Lydia

Founded Year

2013Stage

Series C | AliveTotal Raised

$260.33MValuation

$0000Last Raised

$100M | 4 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-79 points in the past 30 days

About Lydia

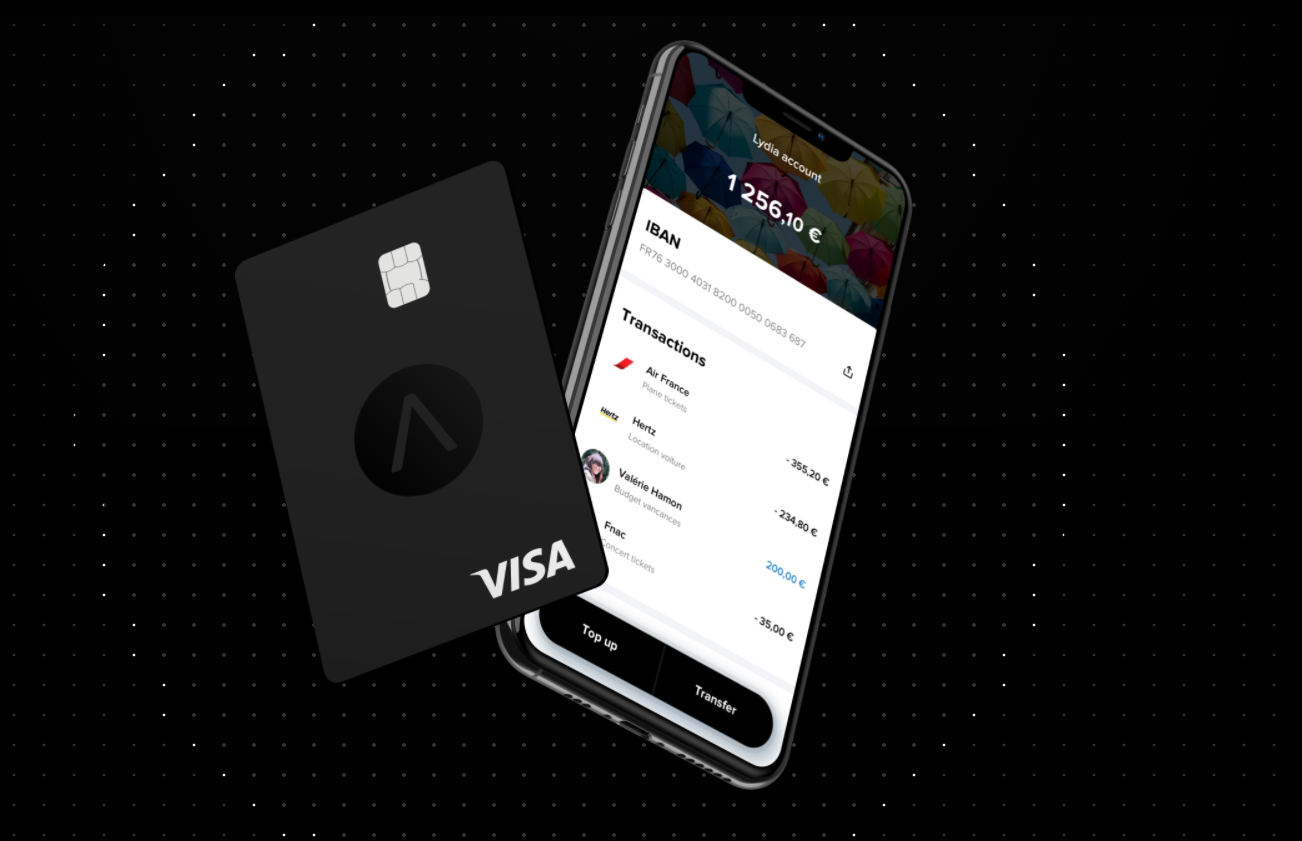

Lydia is a financial technology company that specializes in mobile and digital banking services. The company offers a range of products, including a digital current account, multi-account management, and tools for shared expenses, catering to the needs of modern consumers seeking efficient and secure online financial management. Lydia's services are designed to facilitate everyday banking, instant money transfers, and secure online payments without fees on international transactions. It was founded in 2013 and is based in Paris, France.

Loading...

Lydia's Product Videos

Lydia's Products & Differentiators

Lydia Free

A current account for occasional use

Loading...

