Selective but high conviction. That’s the story of fintech in Q3’25. Overall funding was flat and deal count slipped quarter-over-quarter. But where capital showed up, it did so with conviction: Mega-rounds soaked up two-fifths of the capital raised, with deal sizes trending more than a third higher than last year’s levels.

That conviction clustered around category leaders. And especially those that paired credible AI strategies with strong fundamentals, like resilient unit economics, scalable infrastructure, and defensible tech stacks. Five of the quarter’s biggest raises went to AI-driven finance platforms.

The same pattern is visible in digital assets, with capital focusing on those building institutional-grade capabilities. That institutional momentum has carried into the exit landscape as well. Digital asset players featured prominently in both public debuts and M&A, while Klarna’s long-awaited listing suggested a return of market appetite.

Taken together, Q3’25 was about scale. Whether it’s intelligence platforms with reach, digital assets with institutional buy-in, or business models with proven unit economics. Importantly, this focus on depth and conviction isn’t just a funding story. This is a lens we see shaping conversations, connections, and collaborations as we head into Money20/20 USA 2025.

Fintech is adjusting to a new baseline. Fewer bets. Bigger conviction.

In this report, we used CB Insights data, including funding and dealmaking, valuations, exit activity, and talent signals to highlight the key forces propelling growth and market evolution across fintech.

Key takeaways from the report include:

