Kindbody

Founded Year

2018Stage

Series D - II | AliveTotal Raised

$307.01MLast Raised

$25M | 3 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-52 points in the past 30 days

About Kindbody

Kindbody is a fertility clinic network. It operates in the healthcare sector and provides a comprehensive range of reproductive health services. The company offers fertility assessments, testing, egg freezing, in vitro fertilization (IVF), and virtual fertility telemedicine, as well as women's wellness services. Kindbody is also a family-building benefits provider for employers, aiming to make fertility care more affordable and accessible to a broader population. It was founded in 2018 and is based in New York, New York.

Loading...

ESPs containing Kindbody

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

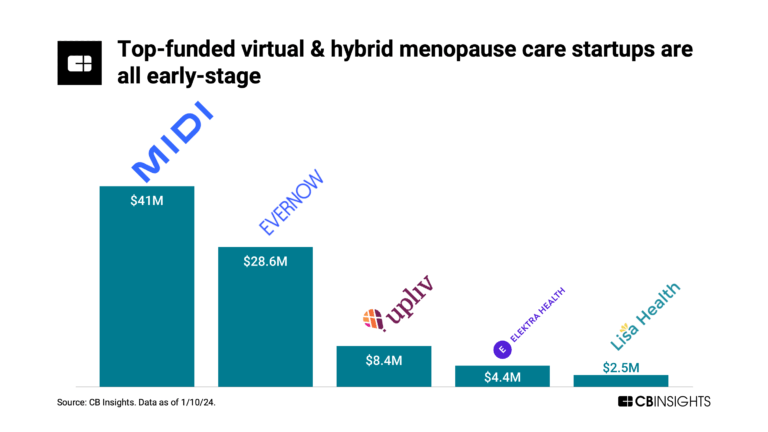

The virtual menopause care market provides solutions for individuals experiencing perimenopause and menopause. Companies in this market offer telehealth consultations, hormone replacement therapy (HRT) management, symptom tracking platforms, personalized care plans, and educational resources. These platforms connect patients with menopause specialists, provide prescription management, and deliver …

Kindbody named as Highflier among 15 other companies, including Maven, Midi, and Elektra Health.

Kindbody's Products & Differentiators

Fertility and family-building benefits

Kindbody is a leading fertility clinic network and family-building benefits provider for employers offering comprehensive virtual and in-person care. Kindbody's clinically managed program includes fertility assessments and education, fertility preservation, genetic testing, in vitro fertilization (IVF), donor and surrogacy services, and adoption, as well as physical, mental, and emotional support from preconception through postpartum.

Loading...

Research containing Kindbody

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Kindbody in 8 CB Insights research briefs, most recently on Apr 25, 2024.

