Celestial AI

Founded Year

2020Stage

Series C - II | AliveTotal Raised

$593.87MValuation

$0000Last Raised

$255M | 8 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+15 points in the past 30 days

About Celestial AI

Celestial AI focuses on artificial intelligence (AI) infrastructure solutions within the technology sector. The company has developed a platform called Photonic Fabric, which aims to improve optical interconnects for AI computing scaling and system performance. Celestial AI's innovations are intended for the AI computing and networking fields, responding to the needs for bandwidth and latency in AI training and inferencing. Celestial AI was formerly known as Inorganic Intelligence. It was founded in 2020 and is based in Santa Clara, California.

Loading...

Celestial AI's Products & Differentiators

Photonic Fabric Technology Platform

Photonic Fabric is a full stack interconnect solution. It uses a thermally stable modulator that can be integrated directly into a high-power AI ASIC. This allows us to deliver data directly at the point of consumption. This allows us to be unconstrained by the ASIC beachfront and hence achieve an industry leading bandwidth density of 1.8 Tbps/mm2 . Photonic Fabric also includes technology components that allow us to be protocol adaptive and support any protocol including HBM, DDR, CXL or other proprietary protocols. We can therefore deliver solutions (e.g. chiplets or IP) that enable customers to build compute-to-compute or compute-to-memory interconnects. Our Gen1 technology offers up to 14.4 Tbps bandwidth per chiplet with Gen 2 bandwidth 4x of Gen1

Loading...

Research containing Celestial AI

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Celestial AI in 1 CB Insights research brief, most recently on Sep 13, 2024.

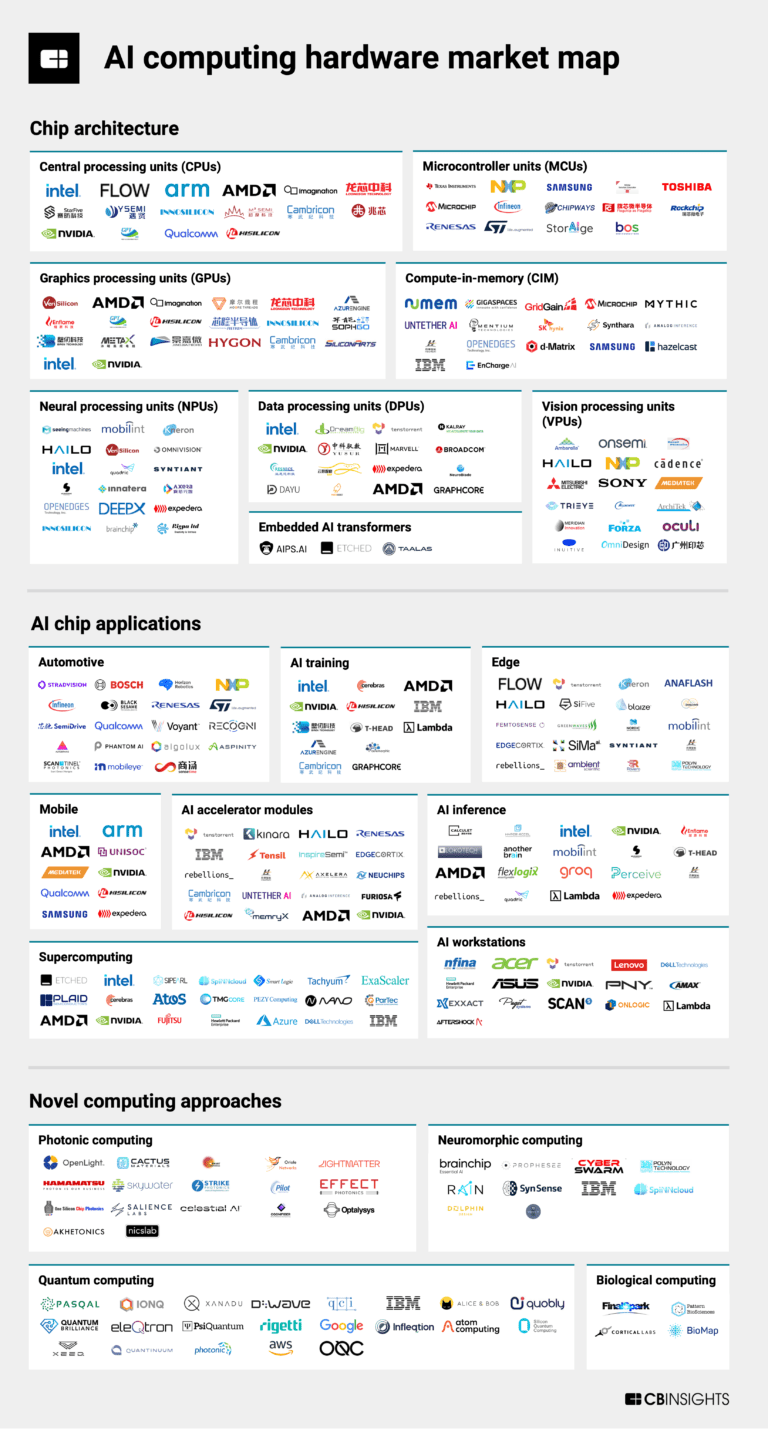

Sep 13, 2024

The AI computing hardware market mapExpert Collections containing Celestial AI

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Celestial AI is included in 3 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,309 items