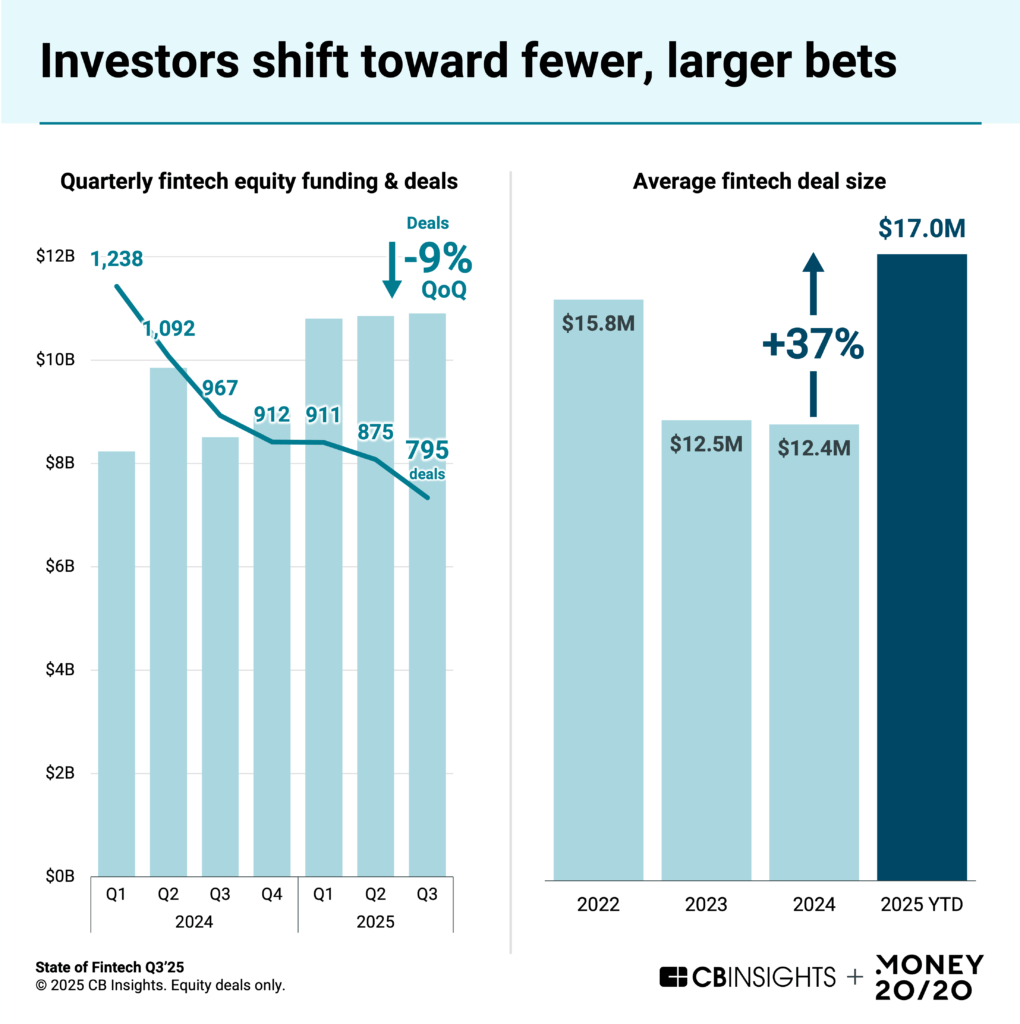

- Fintech funding is flat vs. Q2’25, but capital is concentrating in mega-rounds. Fintech funding hit $10.9B in Q3’25. Deal count declined 9%, mirroring the slowdown in dealmaking across venture. But mega-rounds accounted for 40% of all funding as investors continue to shift toward fewer, larger bets: year-to-date, average and median deal sizes are more than 35% above 2024 levels, even as deal count declines. If this trend continues, smaller competitors may face increased pressure, potentially accelerating consolidation and strategic acquisitions in the sector.

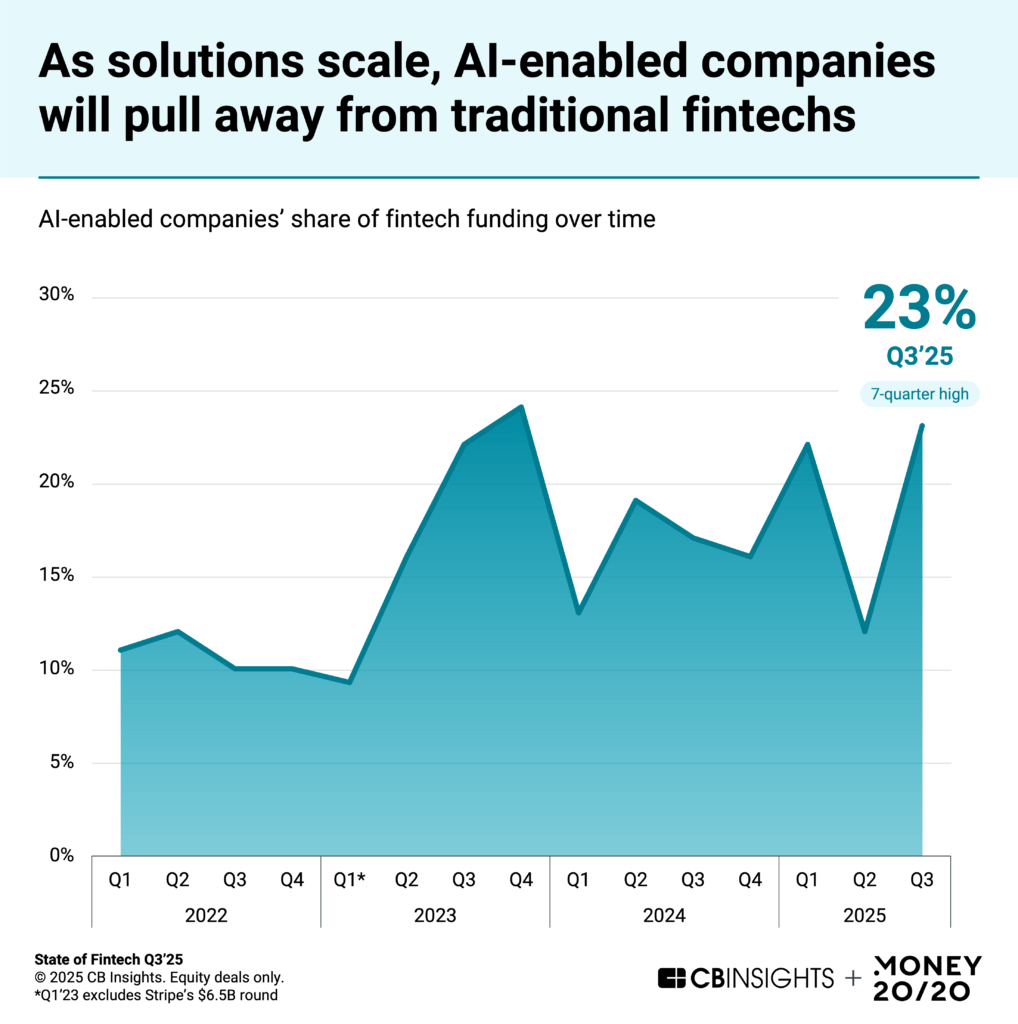

- AI captures nearly one-quarter of fintech funding as agentic solutions gain market traction. Five of the top 10 deals went to AI-powered finance platforms like Ramp and AppZen, positioning AI leaders to widen their competitive gap as AI-first and agentic solutions scale.

