Investments

1352Portfolio Exits

296Funds

32Partners & Customers

10Service Providers

3About Insight Partners

Insight Partners operates as a global software investor focused on technology, software, and Internet startup and ScaleUp companies. The company provides venture capital investment and growth-stage funding, as well as initial public offer (IPO) advisory services. It serves the technology sector and supports companies during their investment journey. Insight Partners was formerly known as Insight Venture Partners. It was founded in 1995 and is based in New York, New York.

Expert Collections containing Insight Partners

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Insight Partners in 8 Expert Collections, including Store tech (In-store retail tech).

Store tech (In-store retail tech)

56 items

Startups aiming work with retailers to improve brick-and-mortar retail operations.

Travel Technology (Travel Tech)

39 items

Tech-enabled companies offering services and products focused on tourism. This collection includes booking services, search platforms, on-demand travel and recommendation sites, among others.

Education Technology (Edtech)

58 items

CB Insights Smart Money Investors

25 items

CB Insights Fintech Smart Money Investors - 2020

25 items

CB Insights Consumer Smart Money Investors - 2020

25 items

Track the world's top-performing VC investors in consumer. Firms are presented in alphabetical order.

Research containing Insight Partners

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Insight Partners in 3 CB Insights research briefs, most recently on Feb 27, 2024.

