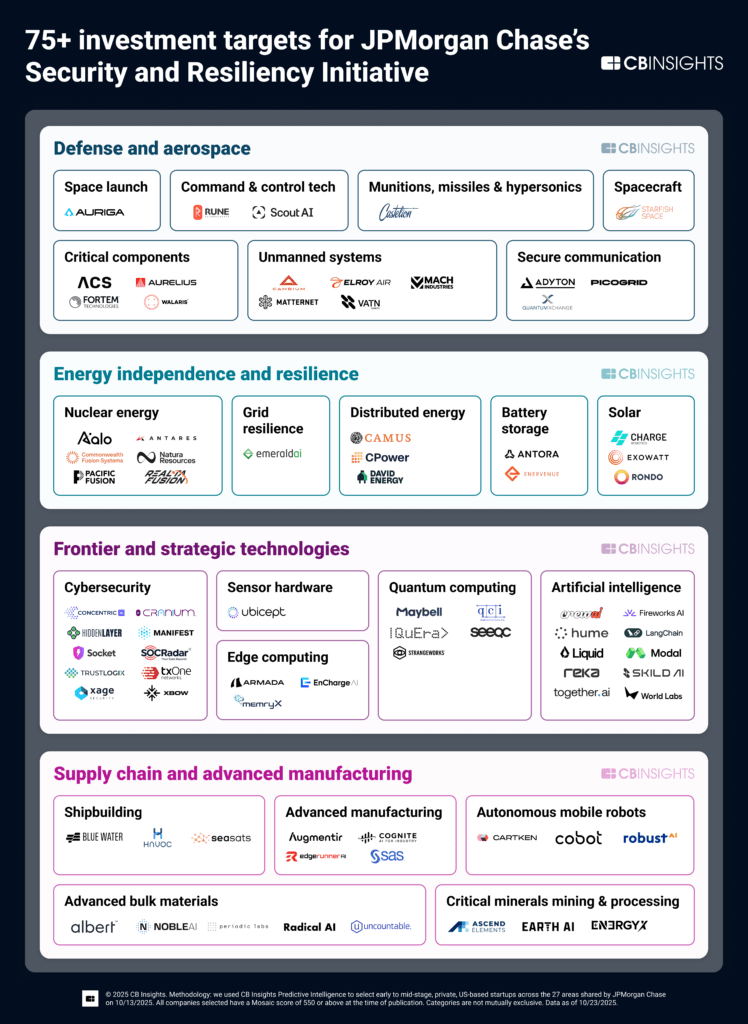

To help, we’ve used CB Insights’ predictive signals, including our outlook score for company success, Mosaic, to shortlist 79 companies for JPMorgan Chase to consider investing in.

We map them all below, categorized across all but 4 of the strategic areas identified by JPMorgan Chase due to a lack of promising startups matching our criteria — full methodology available at the end of this report. Key recommendations follow.

Key recommendations

Invest in AI as the backbone of manufacturing sovereignty

A new class of industrial AI startups is aiming to rebuild the nation’s productive capacity across manufacturing, materials, and mobility.

Companies like Skild AI (robot foundation models), Charge Robotics (factory automation), and Cartken (autonomous mobile robots) are reducing the cost gap for onshore production by automating physical work and logistics.

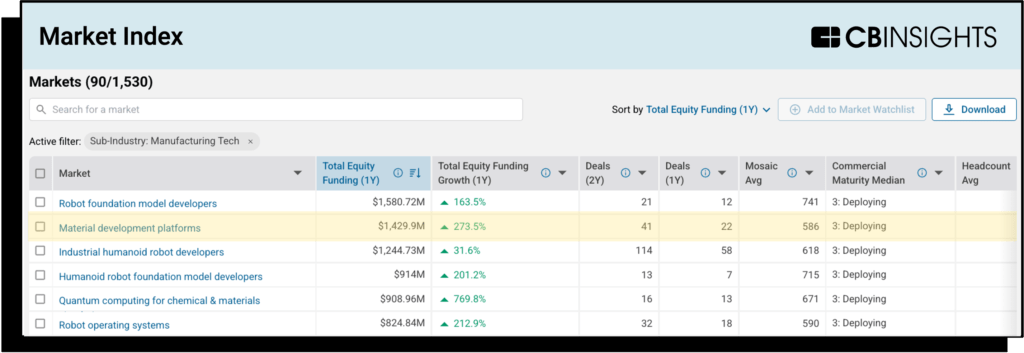

Meanwhile, Earth AI and Periodic Labs are applying AI to accelerate materials discovery and secure domestic access to critical minerals and battery inputs. Material development platforms have recently captured investor attention as AI and quantum computing unlock new capabilities, becoming one of the hottest emerging markets (i.e., with a Commercial Maturity median of 3 or below) in the manufacturing sector.

