Foreword

Rohit Verma, President & Chief Executive Officer of Crawford & Company, shares executive insights on insurance affordability.

A few months ago, I sat down to review my monthly expenses and was stunned. My auto insurance premium had climbed over 30%, and my home insurance has almost doubled since the start of the pandemic. These aren’t discretionary expenditures — they’re essential protections. Friends and colleagues have shared similar stories, some even seeing insurance costs exceed their monthly mortgage payments, a shift unimaginable just a few years ago. One friend recently asked me, “Where is this going? Are we heading toward a future where insurance becomes unaffordable for the average household?”

In recent years, insurance rates have increased considerably, largely due to severe property losses from wildfires, storms, and hurricanes. Social inflation is also straining the industry. These pressures have forced carriers to raise deductibles and prices; trends reflected in property loss ratios. Necessary to maintain industry stability, these actions have also burdened policyholders, challenging affordability and accessibility, and intensifying financial strain. Crawford adjusters witness how today’s risk environment challenges insurance’s core purpose: transferring risk from insured to insurer.

Thankfully, recent reinsurance renewals suggest relief may be on the horizon, barring major catastrophes. As these dynamics unfold, we expect pricing and deductibles to ease, leading to normalization in the next 12 to 18 months. However, current premiums aren’t sustainable, and the industry must act now to support customers through this period.

This short-term relief opens a critical window to implement more sustainable solutions, like enhanced technology adoption, resilient rebuild strategies, and stronger safeguards against legal exposure and fraud. Smarter technology use, resilient rebuilding, and proactive stances against damaging practices offer meaningful progress toward stability, though none are quick fixes.

Technology is a vital lever to alleviate cost pressures and improve the insurance experience as the market normalizes. Advanced solutions, such as agentic AI, predictive analytics, and AI-powered risk insights, are already transforming insurance. These technologies streamline workflows, enable faster, more accurate estimates, and help insurers proactively manage risks.

These innovations go beyond efficiency; they reshape the customer experience. Policyholders benefit from faster claims resolution, more transparent communication, and tailored risk management. Leveraging real-time data and automation, insurers deliver responsive, personalized service, restoring trust and confidence, even amid market pressures.

This report, developed with CB Insights and Crawford & Company, offers a data-driven roadmap for addressing affordability. By analyzing tech momentum and affordability across nine P&C lines, we pinpoint where technology most effectively reduces loss costs and benefits policyholders. Findings show targeted adoption of advanced tech, especially in cyber, homeowners, and auto, delivers the greatest impact.

I encourage all of us as industry stakeholders to use this insightful report to explore investments, partnerships, and solutions. Together, we can build a more resilient insurance ecosystem — keeping coverage accessible, affordable, and customer-centric for all.

Rohit Verma

President & Chief Executive Officer

Crawford & Company

Overview

Insurance coverage is becoming increasingly unaffordable for businesses and consumers, with loss costs rising rapidly due to factors like extreme weather, labor shortages, and supply chain disruptions.

To improve affordability, insurance companies must prioritize innovative ways to deploy technology across loss prevention efforts. While technology alone is not enough to improve affordability, it offers the most tangible opportunities to lower costs.

