Investments

66Portfolio Exits

7Funds

2About ManchesterStory Group

ManchesterStory Group is a venture capital firm that invests in technologies within the financial services, healthcare, and insurance industries. The company provides capital and partnerships to early and growth-stage companies in these sectors, focusing on enhancing their operations through technology. It was founded in 2017 and is based in West Des Moines, Iowa.

Expert Collections containing ManchesterStory Group

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find ManchesterStory Group in 3 Expert Collections, including ITC Vegas 2024 - Exhibitors and Sponsors.

ITC Vegas 2024 - Exhibitors and Sponsors

699 items

Created 9/9/24. Updated 10.22.24. Company list source: ITC Vegas. Check ITC Vegas' website for final list: https://events.clarionevents.com/InsureTech2024/Public/EventMap.aspx?shMode=E&ID=84001

InsurTech NY — Spring Conference 2025

124 items

Sponsors, speaker companies, and startup competition finalists as of 3.19.25

ITC Vegas 2025

496 items

Based on sponsor list as of 9.22.2025

Research containing ManchesterStory Group

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned ManchesterStory Group in 1 CB Insights research brief, most recently on Nov 6, 2025.

Nov 6, 2025 report

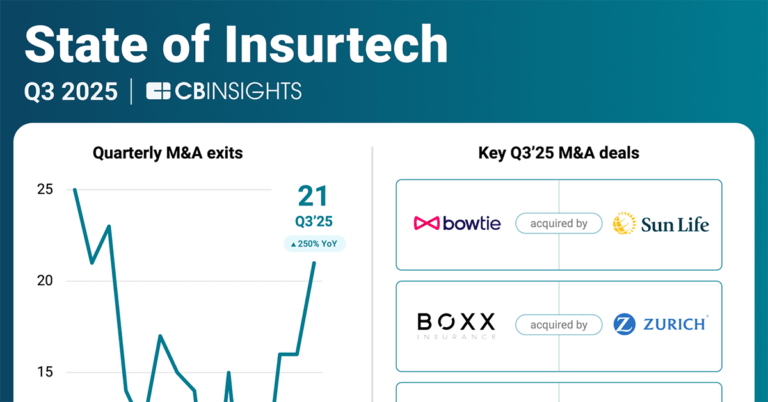

State of Insurtech Q3’25 ReportLatest ManchesterStory Group News

Sep 11, 2025

News provided by Share this article Share toX Former chief data officer of UnitedHealthcare, Kaiser Permanente, and Optum launches new healthcare AI company to streamline workflows and reduce inefficiencies PALO ALTO, Calif., Sept. 11, 2025 /PRNewswire/ -- Penguin Ai , a healthcare artificial intelligence company that solves administrative burdens, announced today that it has secured $29.7 million in venture funding, including a $25M Series A led by Greycroft. Other participants in the financing include UPMC Enterprises, SemperVirens, Snowflake Ventures, Watershed Ventures and Horizon Mutual Holdings, Inc, the parent of New Jersey's largest and oldest health insurer. The round also included support from the original lead seed investors ManchesterStory and Overwater Ventures, as well as California Health Care Foundation, and Matt Kozlov, formerly of Techstars and now at Multiball Capital. Canvas Prime, Plug and Play and individual angels like John Santelli, former CIO of UnitedHealthcare and Eric Larsen, formerly of the Advisory Board also helped fund the company's seed round last year. The funding will support hiring, product development, and scaling deployments with payers and providers. Penguin Ai's flagship platform is designed to help payers and providers streamline high-volume administrative workflows, significantly reduce operational costs, and improve overall efficiency through the use of advanced generative AI technologies. "The healthcare industry is plagued by inefficiencies and is spending billions on administrative tasks annually," said Fawad Butt, founder and CEO of Penguin Ai, and former chief data officer of UnitedHealthcare, Kaiser Permanente and Optum. "By harnessing the power of generative AI, we can significantly reduce these costs, improve accuracy, and unburden valuable resources so payers and providers can focus on delivering quality care to patients." Penguin Ai has already secured key partnerships with leading health plans, providers, and technology organizations and is actively collaborating with several customers to accelerate the development of its enterprise-grade AI platform, proprietary Language Models and Digital Workers and Agents. "Since partnering with Penguin Ai over a year ago, we've been impressed with their bold platform vision and early customer traction," said Mark Terbeek, partner at Greycroft. "We're excited to see them accelerate their go-to-market initiatives and further advance their next-generation AI platform." From the inception of the company in early 2024, Penguin Ai has built a high-performing team while architecting an enterprise-grade AI platform. Penguin Ai's leadership brings over 100 years of payer, provider and hi-tech experience from organizations like: Capital Blue Cross, UnitedHealthcare, Optum, Kaiser Permanente, Amazon, McKesson, Elevance, and federal health agencies. Platform Over Point Solutions A complete AI platform purpose-built for healthcare, Penguin Ai combines AI tooling with proprietary Language Models (LMs) and out-of-the box Digital Workers and Agents --all built specifically for back-office workflows. The platform enables customers to get their data ready for AI, use pre-built healthcare LLMs via APIs, or start with an out-of-the-box solution in areas such as medical coding, prior authorizations, claims adjudication, appeals management, risk adjustment, medical chart summarization or payment integrity, etc. "At UPMC Enterprises, we innovate to solve real world problems in health care, which is a mindset shared by Penguin Ai and its founder, Fawad Butt," said Nicholas Shapiro, vice president, UPMC Enterprises , the innovation, commercialization, and venture capital arm of UPMC. "Security and fairness, which have always been priorities in health care, are particularly crucial when incorporating AI into medical practice. Penguin Ai's platform capabilities, specifically their comprehensive governance and bias correction, service those existing needs, while also preparing for future demands in this evolving AI market." "We invested in Penguin Ai because of its full-service healthcare platform vision and because the technology is fully AI native from the ground up and built by former executives from leading payer and provider organizations," said Robby Peters, founder and managing partner at SemperVirens. "The company is entirely focused on automating complex and costly workflows within healthcare, and we believe their platform will benefit our LPs and strategic partners who want to leverage one solution rather than work with numerous vendors who offer AI-enhanced point solutions." "Penguin Ai is redefining how healthcare payers and providers use data and AI to cut costs, reduce friction, and improve outcomes," said Harsha Kapre, director of Snowflake Ventures. "Our investment brings their specialized applications directly into the Snowflake AI Data Cloud, giving healthcare organizations the confidence to embrace AI and transform their operations." Penguin Ai is poised to reduce administrative burdens across healthcare and currently serves health plans, providers and revenue cycle management companies as well as system integrators and technology partners to extend its reach and deliver joint solutions. To learn more or request a demo, visit www.penguinai.co . About Penguin Ai Penguin Ai is a healthcare AI company focused on transforming operations for healthcare payers and providers by leveraging cutting-edge generative AI technology. Its flagship platform combines task-specific Small Language Models (SLMs), Digital Workers and Agents, with a full-service healthcare AI platform to streamline healthcare administration processes such as prior authorizations, claims processing, medical records summarization, and appeals management. Designed to streamline healthcare workflows and enhance operational efficiency, Penguin Ai leverages advanced AI models, compliance capabilities, and Digital Workers and Agents to transform the way healthcare enterprises manage their data and operations. Founded by the former Chief Data Officer of Kaiser Permanente, UnitedHealthcare and Optum, Penguin Ai is on a mission to reduce the $1 trillion annual cost of healthcare administration inefficiencies. Through its cutting-edge AI solutions, Penguin Ai aims to streamline healthcare operations, lower costs, and enable better outcomes for patients and providers alike. For more information about Penguin Ai and its transformative solutions, visit www.penguinai.co . Media Contact:

