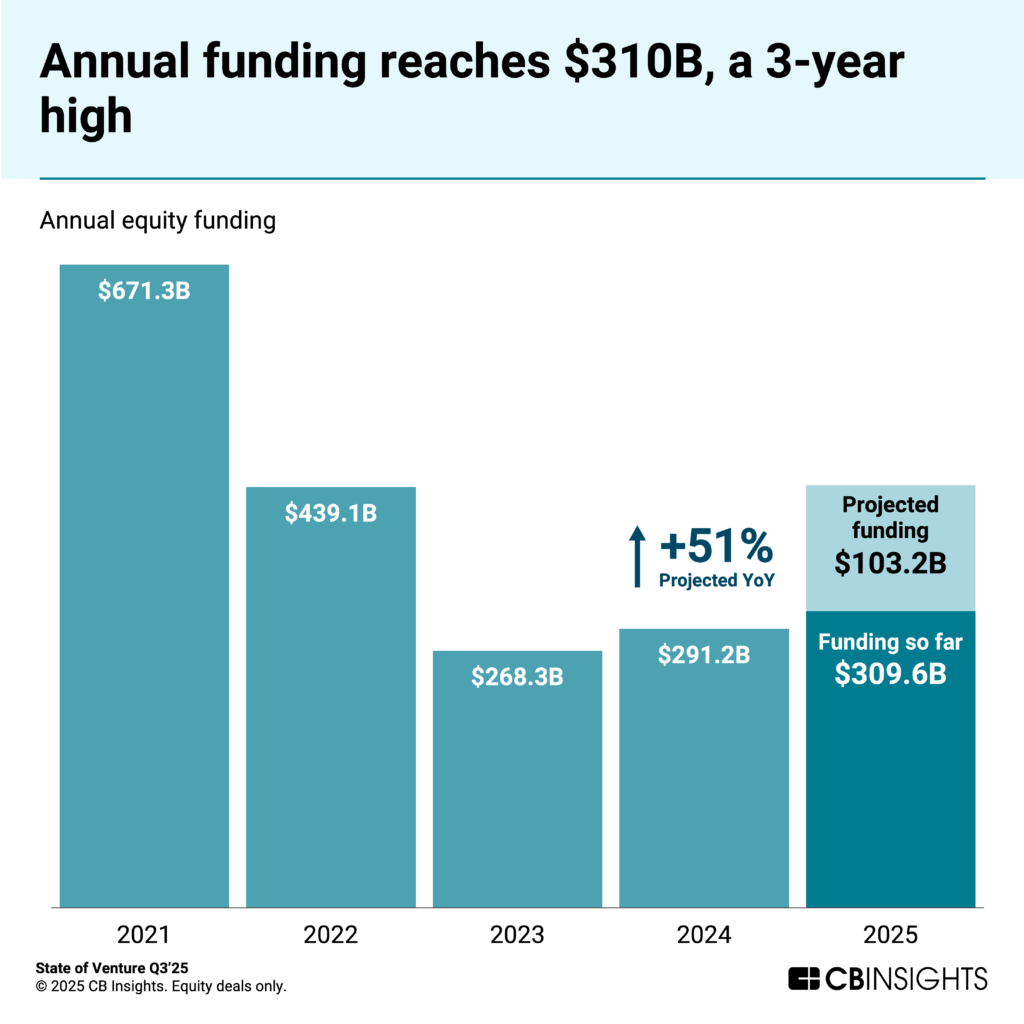

Venture funding is rebounding in 2025 — reaching its highest annual level since 2022 — even as deal activity fell for the sixth straight quarter.

The surge was fueled by outsized mega-rounds to new decacorns — companies with $10B+ valuations — and the continued dominance of AI, which accounted for 51% of all funding and 22% of deals in Q3’25.

However, funding growth was far from uniform across sectors. Retail and healthcare saw quarterly declines, while fintech remained flat. The data suggests that investors are pulling back from traditional industries and doubling down on emerging technologies, especially AI.

Below, we break down the top stories from this quarter’s report, including:

- Funding surpassed $90B for the 4th consecutive quarter

- AI is on track to capture over 50% of total annual venture funding for the first time

- Decacorns raise record funding, as quarterly tech mega-rounds reach a new high

- Humanoid robots captured the most deals for the 2nd quarter in a row

- Exits are rebounding despite companies staying private longer

Let’s dive in.

Download the full report to access comprehensive data and charts on the evolving state of venture across sectors, geographies, and more.

