The race to extend the human healthspan is heating up.

What began as a niche biohacking movement has evolved into a rapidly growing ecosystem spanning early disease screenings, stem cell preservation, hormone support, and next-gen therapeutics.

Momentum is building as leading companies move from research toward validation. Altos Labs, which raised a whopping $3B in 2022, is advancing preclinical programs and expanding into senescence-targeting therapies through its May acquisition of Dorian Therapeutics. Meanwhile, Sam Altman-backed Retro Biosciences partnered with OpenAI in early 2025 to develop an AI model that helps design proteins capable of repairing cells — a key step toward slowing or reversing aging.

Consumer demand is also surging. Longevity clinic Neko Health has a 100K+ waitlist for its preventive screenings, while virtual menopause provider Midi Health, which launched its longevity care program in May, projects a $150M revenue run rate in 2025 — up from $60M in 2024.

Together, these developments reflect the ongoing acceleration toward longevity-focused healthcare, from consumer platforms emphasizing prevention and early detection to therapeutics targeting the biological mechanisms of aging itself.

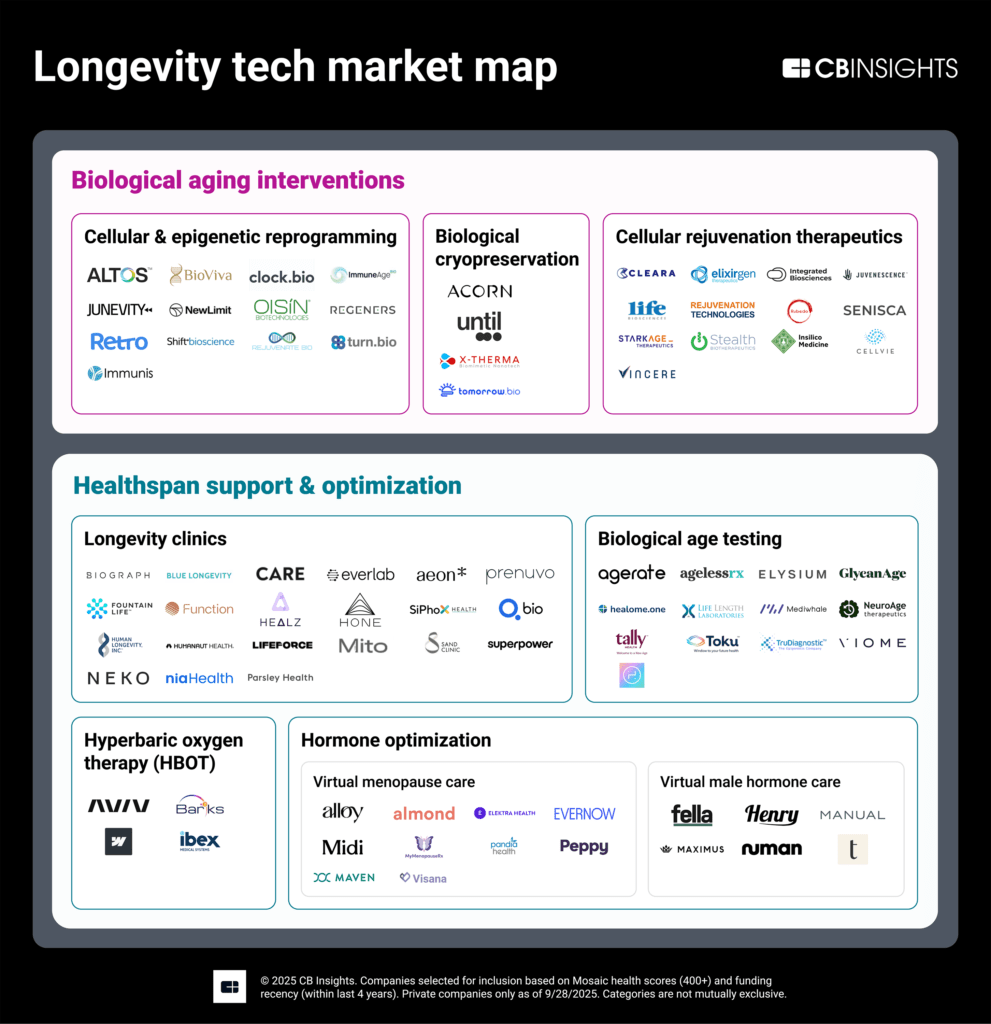

Using CB Insights’ predictive intelligence on private companies, we identified 84 companies across 8 longevity tech markets. We define longevity tech as technologies whose primary purpose is to support and extend the human healthspan by targeting biological, behavioral, or lifestyle factors.

