Investments

2036Portfolio Exits

655Funds

4Partners & Customers

10About Intel Capital

Intel Capital focuses on venture capital investment within the technology sector, specifically targeting early-stage startups. The company provides financial backing and support to companies involved in cloud computing, silicon technology, device innovation, and frontier technologies. Intel Capital primarily serves the technology ecosystem, investing in ventures within the computing domain. It was founded in 1991 and is based in Santa Clara, California.

Expert Collections containing Intel Capital

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Intel Capital in 7 Expert Collections, including AR/VR.

AR/VR

33 items

Store tech (In-store retail tech)

56 items

Startups aiming work with retailers to improve brick-and-mortar retail operations.

Grocery Retail Tech

16 items

Startups providing tools to grocery businesses to improve in-store operations. Includes IoT tools, customer analytics platforms, in-store robots, predictive inventory management systems,and more. (Does not include on-demand grocery delivery startups or online-only grocery stores)

Fortune 500 Investor list

590 items

This is a collection of investors named in the 2019 Fortune 500 list of companies. All CB Insights profiles for active investment arms of a Fortune 500 company are included.

Education Technology (Edtech)

58 items

Digital Lending

34 items

This collection contains alternative means for obtaining a loan for personal or business use. Companies included in the application, underwriting, funding, or collection process is included in the collection.

Research containing Intel Capital

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Intel Capital in 6 CB Insights research briefs, most recently on May 29, 2024.

