Loadsmart

Founded Year

2014Stage

Series D | AliveTotal Raised

$345.2MValuation

$0000Last Raised

$200M | 4 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-87 points in the past 30 days

About Loadsmart

Loadsmart specializes in logistics and transportation services, focusing on freight brokerage and technology solutions. The company offers a suite of services, including managed transportation, next-generation transportation management systems (TMS), and dock scheduling software, all designed to optimize freight operations and enhance efficiency. Loadsmart's products cater to shippers, carriers, and warehouses, providing tools for freight procurement, real-time tracking, and asset visibility. Loadsmart was formerly known as Disruptive Logistics, LLC. It was founded in 2014 and is based in Chicago, Illinois.

Loading...

Loadsmart's Product Videos

ESPs containing Loadsmart

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

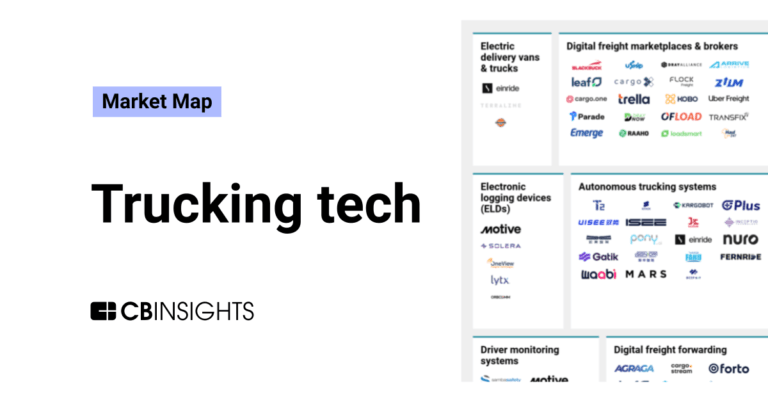

The digital freight marketplaces & brokers market provides online platforms that connect shippers with carriers to facilitate freight transactions. These include neutral marketplaces that enable direct shipper-carrier matching and digital brokers that leverage technology to streamline traditional brokerage services. Core features include real-time capacity visibility, automated matching algorithms…

Loadsmart named as Leader among 15 other companies, including C.H. Robinson, Flexport, and Uber Freight.

Loadsmart's Products & Differentiators

Opendock

Opendock is a centralized dock scheduling platform that simplifies carrier appointment booking for warehouses and distribution centers. It eliminates the back-and-forth of phone calls and emails by allowing carriers to schedule, reschedule, or cancel appointments online. For facilities using Loadsmart's YMS (Yard Management System), Opendock seamlessly integrates to provide real-time visibility into yard activity, optimize trailer movement, and improve overall efficiency. Together, Opendock and our YMS streamline operations, reduce dwell time, and enhance communication between shippers and carriers—all in one intuitive platform.

Loading...

Research containing Loadsmart

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Loadsmart in 1 CB Insights research brief, most recently on Mar 21, 2024.

Expert Collections containing Loadsmart

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Loadsmart is included in 4 Expert Collections, including Supply Chain & Logistics Tech.

Supply Chain & Logistics Tech

6,187 items

Companies offering technology-driven solutions that serve the supply chain & logistics space (e.g. shipping, inventory mgmt, last mile, trucking).

Unicorns- Billion Dollar Startups

1,309 items

AI 100 (All Winners 2018-2025)

100 items

The winners of the 4th annual CB Insights AI 100.

Artificial Intelligence (AI)