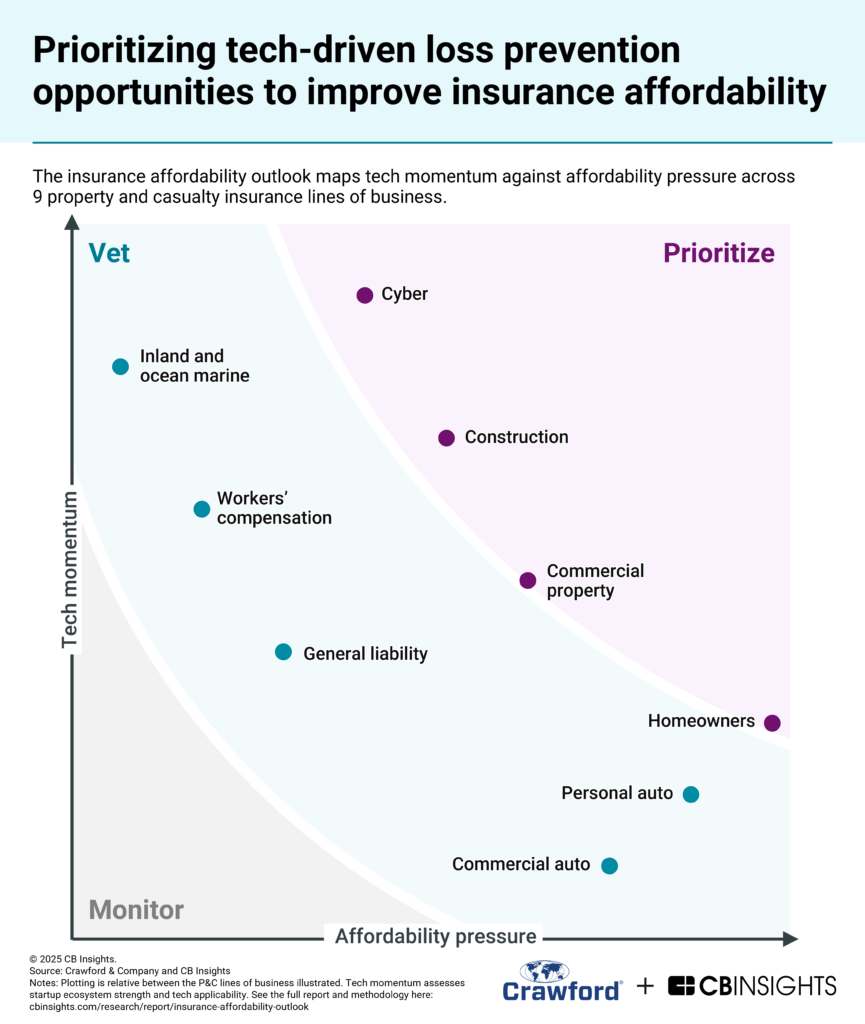

Below, we identify top tech-driven loss prevention opportunities to improve insurance affordability across nine P&C insurance lines of business. We rank these opportunities across two axes:

- Tech momentum assesses startup ecosystem strength and tech applicability across a line of business. We measure tech momentum using CB Insights’ datasets such as deal activity, company headcount, and our proprietary Commercial Maturity — which measures a private company’s ability to compete or partner — and Mosaic scores — which measure the overall health and growth potential of private companies.

- Affordability pressure assesses the impact of loss cost increases for policyholders across a line of business. We evaluate affordability pressure by surveying Crawford & Company’s global claims experts, coupled with CB Insights’ Public Company Financials data.

Key takeaways: Opportunities with the greatest potential impact

- Cyber leads in startup momentum, offering insurers the richest landscape of tech innovation to improve affordability.

- Homeowners’ insurance faces the greatest affordability pressure, making it the most urgent line for loss-prevention technologies despite limited ready-made solutions.

- Commercial and personal auto face an innovation gap, with high affordability pressure but low startup momentum — requiring insurers to carefully vet and selectively scale emerging solutions.

1. Cyber leads in startup momentum, offering insurers the richest landscape of tech innovation to improve affordability.

Cyber insurance faces only moderate affordability pressure, primarily from data breaches and hacks, compared to other lines like auto and homeowners that are more exposed to medical costs, materials shortages, and natural catastrophes (NatCats). What makes cyber unique is that leading players such as Coalition (an insurtech unicorn with $300M+ in revenue in 2024) actively embrace technology to prevent and reduce losses at scale.

Because the line is inherently tech-centered, nearly every new entrant presents a potential opportunity to lower loss costs. Risk management practices within cyber have generally reduced claims severity, as noted by Greg Smith, President, Canada at Crawford & Company:

“A larger number of smaller cyber claims are reducing severity, as is a more disciplined focus on underwriting and loss control in this space. Loss ratios for cyber lines in Canada have improved significantly in recent years because of improved underwriting and risk management.”

