iTrustCapital

Founded Year

2018Stage

Series A - II | AliveTotal Raised

$131.2MLast Raised

$6.2M | 3 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-33 points in the past 30 days

About iTrustCapital

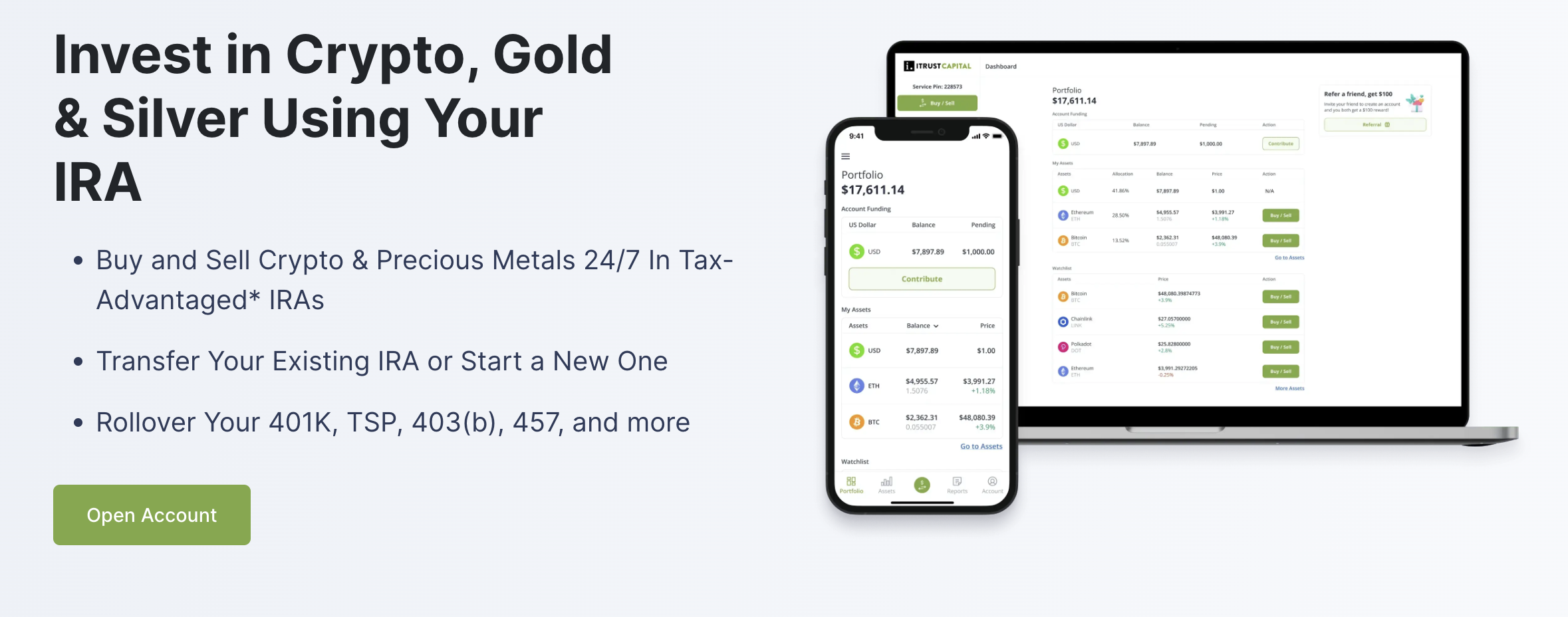

iTrustCapital offers a platform for individuals to buy and sell cryptocurrencies, gold, and silver within their individual retirement accounts (IRAs). The primary customers of the company are individuals planning for retirement who are interested in diversifying their portfolios with alternative assets. It was founded in 2018 and is based in Irvine, California.

Loading...

iTrustCapital's Product Videos

_thumbnail.png?w=3840)

iTrustCapital's Products & Differentiators

IRA

Tax-advantaged retirement accounts that can hold

Loading...

