Fintech in 2025 looks different. The era of cheap capital, consumer hype, and pandemic-fueled growth has passed. But the momentum hasn’t disappeared — it’s shifted from the front end to the foundation, as companies focus on building the systems and automation that keep financial services running.

To no surprise, AI is at the forefront of these changes. The tech is no longer confined to chatbots or data analysis; it now executes real financial workflows, from compliance reviews to transaction monitoring. Crypto’s story is maturing in parallel and moving away from speculation, as stablecoins, custody platforms, and tokenization become part of everyday financial operations for businesses and institutions alike.

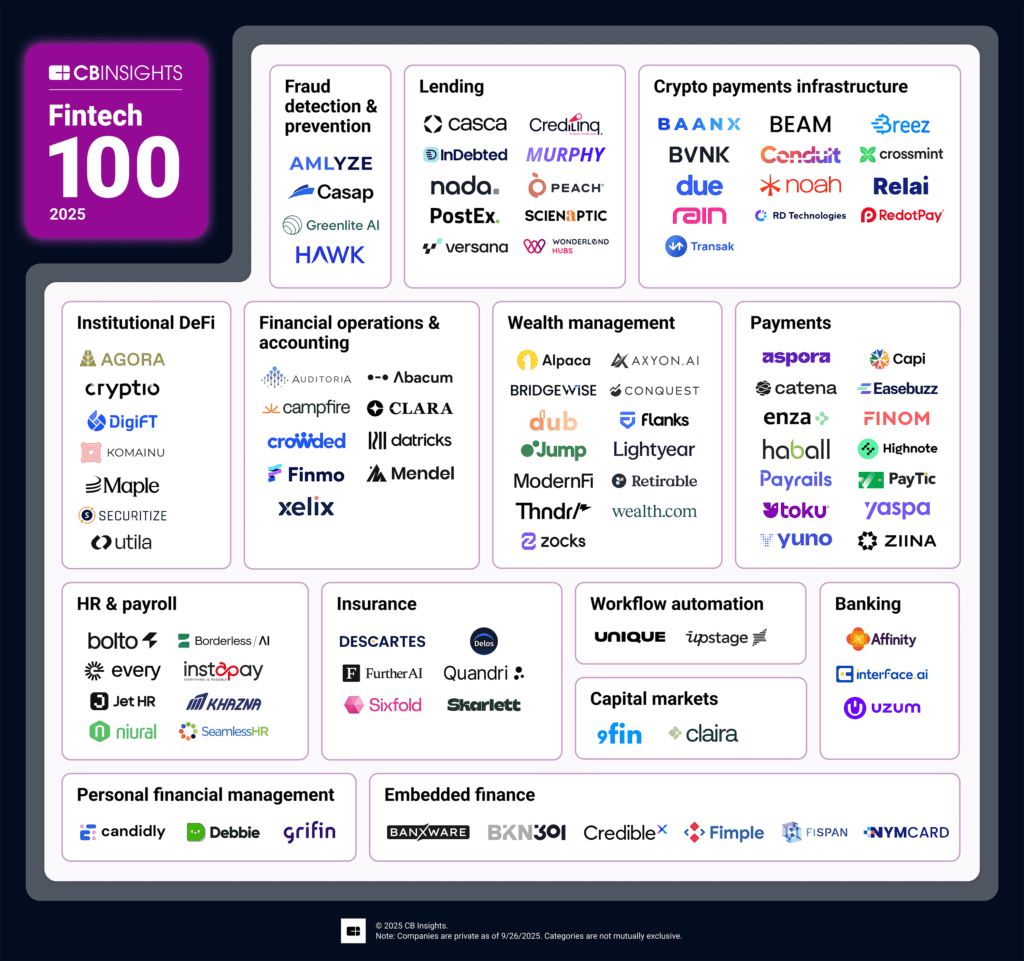

This year’s Fintech 100 highlights the companies poised to lead this transformation. We selected the 100 winners from over 15,000 companies using deal activity, industry partnerships, investor strength, hiring momentum, and CB Insights’ predictive scores for success (Mosaic Scores) and commercial traction (Commercial Maturity).

This year’s cohort spans 26 countries with a record 60 winners outside the US. The winners have an average Mosaic score of 775 (top 2% of private companies) and are scaling fast with 61% average headcount growth over the past year vs. the fintech average of 13%.

Below, we map out the winners, categorizing them based on their core offering. Customers can track all 100 companies in this Expert Collection. Key trends follow.

