Jeeves

Founded Year

2019Stage

Line of Credit | AliveTotal Raised

$470.66MLast Raised

$75M | 2 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+88 points in the past 30 days

About Jeeves

Jeeves operates a financial platform providing payment and expense management solutions within the financial services industry. The company offers a suite of tools that streamline global finance operations, including multi-currency accounts, corporate card issuance, cross-border payments, and integrated expense management. Jeeves primarily serves businesses looking to manage their financial operations across multiple countries. It was founded in 2019 and is based in Orlando, Florida.

Loading...

Loading...

Research containing Jeeves

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Jeeves in 5 CB Insights research briefs, most recently on Aug 23, 2024.

Aug 23, 2024

The B2B payments tech market map

Dec 14, 2023

Cross-border payments market map

Dec 8, 2023 report

The top 25 most successful startup accelerators

Oct 26, 2023

The CFO tech stack market mapExpert Collections containing Jeeves

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Jeeves is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,309 items

Payments

3,277 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

9,809 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Digital Banking

108 items

The open banking ecosystem is facilitated by three main categories of startups including those focused on banking-as-a-service, core banking, and open banking startups (i.e. data aggregators, 3rd party providers). These are primarily B2B companies, though some are also B2C.

Fintech 100

349 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Silicon Valley Bank's Fintech Network

88 items

We mapped out some of SVB's biggest clients, partnerships, and sectors that it serves using CB Insights’ business relationship data from SVB’s profile to uncover just how important it is to the fintech universe. The list is not exhaustive.

Latest Jeeves News

Oct 8, 2025

Keep up to Date with Latin American VC, Startups News The existence of frozen wealth presents a huge opportunity for Latin America. Large sectors of assets, from property and infrastructure, lack liquidity due to a slow and costly cross-border payment system, which acts as a brake on international trade and business expansion. Confronting this scenario, tokenization emerges. This technology, based on blockchain, makes it possible to convert a physical asset or right into digital tokens, i.e. fractional and secure digital representations. The idea is to be able to own a small part of a real estate property or a fleet of logistics trucks, all through a digital platform. Brazil is positioning itself as a pioneer in this area . Local entrepreneurs are demonstrating how static ownership models can become dynamic. Companies like CometCash, TeraHub, and InspireIP are launching solutions using tokenization to “unlock liquidity in real assets,” with applications ranging from intellectual property to business ecosystems. From the same sector, a paradigmatic example is Jeeves, an American unicorn. Its CEO, Dileep Thazhmon, revealed that the company grew 300% in the last year . This growth is not only due to its corporate cards, but also owes to a bet on cross-border transfers, with the upcoming launch of a service based on stablecoins. Horasis Global Summit 2025 Democratizing investment Investing in property or businesses is no longer just for a select few. What tokenization seeks, according to its promoters, is to democratize investment, allowing fractional participation in assets that were previously out of reach. However, the pursuit of a fluid economy is not without its obstacles. The main challenge is regulation. How do you oversee digital assets that are, by nature, cross-border. In addition, the challenge of adoption persists. Although, as Thazhmon notes, “Mexico and Latin America are pioneers in the adoption of stable currencies” due to the volatility of local currencies. End-user confidence is also key and the credibility of established companies will be fundamental for SMEs to make the leap to these new technologies. These issues will be discussed in a panel during the Horasis Global Summit 2025 , which will be held in São Paulo. The discussion will include the participation of people such as: Cesar R. Carvalho, Partner, Baptista Luz Advogados, Brazil Jonathan Feder, Founder, CometCash, Brazil Tatiana Fioratti, Founder, TeraHub Digital, Brazil Diana Patrut, Director, Blockchain Intelligence Professionals Association, Romania Caroline Nunes, Founder, InspireIP, Brazil (Chair) Tokenization and digitization of payments are important up-and-coming tools to unlock Latin America’s economic potential. The way forward requires close collaboration between entrepreneurs, who are building the future, and regulators, who must ensure that this new ecosystem is secure, inclusive, and sustainable for all.