Expert Collections containing iTrustCapital

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

iTrustCapital is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,297 items

Blockchain

9,872 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Wealth Tech

2,489 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Fintech

9,809 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Latest iTrustCapital News

Oct 17, 2025

assets on platform , has announced a first-of-its-kind integration with Coinbase Asset Management (CBAM) to enable Accredited Investors in the CBAM-managed fund strategies to hold their participations in tax-deferred IRA accounts. The integration will debut with a CBAM managed Bitcoin (BTC) yield strategy, which seeks to outperform the price of Bitcoin by delivering investors Bitcoin's beta return plus additional yield. Why this integration matters In August, the Trump Administration signed an Executive Order to usher in actively managed crypto strategies into 401k's and retirement accounts broadly. Coinbase Asset Management is wholly-owned by Coinbase Global, Inc, one of the most trusted brands in crypto, renowned for powering investors with a strong focus on regulatory compliance and prudent risk management. In collaboration with Coinbase Asset Management, iTrustCapital combines extensive experience in operating a tax-efficient crypto IRA platform with a proven track record in managing the custodial framework and high-touch service component, supporting the long-term digital asset strategies of nearly 100,000 working professionals across the US. The result is institutional-grade yield products, with world-class security infrastructure, and five-star service that opens new opportunities for Bitcoin investors saving for retirement. The Bitcoin economy Anthony Bassili, President of Coinbase Asset Management says “Bitcoin is today approximately a $2.3 trillion asset and has cemented itself as “digital gold” and a “store of value” amongst retail and institutional investors alike . Bitcoin's role as pristine collateral creates opportunity for income generation and higher long-term compounded returns, core to CBAM's strategy. The tax efficiency of having bitcoin yield opportunities in an IRA allows investors to further prepare for retirement by compounding and sheltering income generated from taxes.” The integration, expected to launch in Q4 2025 or early Q1 2026 , will begin with iTrustCapital expanding the list of supported assets IRA customers can hold in their retirement accounts, extending from spot crypto to now also include CBAM-managed yield opportunities for eligible Accredited Investor clients. iTrustCapital CEO Kevin Maloney said “We're incredibly excited to partner with Coinbase Asset Management on the BTC yield strategy, which is recognition of the continued growth of digital assets across institutions, our relentless focus on the customer experience, and clear recognition that crypto is now part of the story in saving for retirement.” Eligible iTrustCapital clients who hold Bitcoin or USD in their IRA will be able to subscribe to the Bitcoin yield opportunity through CBAM. Yield participations for iTrustCapital clients who opt-in and participate in a self-directed manner will be custodied within their supported iTrustCapital IRA account compounding tax-free, further increasing their total bitcoin holdings as they save for retirement. About iTrustCapital iTrustCapital is a leading fintech software platform for alternative assets. The company provides 24/7 access to digital assets, cryptocurrencies, and precious metals through self-directed, tax-advantaged IRA, and Non-IRA account options. Leveraging a highly secure closed-loop system and third-party US banks and custodians, iTrustCapital provides greater asset protection and flexibility for a broad range of retail and institutional clients. About Coinbase Asset Management Coinbase Asset Management is an SEC-registered investment adviser, regulated by the CFTC, and an NFA member. Melding “TradFi” experience with digital acumen, CBAM build solutions and offer insights to navigate the complex digital asset ecosystem. Based on internal data and assets on platform as of 9/25/2025. Market ranking is based on a review of publicly available information on providers of digital asset IRAs and is subject to change. iTrustCapital has entered into a partnership with Coinbase Asset Management (CBAM). This partnership is a commercial arrangement from which iTrustCapital receives fees for its services. The statements concerning the Trump Administration's Executive Order are for informational purposes only. The impact and implementation of such an order are subject to political and regulatory developments. It is not an indication of any endorsement of iTrustCapital or its products. Investing in digital assets is highly speculative and volatile and is not suitable for all investors. Investors may lose their entire investment. The value of digital assets can fluctuate significantly, and past performance is not a guarantee of future results. The discussion of compounded returns and potential yield is for illustrative purposes only and is not an indication of future performance. Yield and income generation are not guaranteed and are subject to market conditions, and may be subject to additional fees and expenses not mentioned. Tax deferral benefits are not guaranteed and are dependent on individual circumstances and changes to tax laws. The hypothetical performance discussed herein is for illustrative purposes only and does not represent actual performance. It is not an indication of future returns and is based on certain assumptions. There are inherent limitations in hypothetical performance, as it does not reflect the impact of transaction costs, fees, or other expenses, and it does not represent a real investment. The information in this press release is subject to change. The integration with Coinbase Asset Management and the availability of a bitcoin yield fund are expected to launch in Q4 2025, but this timeline is an estimate and is not guaranteed. Kevin Maloney is the CEO of iTrustCapital. His statement represents his personal opinion and is not a guarantee of future results or performance. ITC2.0, Inc. dba iTrustCapital is a fintech software platform for alternative assets. iTrustCapital is not an exchange, funding portal, custodian, trust company, licensed broker, dealer, broker-dealer, investment advisor, investment manager, or adviser in the United States or elsewhere. iTrustCapital is not affiliated with and does not endorse any particular digital asset, precious metal or investment strategy. This press release is for informational purposes only and is not intended as an offer to sell or a solicitation of an offer to buy any securities. This press release does not constitute an advertisement for advisory services to any person in any jurisdiction where such an offer or solicitation would be unlawful. It is not an advertisement as defined by the SEC Marketing Rule, but includes information that may be subject to it. It is intended for professional use by media and journalists.