Please click to enlarge.

This map includes private startups with a CB Insights Mosaic score (a proprietary measure of private company health and growth) of 400 or higher and/or those that have raised funding in the last four years. In line with the definition above, we excluded companies focused on improving the quality of life for the elderly and sick or solely alleviating the symptoms of aging-related diseases. Categories are not mutually exclusive and are not intended to be exhaustive.

Key takeaways

Longevity clinics are democratizing preventive care as costs drop and datasets scale

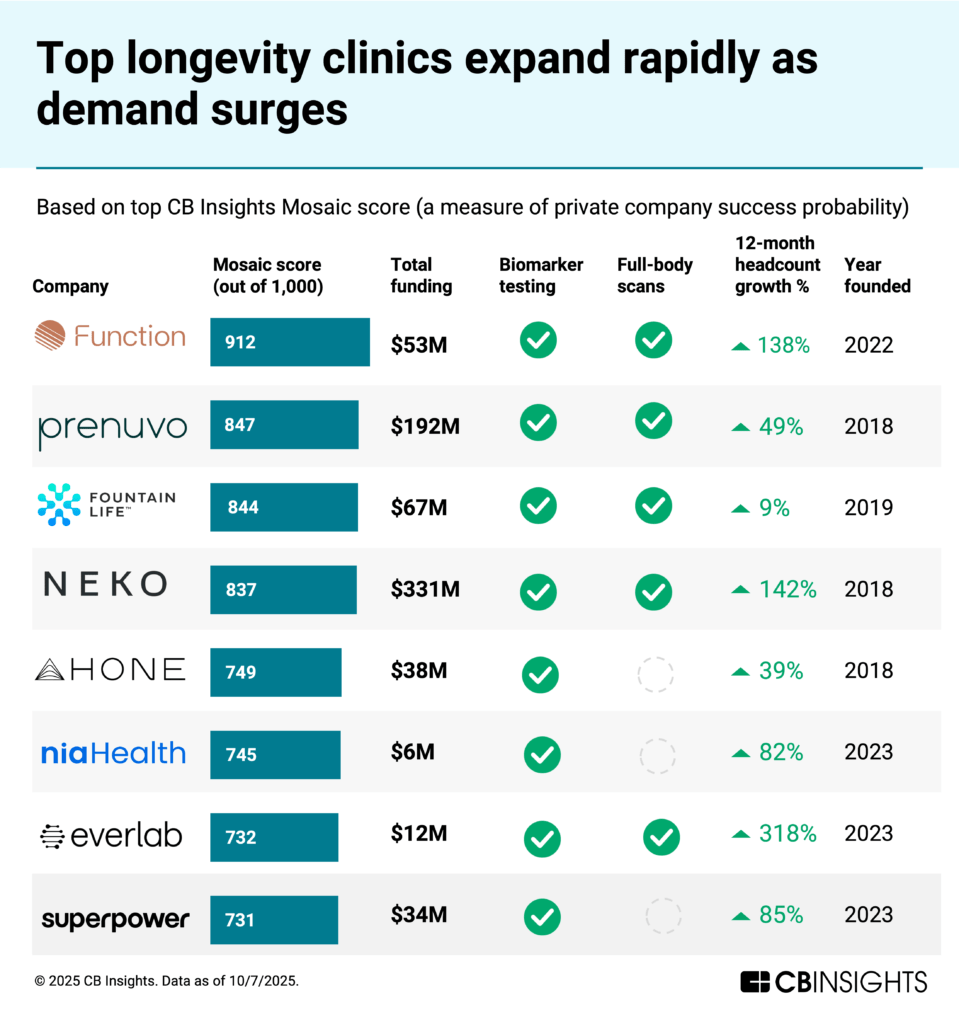

Longevity clinics lead all categories on the market map with 37% headcount growth year-over-year, reflecting rapid scaling as consumer demand accelerates.

These clinics operate on membership models, combining blood biomarker panels, full-body scans, and personalized health consultations. What’s enabling rapid adoption is the convergence of declining diagnostic costs and the creation of longitudinal health datasets — data that tracks the same individuals over time and can reveal patterns typical annual physicals may miss.