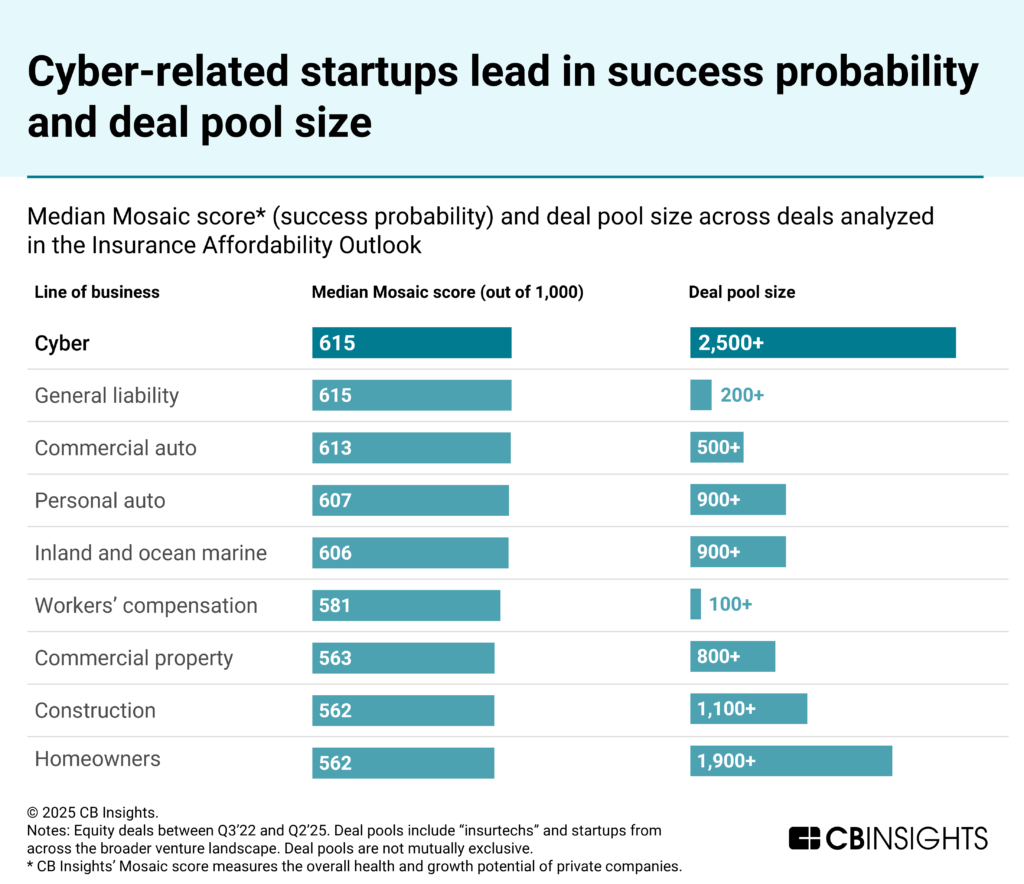

Between July 2022 and June 2025, cyber-focused startups completed more than 2,500 deals of at least $100K in funding, more than any other line of business analyzed. With a median CB Insights’ Mosaic score (success probability) of 615 out of 1,000, cyber startups tie general liability for the highest score across the 9 lines of business.

This surge of new entrants reflects rising enterprise concerns around AI security, which has spiked in executive commentary since the release of ChatGPT in late 2022. For example, Knostic, founded in 2023 and recently doubling its headcount from 22 to 44, helps enterprises identify and mitigate large language model data leakage risks.

Looking ahead, as individuals and businesses increasingly adopt AI, advanced cyber risk detection and rapid response capabilities will become critical. Insurance companies should prioritize evaluating partnerships with cyber startups or building comparable in-house capabilities to pass affordability gains onto policyholders.

2. Homeowners’ insurance faces the greatest affordability pressure, making it the most urgent line for loss-prevention technologies despite limited ready-made solutions.

Homeowners’ insurance experienced the steepest estimated loss ratio increases among all business lines analyzed, coinciding with rate increases spurred by natural catastrophes (NatCats). Survey respondents also pointed to fraud, labor shortages, and materials shortages as amplifying factors.

Reducing loss costs within homeowners’ insurance will depend on consistent data availability for individual homes and surrounding communities, as noted by Tim Butler, Head of Contractor Connection & CRD, Australia at Crawford & Company:

“For quite a number of years, there has been consistent talk of preventative measures in the form of water pressure meters and standard home tech. Unfortunately, it appears adoption of this technology remains an uphill effort. There is, however, an increase in the use of data available, which appears to be creating more consistency around loss cost.”