20,894 items

Latest Loadsmart News

Sep 25, 2025

2034, increasing from USD 39.32 billion in 2026, at a CAGR of 16.92% during the forecast period 2025 to 2034. Ottawa, Sept. 25, 2025 (GLOBE NEWSWIRE) -- The global digital freight matching market reached approximately USD 33.63 billion in 2025, with projections suggesting it will climb to USD 137.31 billion in 2034, according to a report from Towards Automotive, a sister firm of Precedence Research. All the Stats, Charts & Insights You Need - Get the Databook Now: https://www.towardsautomotive.com/download-sample/1127 Key Takeaways By platform type, open marketplace platforms dominated the market in 2024. By platform type, private/enterprise platforms are expected to grow at the fastest rate. By deployment model, the cloud-based segment held the largest market share in 2024. By deployment model, the on-premise segment is the fastest growing segment as of 2024. By end-user, shippers held the largest share of the digital freight matching market. By end-user, freight carriers are seen to grow at the fastest rate throughout the forecast period. By region, Asia-Pacific held the largest market share this year. By region, North America is expected to grow at the fastest rate throughout the forecast years. Market Overview The Digital Freight Matching (DFM) market is revolutionizing the way shippers, carriers and freight brokers connect and transact by leveraging technology to automate and optimize the process of matching available freight with carrier capacity. From real-time load tracking and tendering to dynamic pricing and optimization algorithms, these platforms offer unprecedented efficiency, transparency and scalability in freight logistics. The sector is rapidly shifting from traditional paper-based methods to digital solutions for booking, invoicing, and dispatching. Newly emerging digital freight matching platforms now offer end-to-end solutions, enabling paperless transactions, real-time bookings, automated invoicing and load tracking. These features help streamline operations, reduce administrative tasks and enhance efficiency by eliminating manual paperwork and errors. You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com Market Trends Advanced technologies such as artificial intelligence, machine learning and automation are transforming global freight matching platforms by streamlining operations, enhancing decision-making and reducing inefficiencies. These technologies allow platforms to handle complex tasks that previously required manual effort and used up significant time and resources. Another market trend that is gaining traction in the digital freight matching market is the use of blockchain technology. Blockchain provides a decentralized and immutable ledger for transactions, ensuring transparency, security and accountability in freight transactions. For shippers and carriers, this means reduced fraud risks, faster payment processing and a more streamlined dispute resolution process. With increasing pressure from regulators and consumers, the logistics industry is making significant strides toward sustainability. Digital freight matching is playing a pivotal role in reducing the carbon footprint of freight operations by optimizing route planning and cargo loads. By ensuring that vehicles run with full capacities and take the most efficient routes, digital freight matching solutions help minimize empty miles and emissions. Integration with transportation management systems (TMS) and enterprise resource planning (ERP) systems is further enhancing the functionality and interoperability of DFM platforms. Seamless integration with existing IT infrastructure enables end-to-end visibility, automation and data-driven decision-making across the supply chain. The expansion of the DFM ecosystem is driving collaboration and innovation among technology providers, logistics companies, and industry stakeholders. Partnerships, acquisitions and investments are fueling the growth of DFM platforms, expanding their capabilities and accelerating market adoption. More Insights of Towards Automotive: Freight Forwarding Market Demand, Size, and Growth Rate Forecast 2034 - The freight forwarding market is forecast to grow from USD 232.37 billion in 2025 to USD 358.32 billion by 2034, driven by a CAGR of 4.93% from 2025 to 2034. Freight Transport Market Size to Skyrocket USD 116.11 Bn by 2034 - The global freight transport market size is calculated at USD 39.62 billion in 2024 and is expected to be worth USD 116.11 billion by 2034. Freight Railcar Repair Market Size, Share, Trends and Forecast 2034 - he Freight railcar repair market is projected to reach USD 309.78 billion by 2034, growing from USD 21.08 billion in 2025. Freight Trucking Market Strategic Growth, Innovation and Investment Trends - The freight trucking market is expected to increase from USD 307.29 billion in 2025 to USD 466.99 billion by 2034. Freight Transport Management Market Driven by 10.96% CAGR - The freight transport management market is projected to reach USD 86.52 billion by 2034, expanding from USD 33.93 billion in 2025. Air Freight Forwarding System Market Strategic Growth, Innovation & Investment Trends - The air freight forwarding system market is projected to reach USD 13.27 billion by 2034, expanding from USD 9.22 billion in 2025. Freight Brokerage Market Size to Scale $111.53 Bn by 2034 - The freight brokerage market is projected to reach USD 111.53 billion by 2034, growing from USD 69.71 billion in 2025. Fleet Decarbonization Market Drives at 7.15% CAGR (2025-34) - The fleet decarbonization market is projected to reach USD 797.96 billion by 2034, expanding from USD 428.6 billion in 2025. Pickup Trucks Market Drives at 5.56% CAGR (2025-34) - The pickup trucks market is forecasted to expand from USD 232.23 billion in 2025 to USD 377.93 billion by 2034. Electric Utility Terrain Vehicles (UTV) Market Drives at 22.87% CAGR (2025-34) - The electric UTV market is forecasted to expand from USD 84.00 million in 2025 to USD 368.53 million by 2034. Market Dynamics Driver Rise in E-commerce and Acquisitions The increasing global E-commerce activities are expected to propel the growth of the digital freight matching market in the upcoming years. The E-commerce