Source: CB Insights Markets Index (as of 9/9/2025)

Even legacy-heavy domains like shipbuilding are seeing AI-enabled autonomy from firms such as Seasats and Blue Water Autonomy, which aim to reduce costs in a historically high-cost, labor-intensive industry.

Together, these companies are forming the digital-industrial layer for intelligent reshoring, using AI to make domestic manufacturing faster, adaptive, and globally competitive again.

Bet on autonomous defense systems to redefine deterrence

Modern conflict is evolving faster than traditional defense procurement can adapt, primarily driven by the proliferation of drone warfare with the invasion of Ukraine. A new generation of startups is filling the gap with software-defined, low-cost autonomy.

Companies like Fortem Technologies (drone detection and interception) and Allen Control Systems (Counter-unmanned systems) are deploying scalable unmanned systems across air and land. Paired with Picogrid’s defense connectivity networks and Rune Technologies’ predictive logistics AI, these platforms create adaptive, sensor-rich meshes that can respond to threats in real time.

The result is a rapidly emerging autonomous defense ecosystem that strengthens deterrence through speed, intelligence, and distributed resilience.

Smarter and cleaner energy production and distribution will help maintain AI lead

The AI boom has made energy an ever greater strategic resource, making diversified, digitally managed generation essential to both national security and computational progress.

Investing in startups focused on nuclear innovation, solar automation, and AI-driven grid resilience will help build a smarter, sovereign energy base.

Companies like Pacific Fusion and Realta Fusion are redefining what clean baseload power can look like, while Aalo Atomics and Natura Resources advance modular fission systems that can be rapidly deployed near data and industrial centers.

Paired with Antora and Rondo Energy’s storage systems and David Energy’s automated grid orchestration, these technologies form an adaptive, distributed energy network capable of self-balancing demand spikes from AI compute and industrial electrification.

Investing in this ecosystem builds not only clean power capacity but also strategic autonomy, ensuring the intelligence revolution runs on domestically controlled, resilient, and low-cost energy.

Support edge intelligence to make AI truly ubiquitous

The frontier of artificial intelligence is shifting from centralized data centers to the physical world, where latency, cost, and privacy demand on-device autonomy.

Startups like EnCharge AI (compute-in-memory chips) and MemryX (edge inference for automotive and robotics) are re-architecting silicon for real-time decision-making, while Modal and Fireworks AI deliver serverless deployment layers that make model execution as elastic as cloud functions.

On the software side, Together AI (an AI 100 2025 winner) and Liquid AI are advancing compact, efficient small language models that can run locally, enabling intelligence in drones, sensors, and industrial systems.

Combined, these technologies are creating a distributed AI fabric that embeds cognition into every node of the economy, from factory floors to vehicles and handhelds. The result: lower latency, greater resilience, and unprecedented reach, as intelligence moves from “in the cloud” to everywhere work gets done.

Finance the intelligent age security: AI, data, and infrastructure

As AI becomes the backbone of critical systems, the attack surface expands exponentially.

A new cohort of startups is fortifying this frontier by integrating AI-native security, quantum-safe encryption, and infrastructure hardening into the fabric of the intelligent economy.

Companies like TXOne Networks and Xage Security are protecting industrial and energy assets with zero-trust architectures built for operational technology, while TrustLogix and Concentric AI safeguard sensitive enterprise data through granular policy enforcement and autonomous monitoring.