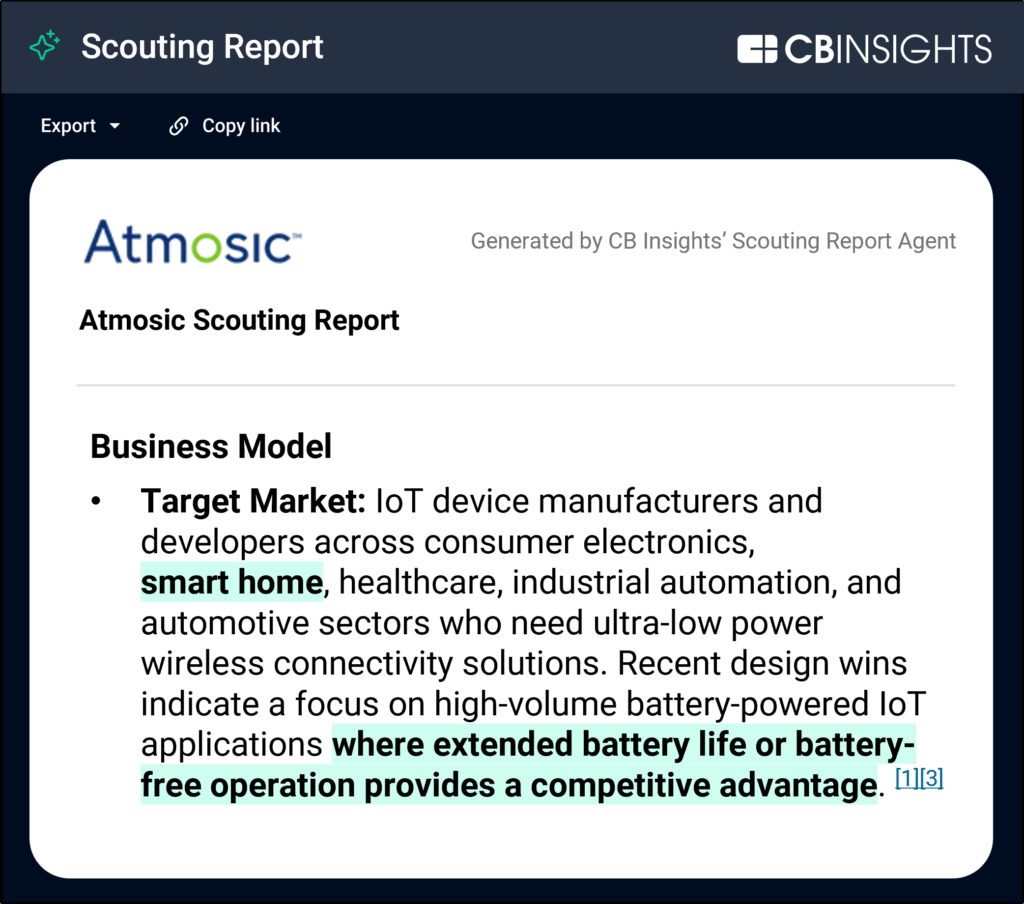

While more than 1,900 startup deals touch the homeowners’ space, many of these products were not designed specifically for insurers, requiring carriers to actively identify and adapt external technologies for loss prevention.

For example, Atmosic is developing low-power Internet of Things (IoT) charging infrastructure that insurers could implement via homeowner-provided sensors. Homeowners could receive these sensors at the start of hurricane season, ensuring extended power to generate data on risks that could result in a costly claim.

Beyond sensors, insurance companies should also eye non-traditional data and risk engineering methods to improve affordability. For instance, Figure, a humanoid robotics company founded in 2022 and backed by Bezos Expeditions, Microsoft, NVIDIA, and OpenAI, is targeting household deployments. In the future, humanoid robots could proactively maintain homes, generate maintenance data, and provide insurers with differentiated insights to mitigate loss risks.

Looking ahead, affordability improvements in homeowners’ insurance will require a broad set of technologies that support both loss control and proactive risk management. NatCat events, in particular, will continue to stress the market, presenting increasingly pressing needs to reduce loss costs to the greatest extent possible.

3. Commercial and personal auto face an innovation gap, with high affordability pressure but low startup momentum — requiring insurers to carefully vet and selectively scale emerging solutions.

Commercial and personal auto rank lowest in tech momentum across all lines of business analyzed. Many of these startups are in the electric vehicle space, a sector now facing market headwinds with reduced executive attention and a pullback in dealmaking.

Despite weak innovation supply, both auto lines remain under high affordability pressure, second only to homeowners. Survey participants cited macro-economic factors such as rising materials costs and social inflation as primary contributors to worsening claim trends, with Steve Blakemore, Managing Director, U.S. Loss Adjusting at Crawford & Company, noting:

“Cost of materials and specialized repair processes to include aluminum bodies and e-vehicles have increased significantly beyond affordable deductibles.”