May 29, 2024

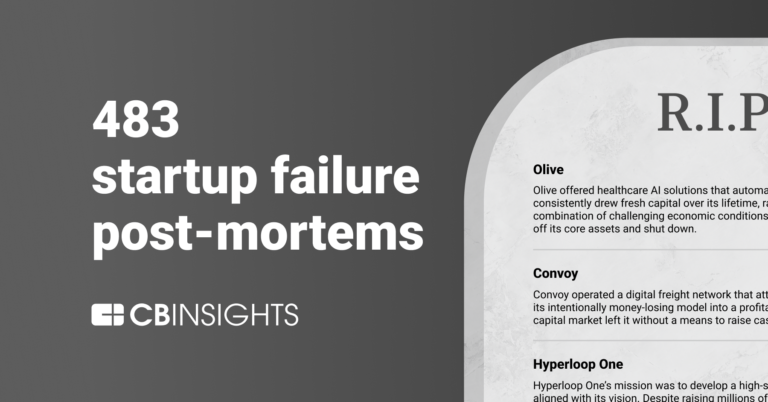

483 startup failure post-mortems

May 16, 2024 report

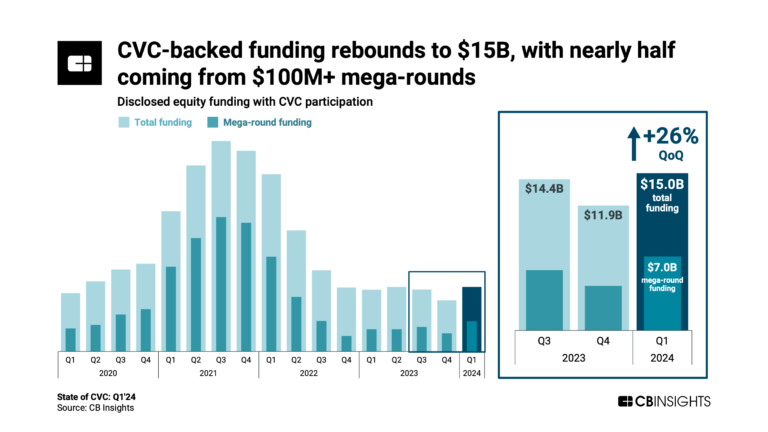

State of CVC Q1’24 Report

Mar 26, 2024

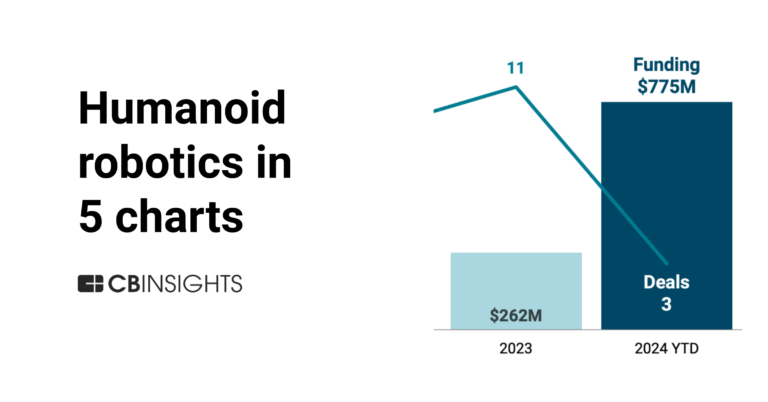

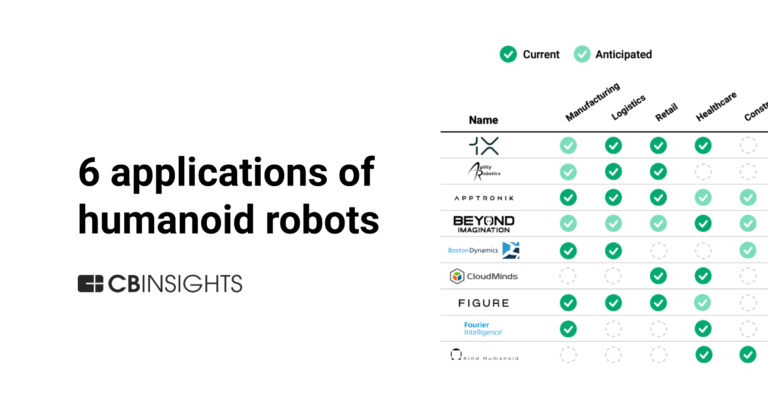

6 applications of humanoid robots across industries

Aug 1, 2023

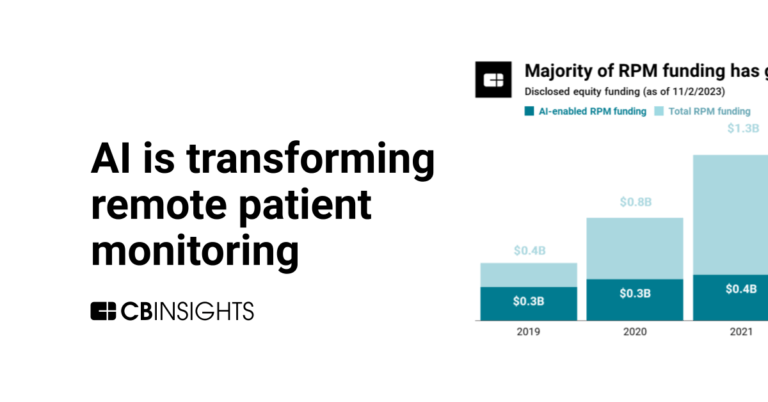

The state of healthcare AI in 5 chartsLatest Intel Capital News

Nov 14, 2025

Intel Capital veteran Chetty moves to utility National Grid’s VC unit Nov 14, 2025 • Robert Lavine Arun Chetty has joined National Grid Partners as senior partner as it boosts its digital tech investment capabilities. National Grid Partners (NGP), the strategic investment arm of energy utility National Grid, has hired former GCV Emerging Leader Arun Chetty as vice-president and senior partner. Chetty succeeds Andre Turenne, vice-president of investments for NGP, who sadly passed away earlier this year, and will focus on software and hardware that can modernise the grid. He tells GCV he is especially comfortable with hardware products such as sensors, robotics and internet-of-things technologies – “anything that has kind of a deep tech component”. “It’s got to deliver both financial return and really make a substantial difference for National Grid,” he says. “That gives a sense of satisfaction that you’ve contributed to something meaningful for the industry, as opposed to just making money for the company.” Chetty made the Emerging Leaders list in 2021 , during a 20-year stint with chipmaker Intel’s corporate venture unit, Intel Capital, where he worked his way up to managing partner. He has invested more than $300m in 45 startups in his career, achieving a 6X cash on cash return. “I’ve spent many years at Intel Capital and I’ve been through lots of up and down cycles,” he says. “We tweaked that organisation over the years and refined it into a really great machine, and there have been a lot of learnings in that process. I would love to be able to help implement some of those key learnings where it makes a difference.” The CVC work bookends a short period as a senior investment partner at Natcast, the non-profit organisation set up to run National Semiconductor Technology Center, the research and prototyping hub formed by the Biden administration’s CHIPS and Science Act in 2022. Natcast was subsequently forced to lay off most of its staff in September this year, when the US Commerce Department refused to supply the $7.4bn in payments pledged by the previous administration. Is there a perfect candidate in your organisation to be a GCV Rising Star or Emerging Leader next year? If so, make sure to get your nominations in by the deadline! Robert Lavine