activity arises because of convenience, wide variety of products, competitive pricing and personalization. Digital freight matching can be employed to enhance E-commerce activities further by providing efficient, cost-effective and transparent transportation solutions tailored to the specific needs of online businesses. Strategic mergers and acquisitions are also one of the drivers in the digital freight matching market. By acquiring smaller players or forming strategic partnerships, major logistics companies and tech firms are able to expand their service offerings, enhance technological capabilities and gain access to new markets. Companies involved in these activities are likely to benefit from a broader customer base, increased operational efficiencies and faster market penetration. Restraint High Implementation Costs One of the main barriers in the market that slows the market entry of companies is the high implementation cost associated with digital freight matching platforms. These advanced solutions require significant investments in technology infrastructure, software and training. Smaller carriers and shippers may struggle to keep up with these costs, especially if they have limited resources or come from developing nations. Resistance to adopting new technologies among traditional logistics providers also proves to be a hurdle in the digital freight matching market growth. A large number of small and family-run freight companies still use traditional techniques as they are not aware of such technologies. Many lack adequate technological knowledge and skills, slowing down growth and development. Opportunity Real time Visibility and Sustainability One of the key opportunities in the market is the aspect of real-time visibility. It allows shippers and carriers to track the movement of goods and monitor various aspects of the supply chain, inclusive of inventory levels and transportation status. Automated freight matching leverages this data to efficiently match available carriers with shipments, optimizing routes and reducing idle time, ultimately leading to more efficient resource utilization. This maintains transparency in supply chain operations which further minimizes uncertainties and delays. Another key opportunity is the rise in sustainability initiatives. With increasing pressure to reduce carbon footprints and adhere to environmental regulations, the digital freight matching market benefits from the growing demand for sustainable logistics solutions. Platforms that offer eco-friendly carrier options, optimize routes to reduce emissions and ensure efficient resource usage are becoming increasingly popular. As sustainability becomes a key factor in consumer decision-making, businesses are most likely to turn to digital freight matching in order to meet their environmental goals. Get the latest insights on automotive industry segmentation with our Annual Membership: https://www.towardsautomotive.com/get-an-annual-membership Regional Analysis Why is North America dominating the market? North America dominated the digital freight matching industry in 2024. This dominance is because the country has a developed technological infrastructure with high internet and smartphone penetration. Hence, the shippers and carriers in the region can access digital freight matching platforms. The presence of prominent market players such as U.S.-based Uber Freight (Uber Technologies, Inc.) and Convoy, Inc., as well as high research and development has created favorable environment for the market. U.S Market Drivers: Persistent truck driver shortages and rising labor costs is pushing U.S logistics to adopt DFM platforms that help maximize truck utilization and reduce inefficiencies. There is a strong shift towards data driven logistics, with carriers and shippers using predictive analytics and load matching tools to lower operational costs and increase efficiency. The continuous growth of e-commerce platforms driven by multiple players like Amazon, Walmart and Shopify is sustaining the demand for fast, flexible and digitally coordinated freight solutions. Significant venture capital and private equity investments in freight tech startups like Convoy, Uber Freight and Transfix is shaping the competitive landscape as well as spurring innovation. What are the advancements in Asia-Pacific? Asia Pacific is expected to grow at the fastest rate throughout the forecast years. The region makes up a significant share of the global population, and the e-commerce industry is growing rapidly. Hence, digital freight matching platforms are likely to be adopted at a significant rate to meet consumer demand in the region. Additionally, rising smartphone adoptions and 5G connections are expected to push the market significantly in the coming years. Improving technological infrastructure and growing e-commerce sales are also driving the market's growth in the region. China Market Drivers: China is witnessing a rapid integration of 5G networks and IoT enabled telematics that is accelerating the adoption of DFM, enhancing freight visibility and overall fleet performance. The widespread use of mobile freight applications is transforming the country's logistics sector, with both companies as well as independent truckers relying on this for greater efficiency. The country is also witnessing consolidated and strategic partnerships between freight startups and established players such as JD Logistics and Alibaba. This helps accelerate the scalability of the market. Growing sustainability pressures are encouraging shippers and carriers to adopt digital platforms that can optimize fuel consumption and lower carbon emissions. Elevate your automotive strategy with Towards Automotive. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardsautomotive.com/schedule-meeting Segmental Analysis Platform Type Insights Which platform type dominated the market in 2024? Open Marketplace Platforms dominated the market in 2024. This dominance is due to their broad carrier and shipper networks which provide unmatched flexibility and capacity access. These platforms allow multiple shippers and carriers to interact freely, promote competitive pricing and carry out faster load matching. The advantage of this segment is its transparency and scalability, making them particularly advantageous for large scale logistical operations and spot freight needs. Private/Enterprise Platforms are expected to grow at the fastest rate as of this year. They are usually proprietary platforms operated by large shippers or logistics providers to manage their internal freight flows. Companies are increasingly adopting private platforms in order to reduce reliance on third party marketplaces and enhance operational efficiency. Their growth is further fueled by the enterprise's focus on supply chain resilience, data security and existing transportation management systems (TMS). Deployment Model Which deployment model led the market this year? The cloud-based segment held the largest market share in 2024. This dominance is due to the fact that a number of companies are increasingly shifting to cloud platforms as they offer flexibility, scalability as well as accessibility from any location, all of which are essential factors in today's globalized freight ecosystem. It helps shippers track where their cargo is, optimizes route planning and enables transparent delivery timelines, making it a popular choice. The advantage of this segment lies in its cost effectiveness, making adoption easier for small scale or medium scale carriers. The on-premise segment is the fastest growing segment as of 2024. It appeals primarily to large enterprises and government regulated industries that handle highly sensitive data such as pharmaceuticals, defense or hazardous material transportation. The advantage of this segment lies in its data control, compliance and customizable qualities. It allows organizations to tailor to their exact operational needs without the need of being dependent on any third-party service providers. End User Insights Which end user held the largest market share? Shippers held the largest share of the digital freight matching market in 2024. These organizations rely on digital platforms to manage their supply chains more efficiently, save on transportation costs, and ensure timely deliveries. By utilizing digital freight matching, shippers can access a wider pool of carriers, select the best-fit transport solutions and gain better visibility into their supply chain operations. Additionally, companies heavily involved in e-commerce such as Amazon and Alibaba are increasingly dependent on digital freight matching to support their vast, global supply networks. Freight carriers are seen to grow at the fastest rate throughout the forecast period. Both large fleets and small independent truckers use digital freight matching platforms to increase their efficiency and maximize the utilization of their vehicles. By connecting with shippers directly through these platforms, carriers can fill more loads, reduce empty miles, and boost their bottom line. Additionally, carriers benefit from real-time updates on load availability, better route planning and reduced administrative work associated with manual dispatching. Access our exclusive, data-rich dashboard dedicated to the Digital Freight Matching Market designed specifically for decision-makers, strategists, and industry leaders. Towards Automotive dashboard offers in-depth statistical insights, segment-wise market analysis, regional share breakdowns, comprehensive company profiles, annual updates, and much more. From market sizing to competitive benchmarking, this all-in-one platform is your strategic gateway to smarter, data-driven decisions. Access Now: https://www.towardsautomotive.com/contact-us Top Key Players Convoy Uber Freight Loadsmart Transfix NEXT Trucking Project44 FreightWaves 10-4 Systems (Trimble) KeepTruckin FourKites Recent Developments In July 2025, DAT Freight and Analytics announced that they will acquire the Convoy platform from Flexport. It shared its plans of integrating Convoy's freight matching technology into its DAT One Marketplace to give carriers and brokers better automated load matching and more efficient transactions. In August 2025, Trimble announced that its digital freight matching procurement platform has expanded to North America. The platform was already being operated in Europe via Transporeon, and now carriers and shippers in the U.S and Canada can use it for automated bidding, connecting hundreds of new carriers as well as simplifying rate negotiations. It will enable the discovery of reliable partners and negotiable competitive rates for strategic, lane level, and spot bidding. Segments Covered in the Report By Platform Type Open Marketplace Platforms Private/Enterprise Platforms Brokerage-Owned Platforms By Deployment Model Cloud Based On-Premises By End-User Shippers Carriers Freight Brokers Others By Region North America Latin America Europe Asia Pacific Middle East and Africa Invest in Our Premium Strategic Solution: https://www.towardsautomotive.com/price/1127 Become a Valued Research Partner with Us - Schedule a meeting: https://www.towardsautomotive.com/schedule-meeting Request a Custom Case Study Built Around Your Goals: sales@towardsautomotive.com About Us Towards Automotive is a leading research and consulting firm specializing in the global automotive industry. We deliver actionable insights across key segments such as electric vehicles (EVs), autonomous driving, connected cars, automotive software, aftermarket services, and more. Our expert team supports both global enterprises and start-ups with tailored research on market trends, technology, and consumer behavior. With a focus on accuracy and innovation, we empower clients to make informed decisions and stay competitive in a rapidly evolving landscape. Stay Connected with Towards Automotive: Find us on Social Platforms: LinkedIn | Twitter | Instagram Subscribe to Our Newsletter: Towards AutoTech Read Our Printed Chronicle: Automotive Web Wire Visit Towards Automotive for In-depth Market Insights: Towards Automotive APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44 Get ahead of the trends – follow us for exclusive insights and industry updates: Tumbler | Bloglovin | Medium | Hashnode | Pinterest Towards Automotive Releases Its Latest Insight - Check It Out: EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Loadsmart Frequently Asked Questions (FAQ)

