Generative AI is fundamentally restructuring the software development lifecycle (SDLC), compressing timelines and shifting the role of developers from coders to orchestrators of AI agents.

AI-powered coding has become one of the fastest-growing enterprise use cases for LLMs. Startups like Anysphere (maker of Cursor), Replit, and Lovable have crossed $100M in ARR in record time, with adoption surging across professionals and amateurs, small companies and enterprises alike.

Satya Nadella says that as much as 30% of Microsoft’s code is now written by AI. But this breakneck adoption is exposing new pain points for enterprises: volatile costs and emerging security risks as AI-generated code volumes surge.

As agentic AI transforms software development, tools that deliver shipping speed, cost certainty, and de-risk AI outputs will separate sustainable enterprise adoption from expensive experiments.

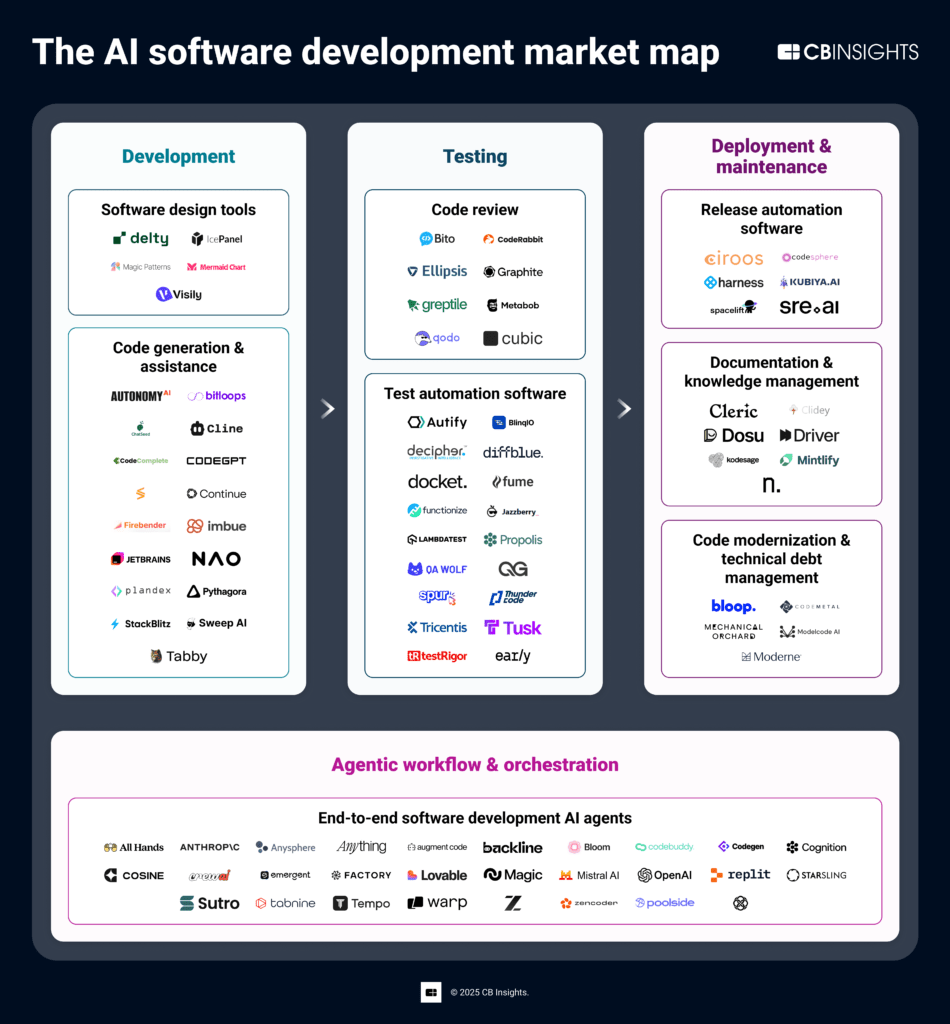

Using CB Insights’ predictive intelligence on private companies, we mapped 90+ companies offering AI-powered solutions across 8 software development markets to reveal how agentic AI is collapsing the development stack, identify which capabilities set winners apart from losers, and uncover which features matter most to enterprises.