Top stories in Q3’25

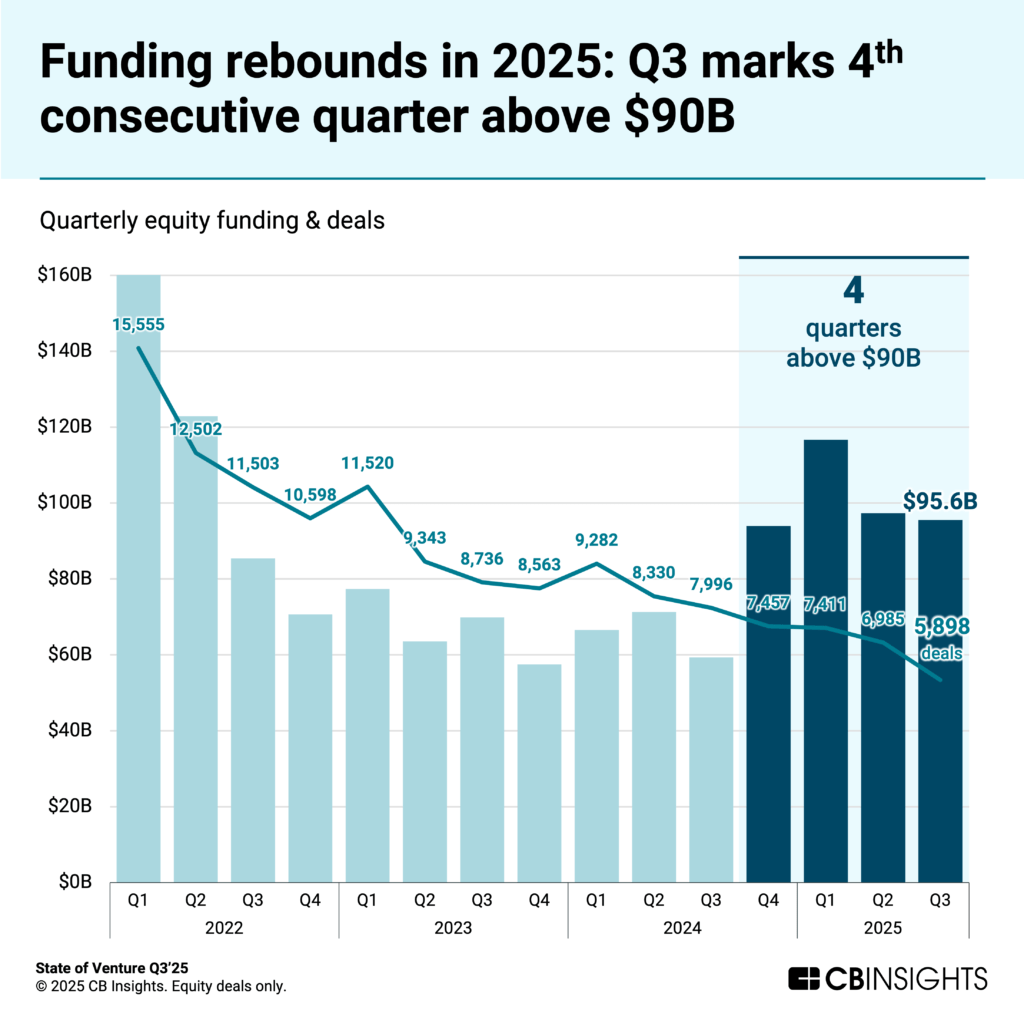

1. Funding surpassed $90B for the 4th consecutive quarter

Venture funding exceeded $90B for the fourth consecutive quarter, reaching $95.6B in Q3’25. The year-to-date total surpassed $310B, marking the highest annual figure since 2022.

Deal count, however, fell to its lowest point since Q4’16, underscoring an ongoing trend: investors are writing bigger checks to fewer companies. This pattern has persisted for over a year.

AI maintained its stronghold on the venture market, capturing $47.8B in Q3, for 50% of total funding and 22% of deals. Both figures represent the second-highest quarterly levels on record, confirming AI as the primary driver of venture strength.

While the largest rounds of the quarter went to leading AI players, such as Anthropic and OpenAI, other standout fundraisers included:

- China Fusion Energy, which raised $1.6B to advance fusion reactor engineering and commercialization.

- DBG Health raised $1B to provide a range of healthcare services.

- PsiQuantum, a developer of photonic quantum computers, raised a $1B Series E round.

Investors are also fueling a resurgence in hard tech — particularly in aerospace, defense, and advanced computing:

- Aerospace funding reached $14.1B through Q3’25 and is expected to reach $18.9B by year-end — surpassing its 2021 record by 20%.