Expert Collections containing Lydia

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Lydia is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,309 items

Payments

3,277 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

14,203 items

Excludes US-based companies

Digital Banking

1,182 items

Challenger bank offer digitally native banking products (checking and savings account at the most basic) and either leverage partner banks or are fully-licensed banks themselves.

Fintech 100

249 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Lydia Patents

Lydia has filed 1 patent.

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

6/28/2013 | 12/2/2014 | Grant |

Application Date | 6/28/2013 |

|---|---|

Grant Date | 12/2/2014 |

Title | |

Related Topics | |

Status | Grant |

Latest Lydia News

Oct 10, 2025

Janette KunzOctober 10, 2025 France has quietly become one of the most active fintech centres in Europe. In the last ten years, a new generation of startups has changed the way people pay, save, invest and handle their money. French fintech companies are showing that the country’s spirit of innovation goes beyond just luxury goods and food. They range from digital banks to insurtech and blockchain innovators. These startups are now competing on a global scale thanks to a strong talent pool, a thriving tech ecosystem and progressive rules. Fintech is short for “financial technology,” and it means using technology in new ways to make financial services better and more efficient. It includes everything from blockchain and insurance technology to digital payments and online banking. Fintech startups want to make financial processes easier, clearer and more accessible for both people and businesses. Fintech uses software, data analysis and automation to make financial systems faster, smarter and more open to everyone, instead of relying on traditional banks and manual systems. Fintech has become a key part of digital transformation in France. French fintech startups are changing the way money moves, not just in France but also in Europe and beyond. They are doing this with the help of strong government incentives, a tech-savvy population and a growing number of investors. A mix of regulatory support and technological innovation sparked France’s fintech revolution in the middle of the 2010s. La French Tech and government-backed funding programs are examples of initiatives that helped new financial startups grow. France is now one of Europe’s top fintech countries, along with the UK and Germany. Digital banking, mobile payment apps and new cryptocurrencies have all made France a great place for fintech entrepreneurs to start their businesses. A change in culture has also helped the country’s startup scene. Young professionals now expect digital-first, easy-to-use financial services. Investors have also shown confidence. In 2025 alone, French fintechs raised more than €750 million, showing that the momentum is still going. Fintech in France is more than just making things easier; it’s also about giving people power. Fintech is making the financial world more open by helping small businesses manage their cash flow and letting people pay easily through mobile apps. Fintech is more important now than ever. Fintech is the basis for new ways to pay, borrow, insure and invest as the world moves towards a cashless, digital economy. It is also helping to solve systemic problems like financial exclusion, complicated business operations and outdated systems that don’t work well. Fintech gives businesses access to real-time financial information, automated accounting and faster access to money. For customers, it means better experiences, more payment options and lower fees. Fintech startups are changing the finance industry, but they’re also changing what trust, speed and innovation mean in a global economy where being able to adapt quickly is important. AI, embedded finance and sustainable finance solutions are likely to be the next big things in fintech in France. Companies like Qonto, Ledger and Alan are already making financial systems smarter and more focused on people. Qonto – Simplifying Business Banking Qonto is one of the most well-known fintech unicorns in France. It provides digital banking services to freelancers and small to medium-sized businesses. Qonto was started in 2016 and offers modern financial management tools, easy account setups and clear pricing. This is very different from the red tape that comes with traditional banks. Qonto’s goal is to make business banking easy, fast and completely online. The company works in several European markets. Alan – Reinventing Health Insurance Alan has changed health insurance by making it easier to understand and using technology. Alan is a digital-first insurance company that offers clear prices, quick reimbursements and telehealth services. It has grown into a bigger health platform that includes tools for well-being, access to therapy and personalised health advice, in addition to insurance. Its focus on the user has set it apart from other European insurtech companies. Ledger is the best company in the world at keeping crypto safe. The company is known for its hardware wallets and has sold more than six million of them. It serves both private and business clients. Ledger makes sure that digital assets are stored safely, which is very important as cryptocurrencies and blockchain continue to change. France is now a major player in the global Web3 scene thanks to the company’s success. PayFit – Transforming Payroll and HR Management PayFit makes one of the most difficult business tasks, payroll, easier by automating it. Its SaaS platform makes HR tasks easier, so small and medium-sized businesses can easily handle payroll, benefits and compliance. PayFit is now a key part of the French SaaS fintech ecosystem, with thousands of customers in Europe. Younited – Redefining Consumer Credit Younited is an expert in online lending and embedded finance. Its platform lets people get credit quickly and easily and it also gives businesses B2B financing tools. The company’s tech-driven approach to lending, which focusses on fairness and efficiency, has helped it grow across Europe and recently list on Euronext. Lydia – The All-in-One Financial Super App Lydia began as a mobile payments app, but it has since grown into a full-fledged digital finance platform. It now has bank accounts, savings tools, investments and even access to cryptocurrencies. Lydia is the next generation of mobile-first banking, with millions of users. It is especially popular with younger people who want flexibility and convenience. Swile – Reinventing Employee Benefits Swile turns employee benefits into digital forms, such as meal vouchers, rewards and company perks. Its smart card and app make it easier for businesses to keep track of their expenses and give employees more freedom to use their benefits. French businesses love Swile because of its human-centered design and quick growth. Shift Technology – Fighting Fraud with AI Shift Technology uses AI in the insurance business. Its algorithms help find fake claims, speed up processing and cut costs. Shift is making insurance operations smarter and more open by using data science to make them more accurate and faster. This helps both insurers and customers. Alma – Powering Flexible Payments Alma lets both merchants and customers use “Buy Now, Pay Later” (BNPL) options. The platform lets customers pay in installments, which helps them manage their cash flow and boosts sales for stores. Alma has become one of the fastest-growing fintech companies in Europe thanks to its responsible credit policies and strong partnerships. Pennylane combines tools for accounting, invoicing and cash flow into one smart platform for businesses. It connects accountants and clients in real time, which cuts down on manual work and makes finances more clear. Pennylane is part of the new generation of fintech companies that want to help small and medium-sized businesses (SMEs) grow. Related Articles

