M1

Founded Year

2015Stage

Series E | AliveTotal Raised

$328.17MValuation

$0000Last Raised

$150M | 4 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-24 points in the past 30 days

About M1

M1 focuses on personal finance and investment management. The company provides various financial products, including cash accounts, investing tools, brokerage services, loans, and a credit card. M1 serves individual investors interested in managing their wealth through financial solutions. It was founded in 2015 and is based in Chicago, Illinois.

Loading...

M1's Product Videos

ESPs containing M1

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The digital financial wellness market consists of fintechs that deliver combinations of financial products, including banking, investing, loans, and P&C insurance, as well as planning tools such as goals-based planning, account aggregation, asset allocation, and budgeting tools. These companies often have B2C and B2B2C distribution models. While digital financial wellness companies may offer compl…

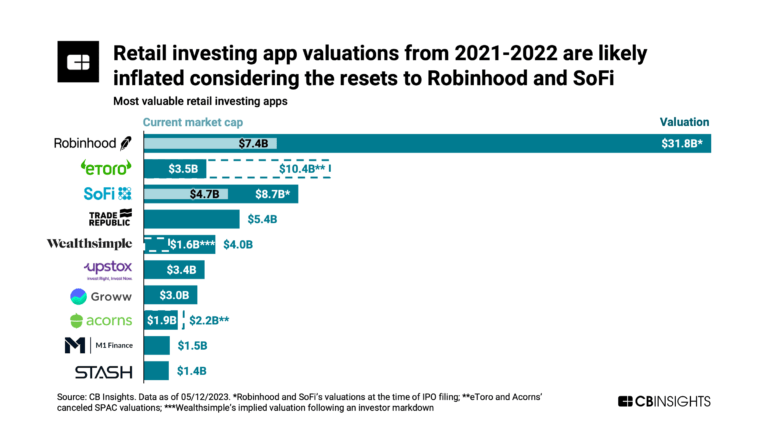

M1 named as Challenger among 15 other companies, including SoFi, Revolut, and MoneyLion.

M1's Products & Differentiators

Individual Brokerage Account

An individual brokerage account is a type of investment account that allows individuals to buy and sell securities, through a brokerage firm, and manage their own investments.

Loading...

Research containing M1

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned M1 in 2 CB Insights research briefs, most recently on Aug 30, 2024.

Aug 30, 2024

The financial planning market mapExpert Collections containing M1

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

M1 is included in 7 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,297 items

Wealth Tech

2,489 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Fintech

9,809 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Digital Banking

1,182 items

Challenger bank offer digitally native banking products (checking and savings account at the most basic) and either leverage partner banks or are fully-licensed banks themselves.

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Tech IPO Pipeline

257 items

The tech companies we think could hit the public markets next, according to CB Insights data.