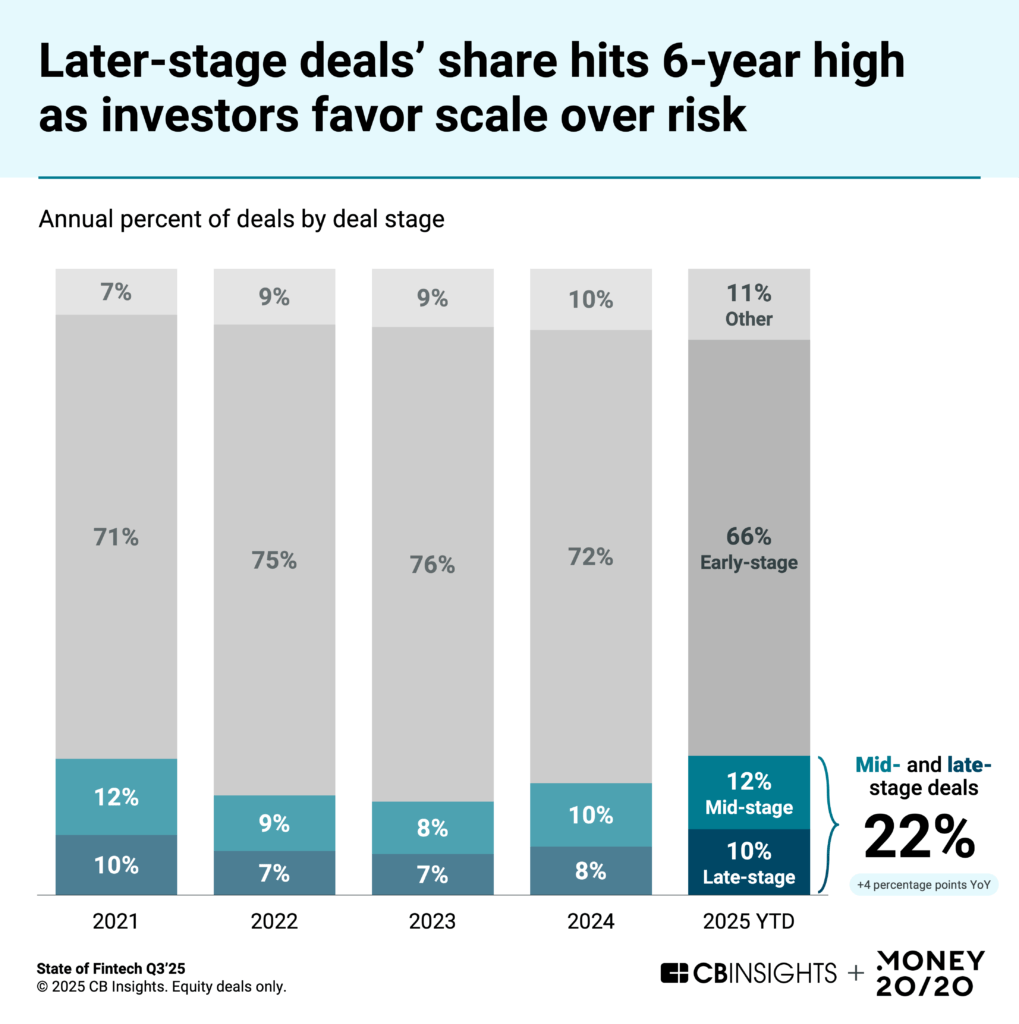

- Investors shift to more established fintechs. In Q3’25, mid- and late-stage fintech deal share reached its highest level since 2021 at 22%. As investors look for clearer paths to scale, funding, high valuations, and exits are concentrating among more mature players, potentially limiting opportunities for early-stage startups.

