Klarna

Founded Year

2005Stage

IPO | IPOTotal Raised

$5.898BDate of IPO

9/10/2025About Klarna

Klarna is a financial technology company that provides buy now, pay later services and payment options within the e-commerce industry. The company offers products that enable consumers to make purchases online and pay in installments, as well as tools for secure shopping. Klarna's technology is used by various global retailers. Klarna was formerly known as Kreditor. It was founded in 2005 and is based in Stockholm, Sweden.

Loading...

ESPs containing Klarna

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

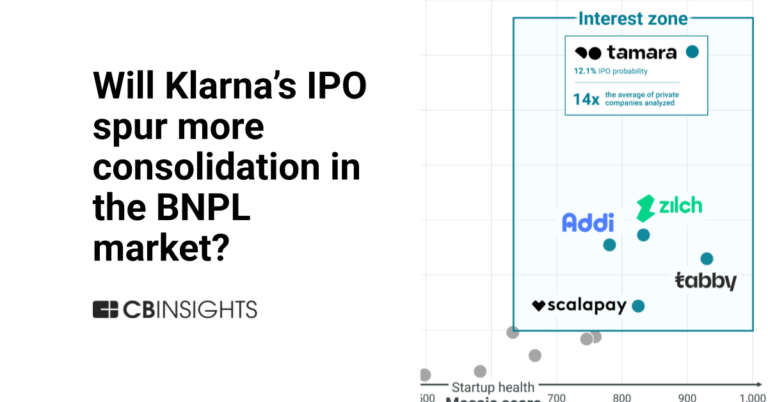

The buy now pay later (BNPL) — B2C payments market offers a flexible payment solution for consumers, allowing shoppers to make purchases and split the cost into multiple installments, typically interest-free. BNPL solutions provide an alternative to traditional credit cards and enable customers to make purchases without upfront payment or the need for a credit check. BNPL solutions typically offer…

Klarna named as Leader among 15 other companies, including Affirm, Synchrony, and Bread Financial.

Loading...

Research containing Klarna

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Klarna in 11 CB Insights research briefs, most recently on Oct 15, 2025.

Oct 15, 2025 report

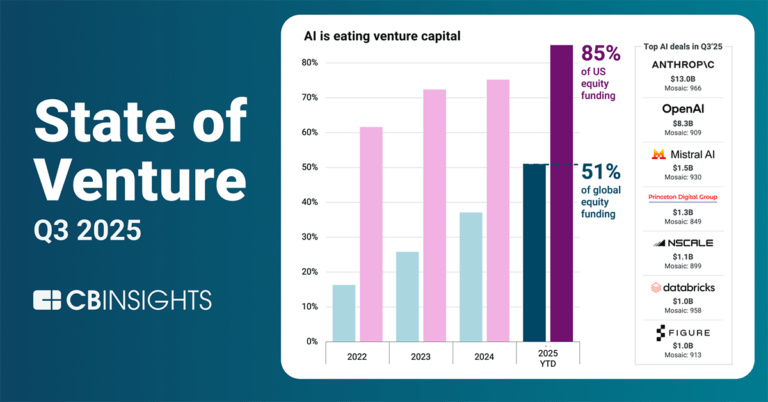

State of Venture Q3’25 Report

Jul 31, 2025 report

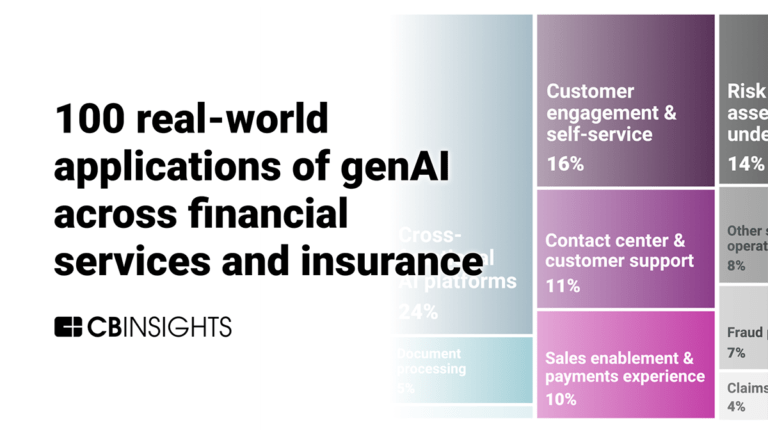

100 real-world applications of genAI across financial services and insurance

Feb 28, 2025

What’s next for AI agents? 4 trends to watch in 2025

May 8, 2024

The embedded banking & payments market map

Expert Collections containing Klarna

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Klarna is included in 10 Expert Collections, including E-Commerce.