Feb 27, 2024

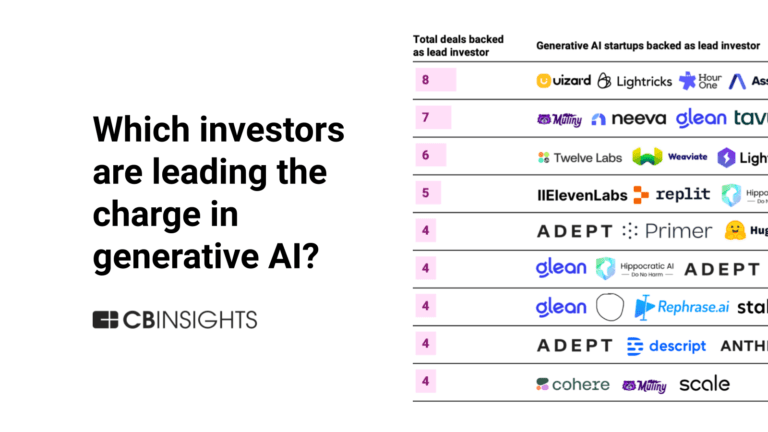

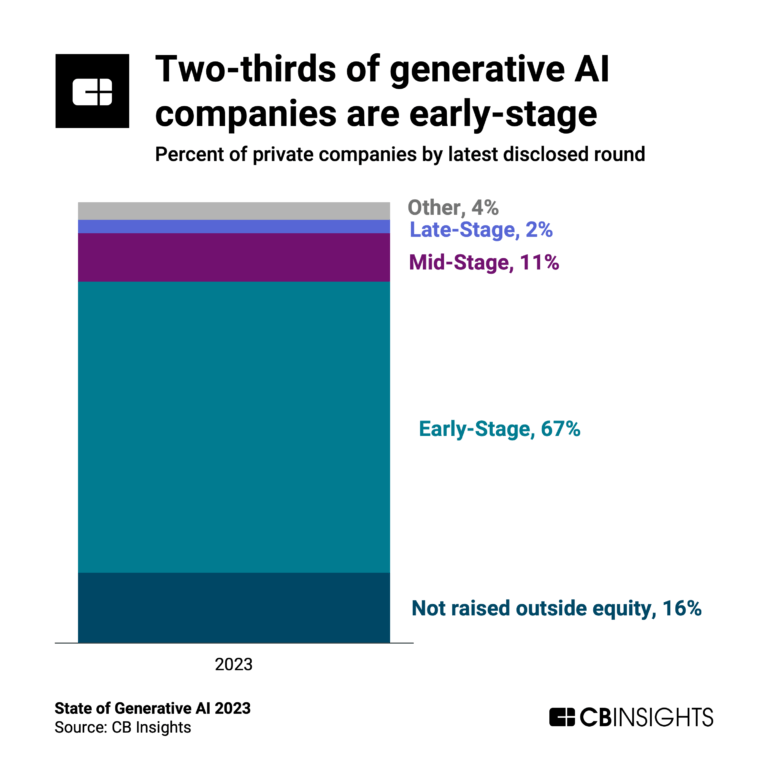

The generative AI boom in 6 chartsLatest Insight Partners News

Nov 18, 2025

Yet regulation has a funny way of sticking around, particularly when it's about something that people care about and are ready to spend their hard-earned dollars on. Over the past years, that crew has found a louder voice as right-wing politics have surged across the globe. Even the European Union, famous for defining everything from fish size to banana curvature, has started questioning the limits of its own bureaucracy. The proposed internal combustion ban is already being tested, and the mood has shifted from blind faith in oversight to cautious pragmatism. Still, two areas have refused to fade. Environmental rules may have begun to sputter, but privacy has not. It began in Brussels with the General Data Protection Regulation, a law that once looked like bureaucratic theater and now stands as one of the most consequential global exports of the century. California, New York City, São Paulo, and Singapore soon followed. Today, more than four-fifths of the world's population is covered by some form of privacy regulation, according to the International Association of Privacy Professionals The regulatory waves are real, and while opposition remains, others have learned to ride them. And for those standing on the sidelines, there's much to learn from the ones mastering the crest. One of those riders is Usercentrics, a Munich-born platform that quietly reached €100 million in annual recurring revenue this August. The task it has taken for itself is to help companies manage consented user data, which is about as plumbing-of-the-internet as one can get. And yet, the result is something the web has sorely lacked and clients are clearly ready to pay for, namely trust engineered at scale. From scandal to awareness “Cambridge Analytica was the canary in the coal mine,” said Brittany Kaiser , the whistleblower who helped expose how political campaigns harvested millions of Facebook profiles without consent “People thought data privacy was a fringe issue. Overnight, it became the story of our time,” she continued. Kaiser's revelations and those shared by others who joined the mission in 2018 triggered public outrage, and soon they would rewire global regulation and corporate behavior. “What shocked people wasn't the data collection itself, it was the realization of how invisible it all was,” she said. “Cambridge Analytica wasn't the first, and it definitely won't be the last. The issue was and remains structural.” Since then, the structure has started to subtly change. Governments moved fast, and Kaiser herself helped shape several of the first legislative frameworks for digital assets and data ownership in the U.S. “I worked on laws that made encryption, blockchain, and consent mechanisms explicitly legal,” she said. “If we didn't write those rights down, the conversation would've stayed too abstract for people to care.” Consumers, meanwhile, adapted to both ends of the spectrum In China, the trade-off between data privacy and state stability has been normalized to the point where social credit scores are no longer an issue. Elsewhere, users have grown used to giving up data for convenience and free services. When you do a search on Google, remember that you're paying with your data and purchase habits. Kaiser rejects the underlying logic of necessary trade-offs the modern platform economies have come to present. “It's a false dichotomy,” she said. “We don't have to trade our privacy to have technology that works. Companies can protect people and still make money. In fact, that's the only sustainable path forward.” And some are making bank by doing exactly that. Doing w ell by doing right by the customer's customer For Donna Dror, the CEO of Usercentrics , that path is the business. “We're focused on fixing what shouldn't be broken,” she told me. “Regulations might have pushed awareness, but the real driver is trust. Clients don't come to us because they fear penalties. They come because their customers demand confidence.” That confidence is fast becoming currency. According to Cisco's latest benchmark study , 95 percent of customers say they will not buy from organizations that don't protect their data. For companies like Usercentrics, the wave is much less about compliance and much more about the inherent opportunity therein. At the same time, the regulatory-tech industry, once the unglamorous plumbing of digital infrastructure, is becoming indispensable because of the growing sophistication of end-users, not all of whom have given up on their data. In fact, many players don't even see themselves as compliance businesses anymore. “We help companies grow through trust,” Dror said. “Privacy is a design principle, not an afterthought.” Oscar Rodriguez, Vice President of Product at LinkedIn , sees the same pattern. “Trust and authenticity is going to matter more than anything else online,” he said. LinkedIn's answer to the growing trust gap has been to invest in verifications. Verification badges on the platform allow members to build trust by showing that specific information about their account such as their identity or workplace has been confirmed. Rodriguez explained that verified profiles get 60 percent more views and 30 percent more connection requests, showing that the users themselves gravitate towards features that embed trust natively into the platforms. There are now over 90 million verified members and counting, with 75 people verifying every minute. “No system is perfect,” Rodriguez said. “But continuous verification, proof that you are who you say you are, builds confidence that scales.” Now, LinkedIn is working to bring those verifications to partner platforms off of LinkedIn, to help boost trust and authenticity further across the internet. "The future of the internet will hinge on verifiable trust,” Rodriguez continued. “That's what keeps people, companies, and markets functioning.” Dror agrees. “When you think about it, trust is the new network effect,” she said. “The more transparent and consent-driven your ecosystem is, the more valuable it becomes.” With the end users ready to demand it, all businesses now needs to do is start delivering. Building companies with intention Behind every regulatory wave are investors who spot conviction before the crowd does. Elodie Dupuy, managing partner at Insight Partners , saw Usercentrics early. “Our sourcing tech picked it up in 2020,” she recalled in our interview. “Regulation was driving adoption, and that's one of the best forms of downside protection you can have.” Dupuy's thesis was that compliance budgets don't move much once committed. When paired with real demand, the result is resilience. “Every website you visit says Usercentrics at the bottom,” she said. “That's not a marketing choice. It's an infrastructure decision.” Soon after investing, Dupuy's team facilitated a merger with Denmark's , creating what she called “a perfect match” of technology and trust. “The gap in the market was obvious,” she said. “But most people don't act because they think regulatory tech is boring. The truth is, that's where the impact is.” Dror echoes the point. “This space rewards patience,” she said. “You can ignore the hype cycles, because what this is really about is building trust into the digital supply chain, one consent at a time.” That deliberate approach has delivered, with Usercentrics processing more than seven billion consents each month across 2.3 million websites and apps, leading to its €100m ARR earlier this October. For Kaiser, the fact that companies that put user consent and trust first are reaching such highs underscores broader truth. “Private-sector innovation is part of the solution,” she said. “The same way green tech helped translate climate regulation into business models, privacy tech is doing that for data rights.” Her own venture, AlphaTON Capital, is investing in tools that embed privacy and data ownership into blockchain-based ecosystems. “The goal isn't to run from regulation,” she said. “It's to build products that make compliance obsolete because they do the right thing by design.” That may sound idealistic, but the market is clearly catching up. Investor capital is flowing into consent-management, identity verification, and digital-trust infrastructure. Governments are codifying ownership rights for data and digital assets. And companies like Usercentrics, LinkedIn and AlphaTon are proving that scaling trust is not only possible but profitable. “We used to think of privacy as the brake pedal,” Dror said. “Now it's the accelerator. When customers know you respect their data, they stay, they share, and they spend.” Rodriguez puts it more simply. “Trust is the growth engine of the modern internet,” he said. The companies that treat regulation as gravity to navigate with, not to fight against, end up building sturdier businesses. The rest spend their time trying to rewrite the laws of nature, only to end up on the losing side of the battle. User consent may not be flashy, but its rise shows that even in an era obsessed with speed, trust remains the most scalable asset of all.