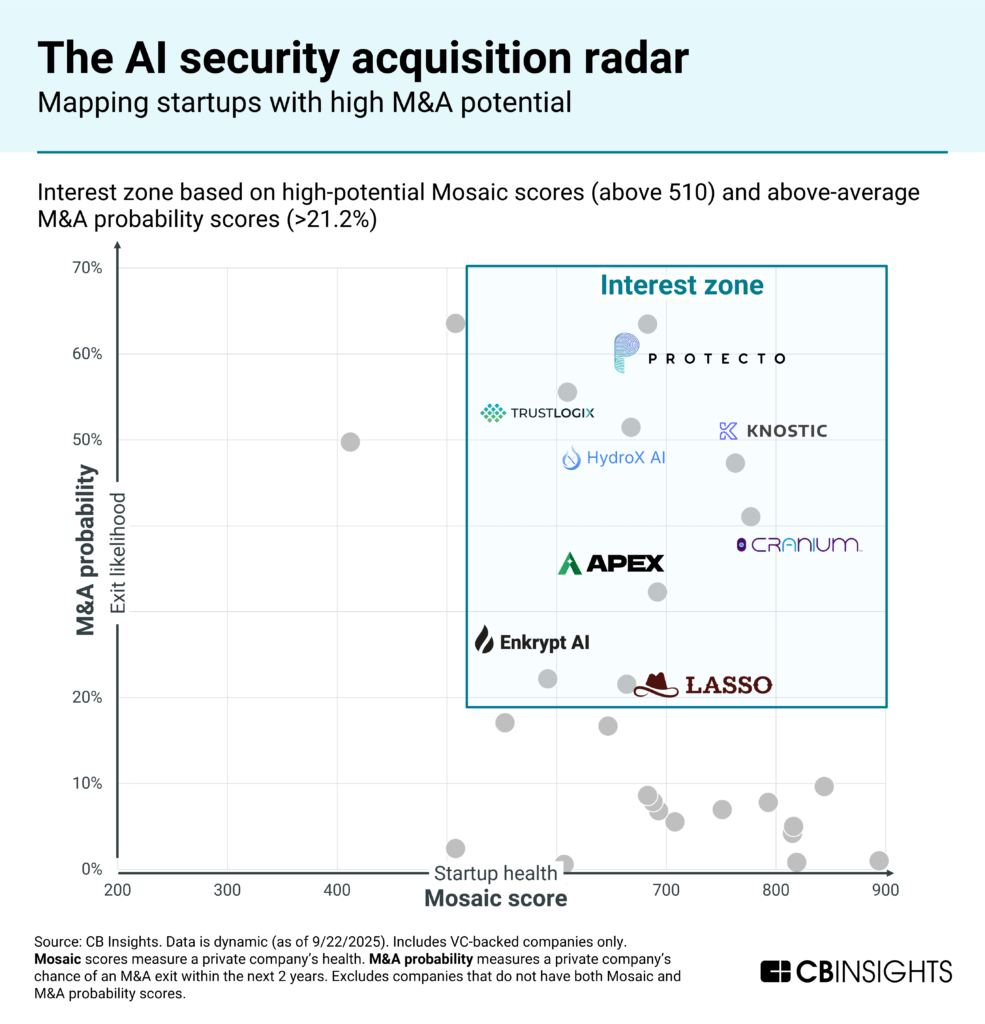

TrustLogix is among the AI security startups most likely to be acquired next, according to CB Insights Predictive Intelligence, as large cyber players have been on a M&A spree to seize this opportunity and integrate AI security features into existing offerings.

Quantum Xchange ensures secure data transmission with quantum-resistant encryption, and HiddenLayer defends AI models themselves against poisoning, inversion, and adversarial attacks.

Together, these technologies create a secure AI infrastructure stack that spans digital, data, and physical domains, ensuring that as intelligence scales, trust scales with it. Investing in this layer isn’t just about cybersecurity; it’s about protecting the nervous system of the modern economy.

Methodology

We used CB Insights’ predictive intelligence to analyze thousands of startups and select the most promising ones that align with JPMorgan Chase Security and Resiliency Initiative’s 4 key areas and 27 sub-areas.

We looked across our 1,500+ Markets to identify the hottest areas based on equity funding raised over the past year and selected companies with the highest Mosaic scores (min 550) operating in these markets. We focused on private, early to mid-stage (Series B max), US-based startups. Data is as of 10/23/2025.

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign up for a free trial to learn more about our platform.