Lydia Frequently Asked Questions (FAQ)

When was Lydia founded?

Lydia was founded in 2013.

Where is Lydia's headquarters?

Lydia's headquarters is located at 14 avenue de l'Opera, Paris.

What is Lydia's latest funding round?

Lydia's latest funding round is Series C.

How much did Lydia raise?

Lydia raised a total of $260.33M.

Who are the investors of Lydia?

Investors of Lydia include Tencent, Accel, Dragoneer Investment Group, Founders Future, Echo Street Capital and 10 more.

Who are Lydia's competitors?

Competitors of Lydia include Adro, Revolut, Monese, Monzo, Orange Bank and 7 more.

What products does Lydia offer?

Lydia's products include Lydia Free and 2 more.

Loading...

Compare Lydia to Competitors

Monzo engages as a digital bank that operates in the financial services sector, offering various banking products and services through its mobile app. The company provides personal and business accounts, savings and investment options, and credit and loan products. Monzo primarily serves individual consumers and businesses. Monzo was formerly known as Mondo. It was founded in 2015 and is based in London, United Kingdom.

Allica Bank specializes in financial services for established businesses and focuses on banking solutions within the financial sector. The company offers a range of products including business current accounts, savings accounts, asset finance, commercial mortgages, and growth finance. It caters primarily to small and medium-sized enterprises with a suite of financial products designed to meet their banking needs. Allica Bank was formerly known as Civilised Bank. It was founded in 2019 and is based in London, United Kingdom.

NatWest operates as a retail and commercial bank in the financial services sector. The company offers financial products, including personal bank accounts, mortgages, loans, savings, investments, credit cards, and insurance solutions. NatWest serves customer segments including individuals, businesses, and institutional clients. It was founded in 1968 and is based in London, United Kingdom.

Bancacao is a developer of banking products. The company's Tzune is a digital financial services platform that offers fair, contactless, and personal solutions.

bunq operates as a digital bank that offers various financial services. The company provides a mobile banking app with features for budgeting, saving, investing in stocks and crypto, credit card services, and support for multiple currencies. bunq serves individual consumers and businesses. It was founded in 2012 and is based in Amsterdam, Netherlands.

Varo offers personal banking services. The company provides savings accounts, tools for credit building, and personal finance management features. Varo primarily serves individuals seeking accessible banking solutions. Varo was formerly known as Ascendit Holdings. It was founded in 2015 and is based in San Francisco, California.

Loading...