Inpher

Founded Year

2015Stage

Acquired | AcquiredTotal Raised

$13.95MAbout Inpher

Inpher specializes in privacy-preserving machine learning and analytics within the technology sector. The company offers products that enable secure data collaboration and encrypted computations for generating business insights without compromising privacy. It was founded in 2015 and is based in New York, New York. In November 2024, Inpher was acquired by Arcium.

Loading...

Inpher's Product Videos

Inpher's Products & Differentiators

XOR

Privacy Enhanced Technology orchestration platform

Loading...

Research containing Inpher

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Inpher in 1 CB Insights research brief, most recently on Sep 6, 2023.

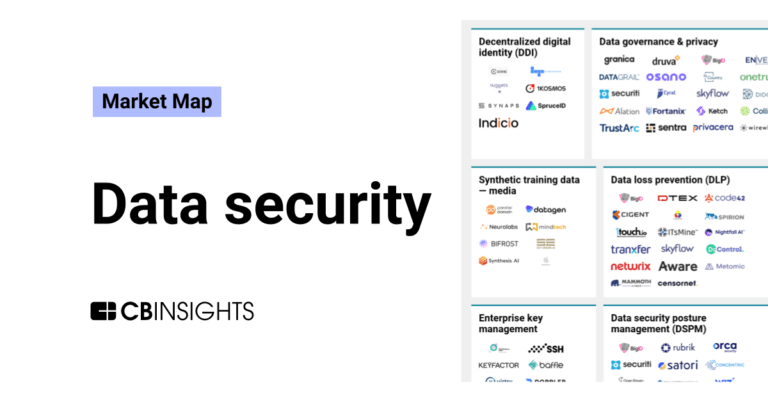

Sep 6, 2023

The data security market mapExpert Collections containing Inpher

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Inpher is included in 4 Expert Collections, including Regtech.

Regtech

1,453 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

Cybersecurity

11,251 items

These companies protect organizations from digital threats.

Fintech

9,809 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Artificial Intelligence (AI)

20,894 items

Inpher Patents

Inpher has filed 8 patents.

The 3 most popular patent topics include:

- cryptography

- theory of cryptography

- computer arithmetic

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

6/29/2021 | 8/1/2023 | Computer arithmetic, Cryptography, Numerals, Binary arithmetic, Numeral systems | Grant |

Application Date | 6/29/2021 |

|---|---|

Grant Date | 8/1/2023 |

Title | |

Related Topics | Computer arithmetic, Cryptography, Numerals, Binary arithmetic, Numeral systems |

