Investments

1470Portfolio Exits

193Funds

21Partners & Customers

5Service Providers

1About Khosla Ventures

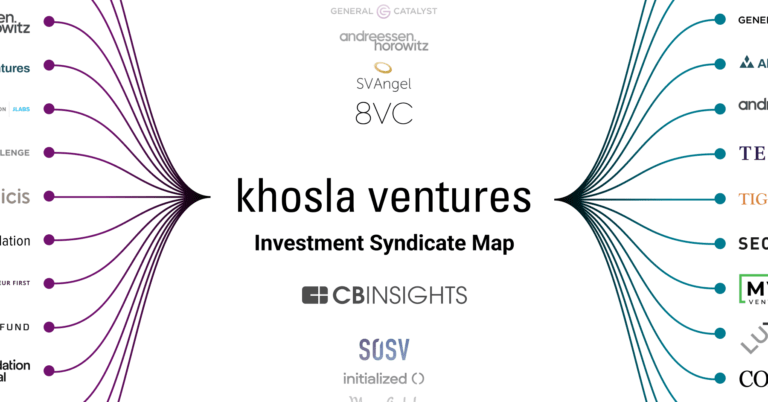

Khosla Ventures operates as a venture capital firm focused on early-stage investments across various sectors. The company provides funding and venture assistance to entrepreneurs in areas such as artificial intelligence, climate and sustainability, enterprise technologies, consumer technologies, financial services, digital health, medtech, and frontier technologies. It was founded in 2004 and is based in Menlo Park, California.

Expert Collections containing Khosla Ventures

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Khosla Ventures in 16 Expert Collections, including Direct-To-Consumer Brands (Non-Food).

Direct-To-Consumer Brands (Non-Food)

37 items

Startups selling their own branded products directly to consumers via online/mobile channels, rather than relying on department stores or big online marketplaces.

Store tech (In-store retail tech)

56 items

Startups aiming work with retailers to improve brick-and-mortar retail operations.

Agriculture Technology (Agtech)

29 items

Companies that are using technology to make farms more efficient

Synthetic Biology

382 items

Wealth Tech

2,489 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Grocery Retail Tech

16 items

Startups providing tools to grocery businesses to improve in-store operations. Includes IoT tools, customer analytics platforms, in-store robots, predictive inventory management systems,and more. (Does not include on-demand grocery delivery startups or online-only grocery stores)

Research containing Khosla Ventures

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Khosla Ventures in 6 CB Insights research briefs, most recently on Sep 18, 2025.

Mar 5, 2024 report

The top 20 venture investors in North America

Aug 1, 2023

The state of healthcare AI in 5 chartsLatest Khosla Ventures News

Nov 17, 2025

November 17, 2025, 12:53 pm IST Sakana AI is betting that the future of AI lies in cleverly combining existing models, not just building bigger ones from scratch. Tokyo-based Sakana AI has just closed a massive 20 billion yen ($135 million) Series B funding round, but it’s not to join the brute-force race of building ever-larger foundation models. Instead, the company is making a contrarian bet: that the future of AI will be defined by efficiency and evolution, not just raw computational power. The funding brings in heavy-hitters like Mitsubishi UFJ Financial Group (MUFG), Khosla Ventures, and Macquarie Capital, alongside a notable investment from In-Q-Tel (IQT), the venture capital arm that serves US intelligence agencies. This isn’t just another cash infusion; it’s a validation of Sakana’s philosophy that genuine innovation comes from constraints. While Silicon Valley giants are locked in a seemingly unsustainable arms race—burning through capital and energy to train models on the assumption of “near limitless resources,” as Sakana puts it—the Tokyo startup is taking a different path. “We believe that intelligent life has arisen not from an abundance of resources but rather from the lack of it,” the company stated in its announcement. “Nature ultimately selects systems that are able to do more with less.” This principle is at the core of Sakana’s technology. Rather than training a new large language model from scratch, the company has pioneered methods to combine and improve existing models. Its research focuses on techniques like “Evolutionary Model Merge,” which fuses capabilities from different open-source models, and using tree search algorithms to orchestrate collaboration between closed models. In essence, Sakana is building AI that can self-improve and evolve, creating powerful new systems from the building blocks that already exist. Evolution, Not Revolution This approach is particularly resonant for Japan, a nation grappling with a declining workforce and limited domestic resources. Sakana AI is positioning itself as the architect of Japan’s “Sovereign AI”—an ecosystem tailored to the country’s specific cultural, industrial, and strategic needs. The company argues that for Japan, the right path isn’t to compete in the large-scale model competition but to innovate on the post-training and optimization layer, making frontier models work efficiently for Japanese enterprise. And it’s already working. Over the past year, Sakana has built a significant enterprise business, partnering with some of Japan’s largest companies, including a strategic partnership with MUFG to develop custom AI for finance. Hironori Kamezawa, CEO of MUFG, noted that the investment aims to extend the benefits of AI “to Japan’s diverse industries.” With the new funds, Sakana plans to double down on this strategy. The company is strengthening its applied AI team to deepen its work in finance while aggressively expanding into the defense, intelligence, and manufacturing sectors. The investment from IQT is a clear signal of the strategic importance of Sakana’s technology for national security applications, both in Japan and potentially for its allies. Sakana is making a bet that the most powerful AI won’t necessarily be the biggest, but the one that is the most adaptable, efficient, and intelligently designed. As the industry questions the economic and environmental sustainability of the current AI trajectory, Sakana AI’s resource-constrained approach offers a compelling vision for a different, and perhaps smarter, future. Don't miss a beat