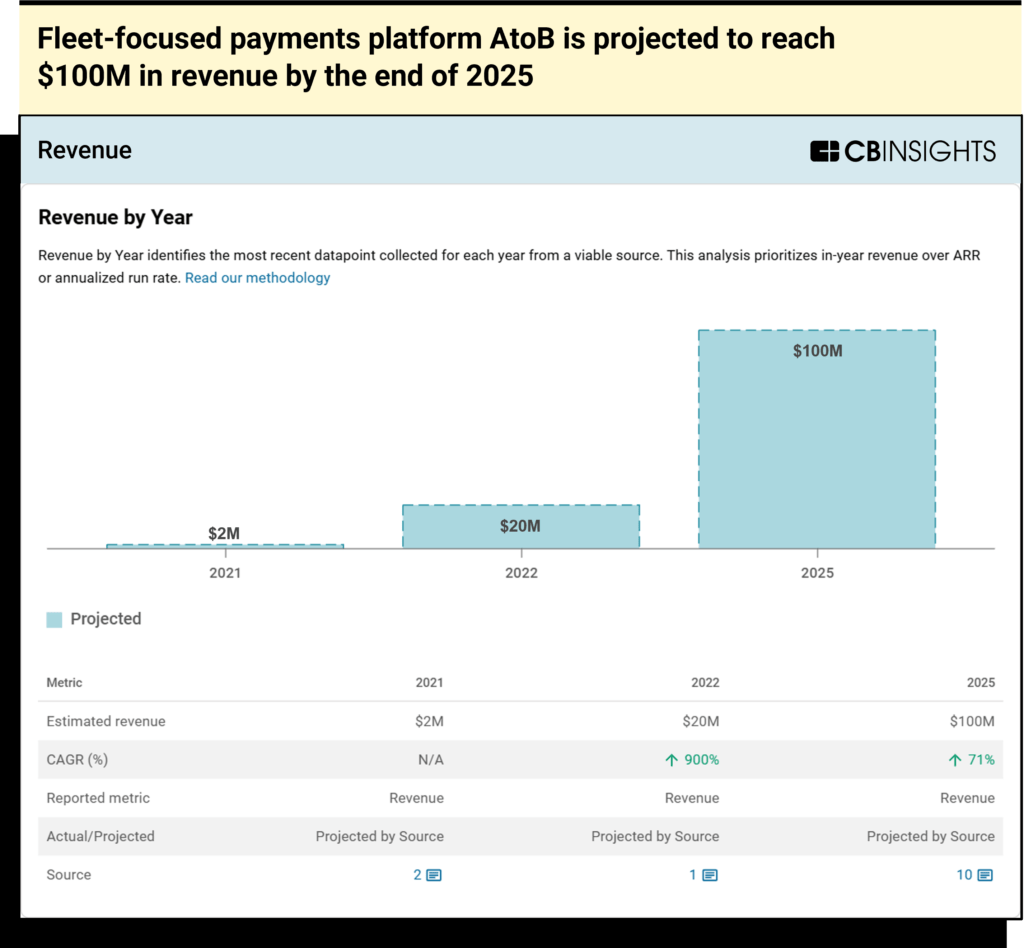

Technology opportunities for loss prevention exist, but they require disciplined evaluation — and need to extend beyond established telematics capabilities. For example, AtoB is a payments platform for the trucking industry with investors including Bloomberg Beta and Mastercard. The company’s revenue is projected to reach $100M by the end of 2025.

Coupled with existing data from telematics capabilities, insurance companies could utilize AtoB’s spending data to offer policyholders predictive notifications — for instance, guidance on routes to avoid areas with a higher likelihood of collisions.

Insurance companies should also identify opportunities related to autonomous vehicles, particularly after Waymo’s $5.6B Series C funding round in October 2024. Autonomous vehicle technology offers insurance companies potentially valuable data points that can inform loss prevention strategies as autonomous driving becomes more prevalent.

Looking ahead, improvements to auto insurance affordability through technology will require access to unique data sources that provide differentiated insights into driving risks. Carefully selected tech partnerships can provide insurance companies with access to this data, enabling them to offer policyholders proactive notifications that curb risky actions and prevent costly losses.

Line of business spotlights

Prioritize

Commercial property

Overview: Insurance coverage for business buildings, facilities, warehouses, and commercial real estate against property damage and operational risks.

Insurance Affordability Outlook placement:

- Affordability pressure ranking — 4th

- Tech momentum ranking — 5th

Data highlights:

- Pool of 800+ deals analyzed

- Median deal size — $10.8M

- Median current Mosaic score — 563 out of 1,000

- Most frequently listed current Commercial Maturity — Scaling (level 4 out of 5)

- Survey respondents indicated that commercial property has significant exposure to weather-related natural catastrophes.

- Survey respondents also identified materials shortages and supply chain disruptions as highly relevant factors to commercial property.

Potential startup collaboration: Doss is an AI-enabled enterprise resource planning platform serving industries like construction, manufacturing, and supply chain. The company more than doubled its headcount between July 2024 and July 2025. An insurance company could pursue a partnership with Doss to gain data access to flag supply chain shortage risks that could otherwise lead to costly repairs and restorations.

Construction

Overview: Specialized insurance coverage for construction companies, contractors, and building projects, addressing construction-specific risks including accidents, defects, and site safety.

