Investments

167Portfolio Exits

30Funds

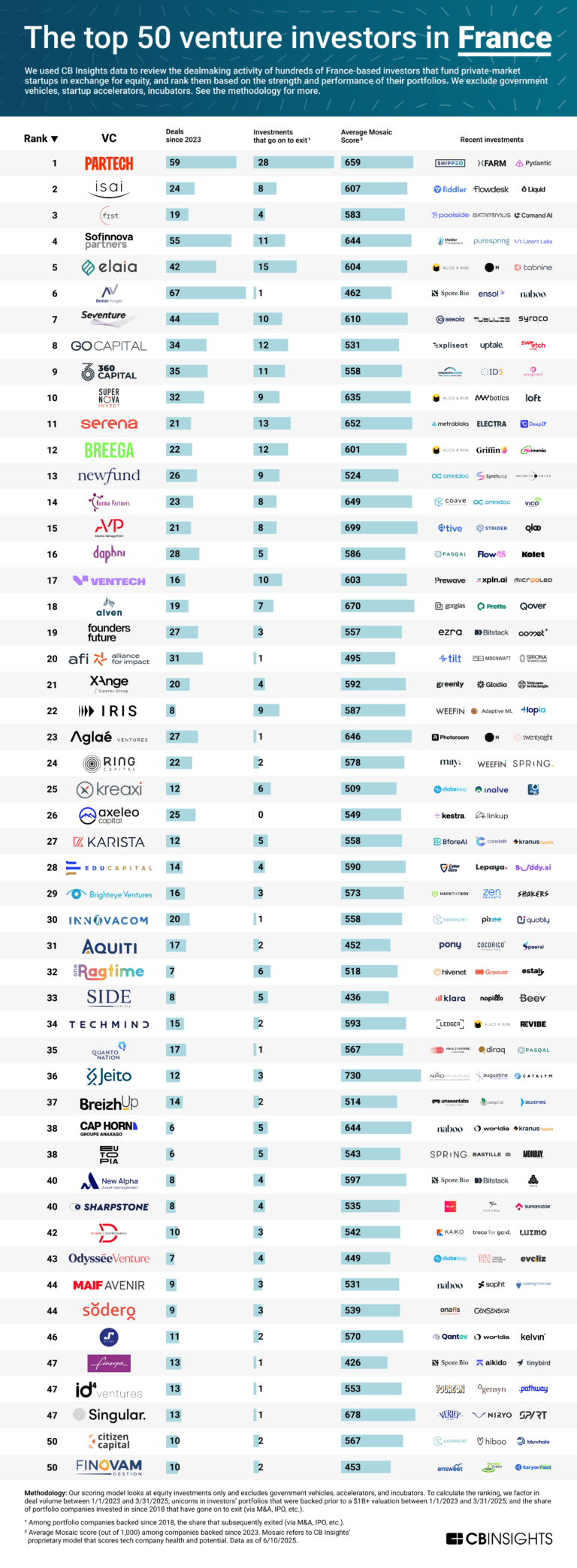

11Research containing ISAI

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned ISAI in 1 CB Insights research brief, most recently on Jun 13, 2025.

Jun 13, 2025

The top 50 venture investors in FranceLatest ISAI News

Nov 17, 2025

Leanspace raises €10 million Series A round to bring software-defined satellite operations to enterprise and institutional space programs STRASBOURG, November 17th, 2025 – Leanspace, a European satellite operations technology provider, today announced it has raised €10 million in Series A funding. The financing round includes new strategic investors: ISAI Cap Venture, Capgemini’s corporate venture arm, and Qwaltec, a US-based space and defense contractor, alongside historical investors specializing in space, defense, and enterprise software: VC firms 42CAP and Karista, and Arnaud Guérin, co-founder of military AI platform Preligens. Additional non-dilutive funding comes from Caisse d’Epargne and Bpifrance via the France 2030 strategic investment plan. The space industry is undergoing a rapid transformation with the rise of satellite constellations, dynamic missions, and increasing security demands. Yet, the technologies to operate space programs have struggled to keep pace, creating cost and complexity for spacecraft operators. With this new financing round and strategic alliances, Leanspace will accelerate the shift to software-defined satellite operations across European and North American markets. Founded in 2020, Leanspace has developed a software platform for satellite and ground segment operations that has been flight-proven and trusted by more than 20 spacecraft operators worldwide, with an initial focus on small satellite missions with customers such as Quantum Space (USA), Look Up (France), and Clearspace (Switzerland). Since 2024, the company has expanded into the enterprise and institutional markets, having already secured 7 contracts with space agencies and leading primes in Europe, the US, and Asia, such as Airbus Defense & Space (France), Hispasat (Spain), and the European Space Agency. Leanspace currently addresses 6 market segments: small satellites, in-orbit services vehicles, satellite constellations, launchers & spaceports, large satellites, and ground station networks. The Leanspace platform provides a wide range of software products across satellite monitoring & control, mission planning, ground segment orchestration, and testing of space hardware. Thanks to its new strategic industrial investors, Leanspace is now accelerating its expansion into large, high-complexity, and security-critical space programs. Leveraging the platform and its open customization model, the new industrial partners will deliver turnkey mission operations systems and provide additional value with managed services, operations engineering support, and local compliance with national security requirements in both Europe and the US. “Software-defined satellite operations solve the key challenges of modern space programs: agility, resilience, and cost efficiency,” said Guillaume Tanier, CEO of Leanspace. “This new financing round and strategic partnerships bring heritage and execution power, reinforcing our credibility as expected by major enterprise, civilian, and military customers. This supports our goal to be a trusted infrastructure for complex space programs and validates our long-term vision of becoming the technological de facto standard around the world.” Around its platform, Leanspace is building a global ecosystem of industrial partners. The company is welcoming additional players – satellite manufacturers, software integrators, cloud providers, SSA, GSaaS, and other providers of space services – to join and build the software-defined space industry of the future. About ISAI Cap Venture II ISAI Cap Venture II is an 80 M€ investment fund, launched from the partnership between ISAI and Capgemini, to invest around the world in start-ups and scale-ups offering innovative solutions aimed at large companies. The fund co-invests in Series A and onwards with an entry ticket between 1M and 5M€. ISAI manages its investments in accordance with the rules and practices of the venture capital industry. Capgemini, as a business partner, facilitates client adoption of the innovative solutions, helping to accelerate the growth of start-ups and scale-ups in the portfolio. www.isai.fr About Qwaltec, Inc Qwaltec is a US-based, woman-owned defense contractor and a trusted partner to NASA, the US Department of Defense, and other leading aerospace corporations for over 25 years. Qwaltec has been building and operating efficient and cost-effective ground system solutions for government and commercial space programs since 2001. With deep expertise in systems engineering, mission operations, readiness & training, and testing & integration, Qwaltec ensures the success of today’s and tomorrow’s space missions. For more information, visit: www.qwaltec.com Related