Khosla Ventures Investments

1,470 Investments

Khosla Ventures has made 1,470 investments. Their latest investment was in Sakana AI as part of their Series B on November 17, 2025.

Khosla Ventures Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

11/17/2025 | Series B | Sakana AI | $135M | No | Factorial Funds, Fundomo, Geodesic Capital, IQT, Lux Capital, Macquarie Capital, Mitsubishi UFJ Financial Group, Mouro Capital, MPower Partners, NEA, Ora Global, Shikoku Electric Power Company, and Undisclosed Investors | 6 |

11/17/2025 | Series E - III | Ramp | $300M | No | 137 Ventures, 1789 Capital, 8VC, Alpha Wave Global, Anti Fund, Avenir, Bessemer Venture Partners, BOX GROUP, Coatue, Coral Capital, D1 Capital Partners, Definition Capital, Emerson Collective, Epicenter Capital, Founders Fund, General Catalyst, GIC, Glade Brook Capital, ICONIQ Growth, Kultura Capital, Lightspeed Venture Partners, Lux Capital, Pinegrove Capital Partners, Robin Hood Ventures, Soma Capital, Stripes, Sutter Hill Ventures, T. Rowe Price, and Thrive Capital | 6 |

11/17/2025 | Seed VC | RunLayer | $11M | Yes | David Soria Parra, and Felicis | 6 |

11/13/2025 | Series A - II | |||||

11/6/2025 | Series D |

Date | 11/17/2025 | 11/17/2025 | 11/17/2025 | 11/13/2025 | 11/6/2025 |

|---|---|---|---|---|---|

Round | Series B | Series E - III | Seed VC | Series A - II | Series D |

Company | Sakana AI | Ramp | RunLayer | ||

Amount | $135M | $300M | $11M | ||

New? | No | No | Yes | ||

Co-Investors | Factorial Funds, Fundomo, Geodesic Capital, IQT, Lux Capital, Macquarie Capital, Mitsubishi UFJ Financial Group, Mouro Capital, MPower Partners, NEA, Ora Global, Shikoku Electric Power Company, and Undisclosed Investors | 137 Ventures, 1789 Capital, 8VC, Alpha Wave Global, Anti Fund, Avenir, Bessemer Venture Partners, BOX GROUP, Coatue, Coral Capital, D1 Capital Partners, Definition Capital, Emerson Collective, Epicenter Capital, Founders Fund, General Catalyst, GIC, Glade Brook Capital, ICONIQ Growth, Kultura Capital, Lightspeed Venture Partners, Lux Capital, Pinegrove Capital Partners, Robin Hood Ventures, Soma Capital, Stripes, Sutter Hill Ventures, T. Rowe Price, and Thrive Capital | David Soria Parra, and Felicis | ||

Sources | 6 | 6 | 6 |

Khosla Ventures Portfolio Exits

193 Portfolio Exits

Khosla Ventures has 193 portfolio exits. Their latest portfolio exit was Teamshares on November 14, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

11/14/2025 | Acq - Pending | Live Oak Acquisition V | 6 | ||

11/4/2025 | Acquired | 3 | |||

10/16/2025 | Acquired | 6 | |||

Date | 11/14/2025 | 11/4/2025 | 10/16/2025 | ||

|---|---|---|---|---|---|

Exit | Acq - Pending | Acquired | Acquired | ||

Companies | |||||

Valuation | |||||

Acquirer | Live Oak Acquisition V | ||||

Sources | 6 | 3 | 6 |

Khosla Ventures Fund History

21 Fund Histories

Khosla Ventures has 21 funds, including Khosla Ventures Opportunity Fund I.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