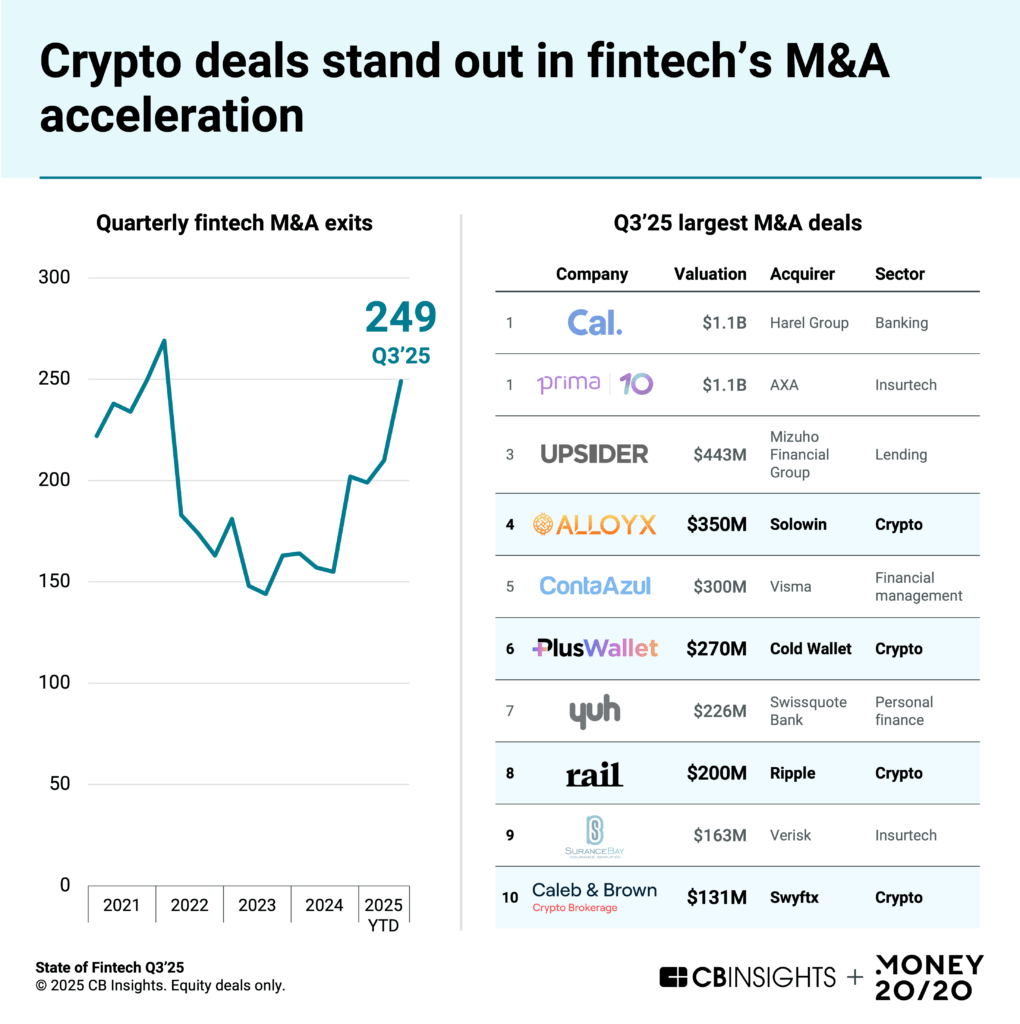

- The recovery in fintech exit activity continues. Fintech exits accelerated in Q3’25, with M&A deals rising 19% to 249 — the highest in more than 3 years — and IPOs for the quarter reaching 15, a 16-quarter high. Digital assets remain a key driver: many of the largest M&A and public offerings were in crypto, underscoring growing institutional interest. The rebound signals growing investor confidence and could spur further consolidation, particularly into crypto-focused fintech.