Insurance Affordability Outlook placement:

- Affordability pressure ranking — 5th

- Tech momentum ranking — 3rd

Data highlights:

- Pool of 1,100+ deals analyzed

- Median deal size — $4.0M

- Median current Mosaic score — 562 out of 1,000

- Most frequently listed current Commercial Maturity Score — “Deploying” (level 3 out of 5)

- Construction has the third-highest tech momentum, indicating ample opportunity for innovation in the space.

- Survey participants indicated the following factors as highly relevant: weather-related natural catastrophes, labor shortages, materials shortages and supply chain disruptions.

Potential startup collaboration: AUAR builds mobile, robotics-powered micro-factories for home construction. The company partnered with industrial giant ABB in 2024 to expand operations in the United States. Given that micro-factories can reduce construction costs due to the potential need for less labor, materials, and transportation, insurance companies could offer AUAR-partnered construction companies less costly premiums.

Cyber

Overview: Insurance coverage against cybersecurity threats, data breaches, and digital risks affecting business operations and customer information.

Insurance Affordability Outlook placement:

- Affordability pressure ranking — 6th

- Tech momentum ranking — 1st

Data highlights:

- Pool of 2,500+ deals analyzed

- Median deal size — $6.0M

- Median current Mosaic score — 615 out of 1,000

- Most frequently listed current Commercial Maturity Score — “Deploying” (level 3 out of 5)

- Cyber has the highest tech momentum, boosted above the others as the line is inherently tech-enabled. Cyber startups have the highest weighted-average score across deals analyzed in the report, and the largest deal count analyzed across the lines of business.

Potential startup collaboration: Lakera is a security platform for genAI applications. The startup has a CB Insights’ Mosaic score among the top 2% of companies globally, and is one of the world’s most-promising AI startups as a 2025 AI 100 winner. Insurance companies could partner with Lakera to offer the company’s tech to support policyholders’ AI agents, identifying and protecting against potential data breach attempts from malicious prompts.

Homeowners

Overview: Personal insurance coverage protects residential properties and personal belongings against property damage, natural disasters, and household risks.

Insurance Affordability Outlook placement:

- Affordability pressure ranking — 1st

- Tech momentum ranking — 7th

Data highlights:

- Pool of 1,900+ deals analyzed

- Median deal size — $4.2M

- Median current Mosaic score — 562 out of 1,000

- Most frequently listed current Commercial Maturity Score — “Deploying” (level 3 out of 5)

- Homeowners’ insurance leads in affordability pressure, with analysis zeroing in on claims severity and loss ratio change (the greatest across lines analyzed) as key pain points.

- Survey respondents indicated that homeowners’ insurance has significant exposure to weather-related natural catastrophes.

Potential startup collaboration: Honey Homes is an on-demand maintenance service currently serving homeowners in California, Illinois, and Texas. Insurance companies could evaluate partnerships with Honey Homes to gain access to trending service requests in localized areas, like upticks in window replacements across older homes. Insurance companies could then derive data-driven signals from those requests to inform preventive action for potentially costly events, such as sending plywood and sandbags to homeowners in a projected hurricane path.

Vet

Commercial auto

Overview: Insurance coverage for vehicles used in business operations, including fleet management, trucking operations, and commercial transportation risks.

Insurance Affordability Outlook placement:

- Affordability pressure ranking — 3rd

- Tech momentum ranking — 9th

Data highlights:

- Pool of 500+ deals analyzed

- Median deal size — $7.0M

- Median current Mosaic score — 613 out of 1,000

- Most frequently listed current Commercial Maturity Score — “Deploying” (level 3 out of 5)

- Commercial auto had the lowest tech momentum ranking due to below-average company scores and deal count.

- Materials shortages, medical costs, and social inflation are key factors in commercial auto claims.

Potential startup collaboration: Outpost offers a network of managed freight terminals, featuring a gate management platform that reviews truck data like license plates and registration numbers using computer vision technology. The company doubled its financial capacity in September 2025 to $1B. Insurance companies could pursue a partnership conversation with Outpost to gain access to gate data for risk modeling purposes.

General liability

Overview: Broad business insurance covering third-party claims for bodily injury, property damage, and operational risks arising from normal business activities.

Insurance Affordability Outlook placement:

- Affordability pressure ranking — 7th

- Tech momentum ranking — 6th

Data highlights:

- Pool of 200+ deals analyzed

- Median deal size — $6.6M

- Median current Mosaic score — 615 out of 1,000

- Most frequently listed current Commercial Maturity Score — “Deploying” (level 3 out of 5)

- Survey responses indicated that general liability is experiencing increased claims severity. Social inflation and increased medical costs are key factors relevant to general liability claims.