Sweden-based Neko Health, co-founded by former Spotify CEO Daniel Ek, has a 100K+ waitlist across its locations in Sweden and the UK. Neko offers full-body scans using 70 sensors for mole mapping and other diagnostics, plus an AI-powered health prediction tool that highlights projected health trajectories for conditions like diabetes and cardiovascular disease. The company raised a $260M Series B round at a $1.8B valuation in January 2025.

Other platforms are scaling similar preventive screening models. For example, Prenuvo offers whole-body MRI scans, biomarker testing, brain health assessment, and body composition analysis for $3,999 USD. As of May 2025, it has conducted 130K+ scans.

Function Health‘s acquisition of MRI platform Ezra in May 2025 signals how these preventive platforms are consolidating services. By combining lab testing with whole-body MRI scans, the merged entity can offer comprehensive screening more cost-effectively while building a unified longitudinal dataset.

This model captures patients before they enter traditional primary care settings, potentially shifting diagnostic volume away from conventional clinics while creating a new standard for preventive screening.

Silicon Valley investors are betting cellular aging can be reversed

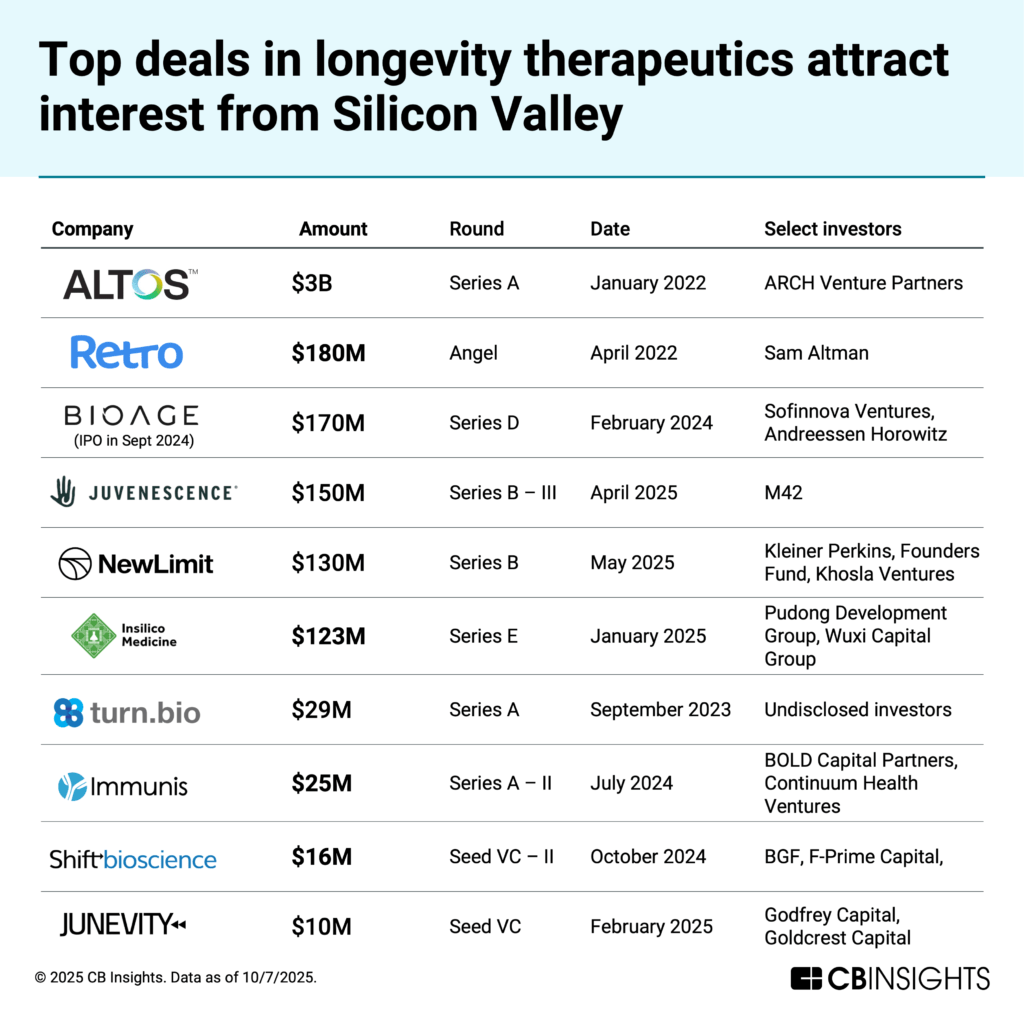

Investors are funding therapeutics that target the biological processes driving aging — such as cellular damage and protein dysfunction that underlie many age-related diseases. The bet is that by addressing the root causes of aging, a single therapy could help prevent or delay multiple diseases at once.