ManchesterStory Group Investments

66 Investments

ManchesterStory Group has made 66 investments. Their latest investment was in Penguin Ai as part of their Series A on September 11, 2025.

ManchesterStory Group Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

9/11/2025 | Series A | Penguin Ai | $25M | No | California Health Care Foundation, Greycroft, Horizon Mutual Holdings, Matt Kozlov, Overwater Ventures, SemperVirens Venture Capital, Snowflake Ventures, UPMC Enterprises, and Watershed Ventures | 3 |

7/8/2025 | Seed VC | StitchStudio | $3M | Yes | 2 | |

4/22/2025 | Series A | Journey | $8M | Yes | Cambrian, Canaan Partners, HealthTech Capital, J-Impact Fund, J-Ventures, Life Science Angels, and Undisclosed Investors | 3 |

9/12/2024 | Series B | |||||

4/23/2024 | Seed VC - II |

Date | 9/11/2025 | 7/8/2025 | 4/22/2025 | 9/12/2024 | 4/23/2024 |

|---|---|---|---|---|---|

Round | Series A | Seed VC | Series A | Series B | Seed VC - II |

Company | Penguin Ai | StitchStudio | Journey | ||

Amount | $25M | $3M | $8M | ||

New? | No | Yes | Yes | ||

Co-Investors | California Health Care Foundation, Greycroft, Horizon Mutual Holdings, Matt Kozlov, Overwater Ventures, SemperVirens Venture Capital, Snowflake Ventures, UPMC Enterprises, and Watershed Ventures | Cambrian, Canaan Partners, HealthTech Capital, J-Impact Fund, J-Ventures, Life Science Angels, and Undisclosed Investors | |||

Sources | 3 | 2 | 3 |

ManchesterStory Group Portfolio Exits

7 Portfolio Exits

ManchesterStory Group has 7 portfolio exits. Their latest portfolio exit was Radion Health on July 31, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

7/31/2025 | Acquired | 2 | |||

Date | 7/31/2025 | ||||

|---|---|---|---|---|---|

Exit | Acquired | ||||

Companies | |||||

Valuation | |||||

Acquirer | |||||

Sources | 2 |

ManchesterStory Group Fund History

2 Fund Histories

ManchesterStory Group has 2 funds, including ManchesterStory Venture Fund.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

2/1/2017 | ManchesterStory Venture Fund | Multi-Stage Venture Capital | Closed | $41M | 3 |

BrokerTech Fund, LP |

Closing Date | 2/1/2017 | |

|---|---|---|

Fund | ManchesterStory Venture Fund | BrokerTech Fund, LP |

Fund Type | Multi-Stage Venture Capital | |

Status | Closed | |

Amount | $41M | |

Sources | 3 |

ManchesterStory Group Team

3 Team Members

ManchesterStory Group has 3 team members, including current Founder, Managing Partner, Matthew P. Kinley.

Loading...