Potential startup collaboration: Relay provides communication and location-tracking devices for frontline workers across industries, like entertainment, healthcare, and hospitality. The startup’s headcount has grown rapidly in recent years, with a projected revenue of $100M by 2027. Insurance companies could evaluate offering Relay’s product to business customers, like concert venues and restaurant operators. The tech deployment would support employee responses to potential claims-triggering risks, such as wet floors that could lead to slip and fall incidents.

Inland and ocean marine

Overview: Specialized coverage for goods in transit, commercial equipment, and property that moves between locations or operates in maritime environments.

Insurance Affordability Outlook placement:

- Affordability pressure ranking — 9th

- Tech momentum ranking — 2nd

Data highlights:

- Pool of 900+ deals analyzed

- Median deal size — $5.3M

- Median current Mosaic score — 607 out of 1,000

- Most frequently listed current Commercial Maturity Score — “Deploying” (level 3 out of 5)

- Inland and ocean marine has the second-highest tech momentum, indicating strong opportunities to improve insurance affordability — despite the lowest pressure to improve affordability across all lines of business assessed.

- Survey respondents indicated the following factors as relevant: fraud, labor shortages, materials shortages and supply chain disruptions, and weather-related natural catastrophes.

Potential startup collaboration: Altana AI is a supply chain intelligence platform backed by Google Ventures and Salesforce Ventures, and — as a CB Insights 2024 Insurtech 50 winner — one of the world’s most-promising insurtech startups. The company offers products for business interruption risk and supply chain network planning. Insurance companies could explore Altana AI’s platform to gain visibility into potential supply chain risks and reroute shipments that otherwise face heightened risk for damage or loss.

Personal auto

Overview: Individual insurance coverage for personal vehicles, protecting against accidents, vehicle damage, and liability arising from personal driving.

Insurance Affordability Outlook placement:

- Affordability pressure ranking — 2nd

- Tech momentum ranking — 8th

Data highlights:

- Pool of 900+ deals analyzed

- Median deal size — $7.3M

- Median current Mosaic score — 606 out of 1,000

- Most frequently listed current Commercial Maturity Score — “Deploying” (level 3 out of 5)

- Personal auto has the second-highest affordability pressure among lines of business analyzed, primarily due to loss ratio change estimates.

- Startups relevant to personal auto ranked the lowest in momentum due to a low weighted average score.

- Survey respondents indicated challenges around claims severity.

Potential startup collaboration: NoTraffic is a traffic management company that offers IoT devices to collect data at intersections and an AI platform to support traffic optimization decisions. NoTraffic is a NVIDIA partner and previously participated in the NVIDIA Inception Program. Insurance companies could evaluate partnerships with NoTraffic to support deployments that could reduce traffic accidents and lower claims costs.

Workers’ compensation

Overview: Mandatory insurance providing medical benefits and wage replacement for employees injured on the job, covering workplace accidents and occupational hazards.

Insurance Affordability Outlook placement:

- Affordability pressure ranking — 8th

- Tech momentum ranking — 4th

Data highlights:

- Pool of 100+ deals analyzed

- Median deal size — $5.0M

- Median current Mosaic score — 581 out of 1,000

- Most frequently listed current Commercial Maturity Score — “Deploying” (level 3 out of 5)

- Survey participants generally viewed medical cost increases and social inflation as relevant to workers’ compensation insurance.

Potential startup collaboration: Protex AI offers a computer vision product that gives customers visibility into workplace risks (like speeding forklifts in warehouse environments) to prompt intervention by environment, health, and safety teams. DHL and Marks & Spencer are among Protex AI’s customers. Insurance companies could seek a partnership with Protex AI to offer the platform to policyholders facing elevated risks for workers’ compensation claims, like manufacturers and warehouse operators, due to workplace injuries.

Monitor

No lines of business fall within this category.

Methodology

The insurance affordability outlook provides an informational visual framework for insurance leaders to identify opportunities to improve insurance affordability for policyholders.

The opportunities encompass potential tech deployments for loss prevention and response across 9 lines of business: commercial auto, commercial property, construction, cyber, general liability, homeowners, inland and ocean marine, personal auto, and workers’ compensation.

The resulting visual plots the lines of business relative to one another across 3 categories:

- Monitor — Lines of business with lower signals to warrant investment in tech to support insurance affordability. Insurance leaders should track developments in this space for future consideration.

- Vet — Lines of business with moderate signals to warrant investment in tech to support insurance affordability. Insurance leaders should evaluate potential partnerships and tech deployment, pursuing the most-promising opportunities as innovation activities.

