Mambu

Founded Year

2011Stage

Debt | AliveTotal Raised

$445.51MValuation

$0000Revenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-14 points in the past 30 days

About Mambu

Mambu operates as a cloud banking platform that provides core banking solutions. The company offers a framework for banking, allowing financial institutions to construct their digital financial products using various engines, systems, and connectors. Mambu serves banks, lenders, fintechs, retailers, and other financial service providers. It was founded in 2011 and is based in Amsterdam, Netherlands.

Loading...

Mambu's Product Videos

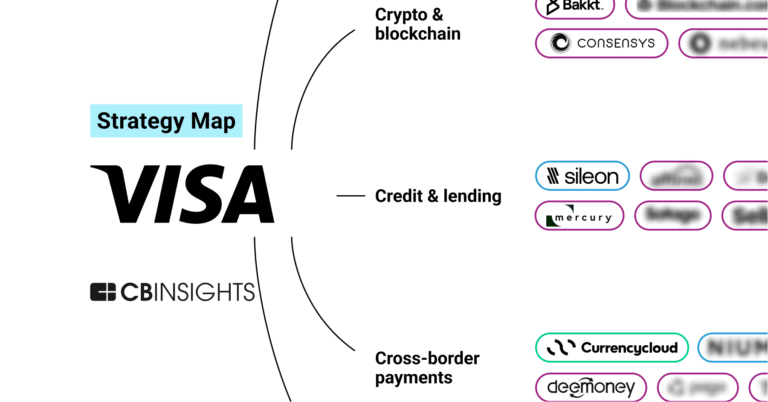

ESPs containing Mambu

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The transaction banking solutions market provides software platforms and technology solutions that enable banks and financial institutions to offer corporate banking services including cash management, payment processing, liquidity management, and treasury operations to business clients. These platforms facilitate real-time transaction processing, multi-currency operations, automated reconciliatio…

Mambu named as Challenger among 15 other companies, including Oracle, Temenos, and Fiserv.

Mambu's Products & Differentiators

Mambu platform

A SaaS and cloud-native core banking platfrom

Loading...

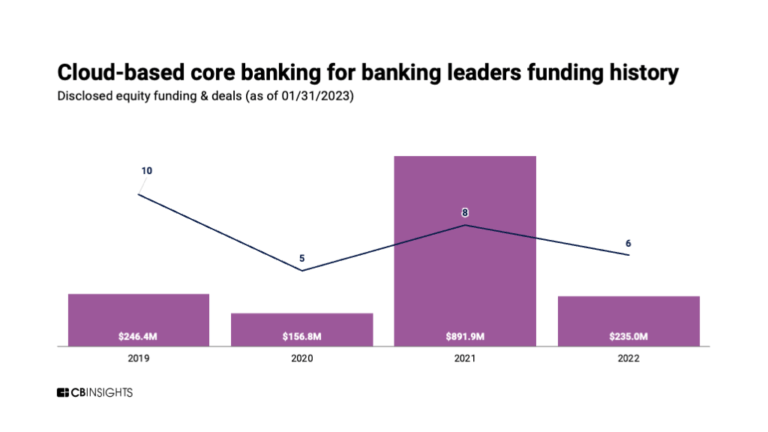

Research containing Mambu

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Mambu in 4 CB Insights research briefs, most recently on May 8, 2024.

May 8, 2024

The embedded banking & payments market map

Jan 4, 2024

The core banking automation market mapExpert Collections containing Mambu

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Mambu is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,297 items

Digital Lending

2,641 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Fintech

14,203 items

Excludes US-based companies

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Digital Banking

1,153 items

The open banking ecosystem is facilitated by three main categories of startups including those focused on banking-as-a-service, core banking, and open banking startups (i.e. data aggregators, 3rd party providers). These are primarily B2B companies, though some are also B2C.

Tech IPO Pipeline

257 items

The tech companies we think could hit the public markets next, according to CB Insights data.