- Defense tech raised a record $13.7B, driving the emergence of a new military-startup complex.

- Quantum computing tripled its previous annual funding record, reaching $3.7B.

The data points to a venture market in transition — one defined by larger checks, fewer deals, and a growing concentration of capital in AI and hard tech.

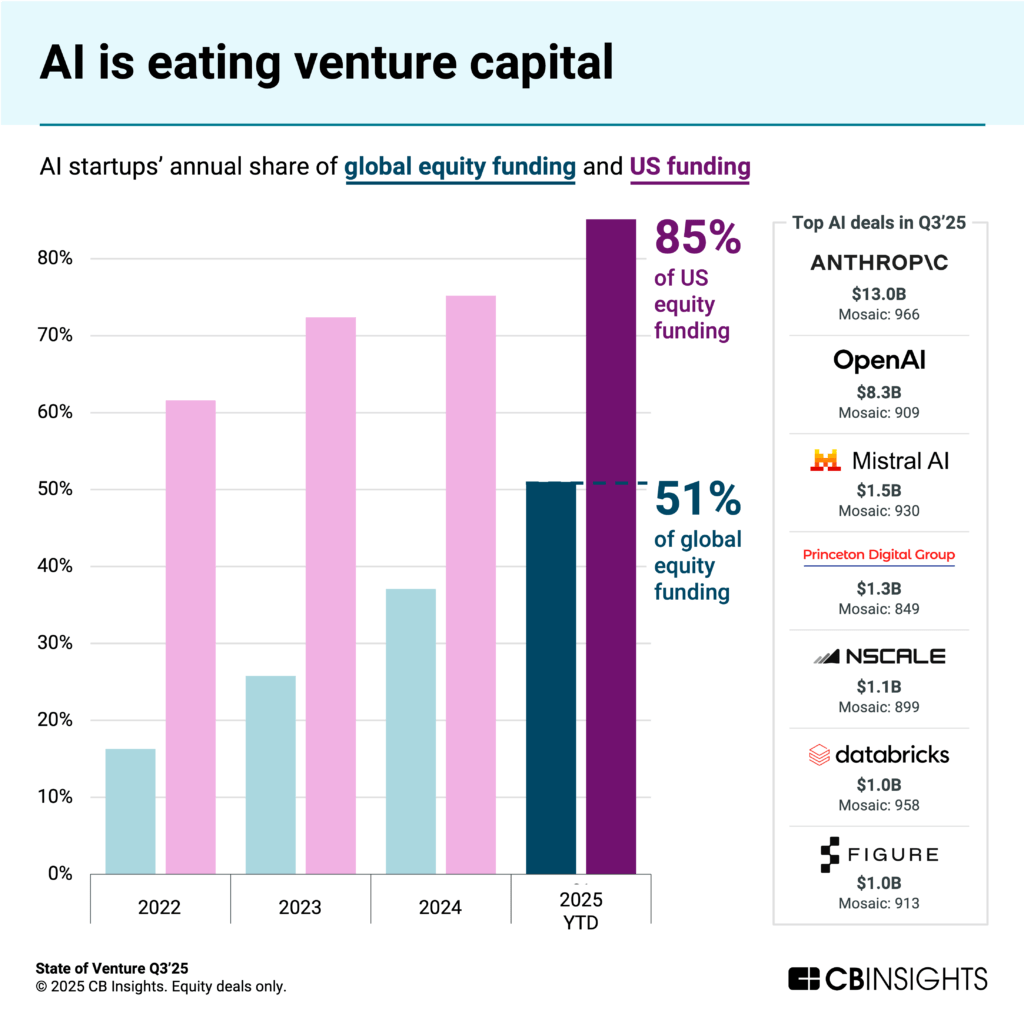

2. AI is on track to capture over 50% of total annual venture funding for the first time

AI companies are capturing a record share of funding and deals this year, at 51% of funding and 22% of deals. They also claimed 7 of the 10 largest rounds this quarter.

The US is proving especially dominant in AI, attracting 85% of total AI funding and 53% of deals in 2025. Four of the 7 largest rounds this quarter were based in the US: Anthropic, OpenAI, Databricks, and Figure.

Funding to AI-enabled companies is also taking a significant share of traditional sectors:

- Retail tech declined to $5.4B, its lowest quarter since Q3’24, with AI startups raising 36% of annual funding.

- Digital health fell to $4.5B, marking its weakest quarter since Q4’24, with AI startups representing 63% of the sector so far this year.