Jeeves Frequently Asked Questions (FAQ)

When was Jeeves founded?

Jeeves was founded in 2019.

Where is Jeeves's headquarters?

Jeeves's headquarters is located at 924 North Magnolia Avenue, Orlando.

What is Jeeves's latest funding round?

Jeeves's latest funding round is Line of Credit.

How much did Jeeves raise?

Jeeves raised a total of $470.66M.

Who are the investors of Jeeves?

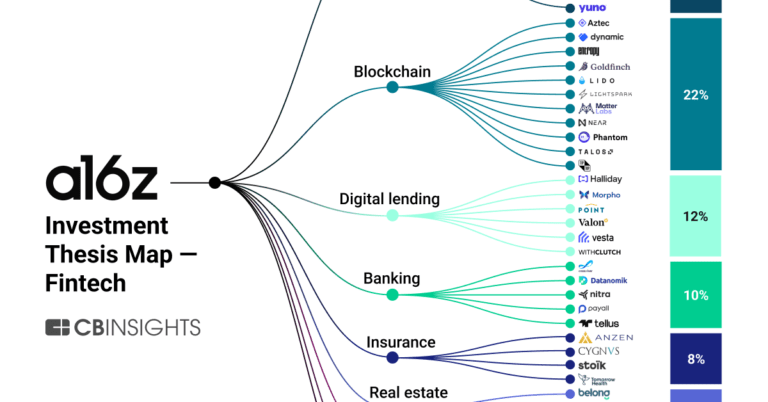

Investors of Jeeves include Community Investment Management, Tencent, Charles River Ventures, Clocktower Technology Ventures, Andreessen Horowitz and 64 more.

Who are Jeeves's competitors?

Competitors of Jeeves include Ramp, ASAAS, Fyle, Clara, Center and 7 more.

Loading...

Compare Jeeves to Competitors

Brex provides spend management solutions across various sectors. The company offers products including corporate cards, expense management, travel, bill pay, and banking services aimed at assisting businesses in managing spending and financial processes. Brex serves startups, mid-size companies, and enterprises with its range of financial products. Brex was formerly known as Veyond. It was founded in 2017 and is based in Salt Lake City, Utah.

Soldo provides spend management solutions within the financial services sector. The company offers a platform that connects with financial systems to manage corporate spending through company cards, a mobile app for tracking expenses, and tools for financial compliance. Soldo serves businesses that need to manage their expense processes and gain insights into their spending. Soldo was formerly known as PX Technology. It was founded in 2014 and is based in London, United Kingdom.

Moss provides spend management solutions within the financial technology sector. The company has a platform that allows businesses to manage expenses, handle month-end financial closing, and connect with existing human resources and accounting systems. Moss serves finance teams that require expense management tools. It was founded in 2019 and is based in Berlin, Germany.

Capital on Tap provides financial solutions for small businesses through its business credit cards and spend management platform. The company offers employee expense management, rewards programs, and financial technology to manage business spending. Capital on Tap serves small businesses that need funding, expense management, and rewards on their business purchases. It was founded in 2012 and is based in London, United Kingdom.

Custodia focuses on corporate expense management in the financial technology sector. The company offers a range of services, including smarter expense management, AI-driven budgeting and spending, and real-time approvals and insights, all designed to empower employees and maintain financial control. Primarily, it caters to businesses ranging from small to large scale, providing them with tools for digital finance. It was founded in 2018 and is based in New York, New York.

Payhawk provides corporate spend management solutions within the financial technology sector. It offers a platform that includes corporate cards, expense management, accounts payable, and accounting software for business payments and financial control. Payhawk's services aim to automate expense reporting and reconciliation and provide visibility and control over company spending, while also integrating with existing financial systems. It was founded in 2018 and is based in London, United Kingdom.

Loading...