Semiconductors, Chips, and Advanced Electronics

7,494 items

Companies in the semiconductors & HPC space, including integrated device manufacturers (IDMs), fabless firms, semiconductor production equipment manufacturers, electronic design automation (EDA), advanced semiconductor material companies, and more

Artificial Intelligence (AI)

20,630 items

Celestial AI Patents

Celestial AI has filed 33 patents.

The 3 most popular patent topics include:

- integrated circuits

- photonics

- computer buses

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

9/6/2022 | 4/8/2025 | Computer memory, Video cards, Parallel computing, Vector supercomputers, Computer buses | Grant |

Application Date | 9/6/2022 |

|---|---|

Grant Date | 4/8/2025 |

Title | |

Related Topics | Computer memory, Video cards, Parallel computing, Vector supercomputers, Computer buses |

Status | Grant |

Latest Celestial AI News

Nov 12, 2025

Next-gen networking tech, sometimes powered by light instead of electricity, is emerging as a critical piece of AI infrastructure. Comment Save this story The new era of Silicon Valley runs on networking—and not the kind you find on LinkedIn. As the tech industry funnels billions into AI data centers , chip makers both big and small are ramping up innovation around the technology that connects chips to other chips, and server racks to other server racks. Networking technology has been around since the dawn of the computer, critically connecting mainframes so they can share data. In the world of semiconductors, networking plays a part at almost every level of the stack—from the interconnect between transistors on the chip itself, to the external connections made between boxes or racks of chips. Chip giants like Nvidia, Broadcom, and Marvell already have well-established networking bona fides. But in the AI boom, some companies are seeking new networking approaches that help them speed up the massive amounts of digital information flowing through data centers. This is where deep-tech startups like Lightmatter, Celestial AI, and PsiQuantum, which use optical technology to accelerate high-speed computing, come in. Optical technology, or photonics, is having a coming-of-age moment. The technology was considered “lame, expensive, and marginally useful,” for 25 years until the AI boom reignited interest in it, according to PsiQuantum cofounder and chief scientific officer Pete Shadbolt. (Shadbolt appeared on a panel last week that WIRED cohosted.) Some venture capitalists and institutional investors, hoping to catch the next wave of chip innovation or at least find a suitable acquisition target, are funneling billions into startups like these that have found new ways to speed up data throughput. They believe that traditional interconnect technology, which relies on electrons, simply can’t keep pace with the growing need for high-bandwidth AI workloads. “If you look back historically, networking was really boring to cover, because it was switching packets of bits,” says Ben Bajarin, a longtime tech analyst who serves as CEO of the research firm Creative Strategies. “Now, because of AI, it’s having to move fairly robust workloads, and that’s why you’re seeing innovation around speed.” Big Chip Energy Bajarin and others give credit to Nvidia for being prescient about the importance of networking when it made two key acquisitions in the technology years ago. In 2020, Nvidia spent nearly $7 billion to acquire the Israeli firm Mellanox Technologies, which makes high-speed networking solutions for servers and data centers. Shortly after, Nvidia purchased Cumulus Networks, to power its Linux-based software system for computer networking. This was a turning point for Nvidia, which rightly wagered that the GPU and its parallel-computing capabilities would become much more powerful when clustered with other GPUs and put in data centers. While Nvidia dominates in vertically-integrated GPU stacks, Broadcom has become a key player in custom chip accelerators and high-speed networking technology. The $1.7 trillion company works closely with Google, Meta, and more recently, OpenAI, on chips for data centers. It’s also at the forefront of silicon photonics. And last month, Reuters reported that Broadcom is readying a new networking chip called Thor Ultra, designed to provide a “critical link between an AI system and the rest of the data center.” On its earnings call last week, semiconductor design giant ARM announced plans to acquire the networking company DreamBig for $265 million. DreamBig makes AI chiplets—small, modular circuits designed to be packaged together in larger chip systems—in partnership with Samsung. The startup has "interesting intellectual property ... which [is] very key for scale-up and scale-out networking" said ARM CEO Rene Haas on the earnings call. (This means connecting components and sending data up and down a single chip cluster, as well as connecting racks of chips with other racks.) Light On Lightmatter CEO Nick Harris has pointed out that the amount of computing power that AI requires now doubles every three months—much faster than Moore’s Law dictates. Computer chips are getting bigger and bigger. “Whenever you’re at the state of the art of the biggest chips you can build, all performance after that comes from linking the chips together,” Harris says. His company’s approach is cutting-edge and doesn’t rely on traditional networking technology. Lightmatter builds silicon photonics that link chips together. It claims to make the world’s fastest photonic engine for AI chips , essentially a 3D stack of silicon connected by light-based interconnect technology. The startup has raised more than $500 million over the past two years from investors like GV and T. Rowe Price. Last year, its valuation reached $4.4 billion. “The future of computing is really about light,” Harris says. “You’re obviously going to have electronics, and software is an absolutely critical piece of this, too, but at this level of computing you need new ideas, and a big chunk of the new frontier of computers involves light.” The startup Celestial AI has also attracted attention—and investors—for its optical interconnect technology. Earlier this year it raised $250 million from Fidelity Management, BlackRock, Tiger Global Management, Temasek, AMD, and others. Intel CEO Lip-Bu Tan recently joined the company’s board of directors. And in September, PsiQuantum raised $1 billion from BlackRock, Ribbit Capital, and Nvidia’s venture arm NVentures. PsiQuantum, which uses optical technology to build chips for quantum computers, is now valued at $7 billion. Optical networking technology is not a shoo-in, though. It’s expensive to build and requires highly specialized equipment. It also has to be able to “plug in” to existing electrical systems. Bajarin points out that companies like Broadcom and Marvell have the expertise and resources to work with hyperscalers and cater to their specific needs in both AI datacenter chips and networking. Regardless of whether they’re using traditional networking tech or the more cutting edge photonics, these companies know how to scale. “Networking is the thing that makes computers function, but it just feels like the industry is moving towards much more customization, which might be harder for the small guys,” Bajarin says. That doesn’t mean the upstarts don’t have valuable IP, he adds. The demand for faster data speeds, and therefore better networking tech, is only growing. But the payoff for experimental startups might still be years down the line. “We all believe there will be a world with a photonics future,” Bajarin says, “but it’s still a ways away.” This is an edition of the Model Behavior newsletter . Read previous newsletters here.