Mar 28, 2024

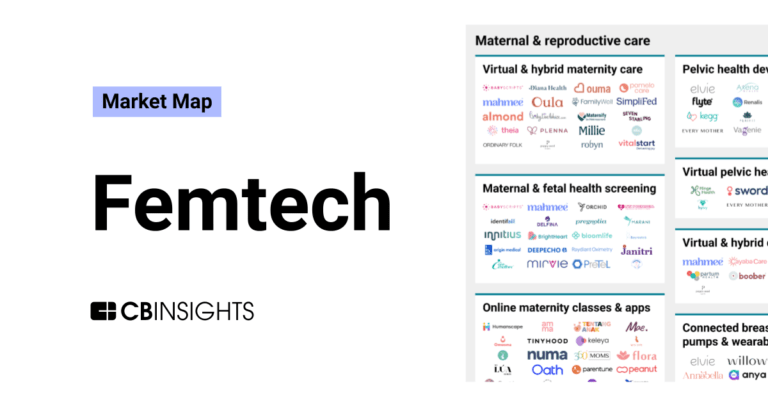

The femtech market map

Aug 21, 2023

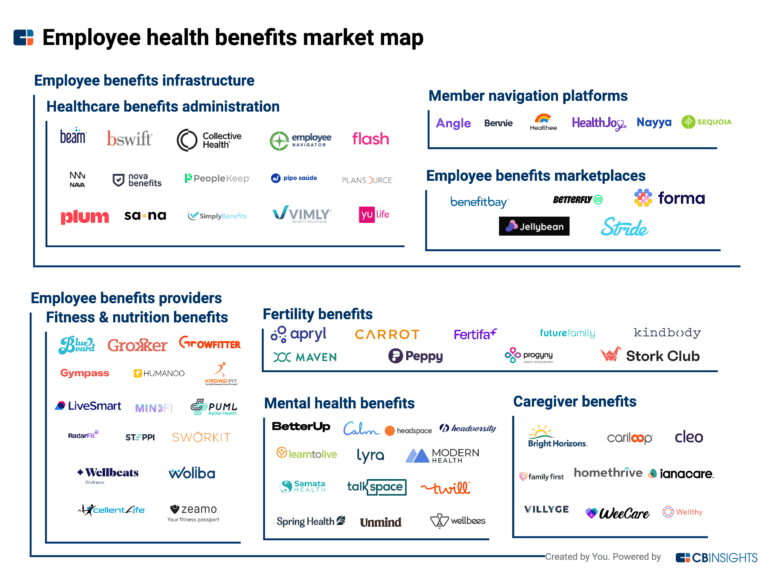

The employee health benefits market map

May 23, 2023 report

State of Digital Health Q1’23 ReportExpert Collections containing Kindbody

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Kindbody is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,309 items

Digital Health 50

450 items

The most promising digital health startups transforming the healthcare industry

Digital Health

12,122 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Telehealth

3,123 items

Companies developing, offering, or using electronic and telecommunication technologies to facilitate the delivery of health & wellness services from a distance. *Columns updated as regularly as possible; priority given to companies with the most and/or most recent funding.

Women's Health Tech

713 items

This collection includes companies applying technology to address a spectrum of physical, mental, and social well-being concerns specific to women. Examples include companies in reproductive health, maternal care, fertility tracking, and menopause support.