Status | Grant |

Latest Inpher News

Sep 29, 2025

Growing adoption of homomorphic encryption in BFSI and healthcare for secure data computation. Austin, Sept. 29, 2025 (GLOBE NEWSWIRE) -- The Homomorphic Encryption Market Size was valued at USD 199.25 Million in 2024 and is expected to reach USD 346.04 Million by 2032 and grow at a CAGR of 7.16% over 2025-2032. The primary factor propelling the global homomorphic encryption market is the rising need for safe data processing in highly regulated industries like government, healthcare, and BFSI. These sectors deal with extremely sensitive data, including patient information, financial transactions, and defense data that must adhere to strict laws like the California Civil Code, the GDPR in Europe, and HIPAA in North America. Conventional encryption techniques can secure data while it is being stored or transported, but they still require decryption during processing, which introduces vulnerabilities. Compute over encrypted data without disclosing it at all thanks to homomorphic encryption, which completely eliminates that risk. Download PDF Sample of Homomorphic Encryption Market @ https://www.snsinsider.com/sample-request/8465 Key Players: NEC Zama Duality Technologies Enveil Inpher Cosmian CryptoExperts Galois Huawei Cloud ShieldIO Cornami DESILO CryptoLab Optalysys Homomorphic Encryption Market Report Scope: Market Size in 2024 USD 199.25 Million Market Size by 2032 USD 346.04 Million CAGR CAGR of 7.16% From 2025 to 2032 Base Year Forecast Period Historical Data Report Scope & Coverage Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook Key Segments • By Component (Solution, Services) • By Method (Full Encryption, Partial Encryption, Somewhat Encryption) • By Application (Secure Data Computation, Data Privacy, Data Monetization, Regulatory Compliance) • By End-Use (BFSI, Government, Healthcare, IT & Telecom, Retail, Education, Others) Customization Scope Available upon request Pricing Available upon request If You Need Any Customization on Homomorphic Encryption Market Report, I nquire Now https://www.snsinsider.com/enquiry/8465 Segmentation Analysis: By Component, in 2024, Solution Led the Market with 65.20% Share in 2024, while Services are the fastest-growing segment with a CAGR 7.32% In, 2024, the market was dominated by the solution segment as enterprises are continuing to prioritize the hardware-based custom solutions for ensuring secure data computation in the cloud technology. The fastest growing segment of the market is Services on account of the high demand for consulting, integration, and managed services that help organizations in the effective implementation of complex homomorphic encryption systems into their organizational environments. By Method, in 2024, Full Encryption Led the Market 48.08%, while Somewhat Encryption is Expected to be the Fastest-growing Segment with a CAGR 7.63% In 2024, the Full Encryption segment is the largest type in the Homomorphic Encryption Market as organizations dealing with sensitive data across BFSI, healthcare and government verticals prefers complete envelop of maximum security. Somewhat Encryption segment is the fastest-growing, which is a hybrid between fully and partially homomorphic encryption, offering some level of encryption and faster processing with lower computational overhead, making it a perfect fit for real-time applications and AI/ML workloads. By Application, in 2024, Secure Data Computation Held the Dominant Market Share of 40.08%, while Data Monetization is the Fastest-growing Segment with a CAGR 9.96% The Secure Data Computation segment dominated the market in 2024 due to the increasing need among organizations to perform analytics and operations on enquiries with sensitive datasets without exposing raw information. The Data Monetization segment is the fastest-growing one with the burgeoning need of enterprises to confidently share or sell encrypted datasets to partners or third parties By End Use, in 2024, BFSI Led the Market with Share of 30.14%, while Healthcare is the Fastest-growing Segment with a CAGR of 8.63% The Banking, Financial Services, and Insurance (BFSI) segment dominated the Homomorphic Encryption Market in 2024, as banks, insurance companies, and financial institutions work to securely compute sensitive data for fraud detection, risk assessment and regulatory compliance. Healthcare segment is the fastest growing segment, attributed to the adoption of privacy-preserving encryption in patient data analytics, collaborative research, and AI-driven diagnostics for hospitals, research centers, and pharmaceutical companies. North America was the Dominating Region in the Market; Asia Pacific is Emerging as the Fastest Growing Region in the Market over 2025-2032 The global Homomorphic Encryption market was led by the North America region in 2024, with more than 42.30% market share, owing to the presence of major technology players operating in this market including IBM Microsoft , and Alphabet , among others. The Homomorphic Encryption market in the Asia-Pacific region is anticipated to show the highest CAGR of 8.08% during the forecast period due to the rising digitization as well as the adoption of cloud computing. Recent Developments: In April 2024 Microsoft released updates to its SEAL (Simple Encrypted Arithmetic Library) homomorphic encryption library, enhancing its capabilities for secure computations on encrypted data. In October 2024 Alphabet introduced the Homomorphic Encryption Intermediate Representation (HEIR) compiler, aiming to simplify the development of homomorphic encryption applications. Buy Full Research Report on Homomorphic Encryption Market https://www.snsinsider.com/checkout/8465 Exclusive Sections of the Report (The USPs): Real-World Computation Statistics – helps you assess the operational efficiency of homomorphic encryption by tracking encrypted query throughput, AI/ML training success rates on encrypted datasets, and computational performance across FHE, partial, and somewhat HE methods. Data Sensitivity Metrics – helps you understand the scale and depth of adoption across highly regulated sectors (BFSI, Healthcare, Government) by analyzing the number of sensitive records encrypted and the total data volume processed without decryption. Innovation & Research Metrics – helps you evaluate the pace of technological advancement through annual algorithmic breakthroughs, latency reduction achievements via hardware/cloud accelerators, and the intensity of academic–corporate collaborations in HE innovation. Security Impact Metrics – helps you quantify the tangible cybersecurity benefits by measuring the number of security incidents prevented, average encryption duration during computation, and overall proportion of sensitive datasets processed fully encrypted. Ai Model Training Efficiency Index – helps you benchmark how effectively AI and ML models are being trained on encrypted datasets compared to unencrypted ones, offering insights into practical readiness for confidential AI deployments. Resource Optimization Benchmarks – helps you evaluate the trade-offs in CPU, GPU, and memory usage across HE variants, guiding infrastructure scaling and cost optimization decisions for enterprise deployments. About Us: SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world. CONTACT: Jagney Dave - Vice President of Client Engagement Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Inpher Frequently Asked Questions (FAQ)

