Ledgebrook

Founded Year

2021Stage

Series C | AliveTotal Raised

$114.8MLast Raised

$65M | 5 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+4 points in the past 30 days

About Ledgebrook

Ledgebrook serves as a tech-enabled company that focuses on the insurance industry, specifically specialty insurance. The company offers a range of insurance products, including general liability, professional liability, and excess liability, all with technology for fast and easy quoting experiences. Ledgebrook primarily serves the insurance industry, particularly wholesale brokers. It was founded in 2021 and is based in Boston, Massachusetts.

Loading...

ESPs containing Ledgebrook

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The insurtech managing general agents — commercial lines property & casualty market comprises insurtech managing general agents (MGAs) that provide commercial lines property & casualty (P&C) insurance. These companies primarily focus on niche coverage areas such as (but not limited to) commercial flood, drone coverage, fleet insurance, professional liability, and more. Also included in this market…

Ledgebrook named as Highflier among 15 other companies, including Coterie Insurance, Vouch, and SageSure.

Ledgebrook's Products & Differentiators

General Liability

Ledgebrook’s General Casualty Team brings to market a diverse casualty appetite to provide solutions across multiple industry segments. Our sweet spot are risks in the $50,000-$200,000 premium range with minimum premiums starting at $15,000 for Construction and Manufacturing, and $25,000 for other classes. Our Standard appetite will support risks into $450,000 in premium and above.

Loading...

Research containing Ledgebrook

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Ledgebrook in 3 CB Insights research briefs, most recently on Oct 16, 2025.

Oct 16, 2025 report

Insurtech 50: The most promising insurtech startups of 2025

Aug 7, 2025 report

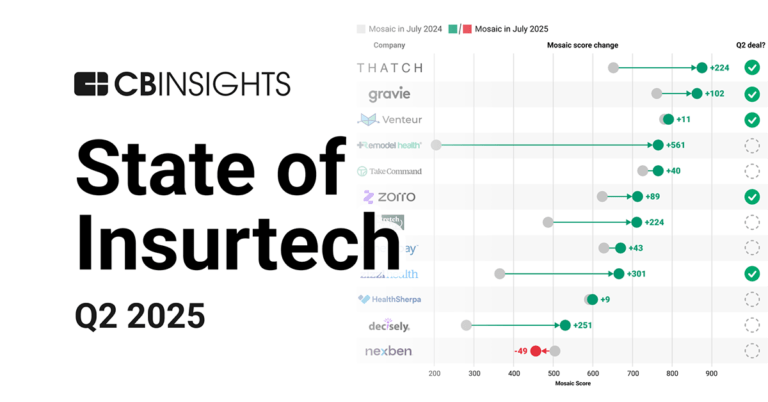

State of Insurtech Q2’25 Report

Feb 23, 2024

The B2C US insurtech market mapExpert Collections containing Ledgebrook

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Ledgebrook is included in 5 Expert Collections, including Insurtech.

Insurtech

4,636 items

Fintech

9,809 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Insurtech 50 (2024)