E-Commerce

11,424 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Store tech (In-store retail tech)

1,874 items

Companies that make tech solutions to enable brick-and-mortar retail store operations.

Fintech 100

1,247 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Digital Lending

2,735 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

SMB Fintech

1,231 items

Payments

3,277 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Klarna Patents

Klarna has filed 37 patents.

The 3 most popular patent topics include:

- classification algorithms

- machine learning

- artificial neural networks

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

4/7/2022 | 8/20/2024 | Social networking services, Machine learning, Classification algorithms, Artificial neural networks, Computational linguistics | Grant |

Application Date | 4/7/2022 |

|---|---|

Grant Date | 8/20/2024 |

Title | |

Related Topics | Social networking services, Machine learning, Classification algorithms, Artificial neural networks, Computational linguistics |

Status | Grant |

Latest Klarna News

Nov 8, 2025

In October, tech giant Amazon let go of 14,000 corporate employees citing investments in its biggest bets including AI. In September, Salesforce 's CEO Marc Benioff revealed the company had laid off 4,000 customer support roles , saying that AI can do 50% of the company's work. Several companies across the U.S. and Europe have announced similar plans to become leaner and more efficient with AI from Accenture and Lufthansa to Klarna The U.S. faced the highest level of layoffs in any October since 2003, with job cuts totaling 153,074, up 183% from September and 175% higher than the same month a year ago, according to a new report from outplacement firm Challenger, Gray & Christmas. It has been the worst year for announced layoffs since 2009. In this bleak economic environment, professionals who have lost their jobs as a result of AI are likely pondering what their next career move should be; whether to transition into a new industry or profession, or how to beef up their arsenal of skills. Fabian Stephany, assistant professor of AI and work at the Oxford Internet Institute, stressed how important it is to remain “skeptical and investigate,” because some companies are using AI as a scapegoat for layoffs. “Is this really due to AI? Even though the company says it's about automation and AI… it might be about mishiring in the past, it might be about [the] economic downturn, all sorts of things, and the advice on what people should do next strongly depends on whether it's really about automation or whether it's really about something else,” Stephany told CNBC Make It in an interview. If the layoffs are not truly about automation, the simple solution is finding the same or similar position at a different company, according to Stephany. For example, if you're a software developer, there's still high demand for those jobs in other firms. However, if your role is slowly becoming obsolete due to AI, then it's time to start thinking about upskilling. Tap into adjacent skillsets Glassdoor's Chief Economist Daniel Zhao told CNBC Make It that “upskilling can be a good way to move into a more promising career path.” He said whether you've been laid off due to AI or other reasons, it's important to reflect on the wide range of skillsets you may already have that can help you stand out. Stephany referred to this as the “bundle of skills” that any professional would have because skills never come in “isolation.” For example, if you're a software developer with technical skills such as programming languages and debugging, you may also have some management and communication skills. Learning something about arts and crafts or a foreign lanague might be far away from your skill set, he said. “However, learning statistical skills, for example, is not so far away because technically speaking, it's adjacent to the skill bundle that you have.” Looking at the “map of skills” that you own can help you make realistic choices about your future career path and have opportunities be accessible to you, without having to inveset tremendous effort and money such as getting another degree. AI literacy AI literacy is becoming a must-have skill as most professionals and recruiters are increasingly favoring workers who are ahead of the curve with AI. In fact, LinkedIn's Skills on the Rise report earlier this year found that AI literacy ranked top for the most popular skill that people are adding to their profiles, as well as how often the category shows up amongst those getting hired. “Just like typing or computer literacy have become universal expectations for many jobs, AI literacy is likely to become a baseline requirement for jobs in the future,” Zhao said. He added that those “who can experiment with AI and figure out how to apply It,” will be more valuable to businesses. Stephany agreed saying that in his research, he found that showing AI skills signals you're “running with the technology” and that you're “ahead of the wave,” which is favorable to employers. AI does the grunt work, humans keep the trust in wealth management, says Arta These skills could range from being able to write prompts to chatbots, debugging code or knowing how to use copilot. He added that similar to tapping into your adjacent skillsets, it's important to develop AI skills that are complementary to your existing expertise. For example, if you work in business operations, there's little benefit to learning how to become a programmer because it would require more money and effort. However, there's always a “close by AI application,” he said. In a business operation environment, it would be learning how to effectively communicate with AI and prompting the best responses. There are also certain soft skills that AI cannot do – it might be great at debugging code but it can't effectively manage a team. “That might be a skill that's actually adjacent to you, because maybe you know the software developer, you want to step up the game and not only do the coding, but also you manage people who are engaged with technology. That's one thing: going for these complementary skills,” Stephany added.