- Fintech remained flat at $10.9B quarterly, with AI firms accounting for 23% of total fintech funding in Q3’25, its 2nd highest quarter on record.

AI is creating a clear split in the venture ecosystem, with AI startups capturing an outsized share of capital and mega-rounds, while non-AI startups face tighter funding conditions.

The rapid rise in AI valuations raises questions about long-term sustainability, as many companies are priced for winner-take-all outcomes across categories, particularly in saturated markets like coding agents & copilots, where dozens of similar startups compete as margins tighten.

The current environment reflects a flight to quality. While AI continues to drive momentum and capital concentration, the market is gradually shifting toward fundamentals — where execution and efficiency, not just promise, will determine which companies justify their valuations.

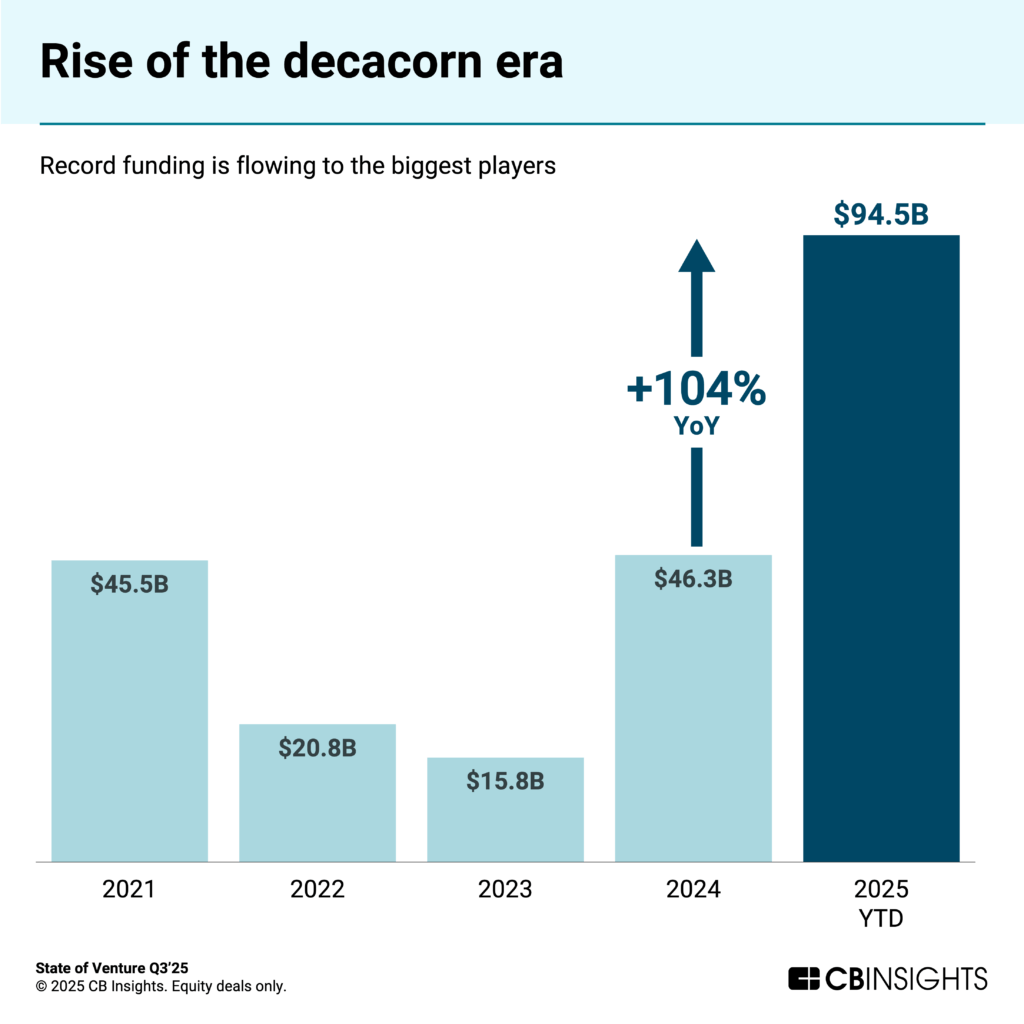

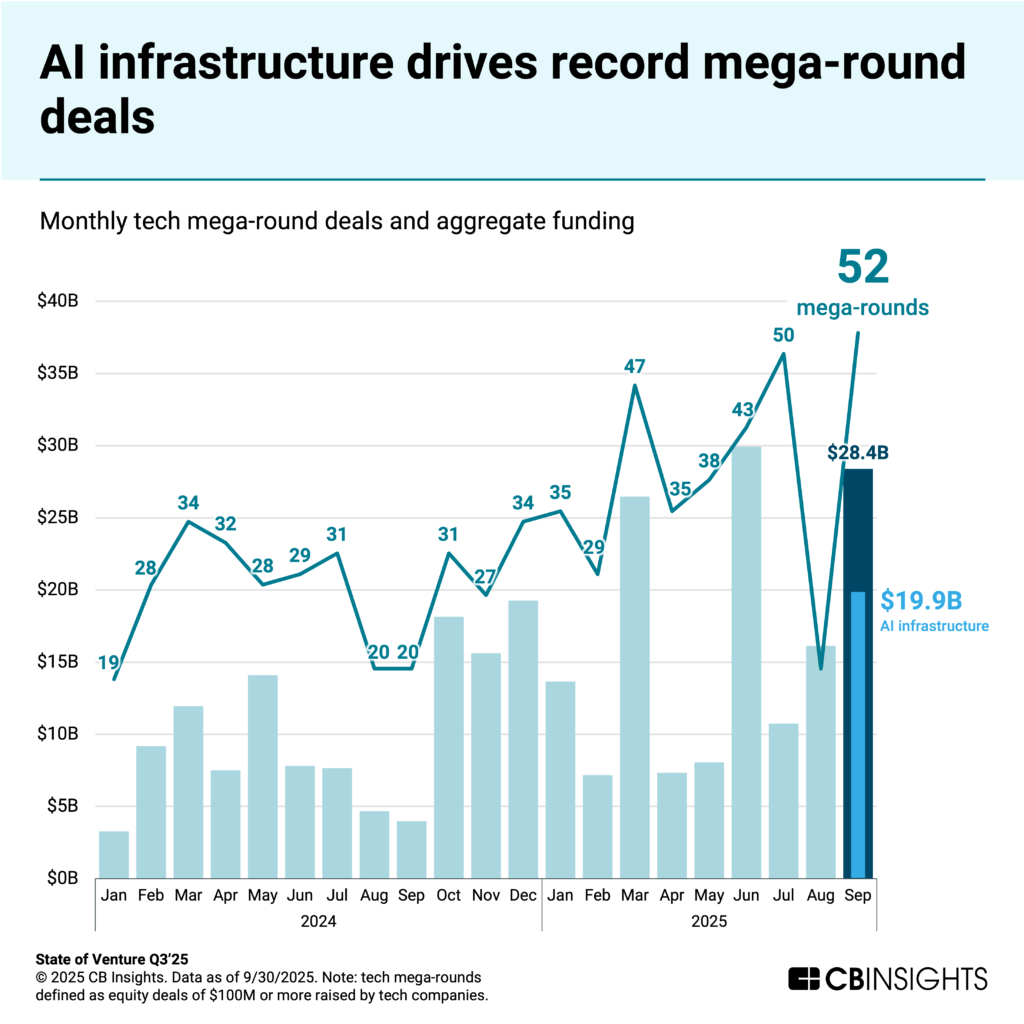

3. Decacorns raise record funding, as quarterly tech mega-rounds reach a new high

The venture landscape is moving beyond unicorns to decacorns — companies valued at $10B or more. Decacorns raised a record $94.5B through Q3’25, surpassing the previous record of $46.3B in 2024.

However, the number of decacorn deals is almost half as much as it was in 2021 when it reached $45.5B — from 60 deals to 32 this year — revealing the high funding concentration among the very largest companies — primarily leading AI startups.

AI leaders raising at decacorn valuations include developers xAI, Scale, and Perplexity, defense startups Anduril and Helsing, and fintech company Ramp.

Beyond decacorns, $100M+ mega-rounds for tech companies also hit record levels. September saw 52 tech mega-rounds in total, with 70% of capital allocated to companies focused on making AI infrastructure more affordable at scale.

Many AI infrastructure companies that raised mega-rounds in Q3’25 have already generated substantial revenue. Invisible Technologies reached $134M in 2024, Baseten reportedly grew 10x YoY, while Rebellions projected $72M in revenue. This shift separates real businesses from overvalued concepts as scrutiny intensifies.

Decacorns and mega-rounds are defining the current venture landscape. The market is bifurcating not only between AI companies and the rest, but also between decacorns and mega-round recipients vs. everyone else.

We expect the gap between well-funded companies and the rest of the venture ecosystem to continue widening as capital concentrates among market leaders who are building critical infrastructure and enterprise solutions.