Silicon Valley has taken notice. BioAge, which develops therapies using AI and genetic data to map aging pathways, raised $297M from leading VC firms such as Andreessen Horowitz and Khosla Ventures before going public in September 2024.

Two closely linked areas are attracting the most investment: cellular rejuvenation and cellular & epigenetic reprogramming. Rejuvenation repairs existing cells — clearing out damaged ones, boosting mitochondrial function, or delivering regenerative factors like stem cells. Reprogramming goes deeper, resetting a cell’s biological age by changing how genes are expressed. Many companies blend both approaches.

Altos Labs, which raised a $3B Series A round from ARCH Venture Partners in January 2022, exemplifies this intersection. It uses partial reprogramming therapies to rejuvenate cells without fully converting them into stem cells, thereby preserving the cells’ identities.

Retro Biosciences, which raised $180M from OpenAI CEO Sam Altman, also spans both approaches. In August 2025, OpenAI announced GPT-4b micro, an AI model for protein engineering developed with Retro. Using it, Retro redesigned key proteins that reprogram adult cells into stem cells — achieving a 50× boost in reprogramming efficiency and improved DNA repair. It’s also working on a compound to restore autophagy — the cellular process that clears damaged proteins — to help reverse Alzheimer’s disease. The first clinical trial is set to launch by the end of 2025.

Coinbase CEO Brian Armstrong’s NewLimit takes a more targeted approach by reprogramming aged cells to behave more like younger ones. Its lead candidate delivers mRNA to aged liver cells to treat alcohol-related liver disease. The company raised $130M in Series B funding in May 2025 from investors including Kleiner Perkins, Founders Fund, and Khosla Ventures.

Hormone health platforms are evolving from symptom relief to comprehensive, preventive care in midlife health

As people live longer, midlife health has come into focus — specifically, the role of hormone health in supporting healthspan.

As we age, hormone levels fluctuate and decline, which can impact physical and cognitive health. Specialized D2C telehealth platforms are now addressing this within the context of overall health, not just isolated symptoms.

The shift is most visible in menopause care. In May 2025, virtual menopause provider Midi launched its longevity program, AgeWell, which includes hormone therapy, bloodwork, and follow-up consults to help optimize long-term health. Midi raised a $50M Series C round in October 2025. That same month, Hims & Hers launched its perimenopause and menopause offerings, signaling that more D2C platforms see transitional care as critical to overall health.

This reflects a broader shift of providers increasingly integrating more holistic, comprehensive offerings targeting hormone health rather than just managing symptoms.

The approach is expanding to men’s health. UK-based Numan, which focuses on testosterone deficiency and other men’s health conditions, raised $60M in funding in July 2025. Its offering includes diagnostics, clinical guidance, and behavioral health coaching. With 650K+ patients treated, it has recently expanded into women’s health and is also growing its B2B offering for employers and insurers to promote preventive health programs.

The integration of hormone therapy into holistic, preventive care is becoming central to extending healthspan, potentially enhancing bone health, cognitive function, and metabolic resilience as people age.

Looking ahead

As longevity tech matures, two key challenges are top of mind for the sector.

Regulatory pathways remain unclear. Because the FDA doesn’t recognize aging as a disease, many therapeutic companies pursue specific disease indications while their platforms also target underlying aging biology. Clinical trials beginning in late 2025 will provide early safety and efficacy signals, but the path to broader aging-related claims remains undefined. How regulators respond to these therapies will shape commercial strategies across the sector.

Meanwhile, the breadth of longevity tech continues to expand. What began with cellular rejuvenation and senolytics now encompasses hormone optimization, preventive screening clinics, and biological age testing. As adjacent sectors such as sleep and cognitive health adopt longevity positioning, the boundaries will blur further. Stakeholders will need clearer frameworks to distinguish technologies directly targeting aging biology from those supporting healthspan indirectly.