Latest Kindbody News

Nov 13, 2025

Get 20% Off All Global Market Reports With Code ONLINE20 – Stay Ahead Of Trade Shifts, Macroeconomic Trends, And Industry Disruptors” — The Business Research Company LONDON, GREATER LONDON, UNITED KINGDOM, November 12, 2025 / EINPresswire.com / -- What Is The Forecast For The At-Home Fertility Hormone Patch Market From 2025 To 2029? Recently, there has been a swift escalation in the market size of at-home fertility hormone patches. The projection for this market is to expand from $0.51 billion in 2024 to approximately $0.59 billion in 2025, with a compound annual growth rate (CAGR) of 15.8%. Several factors have contributed to the market's historical growth. These include increased awareness surrounding infertility and the trend of delayed child bearing, the rise of home-use diagnostic and monitoring tools, fertility clinic overcrowding leading to longer wait times, the emergence of direct-to-consumer telemedicine services, and an uptick in investment in femtech and women's health startups. Expectations are high for substantial expansion in the at-home fertility hormone patch market in the upcoming years. The market is projected to balloon to $1.05 billion by 2029 with a compound annual growth rate (CAGR) of 15.4%. Factors contributing to this growth during the forecast period include the widening of global distribution and direct-to-consumer networks, favorable adjustment to regulatory pathways and reimbursement enlargement, enhanced knowledge of reproductive health, increased adoption of home-based diagnostic methods, and a growing demand for non-invasive fertility tracking. Key trends forecasted for this period include innovation in wearable hormone monitoring, inclusion of telehealth for fertility advice, tailored fertility insights powered by analytics, product development centered on affordability, and significant strides forward in hormone patch technology. Download a free sample of the at-home fertility hormone patch market report: https://www.thebusinessresearchcompany.com/sample.aspx?id=28937&type=smp What Are The Core Growth Drivers Shaping The Future Of The At-Home Fertility Hormone Patch Market? The escalating rates of infertility are anticipated to fuel the development of the at-home fertility hormone patch market in the future. Infertility, a medical issue marked by the incapacity to become pregnant after a year of unprotected intercourse regularly, or physical troubles conceiving or delivering a live child, is becoming more prevalent. This increase is primarily due to the deferral of childbearing, as individuals are increasingly putting off starting a family until later in their reproductive years when aspects such as egg quality, ovarian reserve, and sperm parameters are significantly reducing the likelihood of conception. The growing infertility problem increases the necessity for at-home fertility hormone examination solutions, such as hormone patching, which allows for accessible and non-invasive monitoring of reproductive hormones. These tests aid in the detection of ovulation patterns, the identification of fertile windows, and the making of informed reproductive health decisions without frequent trips to the clinic. For example, the World Health Organization (WHO), a Switzerland-based intergovernmental organization, reported in April 2023 that approximately 17.5% of the adult population, or around 1 in 6 people worldwide, are infertile, showing the urgent necessity for affordable and superior fertility care. Hence, the rising prevalence of infertility is the primary driver of the at-home fertility hormone patch market's growth. Rising financial support for women's health initiatives is also powering the growth of the at-home fertility hormone patch market, as it addresses existing health disparities and the need for easily available community-based services. Women's health initiatives are endeavours, policies, or campaigns aimed at enhancing women's physical, mental, and reproductive health. These initiatives have been receiving more investment due to the ongoing acknowledgment of disparities in healthcare, whereby women's pain and health issues have often been dismissed or underestimated by the medical community, leading to disjointed services and poor health outcomes that necessitate structural changes. By funding research, enhancing accessibility, and addressing historical gaps in reproductive healthcare, investments into women's health initiatives enable technological advancements such as the at-home fertility hormone patch. It encourages women to keep track of and control their fertility from home safely and simply. For instance, the UK's Department of Health and Social Care reported in March 2025 that they allocated around $32 million (£25 million) between fiscal years 2023-2024 and 2024-2025 to local systems to set up women's health hubs as a conceptual demonstration. Thus, the ongoing investment into women's health initiatives is contributing to the growth of the at-home fertility hormone patch market. Which Companies Are Currently Leading In The At-Home Fertility Hormone Patch Market? Major players in the At-Home Fertility Hormone Patch Global Market Report 2025 include: • Amneal Pharmaceuticals LLC • LetsGetChecked Limited • Kindbody Inc. • Natural Cycles AB • Jolly Healthcare Pvt. Ltd. • TMRW Life Sciences Inc. • Easy-Healthcare-Corp • Tempdrop Inc. • YO Home Test Inc. • Hormona AB What Are The Key Trends And Market Opportunities In The At-Home Fertility Hormone Patch Sector? Leading firms in the at-home fertility hormone patch market are prioritizing the creation of cutting-edge solutions like deoxyribonucleic acid (DNA) infused wearable patches. These innovative devices utilize sensors derived from DNA to identify hormone levels in interstitial fluid, allowing people to track hormonal changes in real time, minus the discomfort of blood tests. It aids in monitoring fertility and general hormonal health. For instance, in February 2025, Level Zero Health Inc., a UK-based biotech company, secured $6.9 million during a popular pre-seed investment round. The funds will be used to create the inaugural continuous hormone monitoring patch worldwide. The firm's wearable patch, powered by DNA, tracks vital hormones like cortisol, progesterone, estrogen, and testosterone in the interstitial fluid, providing real-time information for fertility tracking, hormonal health management, and virtual clinic surveillance. This painless device lets users keep an eye on their hormone levels on an ongoing or sporadic basis using a handy patch worn on the arm. It reduces the necessity for hospital visits and uncomfortable procedures. Initially, the startup aims to cater to B2B clinical uses, such as fertility clinics and endocrine therapy centers, while also preparing for a likely venture into customer-based wellness markets. Comparative Analysis Of Leading At-Home Fertility Hormone Patch Market Segments The at-home fertility hormone patchmarket covered in this report is segmented – 1) By Product Type: Single-Use Patch, Reusable Patch 2) By Hormone Type: Estrogen, Progesterone, Luteinizing Hormone, Follicle-Stimulating Hormone, Other Hormone Types 3) By Distribution Channel: Online Pharmacies, Retail Pharmacies, Supermarkets Or Hypermarkets, Other Distribution Channels 4) By Application: Female Fertility Testing, Male Fertility Testing 5) By End-User: Home Care, Clinics, Hospitals, Other End Users Subsegments: 1) By Single-Use Patch: Disposable Fertility Hormone Patches, One-Time Ovulation Monitoring Patches, Single-Cycle Hormone Tracking Patches, Adhesive Single-Use Hormone Detection Patches 2) By Reusable Patch: Multi-Cycle Fertility Hormone Patches, Rechargeable Hormone Monitoring Patches, Long-Term Wearable Hormone Tracking Patches, Smart Reusable Hormone Patches View the full at-home fertility hormone patch market report: https://www.thebusinessresearchcompany.com/report/at-home-fertility-hormone-patch-global-market-report Which Regions Are Dominating The At-Home Fertility Hormone Patch Market Landscape? In the 2025 Global Market Report for At-Home Fertility Hormone Patch, North America led as the largest region in 2024 with expected growth. The report includes regions such as Asia-Pacific, Western Europe, Eastern Europe, South America, Middle East, Africa, in addition to North America. Browse Through More Reports Similar to the Global At-Home Fertility Hormone Patch Market 2025, By The Business Research Company Fertility Treatments Global Market Report 2025 https://www.thebusinessresearchcompany.com/report/fertility-treatments-global-market-report Fertility Drugs Global Market Report 2025 https://www.thebusinessresearchcompany.com/report/fertility-drugs-global-market-report Infertility Treatment Global Market Report Global Market Report 2025 https://www.thebusinessresearchcompany.com/report/infertility-treatment-global-market-report Speak With Our Expert: Saumya Sahay Americas +1 310-496-7795 Asia +44 7882 955267 & +91 8897263534 Europe +44 7882 955267 Email: saumyas@tbrc.info The Business Research Company - www.thebusinessresearchcompany.com Follow Us On: • LinkedIn: https://in.linkedin.com/company/the-business-research-company Oliver Guirdham The Business Research Company info@tbrc.info Legal Disclaimer: EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Kindbody Frequently Asked Questions (FAQ)