Latest Mambu News

Nov 4, 2025

The collaboration integrates Newgen's end-to-end Loan Origination System (LOS) with Mambu's composable core banking platform. November 4, 2025 The collaboration between Newgen and Mambu is aimed at enabling banking institutions to rapidly launch, scale, and adapt lending products. Credit: vectorfusionart/Shutterstock.com. Newgen Software has announced a partnership with Mambu, aiming to accelerate digital lending for banks, digital banks, non-banking financial companies (NBFCs), fintechs, and Islamic lenders. The collaboration integrates Newgen’s end-to-end Loan Origination System (LOS) with Mambu’s composable core banking platform, enabling institutions to rapidly launch, scale, and adapt lending products with enhanced agility, compliance, and customer focus. Go deeper with GlobalData The partnership introduces a plug-and-play lending stack that covers the entire lending lifecycle—from customer onboarding and application processing to underwriting, decisioning, and disbursement. This integrated solution is designed to reduce time-to-market and deliver improved borrower experiences for a diverse range of financial institutions. Newgen Software SVP for sales Rajvinder Singh Kohli stated, “Mambu’s modern core and Newgen’s proven LOS capabilities create a powerful combination that’s built for speed and scale. “We’re giving banks, digital banks, NBFCs, and Islamic lenders the ability to launch and adapt lending products at the speed of innovation, without losing control, compliance, or customer focus. GlobalData Strategic Intelligence US Tariffs are shifting - will you react or anticipate? Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis. By GlobalData The joint offering leverages AI-enabled underwriting, real-time dashboards, rule-based decisioning, and document management. These features help institutions reduce turnaround times, improve operational visibility, and strengthen regulatory compliance. A significant focus of the partnership is on Islamic Banking. The collaboration will deliver continued innovation in Sharia-compliant digital finance products, tailored to community needs. This follows the recent global launch of Mambu’s enhanced Islamic Banking capabilities. Mambu global head of partnerships Anthony Nonnis commented, “Our partnership with Newgen is a testament to the power of collaboration in driving meaningful change within financial services. Together, we are not just integrating technologies; we are co-creating a future for Islamic banking that is both deeply rooted in ethical principles and incredibly forward-looking. “By combining Mambu’s composable, cloud-native core with Newgen’s robust digital process automation capabilities, we are enabling a new generation of lenders—from agile digital banks to modern NBFCs—to truly reimagine their lending practices. “This synergy empowers them to offer innovative, Sharia-compliant products at speed, deliver unparalleled customer experiences, and ultimately lead the charge in the digital transformation of Islamic finance.” Looking ahead, Newgen and Mambu plan to further enhance the lending stack with AI-driven decisioning, advanced analytics, and integrated loan servicing. Mambu, launched in 2011, fast-tracks the design and build of a wide range of financial offerings for banks of all sizes, lenders, fintechs, retailers, and telcos. The company employs 900 people and supports 250 customers in over 65 countries, including Western Union, Commonwealth Bank of Australia, N26, BancoEstado, OakNorth, Raiffeisen Bank, ABN AMRO, OKEO, and Orange Bank. Sign up for our daily news round-up! Give your business an edge with our leading industry insights.

Mambu Frequently Asked Questions (FAQ)

When was Mambu founded?

Mambu was founded in 2011.

Where is Mambu's headquarters?

Mambu's headquarters is located at Piet Heinkade 55, Amsterdam.

What is Mambu's latest funding round?

Mambu's latest funding round is Debt.

How much did Mambu raise?

Mambu raised a total of $445.51M.

Who are the investors of Mambu?

Investors of Mambu include 4G Capital, EQT, Runa Capital, Acton Capital, Bessemer Venture Partners and 11 more.

Who are Mambu's competitors?

Competitors of Mambu include Apex Fintech Solutions, Thought Machine, FlexM, BackBase, M2P and 7 more.

What products does Mambu offer?

Mambu's products include Mambu platform.

Who are Mambu's customers?

Customers of Mambu include ABN Amro - New10, N26 and Cake bank.

Loading...

Compare Mambu to Competitors

Finastra provides financial software solutions across various sectors, including lending, payments, universal banking, and treasury & capital markets. The company offers lending solutions, payment processing, and banking software, serving financial institutions such as retail banks, commercial banks, investment managers, and corporate treasuries. Finastra was formerly known as Misys. It was founded in 1970 and is based in London, United Kingdom.

Candescent provides digital banking solutions and services for financial institutions, including account opening, digital banking features, and digital branch services. The company serves the banking and credit union sectors, offering tools for security, fraud management, data integration, marketing communications, money management, and financial wellness. It was founded in 2024 and is based in Atlanta, Georgia.

BrightFi is a financial technology company that provides digital banking services that help financial institutions and non-banks of all sizes who want to launch banking products, configure, test and deploy new products or digital brands at a fraction of the time and cost.

Nymbus operates in the financial services industry and provides alternatives to traditional banking business models. The company offers products and solutions designed to enable financial institutions of all sizes to grow and serve their customers without the need for core conversion. Nymbus primarily caters to banks and credit unions looking to launch digital banking services, create niche financial brands, or deploy core banking platforms. It was founded in 2015 and is based in Jacksonville, Florida.

Architecht specializes in solutions within the banking and financial technology sector. The company offers products including banking technology platforms, digital banking systems, investment banking platforms, and consumer financing systems. Architecht's solutions serve segments such as retail banking, corporate banking, private banking, investment banking, e-money and payment institutions, insurance, SMEs, and e-commerce. It was founded in 2015 and is based in Istanbul, Turkey.

Business Alliance Financial Services (BAFS) specializes in providing commercial lending software and services to financial institutions. Their main offerings include a cloud-based lending platform known as BLAST, along with a suite of services that support client onboarding, credit administration, and regulatory compliance. They also offer financial statement analysis, credit risk rating systems, and data analytics solutions to enhance the commercial lending process. It was founded in 2009 and is based in Monroe, Louisiana.

Loading...