Please click to enlarge. Data as of 10/23/25.

Key takeaways on the Fintech 100

1. AI agents are tackling specialized financial workflows, from debt collection to autonomous payments.

Eleven companies on this year’s Fintech 100 are enabling AI agents, automating tasks from fraud detection to financial planning. They span 8 of the 14 categories, showing how agents’ impact is permeating across sectors in financial services.

While horizontal AI agent platforms have dominated investment activity in the broader landscape, these companies are carving out niches by building agents for specific financial workflows. For example:

- Borderless’s agent Alberni, launched with LLM developer Cohere, automates global employment and payroll.

- Anti-money laundering (AML) software company Greenlite’s agents accelerate AML reviews.

- Debt collection platform Murphy reports 40% higher recovery rates using agentic models.

Beyond workflow automation, several companies are developing payment infrastructure for AI agents. Catena Labs is building agentic payments rails that will enable users to authorize AI agents to transact on their behalf. Its backers include Coinbase’s and Circle’s venture arms. Circle has also backed Crossmint, which is developing a wallet on the blockchain that will allow agents to hold funds and make independent purchases.

The trajectory is clear: specialized agentic solutions will continue to reach into every layer of financial services.

2. AI is automating the core of enterprise finance as financial operations platforms expand into full-stack ecosystems.

Seventeen companies on this year’s Fintech 100 — up from ten in 2024 — are using AI to take over accounting, payroll, and treasury workflows once managed manually. The result is faster close cycles, cleaner data, and finance teams that operate with real-time visibility across the business.

Fintech 100 leaders are deploying AI to handle complex, repetitive financial tasks:

- Campfire’s AI-powered ERP replacement achieves 95% accuracy on financial reconciliations.

- Xelix’s agents detect fraud, prevent overpayments, and automate supplier queries.

- Niural’s agent EMMA runs global payroll across 150 countries.

At the same time, payroll and financial operations providers are layering in adjacent financial services — salary access, digital banking, and cross-border payments — to create integrated workforce finance platforms.

- Khazna offers earned wage access for underbanked employees in Egypt and Saudi Arabia

- InstaPay collects digital salaries and remittances for migrant workers in Malaysia.

- Every includes incorporation, banking, and benefits management within its payroll suite.

These moves show how payroll is becoming the anchor for embedded finance. Global providers such as Workday, Gusto, and Deel are accelerating this shift through acquisitions and new product extensions.

As AI takes on more financial decisioning and compliance tasks, financial operations platforms are evolving into self-updating systems that can reconcile, forecast, and route payments automatically — turning finance from a reactive function into a continuous, data-driven process.

3. Digital asset companies are enabling crypto in everyday transactions and institutional finance.

Crypto payments infrastructure and institutional DeFi together form the largest sector in this year’s Fintech 100, with momentum driven by unprecedented attention and activity in stablecoins, as well as regulatory tailwinds.

Fintech 100 winners in crypto payments infrastructure are enabling the use of digital assets in day-to-day finance, from crypto card payments to enterprise transactions. On the enterprise side, BVNK, Rain, and Noah are building stablecoin payment rails, allowing businesses to transact with crypto more affordably, while Transak embeds crypto payments and fiat access directly into enterprise workflows. For consumers, RedotPay and Baanx are expanding access to crypto payments via Visa and Mastercard integrations.

As regulators greenlight digital asset use by traditional institutions, other Fintech 100 winners are building the infrastructure for banks and asset managers to hold, issue, and trade tokenized assets at scale:

- RD Technologies was admitted to Hong Kong’s stablecoin standbox and is partnering with ZA Bank to develop stablecoin use cases.

- DigiFT, a dually-licensed Singapore-Hong Kong exchange for tokenized RWAs, expanded its partnership with UBS Asset Management on its Ethereum-based uMINT fund.

- Komainu, a licensed custodian in the UK, Italy, and Dubai serving institutional investors raised $75M in Series B funding in January.

Expect incumbents to pursue deeper partnerships and acquisitions in digital assets as crypto-native firms build the next layer of global financial infrastructure.