Klarna Frequently Asked Questions (FAQ)

When was Klarna founded?

Klarna was founded in 2005.

Where is Klarna's headquarters?

Klarna's headquarters is located at Sveavagen 46, Stockholm.

What is Klarna's latest funding round?

Klarna's latest funding round is IPO.

How much did Klarna raise?

Klarna raised a total of $5.898B.

Who are the investors of Klarna?

Investors of Klarna include Santander, Chrysalis Investments, Leading European Tech Scaleups, Sequoia Capital, Commonwealth Bank of Australia and 109 more.

Who are Klarna's competitors?

Competitors of Klarna include Zilch, PayNearMe, Tamara, Waytobill, Bumper and 7 more.

Loading...

Compare Klarna to Competitors

PayNearMe is a technology company that operates within the financial services industry, providing a payment processing platform. The platform is designed to accept payments and manage exceptions. PayNearMe serves sectors such as auto and consumer lending, tolling, iGaming, Buy Here Pay Here, banks and credit unions, and mortgage servicing. PayNearMe was formerly known as Handle Financial. It was founded in 2009 and is based in Santa Clara, California.

Pine Labs is a merchant platform that provides payment solutions across various business sectors. The company offers services, including in-store and online payment processing, customer loyalty programs, prepaid and gifting services, and analytics. Pine Labs serves sectors such as electronics, lifestyle, automobile, grocery, healthcare, and hospitality. It was founded in 1998 and is based in Noida, India.

PingPong provides cross-border payment solutions for e-commerce businesses. The company offers services including multi-currency receiving accounts, international supplier payments, and tools for marketplace payouts and foreign exchange cost reduction. PingPong serves the e-commerce industry, offering financial solutions to aid in payment processes. It was founded in 2015 and is based in San Mateo, California.

Previse specializes in financial transaction analytics and AI-driven insights within the fintech industry. The company offers a platform that connects, matches, and monitors data to provide insights for businesses. Previse's solutions cater to enterprises, financial institutions, and fintechs, focusing on automating payment processes, managing credit risk, and improving decision-making. It was founded in 2016 and is based in London, England.

Lemonway is a payment institution that specializes in providing payment processing and wallet management solutions for marketplaces, crowdfunding platforms, and e-commerce websites. The institution offers a modular payment system that enables clients to handle transactions, from collection to disbursement, with a focus on KYC/AML regulatory compliance. Lemonway primarily serves the e-commerce industry, crowdfunding platforms, and other online marketplaces. It was founded in 2007 and is based in Paris, France.

Cellulant develops an electronic payment service connecting customers with banks and utility services to create a payment ecosystem. It offers a single application program interface payments platform that provides locally relevant and alternative payment methods for global, regional, and local merchants. Its platform enables businesses to collect payments online and offline while allowing anyone to pay from their mobile money, local and international cards, and directly from their bank. It was founded in 2004 and is based in Nairobi, Kenya.

Loading...