Insight Partners Investments

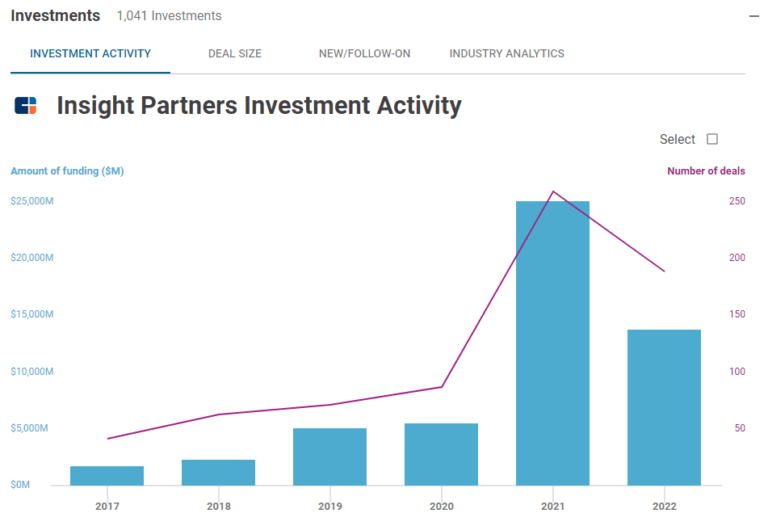

1,352 Investments

Insight Partners has made 1,352 investments. Their latest investment was in Mate Security as part of their Seed VC on November 17, 2025.