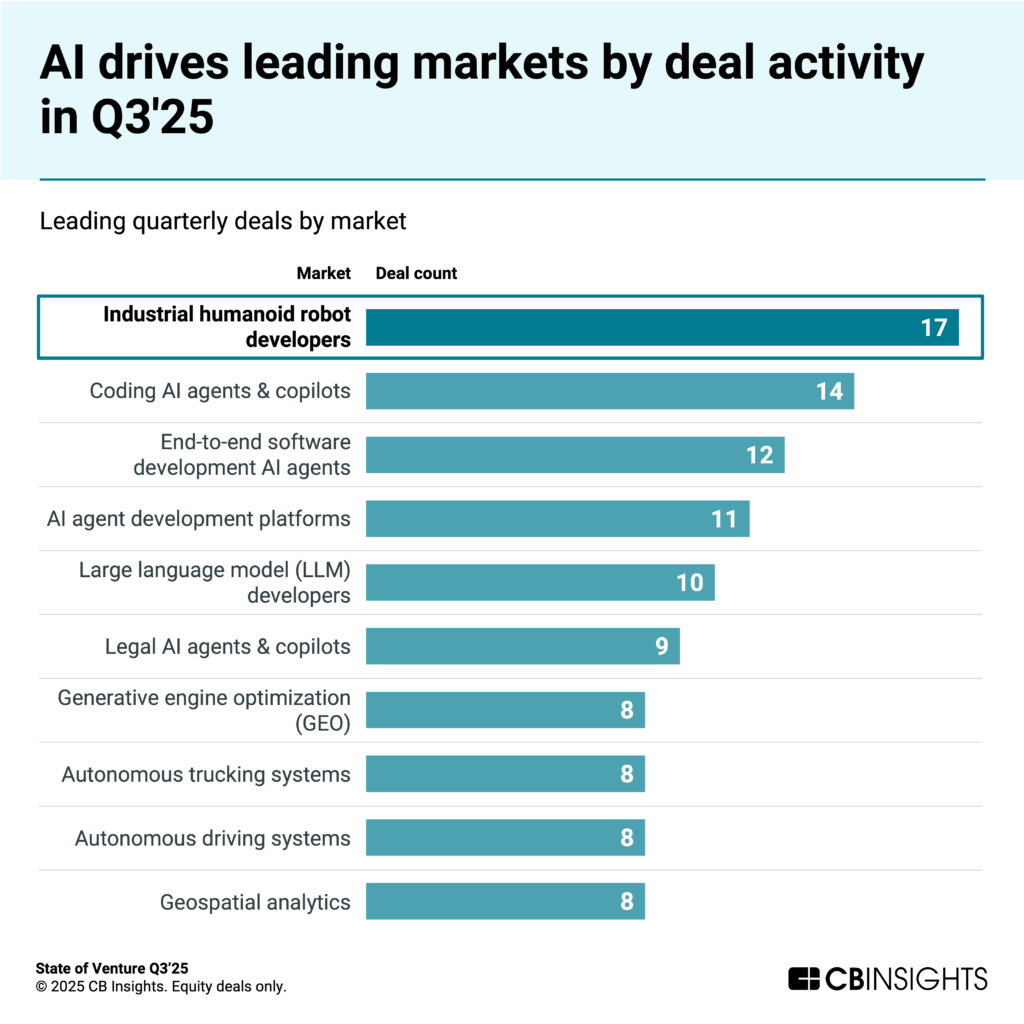

4. Humanoid robots captured the most deals for the 2nd quarter in a row

AI markets dominated the most active deals in Q3’25, including AI-powered humanoids, AI software applications, and autonomous driving.

Industrial humanoid robots captured 17 deals — more than any other market — continuing momentum from Q2’25, when it also led with 23 deals. New humanoid robot unicorns also emerged — Zhiyuan Robot and Unitree Robotics — bringing the total to 4.

Humanoid deal activity extended outside of the industrial sector in Q3. Healthcare humanoid robots secured 7 deals, ranking just outside of the top 10 markets. Figure led both the industrial and healthcare humanoid markets, raising a $1B Series C round at a $39B valuation, making it the 9th most valuable private company globally.

Investor interest in humanoid robots is driven partly by physical AI enabling new robotics capabilities, giving humanoids commercial promise that was not previously possible.

But despite deal activity and future potential, humanoids remain years away from widespread deployment. Developers still face fundamental challenges with inference, dexterity, reliability, and cost, which limit initial use cases to structured environments like factories and warehouses with a controlled and predictable set of tasks.