When was Loadsmart founded?

Loadsmart was founded in 2014.

Where is Loadsmart's headquarters?

Loadsmart's headquarters is located at 175 West Jackson Boulevard, Chicago.

What is Loadsmart's latest funding round?

Loadsmart's latest funding round is Series D.

How much did Loadsmart raise?

Loadsmart raised a total of $345.2M.

Who are the investors of Loadsmart?

Investors of Loadsmart include BlackRock, The Home Depot, SoftBank Latin America Fund, Janus Henderson Investors, CSX and 17 more.

Who are Loadsmart's competitors?

Competitors of Loadsmart include Flock Freight, Dray Alliance, Boon, BlackBuck, Shipwell and 7 more.

What products does Loadsmart offer?

Loadsmart's products include Opendock and 3 more.

Loading...

Compare Loadsmart to Competitors

Leaf Logistics focuses on freight coordination in the logistics industry. The company offers a platform that enables shippers, carriers, and brokers to plan, schedule, and move freight efficiently, reducing empty miles and securing stable rates. The platform primarily serves the freight and logistics industry. It was formerly known as LogisticsExchange. It was founded in 2017 and is based in New York, New York.

CargoX is a technology company that focuses on revolutionizing the cargo transportation sector through digital solutions. The company offers a comprehensive logistics platform that simplifies operations for carriers, shippers, and truck drivers by providing services such as digital freight documentation, risk management, cargo tracking, and secure freight payment systems. It was founded in 2013 and is based in Sao Paulo, Brazil.

Flock Freight is a FreightTech company that provides a shared truckload (STL) solution, FlockDirect. The company offers a shipping mode that serves as an alternative to traditional less-than-truckload (LTL) and full truckload (TL) services, using machine learning to optimize freight movement. Flock Freight primarily serves sectors such as food & beverage, retail tech, building materials, and machinery, and aims to provide services that focus on cost efficiency and service quality. Flock Freight was formerly known as AuptiX. It was founded in 2015 and is based in Encinitas, California.

Ezyhaul is a technology company that operates in the logistics sector and provides a digital freight exchange platform that connects shippers with a network of hauliers. The platform facilitates load management and backhaul matching. Ezyhaul serves the road freight industry, offering tools for digital booking, milestone updates, electronic Proof of Delivery (ePOD), and integrated billing. It was founded in 2016 and is based in Kuala Lumpur, Malaysia.

Yimidida is an express logistics platform. The company offers a nationwide public road express logistics network service and aims to provide customers with integrated logistics services. Yimidida's core business focuses on express delivery and logistics solutions across various sectors. It was founded in 2015 and is based in Shanghai, China.

Kargo is a B2B trucking platform in Indonesia that focuses on logistics and supply chain operations. The company provides products that enable businesses to integrate with Kargo's platform for their supply chain needs. Kargo's services include tools for pricing, tracking, and billing freight, supported by a network of transporters. It was founded in 2015 and is based in Jakarta, Indonesia.

Loading...