Insight Partners Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

11/17/2025 | Seed VC | Mate Security | $15.5M | Yes | Team8 | 2 |

11/12/2025 | Series B - II | Litmus | Yes | 2 | ||

11/12/2025 | Series B | Attentive.ai | $30.5M | Yes | 2 | |

11/11/2025 | Series A | |||||

11/6/2025 | Series B |

Date | 11/17/2025 | 11/12/2025 | 11/12/2025 | 11/11/2025 | 11/6/2025 |

|---|---|---|---|---|---|

Round | Seed VC | Series B - II | Series B | Series A | Series B |

Company | Mate Security | Litmus | Attentive.ai | ||

Amount | $15.5M | $30.5M | |||

New? | Yes | Yes | Yes | ||

Co-Investors | Team8 | ||||

Sources | 2 | 2 | 2 |

Insight Partners Portfolio Exits

296 Portfolio Exits

Insight Partners has 296 portfolio exits. Their latest portfolio exit was LibLab on November 14, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

11/14/2025 | Acquired | 3 | |||

11/10/2025 | Acquired | 4 | |||

10/7/2025 | Acquired | 2 | |||

Insight Partners Acquisitions

46 Acquisitions

Insight Partners acquired 46 companies. Their latest acquisition was Solovis on September 17, 2025.

Date | Investment Stage | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Total Funding | Note | Sources |

|---|---|---|---|---|---|---|

9/17/2025 | Series C | $29.75M | Acq - Fin | 4 | ||

5/5/2025 | Seed / Angel | $4.76M | Acq - Fin | 2 | ||

12/2/2024 | Series C | $24.24M | Acq - Fin | 2 | ||

10/28/2024 | Series C | |||||

12/19/2023 | Other |

Date | 9/17/2025 | 5/5/2025 | 12/2/2024 | 10/28/2024 | 12/19/2023 |

|---|---|---|---|---|---|

Investment Stage | Series C | Seed / Angel | Series C | Series C | Other |

Companies | |||||

Valuation | |||||

Total Funding | $29.75M | $4.76M | $24.24M | ||

Note | Acq - Fin | Acq - Fin | Acq - Fin | ||

Sources | 4 | 2 | 2 |

Insight Partners Fund History

32 Fund Histories

Insight Partners has 32 funds, including Insight Partners Continuation Fund III.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

10/15/2024 | Insight Partners Continuation Fund III | $1,500M | 1 | ||

5/18/2024 | Insight Partners Opportunities Fund II | $1,300M | 2 | ||

8/23/2023 | Insight Partners Fund XIII | $12,500M | 3 | ||

7/6/2023 | Vision Capital 2020 | ||||

3/18/2023 | Insight Partners Continuation Fund II |

Closing Date | 10/15/2024 | 5/18/2024 | 8/23/2023 | 7/6/2023 | 3/18/2023 |

|---|---|---|---|---|---|

Fund | Insight Partners Continuation Fund III | Insight Partners Opportunities Fund II | Insight Partners Fund XIII | Vision Capital 2020 | Insight Partners Continuation Fund II |

Fund Type | |||||

Status | |||||

Amount | $1,500M | $1,300M | $12,500M | ||

Sources | 1 | 2 | 3 |

Insight Partners Partners & Customers

10 Partners and customers

Insight Partners has 10 strategic partners and customers. Insight Partners recently partnered with 3Ventures on October 10, 2025.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

10/29/2025 | Partner | 3Ventures | Saudi Arabia | `` The partnership represents a strategic alignment of expertise and intent and reflects both 3Ventures and Insight Partners 's shared conviction in the future of Saudi Arabia 's innovation economy and our mutual belief that collaboration between local and global venture leaders is essential to scale new ecosystems sustainably , '' Deven Parekh , Insight Partners Managing Director , said . | 2 |