Note: Our market map includes private AI startups operating in the software development space that have received funding in the last 2 years. Companies may operate in multiple markets. This market map is not exhaustive of companies operating in the space.

Key takeaways

Agentic AI is collapsing the software development stack — orchestration will separate winners from losers

The future is agentic. End-to-end agents are not just speeding up coding, they are combining planning, implementation, testing, and deployment into unified workflows, pushing the market from many fragmented tools toward fewer intelligent platforms. Adopters are feeling the same way.

3 out of 4 companies offering solutions for the software development lifecycle (SDLC) now have semi- or fully autonomous agentic features, including multi-agent capabilities. Companies offering agentic features also average a Mosaic score of 653, a 100 points higher than the average for companies without agentic features, signaling stronger overall health and growth potential.

Agentic AI is expediting code creation and enhancing developer workflows better than traditional coding tools, but reliability issues and enterprise requirements, such as compliance, governance, security, and quality assurance, will continue to drive demand for specialized agents at each SDLC phase.

Winners will provide unified orchestration layers that integrate specialized, best-in-class agents for each software development phase with governance and human oversight built in.

To operationalize AI, enterprises should evaluate vendors on integration with existing development infrastructure, governance controls that enable oversight and auditability, and observability into agent performance and associated costs.

Inference cost management is emerging as a key feature as AI coding bills soar

Reasoning models have inflated output token volume by 20x, pushing vendors away from seat-based pricing toward usage-based and hybrid models.

In response, cost control solutions are emerging as critical infrastructure. Larridin tracks AI costs and measures tool effectiveness, Cline is building cost controls directly into its offerings, while Paid reached a $100M valuation, pioneering outcome-based billing.

Enterprises should prioritize vendors with built-in cost governance. Look for solutions that offer cost-monitoring dashboards, usage forecasting, and budget controls as token volumes surge.

As costs shift from predictable seats to variable usage, expand AI governance beyond engineering to include stakeholders across finance, operations, and marketing. Accessible vibe coding tools are democratizing software development, enabling these non-technical teams to become builders and making cross-functional cost oversight essential.

For AI adoption, enterprises should look beyond traditional billing models. Consider vendors like Paid, Alguna, or Orb which offer results-based, AI-native billing to align costs with business value rather than infrastructure consumption.

Enterprise selects agentic AI providers based on security, integration depth, ability to ship software faster, and value-based pricing

End-to-end agents demonstrate strong market validation with an average Mosaic score of 745, indicating robust health, reliability, and growth potential.

We analyzed buyer interviews from the highest-valued agentic AI providers to identify enterprise selection criteria:

- Security compliance for AI-generated code

- Ease of use for non-technical users and the ability to ship end-to-end solutions faster,

- Deep and seamless integration with existing systems

- Transparent pricing justified by measurable value

As enterprises scale AI adoption, prioritizing vendors with native integrations and robust AI code security is key to reducing implementation friction. Check our AI security market to identify vendors leading in security and derisking AI.

Beyond immediate selection criteria, specialized coding small language models (SLMs) are an emerging trend to watch. Relace.ai’s recent $23M funding signals SLMs’ ability to improve coding efficiency at lower costs, a key enabler for value-based pricing models.

The blended AI coding market is temporary — expect separate markets for consumer and enterprise

There is a democratization of AI developer tools. Non-technical and professional use cases are hard to distinguish and startups are currently willing to blend the 2. The total addressable market (TAM) is no longer one or the other as companies can sell into both.

While vibe and enterprise coding markets are currently intertwined, we expect two distinct markets to emerge, targeting individual vibe-coders and professional developers, respectively. For example, Replit recently switched from targeting professional developers to non-technical users and gained momentum as a result.

Companies that can successfully pivot or maintain dual product lines will be better positioned. This suggests looking for teams with the flexibility to adapt their positioning as the market matures.