Intel Capital Investments

2,036 Investments

Intel Capital has made 2,036 investments. Their latest investment was in Fabric8Labs as part of their Series C on November 13, 2025.

Intel Capital Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

11/13/2025 | Series C | Fabric8Labs | $50M | No | Ericsson Ventures, Lam Research Capital, Marunouchi Innovation Partners, Masco Ventures, NEA, SE Ventures, SK hynix, TDK Ventures, and Toppan Global Venture Partners | 3 |

11/6/2025 | Series B | Truffle Security | $25M | Yes | Abstract, Andreessen Horowitz, Casey Ellis, Emilio Escobar, Haroon Meer, and Lytical Ventures | 3 |

9/17/2025 | Seed VC | Mueon | $15.5M | Yes | 2 | |

9/16/2025 | Series C | |||||

9/9/2025 | Series D |

Date | 11/13/2025 | 11/6/2025 | 9/17/2025 | 9/16/2025 | 9/9/2025 |

|---|---|---|---|---|---|

Round | Series C | Series B | Seed VC | Series C | Series D |

Company | Fabric8Labs | Truffle Security | Mueon | ||

Amount | $50M | $25M | $15.5M | ||

New? | No | Yes | Yes | ||

Co-Investors | Ericsson Ventures, Lam Research Capital, Marunouchi Innovation Partners, Masco Ventures, NEA, SE Ventures, SK hynix, TDK Ventures, and Toppan Global Venture Partners | Abstract, Andreessen Horowitz, Casey Ellis, Emilio Escobar, Haroon Meer, and Lytical Ventures | |||

Sources | 3 | 3 | 2 |

Intel Capital Portfolio Exits

655 Portfolio Exits

Intel Capital has 655 portfolio exits. Their latest portfolio exit was Anodot on November 04, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

11/4/2025 | Acquired | 3 | |||

10/9/2025 | Acquired | 2 | |||

9/30/2025 | Acquired | 5 | |||

Date | 11/4/2025 | 10/9/2025 | 9/30/2025 | ||

|---|---|---|---|---|---|

Exit | Acquired | Acquired | Acquired | ||

Companies | |||||

Valuation | |||||

Acquirer | |||||

Sources | 3 | 2 | 5 |

Intel Capital Fund History

4 Fund Histories

Intel Capital has 4 funds, including Intel Capital Diversity Fund.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

6/9/2015 | Intel Capital Diversity Fund | $125M | 2 | ||

5/5/2014 | Intel Capital China Smart Device Innovation Fund | ||||

Intel Capital China Angel Fund | |||||

Intel Capital Experiences and Perceptual Computing Fund |

Closing Date | 6/9/2015 | 5/5/2014 | ||

|---|---|---|---|---|

Fund | Intel Capital Diversity Fund | Intel Capital China Smart Device Innovation Fund | Intel Capital China Angel Fund | Intel Capital Experiences and Perceptual Computing Fund |

Fund Type | ||||

Status | ||||

Amount | $125M | |||

Sources | 2 |

Intel Capital Partners & Customers

10 Partners and customers

Intel Capital has 10 strategic partners and customers. Intel Capital recently partnered with Taylor Wessing on June 6, 2022.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

