Y Combinator‘s Summer 2025 batch shows AI has moved from experimental tools to enterprise-ready business systems.

This summer, the accelerator that spotted OpenAI, Airbnb, and Stripe before they became household names focused its funding on the production-ready AI layer that incumbents will soon race to acquire or replicate.

For strategy teams, Y Combinator represents both a roadmap of where the venture landscape is heading and a curated list of potential acquisition targets, partners, and competitive threats.

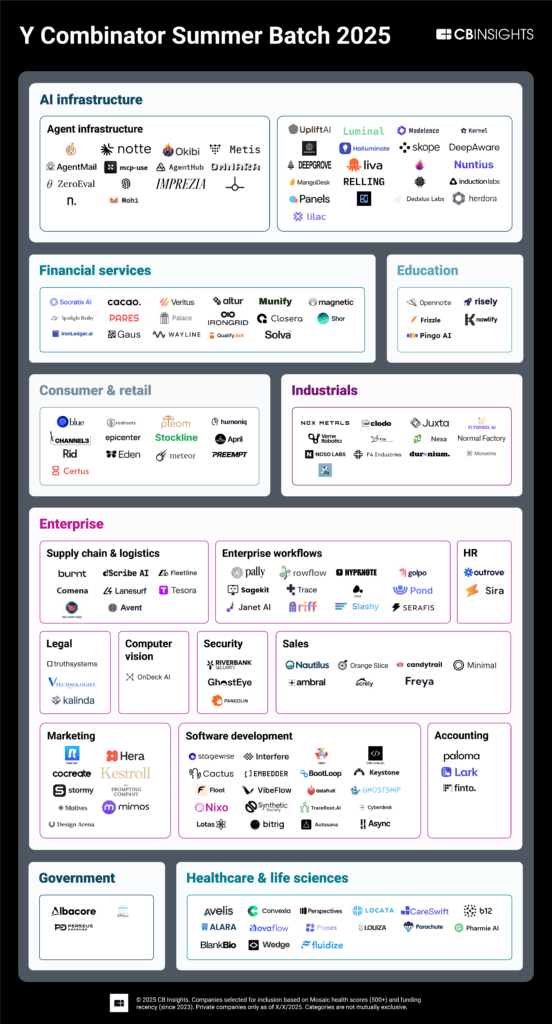

Using CB Insights, we mapped the 165+ companies in the Y Combinator’s 2025 Summer batch across 11 different categories. Then, we analyzed the cohort to make predictions about what this means for the future of enterprise AI.

Please click to enlarge.

Note: Categories are not mutually exclusive. For more, see the Y Combinator Summer Batch 2025 Expert Collection here.

Key Takeaways

- Voice AI is expanding into regulated industries. 16 companies in the batch are building specialized voice AI systems across use cases. Beyond just consumer assistants (April, Blue), startups in this batch are producing enterprise-grade systems managing complex, regulated interactions, notably in financial services (Altur, Veritus Agent, Qualify.bot, Wayline) — where compliance barriers are highest. Meanwhile, startups like Liva AI and Panels are building voice training data, as proprietary datasets that general-purpose models can’t replicate, creating defensive moats for companies employing voice AI.

- Startups are pushing deeper into software development with specialized solutions. With 20 software development companies in this summer’s Y Combinator batch, the category represents the largest, with coding agents still showing the strongest revenue traction among all AI agent types. However, new entrants are expanding beyond the code generation that enterprises already use. For example, Stagewise (frontend agents for codebases) and Interfere (autonomous de-bugging) are moving beyond just code generation to handle the complete development lifecycle, from writing production-ready code to testing on physical hardware.

- Y Combinator is betting on the full agent stack, signaling the technology has moved from experimentation to implementation. Nearly 50% of YC’s Summer 2025 cohort offers AI agents, with 14 of those companies focusing specifically on agent infrastructure needed for deployment — spanning agent evaluation (AgentHub), de-bugging (Fulcrum Research), and monitoring (Mohi). Meanwhile, startups like Nozomio Labs (building context augmentation layers for agents) and Imprezia (creating AI-native ad networks) are pushing beyond traditional tooling into novel applications. As agents become table stakes for enterprises, infrastructure tools will become increasingly critical for building and managing reliability and performance at scale.

- The AI infrastructure focus is shifting from capability to efficiency. Companies like Stellon Labs (tiny frontier models for edge devices), Herdora (low-latency GPU inference for voice AI), and DeepAware AI (AI data center energy optimization) signal that deployment constraints — not model performance — are now the primary barrier to AI adoption. Solutions focusing on efficiency constraints like latency, energy costs, and edge deployment are critical for commercial AI deployment.