When was Kindbody founded?

Kindbody was founded in 2018.

Where is Kindbody's headquarters?

Kindbody's headquarters is located at 120 5th Avenue, New York.

What is Kindbody's latest funding round?

Kindbody's latest funding round is Series D - II.

How much did Kindbody raise?

Kindbody raised a total of $307.01M.

Who are the investors of Kindbody?

Investors of Kindbody include Alumni Ventures, Morgan Health, Perceptive Advisors, RRE Ventures, Claritas Capital and 23 more.

Who are Kindbody's competitors?

Competitors of Kindbody include Visana Health, Fertility Solutions, Boston IVF, Mate Fertility, Reproductive Medicine Associates and 7 more.

What products does Kindbody offer?

Kindbody's products include Fertility and family-building benefits and 1 more.

Loading...

Compare Kindbody to Competitors

Future Family provides financial solutions for fertility treatments within the healthcare sector. It offers financing plans and nursing support for individuals seeking IVF and egg freezing services. The company serves individuals and couples seeking fertility care and treatment financing. It was founded in 2016 and is based in San Francisco, California.

Univfy provides predictions of in vitro fertilization (IVF) success and costs within the fertility care sector. The company offers IVF success predictions through its PreIVF Report and assists with financial planning for fertility treatments, including IVF refund programs. Univfy serves the healthcare sector, specifically fertility clinics and patients seeking IVF treatments. It was founded in 2009 and is based in Los Altos, California.

Genea focuses on fertility treatments and reproductive health. The company offers a range of services, including fertility assessments, assisted conception treatments such as in vitro fertilization (IVF) and intracytoplasmic sperm injection (ICSI), genetic testing, and egg freezing. Genea primarily serves individuals and couples seeking fertility treatments and reproductive health services. It was founded in 1986 and is based in Sydney, Australia.

Carrot Fertility operates within the reproductive health sector, offering services including fertility medication management, payment solutions for care, and support for family-building journeys such as egg, sperm, and embryo freezing, assisted reproduction, gestational surrogacy, adoption, and menopause management. The company serves employers, health plans, and benefit consultants, providing culturally competent care to members worldwide. It was founded in 2016 and is based in West Des Moines, Iowa.

Care Fertility provides fertility treatments and services within the healthcare sector. The company offers a range of services including IVF, IUI, ICSI, and fertility preservation techniques such as egg, sperm, and embryo freezing. Care Fertility serves various client groups, including heterosexual couples, single individuals, same-sex couples, and transgender people seeking to build families. It was founded in 1997 and is based in Nottingham, England.

Alife Health focuses on in vitro fertilization (IVF) clinic operations through artificial intelligence within the healthcare technology sector. The company provides software that assists clinics in managing their operations, monitoring patient outcomes, and analyzing performance metrics. Alife Health's solutions are mainly used by IVF clinics to grade embryos, manage ovarian stimulation cycles, and track key performance indicators. It was founded in 2020 and is based in San Francisco, California.

Loading...