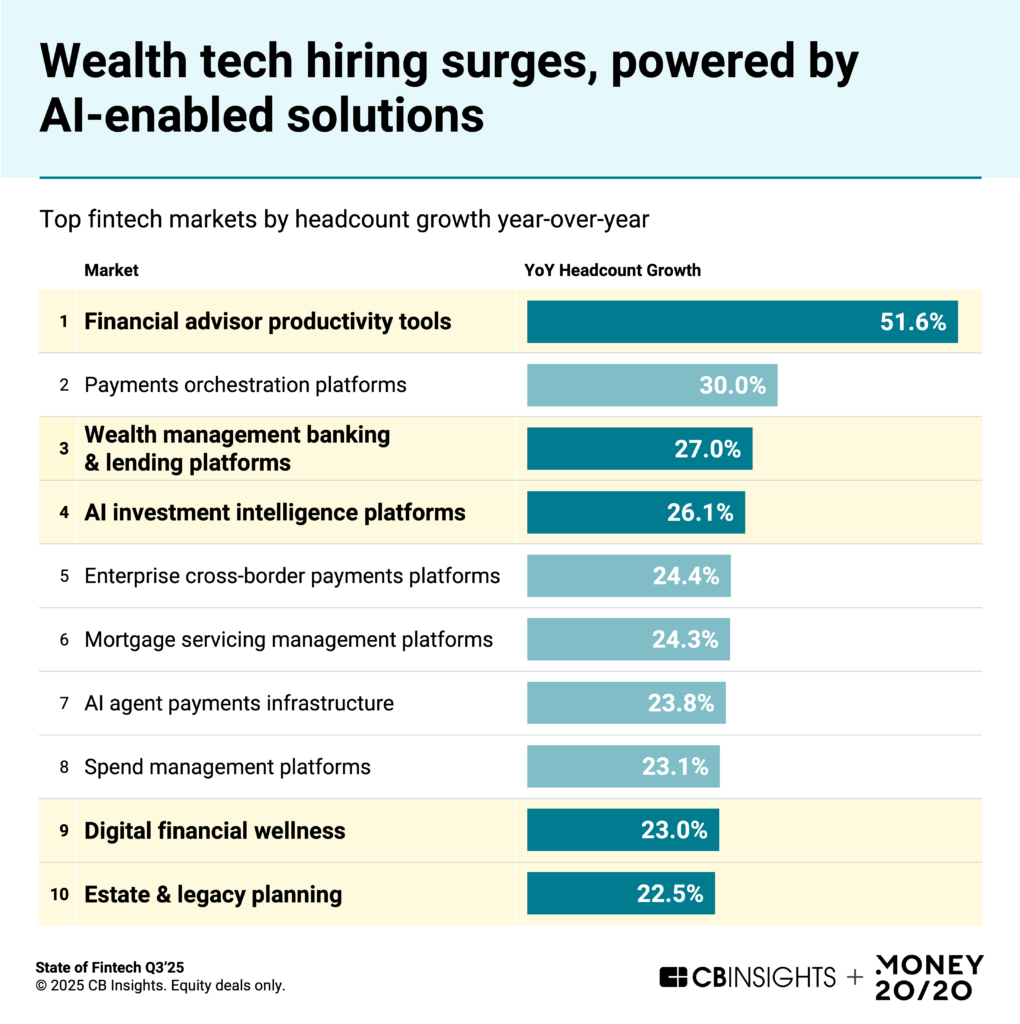

- Wealth tech maintains momentum, with funding on pace to nearly double 2024 totals and companies ramping up hiring activity. Wealth tech’s YTD funding of $4.2B has already surpassed its 2024 level, making it one of the few fintech sectors with strong momentum across the year. Companies in the sector are also expanding rapidly: according to CB Insights talent signals, 3 of the top 5 fastest-growing tech markets in year-over-year hiring are in wealth tech, signaling strong confidence in digital-first wealth management solutions. AI is accelerating this momentum, with applications that can quickly enhance investment and advisory tools, driving faster adoption.

We dive into the trends below.

Fintech funding is flat vs. Q2’25, but capital is concentrating in mega-rounds

In Q3’25, fintech funding was flat versus Q2’25, at $10.9B. Deal count declined 9%, mirroring the broader slowdown in dealmaking across venture. Every fintech vertical saw quarter-over-quarter declines except for payments and capital markets, the latter of which was mainly boosted by iCapital’s $820M raise.

The iCapital deal underscores the return of mega-rounds’ impact in fintech. In Q3, the 10 largest equity deals were all $100M+ rounds, with mega-rounds accounting for 40% of total funding — just below Q2’s 42%, a 9-quarter peak. This shift is driving average and median deal sizes higher, both of which are more than 35% higher YTD than in 2024.

If the trend toward fewer, larger deals persists, the gap between top-tier fintechs and smaller competitors will continue to widen. This could accelerate consolidation in mid-stage fintech and favor strategic acquisitions by incumbents.

AI captures nearly one-quarter of fintech funding as agentic solutions gain market traction

Among the largest deals in Q3’25 were rounds for AI-powered fintechs, highlighting the growing role of autonomous solutions in finance and creating a new competitive tier in fintech. AI-enabled fintechs captured 23% of Q3’25 fintech funding, the highest share since Q4’23.