50 items

Report: https://www.cbinsights.com/research/report/top-insurtech-startups-2024/

Insurtech 50

100 items

Report: https://www.cbinsights.com/research/report/top-insurtech-startups-2024/

Insurtech 50 2025

50 items

Do not share

Latest Ledgebrook News

Jun 27, 2025

Ledgebrook, an Excess and Surplus Lines Insurtech, announced that it has completed the close of an oversubscribed $65 million Series C funding round, led by existing investor The Stephens Group. And existing investors Duquesne, Brand Foundry, Floating Point, and American Family Ventures will also participate in the round, alongside new investors, including Hummingbird Nomads. How the funding will be used: The funding round will enable Ledgebrook to bring in further talent to grow and enhance its client-service-led approach to wholesale brokers, provide new insurance products through its platform, and participate further in retaining risk on the insurance it is writing on behalf of its carrier partners. New board member: Ledgebrook management and employees will continue to be the largest shareholders in the company. And Ryan Morrow, Managing Director at Stephens Group, will join Ledgebrook’s Board of Directors. Advisors: DLA Piper has served as legal counsel to Ledgebrook. Stinson LLP has served as legal counsel to Stephens Group. KEY QUOTES: “I’m really excited to deepen our collaboration with Stephens Group and the Stephens Family. Their fair, open, honest and long-term approach to business partnerships, matches our own at Ledgebrook and has shone through since their initial investment last year.” “The round recognizes the momentum in our business. It positions Ledgebrook to truly establish itself as a premier E + S platform, known for consistent execution on our mission to delight wholesale brokers and for bringing together the best of insurance expertise and technology. I am proud of the backing we have from our existing and new investors and am incredibly grateful for their support.” Gage Caligaris, Founder and Chief Executive Officer of Ledgebrook “Ledgebrook is a unique and truly impressive, founder-led platform in the attractive E+S marketplace with fantastic early momentum. We look forward to a partnership with Gage and Ledgebrook for many years ahead. We and our co-investors could not be more excited to partner with the team as the business scales.” Ryan Morrow

Ledgebrook Frequently Asked Questions (FAQ)

When was Ledgebrook founded?

Ledgebrook was founded in 2021.

Where is Ledgebrook's headquarters?

Ledgebrook's headquarters is located at 6 Liberty Square, Boston.

What is Ledgebrook's latest funding round?

Ledgebrook's latest funding round is Series C.

How much did Ledgebrook raise?

Ledgebrook raised a total of $114.8M.

Who are the investors of Ledgebrook?

Investors of Ledgebrook include Brand Foundry Ventures, American Family Ventures, The Stephens Group, Hummingbird Ventures, Duquesne University and 9 more.

Who are Ledgebrook's competitors?

Competitors of Ledgebrook include Coterie Insurance, Next Insurance, Landmark Underwriting, Counterpart, Pathpoint and 7 more.

What products does Ledgebrook offer?

Ledgebrook's products include General Liability and 2 more.

Loading...

Compare Ledgebrook to Competitors

biBERK is a small business insurance company that offers various insurance products. The company provides coverage such as workers' compensation, professional liability, general liability, business owner's policies, commercial auto, umbrella, and cyber insurance. biBERK serves small businesses across multiple sectors, including accounting, healthcare, construction, and information technology. It is based in Omaha, Nebraska.

Joyn Insurance focuses on underwriting commercial insurance in the small and middle market sectors. The company offers general liability and property insurance, using technology, data, and expertise to deliver a transparent and efficient insurance experience. Joyn Insurance primarily serves sectors such as real estate, manufacturing, services, wholesale, retail, and artisan contractors. It was founded in 2020 and is based in Sacramento, California.

Vouch provides insurance solutions for venture-backed companies within the technology sector. The company offers a range of insurance products, including general liability, business property, cyber, and directors and officers insurance, for startups and high-growth companies. Vouch serves the technology industry, focusing on startups and companies in different stages of growth. It was founded in 2018 and is based in San Francisco, California.

Coterie Insurance provides small business insurance within the commercial insurance sector. The company offers products including business owners policies, general liability, professional liability, and cyber insurance, facilitated through a digital platform that enables quotes. Coterie Insurance serves independent agents and brokers, providing them with resources for the insurance process. It was founded in 2018 and is based in Appleton, Wisconsin.

Dellwood Insurance Group provides business insurance services within the insurance industry. The company addresses small and middle-market commercial risks, using technology and personal service to support wholesale partners. Dellwood's offerings are designed for hard-to-place risks and are written on a non-admitted basis using A.M. Best rated 'A-' paper. It was founded in 2024 and is based in Summit, New Jersey.

TARGO Versicherungen is a company that provides insurance and retirement solutions within the financial services sector. Their offerings include accident insurance, existence protection, and credit life insurance, along with private retirement plans and investment-linked products. The company serves individuals seeking personal insurance and retirement planning services. It is based in Hilden, Germany.

Loading...