Early-stage activity points to what’s next in tech, from AI agents transforming enterprise operations to autonomous labs accelerating scientific discovery.

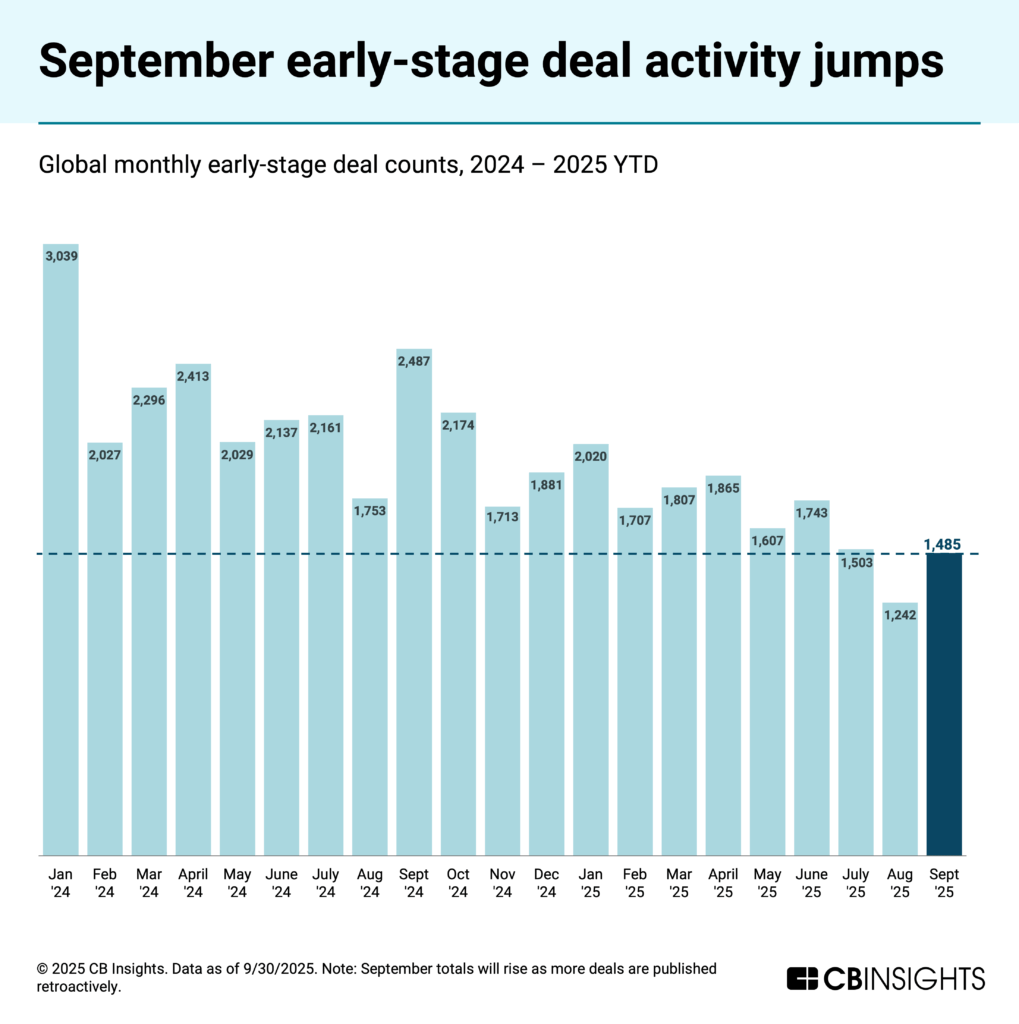

In September, private companies globally raised 1,400+ early-stage rounds (noting this total will rise as more deals are published retroactively). Over 25% of startups that raised rounds are building AI-enabled products and services.

Download the full report to access comprehensive CB Insights data on early-stage activity, including top investors & deals, valuation data, and our predictive signals. Below, we highlight notable trends to watch.

Emerging trends & categories to watch

Click the links to see underlying deal activity. Categories are not mutually exclusive.

AI agents

Similar to last month, companies targeting AI agent applications raised over 50 deals (out of 1,485). Key trends to note include:

- “Smart Money” is all in on AI agents: The top 25 VCs identified by CB Insights backed 13 AI agent startups in September. This represents nearly 20% of all of the early-stage activity from these VCs in the month. Focuses include security (Akto, Fabrix Security, Terra Security) and governance, risk, and compliance (Geordie, Zania), indicating enterprise adoption and risk management are key investment priorities.

- Customer service is one of the most established use cases but is still seeing early-stage traction: AI agents handling customer service, support tickets, and user interactions represent one of the largest early-stage agent categories in September (8+ deals). Support operations have clear unit economics, high volume repetitive tasks, and direct cost savings compared to human agents, driving continued activity here. Top companies to watch based on Mosaic scores include Doo (Mosaic: 747) and Rauda AI (Mosaic: 687).

- Emerging voice AI sector: Voice and phone agents are attracting dedicated investment (6 deals, 11% of agent activity) as investors bet on solutions that can tackle the unique technical challenges of voice interactions (i.e., real-time latency requirements, natural speech processing, emotional intelligence, etc.). Confido Health and Prosper, for example, are focused on healthcare applications. Meanwhile, Vida and Vaani Research are building infrastructure to develop voice AI/phone agents. Review the voice AI development platforms market to compare 30+ vendors in the space.

Robotics

Companies building robots, and the systems that power them, raised over 70 deals in the month.

Within robotics, defense & security applications led early-stage activity (17 deals, 24% of total robotics activity), reflecting geopolitical tensions driving investment in autonomous defense systems and surveillance.

Other notable traction is in foundation models and operating systems for robots, as investors bet on horizontal platforms (4 deals, 6%):

- The leading September round in this category went to DYNA, which raised a $120M Series A. The company is ranked as a “challenger” in our robot foundation model developers market.

- Another highlight is InOrbit, which focuses on robot orchestration and was founded by Florian Pestoni and Julian Cerutti, who have experience at a range of large tech companies, including Google, Atlassian, Meta, and IBM. The founders’ strong pedigree is reflected in the company’s CB Insights Management strength score, which ranked the highest of all the companies raising early-stage deals in September.

Management strength score

CB Insights’ Management strength scores (out of 1,000) the founding and management team’s prior achievements and likelihood of achieving future success, like a high-value exit.

Especially at the earliest stages of the startup lifecycle, the strength of the management team serves as a key signal of potential.

AI for scientific discovery & materials development

Three of the largest early-stage rounds of the quarter went to companies looking to accelerate scientific discovery and materials development with AI:

- Periodic Labs ($300M Series A at $1B valuation)

- Lila Sciences ($235M Series A at $1.23B valuation)

- CuspAI ($100M Series A at $520M valuation)

Both Periodic Labs and Lila Sciences are also building “autonomous labs” — with AI designing, conducting and iterating on experiments. All 3 companies are operating at Commercial Maturity level 2/5 (Validating), indicating they’re still testing and refining their products.

Methodology

This report includes equity early-stage financings (convertible note, angel, pre-seed, seed, Series A) to private companies in August 2025. We excluded companies that are later-stage that raised an angel round or convertible note in the month. Categorization based on company descriptions.

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign up for a free trial to learn more about our platform.