iTrustCapital Frequently Asked Questions (FAQ)

When was iTrustCapital founded?

iTrustCapital was founded in 2018.

Where is iTrustCapital's headquarters?

iTrustCapital's headquarters is located at 2372 Morse Avenue, Irvine.

What is iTrustCapital's latest funding round?

iTrustCapital's latest funding round is Series A - II.

How much did iTrustCapital raise?

iTrustCapital raised a total of $131.2M.

Who are the investors of iTrustCapital?

Investors of iTrustCapital include Walden Venture Capital, Left Lane and Pelion Venture Partners.

Who are iTrustCapital's competitors?

Competitors of iTrustCapital include The Beneficient Company and 2 more.

What products does iTrustCapital offer?

iTrustCapital's products include IRA and 3 more.

Loading...

Compare iTrustCapital to Competitors

Rocket Dollar provides self-directed retirement accounts within the fintech sector. The company offers products for investing in alternative assets like real estate, startups, and cryptocurrencies through self-directed Individual Retirement Account (IRA) and Solo 401(k) plans. Rocket Dollar serves self-employed individuals and investors seeking to diversify their retirement portfolios with non-traditional assets. It was founded in 2018 and is based in Austin, Texas.

Directed IRA is a company that focuses on providing self-directed Individual Retirement Accounts (IRAs) in the financial services industry. The company's main services include offering various types of IRAs that allow investors to invest in non-publicly traded investments such as real estate, LLC/LP, precious metals, notes, and cryptocurrency. Directed IRA primarily serves individuals looking to diversify their retirement investments beyond traditional assets. It was founded in 2018 and is based in Phoenix, Arizona.

BitIRA provides Bitcoin IRA investment services within the financial services sector. The company offers tax-deferred cryptocurrency growth, custodial management of digital assets, and digital currency wallets for retirement accounts. BitIRA serves individuals who want to diversify their retirement savings with cryptocurrencies. It was founded in 2017 and is based in Burbank, California.

AlphaPoint specializes in white label cryptocurrency exchange software and operates within the financial technology sector. The company provides products including digital asset exchanges, brokerage platforms, and wallet solutions to facilitate the trading and management of digital assets. AlphaPoint also offers services for asset digitization and liquidity solutions, catering to clients such as banks, brokers, and payment companies. It was founded in 2013 and is based in New York, New York.

Central Investment Advisors provides financial planning and investment services for various life stages and business needs. The company offers investment advice, retirement planning, education funding strategies, and long-term care financial preparation, based on specific goals and circumstances. They serve individuals and businesses looking to manage their financial resources effectively. It is based in Jefferson City, Missouri.

Apex Fintech Solutions provides wealth technology and digital investing services within the financial services industry. The company offers a cloud-based system that includes tools for account opening, trading, clearing, and custody, as well as solutions like rebalancing and direct indexing. Apex Fintech Solutions serves wealth management firms, broker-dealers, banks, and fintech startups with its range of digital solutions. It was founded in 2012 and is based in Dallas, Texas.

Loading...