Market descriptions

The virtual menopause care market provides solutions for individuals experiencing perimenopause and menopause. Companies in this market offer telehealth consultations, hormone replacement therapy (HRT) management, symptom tracking platforms, personalized care plans, and educational resources. These platforms connect patients with menopause specialists, provide prescription management, and deliver comprehensive support for managing symptoms like hot flashes, sleep disturbances, mood changes, and hormonal imbalances.

Equity funding 2025 YTD: $79M|4 deals

Headcount 1-year change: +10%

Featured companies:

Cellular rejuvenation therapeutics

The cellular rejuvenation therapeutics market includes companies developing therapies that target key hallmarks of aging such as cellular senescence, telomere attrition, and mitochondrial dysfunction. These interventions include senolytics that remove damaged cells, telomere-targeting therapies that maintain chromosome integrity, and mitochondrial treatments that optimize cellular energy production. These therapeutic approaches aim to enhance cellular longevity and function while addressing age-related conditions such as cardiovascular disease, neurodegenerative disorders, and certain cancers through mechanisms that reduce inflammation, improve metabolic regulation, and promote overall cellular health.

Equity funding 2025 YTD: $278M|5 deals

Headcount 1-year change: -1%

Featured companies:

The biological age testing market refers to solutions that use health indicators to determine a person’s biological age. Biological age reflects an individual’s health status based on the functionality of their cells rather than chronological years lived. These tests analyze biomarkers from blood, saliva, or urine samples to assess aging rate and predict health risks. Companies in this market utilize various technologies including AI, epigenetic analysis, and machine learning to provide personalized health insights and recommendations. The market serves both healthcare professionals (B2B) and individual consumers (B2C) seeking to understand aging processes and improve overall health.

Equity funding 2025 YTD: $7M|5 deals

Headcount 1-year change: -4%

Featured companies:

The biological cryopreservation market involves vitrifying human bodies, organs, and other biological matter at low enough temperatures to preserve them and prevent decay. The use cases of cryopreservation include storing stem cells for future healthcare purposes, fertility, organ transplantation, or potentially bringing humans back to life in the future, which is known as cryonics. This market includes companies making antifreeze materials to preserve body parts, stem cell banks, and companies offering cryonics services.

Equity funding 2025 YTD: $67M|3 deals

Headcount 1-year change: +17%

Hyperbaric oxygen therapy (HBOT)

The hyperbaric oxygen therapy (HBOT) market consists of chambers and facilities for individuals to breathe 100% oxygen at high pressure. Medical applications include wound healing, treating carbon monoxide poisoning, and recovery from injuries, while wellness applications focus on athletic performance, anti-aging, and general health optimization. The market includes equipment manufacturers providing chambers for medical or home use, clinical service providers operating treatment centers, and wellness facilities offering HBOT as part of comprehensive programs.

Equity funding 2025 YTD: $21M|3 deals

Headcount 1-year change: +3%

The longevity clinics market leverages advanced screening and diagnostics in a virtual or in-person clinic to provide individuals with proactive insights into their health. These companies focus on early detection, biomarker tracking, and comprehensive lab and/or imaging services that extend beyond routine physicals. By combining clinical-grade testing with personalized interpretation from physicians, health coaches, and AI-driven platforms, they empower individuals to identify risks early, manage chronic conditions, and optimize long-term wellness.

Equity funding 2025 YTD: $307M|14 deals

Headcount 1-year change: +35%

Featured companies:

Cellular & epigenetic reprogramming

The cellular & epigenetic reprogramming market includes biotech companies that are reprogramming the identity of cells and converting them into other cell types for regenerative medicine or drug discovery. This market seeks to target molecular mechanisms associated with aging and age-related diseases through treatments that restore cellular function and vitality. Companies in this market are using a range of advanced technologies from high-throughput screening, AI/ML, to robotics to accelerate the identification and development of targeted therapies using this approach.

Equity funding 2025 YTD: $140M|2 deals

Headcount 1-year change: +9%

Featured companies:

The virtual male hormone care market provides telehealth services and digital platforms that help men optimize their testosterone and other hormone levels through personalized treatment protocols. These companies offer at-home testing, virtual consultations with licensed physicians, and direct-to-consumer delivery of prescription medications such as testosterone replacement therapy (TRT). Platforms offer comprehensive hormone analysis through blood testing, personalized treatment plans, and ongoing monitoring to address symptoms like low energy, decreased libido, mood changes, and reduced muscle mass.

Equity funding 2025 YTD: $34M|3 deals

Headcount 1-year change: +31%

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign up for a free trial to learn more about our platform.