Mosaic scores from the 2025 Fintech 100 winners

| Category | Company | Mosaic |

|---|---|---|

| Banking | Affinity | 686 |

| Banking | interface.ai | 798 |

| Banking | Uzum | 854 |

| Capital markets | 9Fin | 736 |

| Capital markets | Claira | 701 |

| Crypto payments infrastructure | Baanx | 767 |

| Crypto payments infrastructure | Beam | 639 |

| Crypto payments infrastructure | Breez Development | 776 |

| Crypto payments infrastructure | BVNK | 870 |

| Crypto payments infrastructure | Conduit | 835 |

| Crypto payments infrastructure | Crossmint | 660 |

| Crypto payments infrastructure | Due | 642 |

| Crypto payments infrastructure | Noah | 867 |

| Crypto payments infrastructure | Rain | 896 |

| Crypto payments infrastructure | RD Technologies | 807 |

| Crypto payments infrastructure | RedotPay | 957 |

| Crypto payments infrastructure | Relai | 796 |

| Crypto payments infrastructure | Transak | 850 |

| Embedded finance | Banxware | 737 |

| Embedded finance | BKN301 | 805 |

| Embedded finance | CredibleX | 563 |

| Embedded finance | Fimple | 782 |

| Embedded finance | FISPAN | 788 |

| Embedded finance | NymCard | 826 |

| Financial operations & accounting | Abacum | 796 |

| Financial operations & accounting | Auditoria.AI | 852 |

| Financial operations & accounting | Campfire | 721 |

| Financial operations & accounting | Clara | 871 |

| Financial operations & accounting | Crowded | 605 |

| Financial operations & accounting | Datricks | 728 |

| Financial operations & accounting | Finmo | 862 |

| Financial operations & accounting | Mendel | 752 |

| Financial operations & accounting | Xelix | 721 |

| Fraud detection & prevention | Amlyze | 674 |

| Fraud detection & prevention | Casap | 816 |

| Fraud detection & prevention | Greenlite | 801 |

| Fraud detection & prevention | Hawk | 854 |

| HR & payroll | Bolto | 604 |

| HR & payroll | Borderless | 752 |

| HR & payroll | Every | 645 |

| HR & payroll | InstaPay | 722 |

| HR & payroll | Jet HR | 783 |

| HR & payroll | Khazna | 786 |

| HR & payroll | Niural | 752 |

| HR & payroll | SeamlessHR | 671 |

| Institutional DeFi | Agora | 812 |

| Institutional DeFi | Cryptio | 691 |

| Institutional DeFi | DigiFT | 838 |

| Institutional DeFi | Komainu | 872 |

| Institutional DeFi | Maple Finance | 773 |

| Institutional DeFi | Securitize | 894 |

| Institutional DeFi | Utila | 848 |

| Insurance | Delos | 731 |

| Insurance | Descartes Underwriting | 757 |

| Insurance | Further AI | 824 |

| Insurance | Quandri | 699 |

| Insurance | Sixfold | 762 |

| Insurance | Skarlett | 692 |

| Lending | Casca | 800 |

| Lending | CrediLinq | 700 |

| Lending | InDebted | 754 |

| Lending | Murphy | 716 |

| Lending | Nada | 693 |

| Lending | Peach Finance | 752 |

| Lending | PostEx | 742 |

| Lending | Scienaptic | 778 |

| Lending | Versana | 748 |

| Lending | WonderLend Hubs | 647 |

| Payments | Aspora | 714 |

| Payments | Capi | 736 |

| Payments | Catena Labs | 768 |

| Payments | Easebuzz | 881 |

| Payments | Enza | 781 |

| Payments | Finom | 873 |

| Payments | Haball | 791 |

| Payments | Highnote | 831 |

| Payments | Payrails | 869 |

| Payments | PayTic | 734 |

| Payments | Toku | 750 |

| Payments | Yaspa | 822 |

| Payments | Yuno | 780 |

| Payments | Ziina | 849 |

| Personal financial management | Candidly | 718 |

| Personal financial management | Debbie | 620 |

| Personal financial management | Grifin | 702 |

| Wealth management | Alpaca | 914 |

| Wealth management | Axyon AI | 757 |

| Wealth management | BridgeWise | 782 |

| Wealth management | Conquest Planning | 849 |

| Wealth management | Dub | 748 |

| Wealth management | Flanks | 745 |

| Wealth management | Jump | 880 |

| Wealth management | Lightyear | 789 |

| Wealth management | ModernFi | 859 |

| Wealth management | Retirable | 735 |

| Wealth management | Thndr | 830 |

| Wealth management | Wealth.com | 875 |

| Wealth management | Zocks | 899 |

| Workflow automation | Unique | 709 |

| Workflow automation | Upstage | 937 |

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign up for a free trial to learn more about our platform.