When was Inpher founded?

Inpher was founded in 2015.

Where is Inpher's headquarters?

Inpher's headquarters is located at 36 West 25th Street, New York.

What is Inpher's latest funding round?

Inpher's latest funding round is Acquired.

How much did Inpher raise?

Inpher raised a total of $13.95M.

Who are the investors of Inpher?

Investors of Inpher include Arcium, Swisscom Ventures, Plug and Play Fintech Accelerator, Amazon Alexa Fund, Alpana Ventures and 14 more.

Who are Inpher's competitors?

Competitors of Inpher include Duality Technologies, Roseman Labs, Decentriq, Duality AI, Desilo and 7 more.

What products does Inpher offer?

Inpher's products include XOR and 1 more.

Who are Inpher's customers?

Customers of Inpher include ANZ Bank, BNY Mellon and CPPIB.

Loading...

Compare Inpher to Competitors

Enveil is a privacy-enhancing technology company that focuses on protecting data in use across various sectors. The company offers ZeroReveal solutions that enable secure data usage, collaboration, and monetization without compromising data privacy or security. Enveil's products are designed to allow organizations to extract insights and analyze data across boundaries and silos while maintaining the confidentiality and ownership of the underlying data. It was founded in 2016 and is based in Fulton, Maryland.

Duality Technologies focuses on secure data collaboration in the technology domain. The company offers a platform that enables organizations to collaborate and analyze data securely without ever decrypting it. It provides services such as privacy-protected artificial intelligence development and encrypted queries on secured datasets. It serves the financial services, healthcare, and marketing industries. The company was founded in 2016 and is based in Hoboken, New Jersey.

Omnisient specializes in data collaboration within the financial services and consumer brands sectors. The company provides a platform for businesses to share and monetize information while ensuring consumer privacy and data protection. Omnisient serves sectors including retail, telecommunications, healthcare, banking, insurance, and credit bureaus. It was founded in 2019 and is based in Cape Town, South Africa.

TripleBlind is a software company that specializes in privacy and security solutions. The company offers a Privacy Suite that facilitates HIPAA-compliant sharing of protected health data and a SecuriKey module that addresses account takeover attacks. The primary sectors served include healthcare for the Privacy Suite and general cybersecurity for SecuriKey. It was founded in 2019 and is based in Kansas City, Missouri.

Opaque provides AI solutions within the technology sector. The company offers a platform that allows organizations to run AI workloads on encrypted data, with a focus on privacy and data sovereignty through cryptographic verification. Opaque's services are utilized by sectors that require data handling, such as finance, insurance, and high-tech industries. It was founded in 2021 and is based in San Francisco, California.

Decentriq provides data clean rooms within the technology and data collaboration sectors. The company offers a platform for businesses to collaborate on sensitive data without sharing the actual data, using privacy technologies to ensure compliance. Decentriq serves industries such as media, healthcare, banking, and the public sector. It was founded in 2019 and is based in Zurich, Switzerland.

Loading...