ISAI Investments

167 Investments

ISAI has made 167 investments. Their latest investment was in Leanspace as part of their Series A on November 17, 2025.

ISAI Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

11/17/2025 | Series A | Leanspace | $11.59M | Yes | 2 | |

9/16/2025 | Seed VC | Temelion | $3.7M | Yes | 360 Capital Partners, Kima Ventures, SE Ventures, and Undisclosed Angel Investors | 3 |

7/1/2025 | Series A - II | Carbyon | Yes | 3 | ||

4/28/2025 | Seed VC - II | |||||

4/2/2025 | Series B - II |

Date | 11/17/2025 | 9/16/2025 | 7/1/2025 | 4/28/2025 | 4/2/2025 |

|---|---|---|---|---|---|

Round | Series A | Seed VC | Series A - II | Seed VC - II | Series B - II |

Company | Leanspace | Temelion | Carbyon | ||

Amount | $11.59M | $3.7M | |||

New? | Yes | Yes | Yes | ||

Co-Investors | 360 Capital Partners, Kima Ventures, SE Ventures, and Undisclosed Angel Investors | ||||

Sources | 2 | 3 | 3 |

ISAI Portfolio Exits

30 Portfolio Exits

ISAI has 30 portfolio exits. Their latest portfolio exit was Adikteev on September 30, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

9/30/2025 | Management Buyout | 2 | |||

5/21/2025 | Acquired | 2 | |||

4/29/2025 | Acquired | 5 | |||

Date | 9/30/2025 | 5/21/2025 | 4/29/2025 | ||

|---|---|---|---|---|---|

Exit | Management Buyout | Acquired | Acquired | ||

Companies | |||||

Valuation | |||||

Acquirer | |||||

Sources | 2 | 2 | 5 |

ISAI Acquisitions

3 Acquisitions

ISAI acquired 3 companies. Their latest acquisition was One Prepaid on July 10, 2025.

Date | Investment Stage | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Total Funding | Note | Sources |

|---|---|---|---|---|---|---|

7/10/2025 | One Prepaid | Management Buyout | 3 | |||

6/19/2023 | Other | |||||

3/11/2019 |

Date | 7/10/2025 | 6/19/2023 | 3/11/2019 |

|---|---|---|---|

Investment Stage | Other | ||

Companies | One Prepaid | ||

Valuation | |||

Total Funding | |||

Note | Management Buyout | ||

Sources | 3 |

ISAI Fund History

11 Fund Histories

ISAI has 11 funds, including ISAI Expansion III.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

1/10/2024 | ISAI Expansion III | $311.25M | 2 | ||

4/27/2023 | Isai Build Venture Investment Fund | 1 | |||

12/17/2020 | Isai Venture III | $146.99M | 2 | ||

7/4/2018 | Expansion Fund II | ||||

12/4/2015 | Isai Venture II |

Closing Date | 1/10/2024 | 4/27/2023 | 12/17/2020 | 7/4/2018 | 12/4/2015 |

|---|---|---|---|---|---|

Fund | ISAI Expansion III | Isai Build Venture Investment Fund | Isai Venture III | Expansion Fund II | Isai Venture II |

Fund Type | |||||

Status | |||||

Amount | $311.25M | $146.99M | |||

Sources | 2 | 1 | 2 |

Loading...