Autonomous driving showed particular strength among markets powered by physical AI. Both autonomous trucking systems and autonomous driving systems captured 8 deals each, ranking among the most active markets by deal count, alongside prominent AI categories such as coding AI agents, AI agent development platforms, and LLM developers.

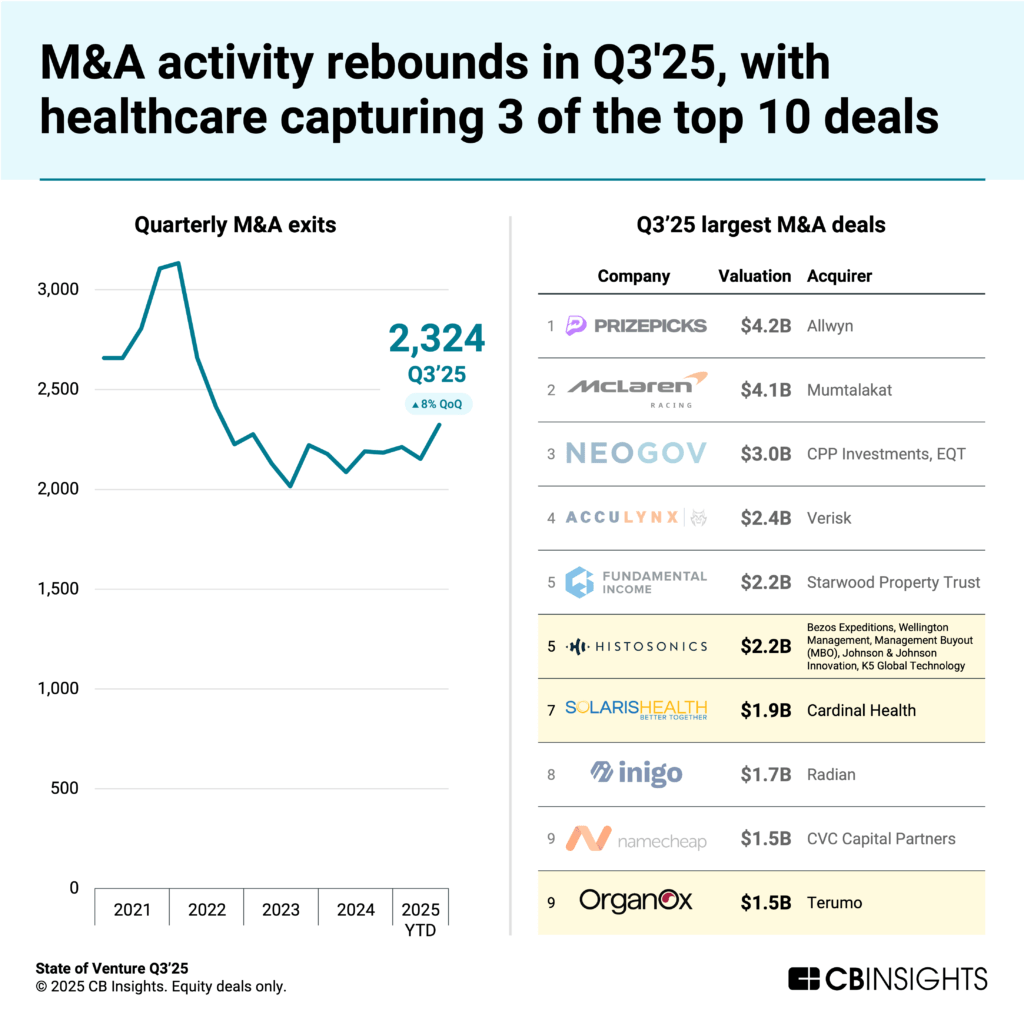

5. Exits are rebounding despite companies staying private longer

Exits are recovering, but the numbers also reveal a fundamental shift in how long startups remain private before going public or getting acquired.

M&A and IPO activity both rebounded in Q3’25, partly driven by maturing AI startups that created more exit opportunities. M&A deals rose 8% from last quarter to 2,324 — the highest total since Q3’22. AI M&A activity remained elevated at 172 deals, contributing to the increase.

Fintech M&A contributed heavily to the rebound, rising to 249 deals — its highest level since Q1’22. Healthcare M&A also hit its strongest level since Q1’23, with 3 of the top 10 M&A transactions going to healthcare companies.

IPO activity climbed 45% from 95 to 138 — the highest quarterly total since Q3’23. AI and fintech contributed to the uptick, but software companies dominated the largest offerings. The biggest IPOs went to Figma and Klarna. The only hardware exception was China-based Best Semi, a semiconductor equipment manufacturer.