Latest M1 News

Oct 10, 2025

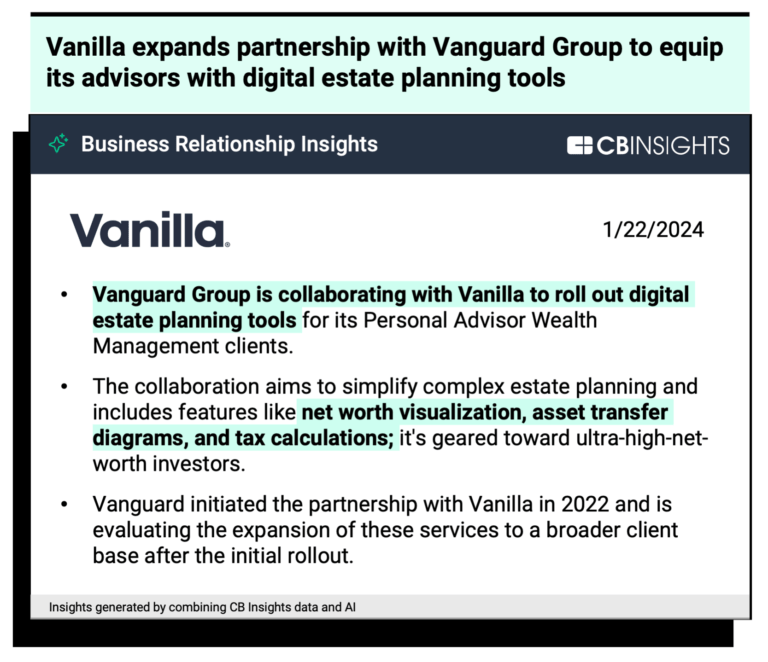

From Betterment's clever automation to Vanguard's proven reliability, explore the robo‑advisors helping everyday investors make big gains WealthTechPexel Imagine having a smart assistant that invests for you, keeps an eye on your money 24/7, and never loses patience. That's essentially what robo‑advisors do. WealthTech, the merging of finance and technology, is booming. According to Statista , the robo‑advisory market is projected to surpass £8.9 billion ($10.8 billion) in revenue by the end of 2025. That means more people than ever are automating their investments to work smarter, not harder. And for those aiming for a £100K portfolio, these nine robo‑advisors could be game‑changers. 1. Betterment — Smart, Simple, Stress‑Free Betterment offers tax‑loss harvesting, low fees and portfolios designed to suit your risk level. Starting with just £7.80 ($10), it's perfect for people who want to invest without overthinking. 2. Wealthfront — Automated Planning That Works Wealthfront is ideal if you love goal‑setting. Whether you want to save for a home, retirement, or travel, Wealthfront's AI tools keep you on track. Just set your goal, and the software adjusts automatically. 3. Schwab Intelligent Portfolios — Professional Investing Without Fees Schwab Intelligent Portfolios charges no advisory fees while offering portfolios diversified across more than 50 ETFs. You need a £4,000 ($5,000) starting balance, but the simplicity and cost‑saving make it worth it. 4. SoFi Automated Investing — Friendly and Flexible SoFi Automated Investing combines automation with live adviser access. There's no management fee, and you can start with £40 ($50). It's perfect if you want the convenience of automation with the option of talking to a real person. 5. M1 Finance — Customisation Meets Automation M1 Finance blends automation with personalisation. You can choose pre‑built 'Pies' or design your own, and M1 will keep them balanced. It's ideal for confident investors who want both control and efficiency. 6. Fidelity Go — Trusted Simplicity Fidelity Go offers a straightforward entry into investing with fees starting at £2.30 ($3) monthly. With Fidelity's reputation and easy‑to‑use interface, it's a strong choice for hassle‑free portfolio management. 7. Acorns — Invest Spare Change, Build Big Wealth Acorns turns everyday spending into an investment opportunity by rounding up purchases and investing the spare change. Saving just £2.50 ($3.32) a day could grow to £912.50 ($1,214) a year without you thinking twice. 8. Vanguard Digital Advisor — Low‑Cost Investing, Big Returns Vanguard Digital Advisor uses index funds to deliver low‑cost, long‑term investing. Starting from £80 ($100), it offers portfolios designed for retirement and other life goals. 9. Ellevest — Investing Designed for Women Ellevest builds portfolios tailored to women's careers and life cycles. It accounts for career breaks and different lifespans, making investing personalised. It's a robo‑advisor with a purpose. How to Turn Robo‑Investing Into £100K Even modest, consistent contributions can compound into serious wealth. For example: Investing £200 ($266) every month at 7% growth could grow to £103,000 ($137,039) in 20 years. Keep annual fees below 0.30% to maximise returns. Automate deposits to make investing effortless. These simple habits can turn a small monthly habit into a substantial portfolio without constant stress. The Future of WealthTech Is Now Robo‑advisors have made investing accessible, affordable, and easy. Whether you choose the tailored service of Ellevest, the reliability of Vanguard Digital Advisor, or the simplicity of Betterment, your financial future is just a click away. Start today with Vanguard Digital Advisor and make your £100K ($133K) portfolio goal a reality. According to Statista , robo‑advisors are projected to manage over £11 trillion ($14 trillion) globally by 2027, proving automation is the future of investing. © Copyright IBTimes 2025. All rights reserved. Request a Correction 2 5 1 6 7

M1 Frequently Asked Questions (FAQ)

When was M1 founded?

M1 was founded in 2015.

Where is M1's headquarters?

M1's headquarters is located at 200 North LaSalle Street, Chicago.

What is M1's latest funding round?

M1's latest funding round is Series E.

How much did M1 raise?

M1 raised a total of $328.17M.

Who are the investors of M1?

Investors of M1 include SoftBank, Clocktower Technology Ventures, Left Lane, Coatue, Chicago Ventures and 7 more.

Who are M1's competitors?

Competitors of M1 include MoneyLion, Webull, Public, BlackRock, December & Company and 7 more.

What products does M1 offer?

M1's products include Individual Brokerage Account and 4 more.

Loading...

Compare M1 to Competitors

ONE is a financial technology company that provides a mobile banking platform. The company includes a digital wallet, debit card rewards, and features for managing spending and saving. ONE serves individuals who aim to simplify their personal finance management. ONE was formerly known as Even. It was founded in 2019 and is based in New York, New York.

Stash serves as a personal finance app that provides tools for budgeting, stock rewards, and saving for immediate needs and retirement. StashWorks is a workplace benefit that offers education, savings contributions, and rewards for reaching financial goals. Stash was formerly known as Collective Returns. It was founded in 2015 and is based in New York, New York.

Betterment operates as a digital investment advisor that focuses on automated investing and savings services within the financial technology sector. The company offers a range of products, including automated portfolio management and tax-advantaged retirement accounts that aid personal finance management for individuals. Betterment provides diversified investment portfolios, tax loss harvesting, and financial planning tools to help clients achieve their financial goals. It was founded in 2008 and is based in New York, New York.

Wealthfront specializes in wealth management and robo-advisory services. The company offers automated investing portfolios, cash accounts, and direct stock investing. Wealthfront serves individual investors looking for financial management and investment options. Wealthfront was formerly known as kaChing. It was founded in 2011 and is based in Palo Alto, California.

Wizest is an investing app operating in the financial services sector that allows users to invest by copying portfolios. The platform provides savings accounts and access to financial advisors who manage investments for users. Wizest primarily serves individual investors seeking guidance in building wealth through the stock market. It was founded in 2019 and is based in Cleveland, Ohio.

Investor Cash Management focuses on cash management solutions. The company offers a cash management account (CMA) that integrates savings, spending, and investing for access through a mobile banking platform. Investor Cash Management primarily serves individual investors, asset managers, wealth management firms, and organizations with financial products and services. It was founded in 2018 and is based in Chicago, Illinois.

Loading...