- Prioritize — Lines of business with strong signals to warrant investment in tech to support insurance affordability. Insurance leaders should prioritize partnerships and tech deployments to operationalize.

Calculations across 2 axes — tech momentum and affordability pressure — guide plotting for each line of business.

Tech momentum

Tech momentum assesses startup ecosystem strength and tech applicability across the 9 lines of business.

This report leverages CB Insights’ AI-enabled deal search to identify 8,900+ venture-backed equity deals of at least $100K across the lines of business between July 1, 2022, and June 30, 2025. Deals were identified based on keywords specific to the lines of business, and some deals were excluded from the analysis. Deals analyzed in this report are not mutually exclusive, although the aggregate total constitutes approximately 9% of venture dealmaking between Q3’22 and Q2’25.

We generate a score for each deal that reflects the company’s momentum within the marketplace. The score uses CB Insights’ data, such as deal activity, company headcount, and proprietary Commercial Maturity and Mosaic scores. We include startups from across the venture landscape, although we assign greater weight to insurtechs given their direct relevance to the insurance market. Weighted average calculation guides the final ranking of the scores and the total number of deals analyzed across each line of business.

Affordability pressure

Affordability pressure evaluates the approximate impact of loss costs on insurance affordability for policyholders across the 9 lines of business.

We leverage 2 different data sources to measure affordability pressure for each opportunity:

- Survey of claims experts — 64 Crawford & Company employees provided directional insights across 160 line of business-specific responses on global loss trends.

- Loss ratio changes among publicly-traded insurers — Loss ratio changes between 2022 and 2024 across a sample of 15 companies: AIG, Allstate, American Financial Group, Arch Capital Group, AXIS Capital, Chubb, Everest Group, GEICO, Mercury General Corporation, Old Republic Insurance Group, Progressive, Selective Insurance, The Cincinnati Insurance Companies, Travelers, and W.R. Berkley. The data points are approximate based on the business mix of each of the 15 companies, and mindful of loss ratio dynamics in recent years due to the potential (or actual) impact of rate and price increases.

The final ranking is guided by the survey outputs and loss ratio change outputs, supported by ChatCBI reasoning leveraging data from across CB Insights’ Business Graph.

Additional notes

CB Insights has provided the information contained in this report for informational purposes only and does not constitute an endorsement or recommendation by CB Insights. Reasonable efforts have been made to ensure the accuracy of the information, and CB Insights makes no representation or warranty, express or implied, as to its completeness or accuracy.

Crawford & Company has not vetted, nor does it endorse, any of the companies or technologies mentioned in this report. These references are illustrative in nature and should be viewed solely as examples rather than recommendations.

The insurance affordability outlook is not an investment analysis, and should not be used to guide financial- or investment-focused decisions, including those pertaining to any insurance company operating across the analyzed lines of business. In addition, the report leverages a non-actuarial analysis and should not be used to discern financial performance (including loss ratio performance) across any lines of business analyzed.

This report is global in scope, although the analysis largely centers on the United States. Regulations and market dynamics differ across geographies, and the report does not account for every nuance across the industry.

We selected the 15 companies for the loss ratio change analysis due to comparable data reporting practices of loss ratio performance on annual reports using CB Insights’ Public Company Financials data. The report uses loss ratios as underlying loss costs are often not reported in a standardized format on annual reports. Loss ratios include loss adjustment expenses and typically spans lines of business. The changes in loss ratios were used to derive signals for lines of business subject to more affordability pressure.

The insurance affordability outlook is not absolute. The insurance industry and broader tech landscapes are subject to constant change, so future developments have the potential to impact the findings presented in this report.

About

Crawford & Company

Crawford & Company® is a leading global provider of quality claims management and outsourcing solutions with an expansive network of experts serving clients in more than 70 countries. Our unique ability to combine innovation and expertise advances our purpose to restore lives, businesses and communities across the globe. For over 80 years, clients have trusted Crawford to care for their customers as a seamless extension of their brand, keeping the focus where it belongs—on people. More information is available at www.crawco.com.

Contact: info@us.crawco.com

CB Insights

Headquartered in New York City, CB Insights is the leading provider of AI for market intelligence. The company aggregates, validates, and analyzes hard-to-find private and public company data. Its powerful AI tells users what it all means to them personally. The world’s smartest companies rely on CB Insights to focus on the right markets, stay ahead of competitors, and identify the right targets for sales, partnership, or acquisition. Visit www.cbinsights.com for more information.

Contact: researchanalyst@cbinsights.com

If you aren’t already a client, sign up for a free trial to learn more about our platform.