The Q3 exit rebound reflects improving conditions and suggests a broader recovery ahead, especially if interest rates continue to decline.

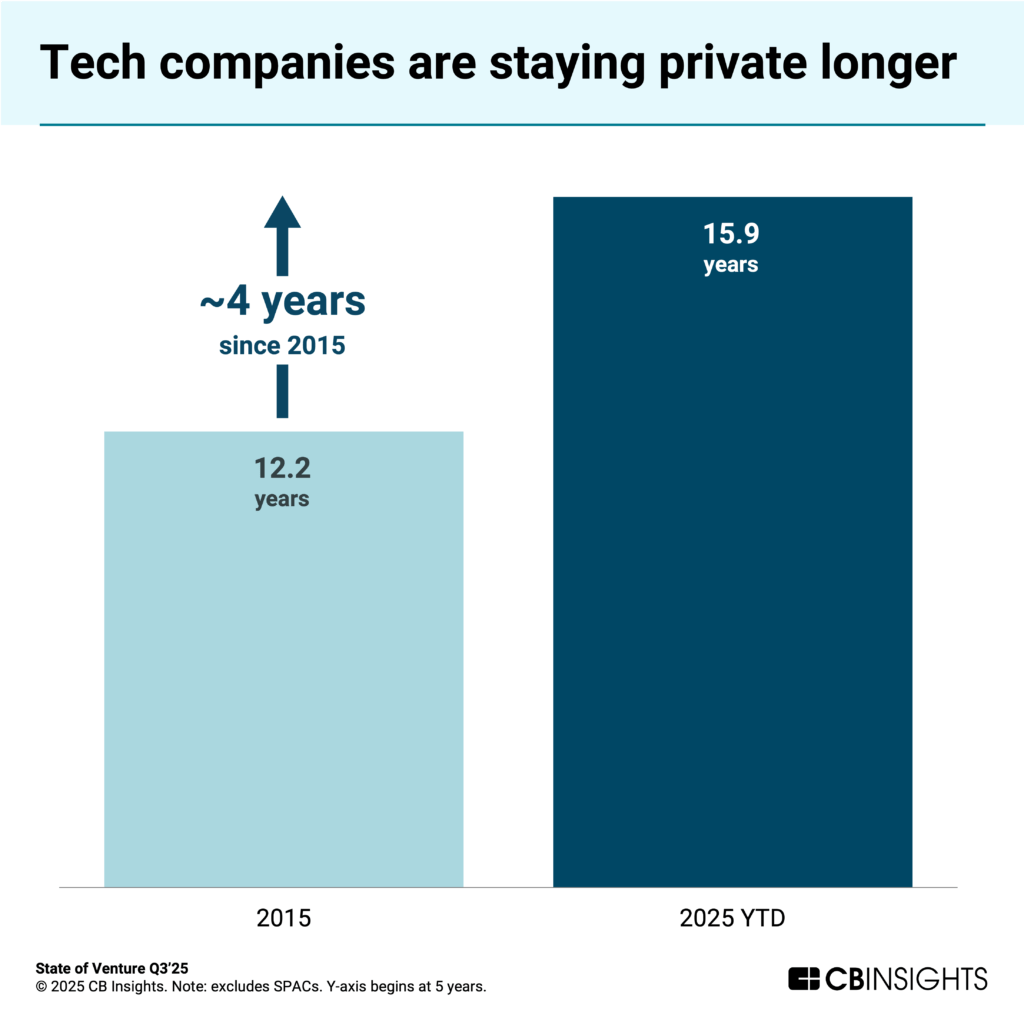

Despite increased exit activity, companies are staying private longer, with the time to exit rising from 12.2 years in 2015 to 15.9 years in 2025.

The ability to raise at decacorn valuations while staying private removes the pressure to go public for capital. Companies can now scale to a massive size, hire top talent through liquid secondary markets, and maintain founder control — all without the quarterly earnings pressure or regulatory burdens associated with going public.

Exit levels are recovering, suggesting that the market is normalizing, but the structural shift toward longer private tenures is likely to remain. The venture lifecycle is undergoing a fundamental change, with companies now possessing viable paths to scale privately that did not exist a decade ago.

If you aren’t already a client, sign up for a free trial to learn more about our platform.

RELATED RESOURCES FROM CB INSIGHTS:

- State of Venture Q2’25 Report

- State of Fintech Q3’25 Report

- State of AI Q2’25 Report

- State of Digital Health Q2’25 Report

- State of Insurtech Q2’25 Report

- State of Tech Exits H1’25

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign up for a free trial to learn more about our platform.