6/9/2022 | Vendor | United Kingdom | 1 | ||

2/14/2022 | Partner | United States | The Investment Heard Around The World - SiFive As an Intel - IP partner , SiFive will offer our industry-leading portfolio of RISC-V-based processor IP to customers of Intel , supported by our partnership with Intel Capital 's $ IPB innovation fund , a collaboration between Intel Capital and Intel . | 2 | |

11/30/2021 | Partner | United States | Katana Graph and Intel Collaborate on Graph Analytics Python Library :: Katana Graph AUSTIN , TX - Katana Graph , the AI-powered graph intelligence company providing faster and more accurate insights on massive and complex data , announced today that it has released a high-performance graph analytics Python library in collaboration with Intel Capital . | 5 | |

2/13/2020 | Partner | ||||

4/2/2019 | Partner |

Date | 6/9/2022 | 2/14/2022 | 11/30/2021 | 2/13/2020 | 4/2/2019 |

|---|---|---|---|---|---|

Type | Vendor | Partner | Partner | Partner | Partner |

Business Partner | |||||

Country | United Kingdom | United States | United States | ||

News Snippet | The Investment Heard Around The World - SiFive As an Intel - IP partner , SiFive will offer our industry-leading portfolio of RISC-V-based processor IP to customers of Intel , supported by our partnership with Intel Capital 's $ IPB innovation fund , a collaboration between Intel Capital and Intel . | Katana Graph and Intel Collaborate on Graph Analytics Python Library :: Katana Graph AUSTIN , TX - Katana Graph , the AI-powered graph intelligence company providing faster and more accurate insights on massive and complex data , announced today that it has released a high-performance graph analytics Python library in collaboration with Intel Capital . | |||

Sources | 1 | 2 | 5 |

Intel Capital Team

42 Team Members

Intel Capital has 42 team members, including current Vice President, Senior Managing Director, Mark E. Rostick.

Name | Work History | Title | Status |

|---|---|---|---|

Mark E. Rostick | Vice President, Senior Managing Director | Current | |

Name | Mark E. Rostick | ||||

|---|---|---|---|---|---|

Work History | |||||

Title | Vice President, Senior Managing Director | ||||

Status | Current |

Compare Intel Capital to Competitors

Lightspeed Venture Partners invests in the enterprise, consumer, health, and financial technology sectors. The firm provides funding and support to entrepreneurs at various stages of their development. Lightspeed Venture Partners serves the startup ecosystem by offering financial resources and industry knowledge to companies within its targeted sectors. It was founded in 2000 and is based in Menlo Park, California.

Bessemer Venture Partners operates in the technology sectors and supports entrepreneurs in building companies. The company provides funding and guidance to startups at various growth stages, particularly in the enterprise, consumer, and healthcare areas. Its investment portfolio includes sectors such as artificial intelligence (AI) and machine learning (ML), biotechnology, cloud computing, consumer products, cybersecurity, fintech, and vertical software. It was founded in 1911 and is based in San Francisco, California.

Google Ventures operates as a venture capital firm investing in various sectors, including life sciences, consumer, enterprise, cryptocurrency, climate, and frontier technology. The firm provides financial backing and resources to startups and connects them with Google. It was founded in 2009 and is based in Mountain View, California.

Sequoia Capital operates as a venture capital firm focused on supporting startups from inception to initial public offering (IPO) within sectors. It provides investment funding and strategic support to help companies grow and succeed. Sequoia Capital primarily serves technology-driven sectors and businesses aiming to become market leaders. It was founded in 1972 and is based in Menlo Park, California.

Next47 focuses on investing in early and expansion-stage companies within the technology sector. The firm specializes in providing capital, domain expertise, and strategic resources to founders developing software as a service (SaaS), artificial intelligence (AI), and enterprise solutions. Next47 primarily serves the technology startup ecosystem, offering support to companies that are innovating and creating new categories in enterprise technology. Next47 was formerly known as Siemens Venture Capital. It was founded in 2016 and is based in Palo Alto, California.

Index Ventures operates as a venture capital firm focused on partnering with entrepreneurs across various industries. The company provides investment and strategic support to startups from seed stage, aiming to assist their development into businesses. Index Ventures serves the startup ecosystem, investing in early-stage companies and supporting them during their growth. It was founded in 1996 and is based in London, England.

Loading...