3/19/2021 | Distributor | Finland | `` The Insight Partners and Statzon have many synergies and this partnership will open up our niche targeted and meaningful strategic Industry insights and forecasts including the impact of Covid 19 to Statzon users . | 1 | |

3/18/2021 | Partner | United Kingdom | |||

3/5/2021 | Partner | ||||

2/1/2021 | Partner |

Date | 10/29/2025 | 3/19/2021 | 3/18/2021 | 3/5/2021 | 2/1/2021 |

|---|---|---|---|---|---|

Type | Partner | Distributor | Partner | Partner | Partner |

Business Partner | 3Ventures | ||||

Country | Saudi Arabia | Finland | United Kingdom | ||

News Snippet | `` The partnership represents a strategic alignment of expertise and intent and reflects both 3Ventures and Insight Partners 's shared conviction in the future of Saudi Arabia 's innovation economy and our mutual belief that collaboration between local and global venture leaders is essential to scale new ecosystems sustainably , '' Deven Parekh , Insight Partners Managing Director , said . | `` The Insight Partners and Statzon have many synergies and this partnership will open up our niche targeted and meaningful strategic Industry insights and forecasts including the impact of Covid 19 to Statzon users . | |||

Sources | 2 | 1 |

Insight Partners Service Providers

4 Service Providers

Insight Partners has 4 service provider relationships

Service Provider | Associated Rounds | Provider Type | Service Type |

|---|---|---|---|

J.P. Morgan Securities | Take Private | Other | Financial Advisor |

Service Provider | J.P. Morgan Securities | ||

|---|---|---|---|

Associated Rounds | Take Private | ||

Provider Type | Other | ||

Service Type | Financial Advisor |

Partnership data by VentureSource

Insight Partners Team

140 Team Members

Insight Partners has 140 team members, including current Founder, Managing Director, Jeffrey L. Horing.

Name | Work History | Title | Status |

|---|---|---|---|

Jeffrey L. Horing | Founder, Managing Director | Current | |

Name | Jeffrey L. Horing | ||||

|---|---|---|---|---|---|

Work History | |||||

Title | Founder, Managing Director | ||||

Status | Current |

Compare Insight Partners to Competitors

Advent International operates as a private equity investor that partners with management teams, entrepreneurs, and founders to work with businesses across various sectors. The company specializes in sectors such as business and financial services, consumer, healthcare, industrial, and technology, and provides expertise and guidance to its portfolio companies. Advent International uses its resources to assist these companies in reaching their goals. It was founded in 1984 and is based in Boston, Massachusetts.

The K Funds operates as a private equity investment firm investing in growth companies across various industries, including technology, software, consumer products, healthcare, information technology (IT), and services. The company also invests in other private equity funds, aligning with its investment objectives. It was founded in 2014 and is based in Los Angeles, California.

MVP Capital Partners operates as a private equity firm involved in later-stage buyouts and capital investments in lower-middle market companies across various industries. The firm provides equity investments and supports earlier-stage ventures with potential for scale. MVP Capital Partners serves sectors such as food and beverage, consumer products, pharmaceuticals, aviation, specialty retailing, niche manufacturing, healthcare, and business services. MVP Capital Partners was formerly known as Meridian Venture Partners. It was founded in 1985 and is based in Wayne, Pennsylvania.

Triansa Capital Partners operates in the finance sector. It focuses on managing deal flow of capital investments in sectors such as agtech, cleantech, and semiconductor manufacturing. It is based in New York, New York.

L Catterton operates in the private equity sector. The company specializes in investing in middle-market companies and emerging enterprises across segments of the consumer industry. It collaborates with management teams to enhance operational performance. It was founded in 1989 and is based in Greenwich, Connecticut.

BYWAY Capital operates as a private equity firm focused on supporting extraordinary entrepreneurs and managers across various sectors. The firm offers investment strategies, providing initial investments ranging from 1 to 10 million euros and the possibility of no-limit refinancing. BYWAY Capital is prepared for long-term commitments and operates with ultra-fast and flexible decision-making processes. It was founded in 2023 and is based in Paris, France.

Loading...