Celestial AI Frequently Asked Questions (FAQ)

When was Celestial AI founded?

Celestial AI was founded in 2020.

Where is Celestial AI's headquarters?

Celestial AI's headquarters is located at 2962 Bunker Hill Lane, Santa Clara.

What is Celestial AI's latest funding round?

Celestial AI's latest funding round is Series C - II.

How much did Celestial AI raise?

Celestial AI raised a total of $593.87M.

Who are the investors of Celestial AI?

Investors of Celestial AI include Temasek, Porsche Automobil Holding, Samsung Catalyst, Koch Disruptive Technologies, Xora Innovation and 21 more.

Who are Celestial AI's competitors?

Competitors of Celestial AI include Avicena Tech and 4 more.

What products does Celestial AI offer?

Celestial AI's products include Photonic Fabric Technology Platform and 1 more.

Loading...

Compare Celestial AI to Competitors

Akhetonics focuses on the development of all-optical general-purpose processors for computing and artificial intelligence in the technology sector. Its main offerings include a cross-domain processing unit that operates entirely in the optical domain, providing low power and fast computing capabilities without the need for electronic signal conversion. It was founded in 2021 and is based in Berlin, Germany.

Lightelligence specializes in the development of optical chips for computing within the technology sector. Their chips are designed to process information using light, resulting in high speed, low latency, and low power consumption, compared to electronic architectures. The company operates at the intersection of hardware and software co-design, with a focus on special-purpose computing. It was founded in 2017 and is based in Pudong New Area, China.

Lightmatter works in silicon photonics within the computing and semiconductor industries. It develops photonic computing solutions, aims to support artificial intelligence infrastructure, and promotes industry collaboration through standardization efforts. The company's products serve to improve digital data processing and interconnectivity in artificial intelligence (AI) applications. It was founded in 2017 and is based in Mountain View, California.

Polaris Electro-Optics focuses on integrated photonics for the communications and computation sectors. The company provides photonics products for data transmission in applications including data centers, cloud computing, artificial intelligence, high-performance computing, and quantum computing. It was founded in 2021 and is based in Broomfield, Colorado.

Ayar Labs focuses on optical Input/Output solutions within the technology sector. The company offers products that facilitate data movement and improve compute efficiency for artificial intelligence (AI) systems, while also addressing costs, latency, and power consumption. Ayar Labs primarily serves the AI infrastructure industry and provides solutions for AI training and inference processes. Ayar Labs was formerly known as OptiBit. It was founded in 2015 and is based in San Jose, California.

Ranovus is focused on data center infrastructure through optical interconnect technology within the semiconductor industry. The company offers products including monolithic silicon photonics platforms and Quantum Dot Multi-Wavelength Lasers that can be used in data centers. Ranovus serves sectors that require optical interconnects, such as cloud computing and artificial intelligence (AI)/machine learning (ML) workloads. It was founded in 2012 and is based in Ottawa, Canada.

Loading...