Five of the 10 largest fintech equity deals went to companies heavily deploying AI in their solutions. Ramp raised a $500M Series E-II just 45 days after its initial Series E in June 2025, as it launched hundreds of AI-powered tools and its first AI agents. AppZen, which builds AI agents for financial operations with its proprietary LLM, also raised a $180M Series D round.

AI-enabled companies’ share of fintech deals remained steady at 17% in both Q2 and Q3’25, reflecting investors’ focus on proven autonomous capabilities.

Investors shift to more established fintechs

Investors are also prioritizing investments in more mature fintechs in 2025, signaling a structural reset in risk appetite.

Mid- and late-stage companies have captured 22% of all deals YTD, the highest concentration since 2021. Median deal sizes YTD for mid- and late-stage deals have also increased vs. 2024, by 16% and 50%, respectively.

In contrast, early-stage deals now make up less than two-thirds (66%) of total activity, the first dip below 70% since 2020. The shift reflects a strategic pivot toward companies with established business models and clearer paths to scale.

The largest mid- and late-stage rounds went to companies with proven scale, predictable growth, and measurable efficiency gains. In addition to the large late-stage rounds for Ramp and AppZen, investors concentrated on financial operations solutions, including automated accounts payable (Xelix), small business financial management (Hala, Uzum), and ERP solutions (Omie).

Meanwhile, competition for capital among early-stage companies is intensifying. Digital asset startups remain notable, capturing almost one-third of the top 20 seed and Series A deals. The rounds include Stable ($28M), which raised $28M to build a blockchain for USDT payments and announced a partnership with PayPal, and Agora ($50M), which offers white-label stablecoins.

For fintech executives and investors, this shift implies that capital will increasingly flow to proven players, potentially compressing opportunities for early-stage startups. If the late-stage concentration continues, we expect 2026’s fintech unicorn pipeline to shrink, and exits will cluster among today’s leaders. Early-stage companies may face longer timelines to reach scale or be forced into strategic partnerships or acquisitions.

The recovery in fintech exit activity continues

Exits in fintech continued to climb quarter-over-quarter, signaling renewed investor confidence as well as opportunities in crypto.

M&A activity grew 19% to 249 deals, the highest level in more than 3 years and 73% higher than the trough in Q3’23. IPO activity reached its highest point since Q4’21, and just the fifth time the quarterly figure hit double digits in the last 4 years.

Similar to last quarter, digital assets remain a driving force in exits. Four of the 10 largest M&A deals in the quarter went to stablecoin and crypto payments companies. Ripple‘s $200M acquisition of stablecoin payments provider Rail marks its second major purchase this year, following April’s Hidden Road deal. This concentrated activity reflects traditional finance’s rush to build crypto capabilities, a trend that will accelerate as regulatory frameworks solidify.

Meanwhile, crypto exchanges Bullish and Gemini completed public offerings, highlighting rising institutional interest. The public market activity provides benchmarks for valuations and signals investor appetite for digital asset innovation.

Continued M&A and IPO momentum is driving fintech’s first major acquisition cycle since 2021. For crypto infrastructure, regulatory clarity and institutional adoption are likely to accelerate consolidation. Broadly, the next exit wave will create new exit opportunities for early- and mid-stage fintechs, while late-stage companies may find IPO windows opening earlier.

Wealth tech maintains momentum, with funding on pace to nearly double 2024 totals and companies ramping up hiring quickly

Wealth tech remains resilient as investors double down on mature wealth solutions and AI-augmented solutions. While funding in the space hit declined QoQ to $1.6B, YTD funding in wealth tech of $4.2B already surpasses 2024’s full-year total of $3.4B, despite broader market headwinds.

Driving Q3’s wealth tech funding total were companies focused on automation, including automated portfolio management software (Pave Finance) and tech-enabled advisors and retirement plans (Savvy Wealth, Vestwell).

Wealth tech companies are also hiring rapidly. According to CB Insights Talent Signals, 3 of the top 5 fastest-growing fintech markets by year-over-year hiring are in wealth tech, covering AI tools for financial advisor productivity and investment intelligence. Year-over-year headcount growth in all of these markets exceeds the fintech average of 5.7% by sixfold or more.

The rapid headcount expansion across AI advisor tools suggests wealth management is approaching an automation inflection point. AI can quickly boost advisor productivity and investment decision-making, creating fast, tangible impact. AI-augmented advisors will become a critical differentiator in wealth management, creating opportunities for strategic investments, tech partnerships, and M&A for AI-enabled advisory solutions.

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign up for a free trial to learn more about our platform.