1/6/2022 | Khosla Ventures Opportunity Fund I | $550M | 2 | ||

11/1/2021 | Khosla Ventures VII | $1,400M | 2 | ||

6/20/2019 | Khosla Ventures VI (AIV) Holding | $20.02M | 1 | ||

6/20/2019 | Khosla Ventures VI (AIV) | ||||

12/31/2014 | Khosla Ventures Seed C |

Closing Date | 1/6/2022 | 11/1/2021 | 6/20/2019 | 6/20/2019 | 12/31/2014 |

|---|---|---|---|---|---|

Fund | Khosla Ventures Opportunity Fund I | Khosla Ventures VII | Khosla Ventures VI (AIV) Holding | Khosla Ventures VI (AIV) | Khosla Ventures Seed C |

Fund Type | |||||

Status | |||||

Amount | $550M | $1,400M | $20.02M | ||

Sources | 2 | 2 | 1 |

Khosla Ventures Partners & Customers

5 Partners and customers

Khosla Ventures has 5 strategic partners and customers. Khosla Ventures recently partnered with Cleveland Clinic on October 10, 2025.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

10/14/2025 | Partner | United States | Cleveland Clinic and Khosla Ventures Form Strategic Alliance to Accelerate Healthcare Innovation -- Cleveland Clinic Innovations and Khosla Ventures today announced a major strategic collaboration , uniting a globally respected international health system with one of Silicon Valley 's premier investors in technology . | 4 | |

5/2/2024 | Vendor | ||||

11/1/2007 | Partner | ||||

Partner | |||||

Partner |

Date | 10/14/2025 | 5/2/2024 | 11/1/2007 | ||

|---|---|---|---|---|---|

Type | Partner | Vendor | Partner | Partner | Partner |

Business Partner | |||||

Country | United States | ||||

News Snippet | Cleveland Clinic and Khosla Ventures Form Strategic Alliance to Accelerate Healthcare Innovation -- Cleveland Clinic Innovations and Khosla Ventures today announced a major strategic collaboration , uniting a globally respected international health system with one of Silicon Valley 's premier investors in technology . | ||||

Sources | 4 |

Khosla Ventures Service Providers

1 Service Provider

Khosla Ventures has 1 service provider relationship

Service Provider | Associated Rounds | Provider Type | Service Type |

|---|---|---|---|

Gunderson Dettmer | Counsel |

Service Provider | Gunderson Dettmer |

|---|---|

Associated Rounds | |

Provider Type | Counsel |

Service Type |

Partnership data by VentureSource

Khosla Ventures Team

17 Team Members

Khosla Ventures has 17 team members, including current Founder, Managing Director, Vinod Khosla.

Name | Work History | Title | Status |

|---|---|---|---|

Vinod Khosla | Founder, Managing Director | Current | |

Name | Vinod Khosla | ||||

|---|---|---|---|---|---|

Work History | |||||

Title | Founder, Managing Director | ||||

Status | Current |

Compare Khosla Ventures to Competitors

Felicis operates as a venture capital firm focused on providing investment and support to early-stage and growth-stage companies in various sectors. It specializes in areas including artificial intelligence (AI), health and bio, infrastructure, security, and vertical SaaS. Felicis also offers programs for executive coaching and development for founders. It was founded in 2006 and is based in Menlo Park, California.

Andreessen Horowitz invests in technology companies across various stages and sectors, including consumer, enterprise, bio/healthcare, crypto, fintech, and games industries. It was founded in 2009 and is based in Menlo Park, California.

SignalFire serves as a venture capital firm with a technology company model, focusing on data-driven investment and support for early-stage to growth-stage startups. The firm offers financial support and services, including insights through its Beacon platform, sector-specific advisory, and portfolio support to assist in scaling and team building. SignalFire primarily serves sectors such as AI/ML, developer tools, B2B SaaS, healthcare, cybersecurity, and consumer markets. It was founded in 2012 and is based in San Francisco, California.

Breyer Capital operates as a venture capital and private equity investor focusing on catalyzing impact entrepreneurs across various sectors. The company makes long-term, strategic investments in businesses leveraging artificial intelligence, machine learning, and other transformative technologies. Breyer Capital primarily invests in sectors such as artificial intelligence (AI), health, consumer software, media and gaming, financial technology, enterprise and data, security, and climate solutions. It was founded in 2006 and is based in Austin, Texas.

FirstMark Capital operates as an early-stage venture capital firm focused on supporting founders in the technology sector. The firm provides funding and assists the growth of startups by offering access to networks, customers, and talent. FirstMark Capital primarily serves the technology industry, partnering with companies to help them scale and adapt in a competitive landscape. It was founded in 2008 and is based in New York, New York.

Swanlaab USA Ventures is a venture capital firm focused on investing in technologies within the series A and B financing stages. The firm specializes in B2B technology and software investments, leveraging a strategy that emphasizes sustainable competitive advantages and impact investment. Swanlaab USA Ventures primarily targets the technology sector, with a particular focus on healthcare, information technology, and internet-based businesses. It was founded in 2021 and is based in Wilmington, Delaware.

Loading...