With an enlarged TAM, this offers investors a chance to diversify portfolios across both enterprise-focused and vibe-code-oriented AI coding tools.

Early traction metrics can mask user composition risks. Investors should verify if startups are winning with their intended customer by checking out the vibe-coding startups with the highest Mosaic scores.

Market descriptions

The software design market provides tools that create blueprints, technical specifications, and user experience designs for applications before development begins. Key activities include high-level design (system architecture and UI/UX structure), low-level design (data models, database schemas, API specifications, and component interfaces), and interface design (wireframes, mockups, prototypes, and design systems). Some platforms use AI to accelerate diagram generation, architectural planning, and technical documentation. These tools enable teams to visualize and validate both system architecture and user experiences before writing code.

This code generation and assistance market offers tools and platforms that use AI to generate code, provide autocomplete suggestions, explain code snippets, debug issues, and assist with writing functions or modules. Solutions are delivered as IDE integrations, native IDE features, standalone applications, or self-hosted platforms. They accelerate coding by reducing boilerplate, catching errors, and offering intelligent recommendations. Some platforms include partial agentic actions that automate routine coding tasks. While some companies extend into adjacent phases like testing or deployment, their core offering focuses on code creation and maintenance.

The code review market provides tools that facilitate the systematic examination of code by developers or peers to identify errors, bugs, vulnerabilities, and adherence to coding standards. These platforms automate code analysis, provide static analysis capabilities, and offer collaboration features for reviewing and discussing code changes. Solutions range from standalone review platforms to integrations within version control systems and CI/CD pipelines. They help teams enforce consistency and quality across codebases and catch issues before they reach production. Some vendors incorporate AI to suggest improvements, detect security flaws, or automatically flag non-compliant code patterns.

The test automation software market provides platforms and tools that automate software testing processes across web, mobile, API, and desktop applications. Solutions enable QA teams and developers to design, create, execute, and manage automated tests through scripted frameworks, low-code/no-code interfaces, and AI-powered test generation. AI capabilities include automatic test case generation, failure prediction, self-healing when applications change, and test suite optimization. These platforms integrate with CI/CD pipelines, version control systems, and development workflows to enable continuous testing throughout the software delivery lifecycle. Both traditional and AI-driven solutions reduce manual testing effort and increase test coverage through automated validation.

The release automation software market provides platforms that automate and orchestrate the deployment of software releases from development to production environments. These solutions manage release planning, deployment automation, environment coordination, and progressive delivery strategies including feature flags and rollback capabilities. Platforms enable teams to schedule releases, coordinate deployments across multiple environments, manage dependencies, and ensure controlled rollouts to production. Solutions integrate with CI/CD pipelines, version control systems, and monitoring tools to provide end-to-end visibility into the release process. The market serves software development and operations teams seeking to standardize release processes and reduce deployment risk.

Code documentation & knowledge management

The code documentation and knowledge management market provides platforms that help development teams create, maintain, and preserve technical knowledge throughout the software development lifecycle. Solutions automatically generate documentation from code, maintain technical wikis, create API references, and answer questions about codebases using AI. These platforms capture what code does and why decisions were made, preserving organizational knowledge as team composition changes. The market serves software development teams seeking to reduce onboarding time, and maintain up-to-date documentation.

Code modernization & technical debt management

Code modernization and technical debt management market encompasses solutions that help organizations refactor, upgrade, and maintain legacy codebases while systematically addressing accumulated technical debt. It includes tools and platforms that automatically analyze and assess legacy code quality, dependencies, and technical debt, migrate applications from legacy languages to modern frameworks and automate code translation, modernization, and cloud migration efforts.

End-to-end software development AI agents

The end-to-end software development AI agents market offers AI agents that function as virtual software developers and engineers, independently handling end-to-end and full-stack development tasks with zero to minimal human supervision. Agentic AI understands requirements, writes code, debug, test, and deploy – operating across the entire software development lifecycle (SDLC) autonomously.

If you aren’t already a client, sign up for a free trial to learn more about our platform.