Marshmallow

Founded Year

2017Stage

Series C | AliveTotal Raised

$225.46MValuation

$0000Last Raised

$45M | 7 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+88 points in the past 30 days

About Marshmallow

Marshmallow provides car insurance for newcomers focusing on the financial services industry. The company offers car insurance policies that consider the driving experience of individuals from any country, including recognition of no-claims discounts. Marshmallow serves UK residents who are new to the country and may hold driving licenses from abroad. It was founded in 2017 and is based in London, United Kingdom.

Loading...

ESPs containing Marshmallow

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The full-stack insurtech carriers — auto market comprises insurtech carriers that underwrite automotive insurance. As with established carriers, insurtech carriers will typically also be licensed by respective authorities and undergo review by rating agencies. The use of alternative data (such as from telematics sensors) is often central to proactive risk management and underwriting practices empl…

Marshmallow named as Challenger among 13 other companies, including Lemonade, Digit Insurance, and Root.

Loading...

Research containing Marshmallow

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Marshmallow in 1 CB Insights research brief, most recently on Aug 7, 2025.

Aug 7, 2025 report

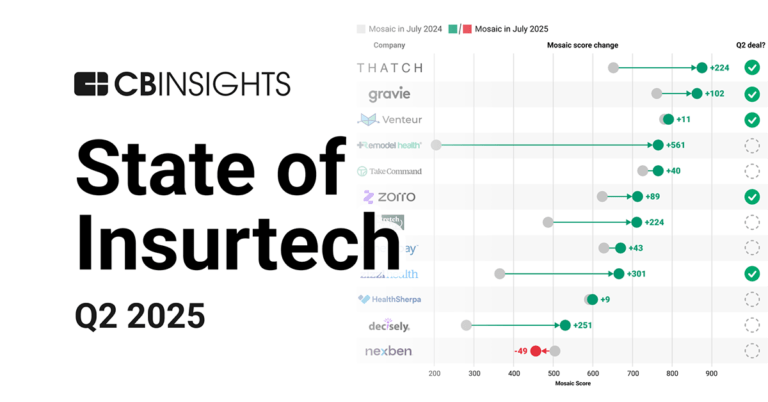

State of Insurtech Q2’25 ReportExpert Collections containing Marshmallow

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Marshmallow is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,309 items

Insurtech

4,636 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

14,203 items

Excludes US-based companies

Insurtech 50

50 items

Report: https://app.cbinsights.com/research/report/top-insurtech-startups-2022/

Marshmallow Patents

Marshmallow has filed 1 patent.

The 3 most popular patent topics include:

- cloud infrastructure

- data management

- data modeling

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

10/20/2022 | Data modeling, Database management systems, Data management, Cloud infrastructure, Free software for cloud computing | Application |

Application Date | 10/20/2022 |

|---|---|

Grant Date | |

Title | |

Related Topics | Data modeling, Database management systems, Data management, Cloud infrastructure, Free software for cloud computing |

Status | Application |

Latest Marshmallow News

Oct 2, 2025

If Insurance Wants to Escape Commoditisation, it Needs to Enter the Conversation This piece is by Conrad Persons, CEO, Grey London Here’s a question: when was the last time you heard anyone talk about insurance? Not a one-off complaint about their annual renewal price or a lost no-claims discount, but as part of an important conversation about life, risk, or planning for the future. I’d bet not recently, if ever. It’s a curious paradox. People today talk about money all the time. The rise of fintech apps, challenger banks and open financial education has made money management part of daily culture. Banking is embedded in our smartphones, our language and our decisions. It’s debated in the media, discussed in WhatsApp groups, and gamified by fintechs who have made money management feel engaging and accessible. Insurance, by comparison, lives in the shadows. It enters the conversation only when something has gone wrong. And that invisibility has consequences. It’s no secret that insurance is a highly commoditised market. With little meaningful differentiation between providers, customers generally default to price. More than 60% of customers say a cheaper deal is their main reason for switching provider, and even long-time holdout Direct Line was forced onto price comparison websites last year. It’s a race to the bottom – one that strips away loyalty, erodes margins and leaves scant room for long-term brand building. And that is especially problematic at a time when industry growth is sluggish (around 2.3% annually in the UK), mid-sized insurers are forced to consolidate, and insurtechs like Marshmallow and Lemonade continue to chip away at market share. Escaping this spiral will not come from product tweaks or tighter margins. It demands a bigger ambition: making insurance more visible, more cultural, and more relevant in people’s everyday lives. In short, insurers need to define – and own – a conversation that extends beyond policies and premiums. Banks have done this for years. Some champion financial literacy, others the democratisation of products or the growth of small businesses. HSBC UK’s Small Business Growth Programme, for instance, provides early-stage companies with resources and confidence to scale beyond just lending them money. Starling’s ‘Make Money Equal’ initiative tackled gender bias in financial imagery, with a free photo library challenging reductive stereotypes and redefining how women are represented in money-focused conversations. These campaigns are distinctive because they transcended product. They give banking brands a credible voice in shaping culture and public debate, and they inspire trust. More broadly, by making money more relevant in cultural conversations, banks have helped make it less taboo. People are far more comfortable discussing money today than they were a decade ago. For brands, it’s not just about joining existing conversations – it’s about creating new ones. Insurance has been slower to follow. There are some promising examples, but as a whole, the industry has yet to stake its claim. What’s the equivalent conversation brands can command in this space? Perhaps it’s about prevention. Hiscox has invested heavily in cybercrime awareness, equipping SMEs to spot phishing scams so they never need to claim. Vitality has tied health insurance to healthier lifestyles, rewarding people for taking proactive care. In both cases, the insurers shifted from backstop to coach, enabling people to make better choices, reduce risks and in turn unlock more affordable cover. And the opportunity is far bigger than isolated campaigns. Imagine insurers acting as personal advisers on climate risk, helping homeowners make smarter decisions about where to live. Or working with dating apps to highlight compatibility in attitudes to money and financial risk – two of the biggest causes of relationship breakdown. Or working with schools to teach young people about everyday risks long before they ever become policyholders. Some brands are beginning to explore long-term initiatives like these, but they’re still far from mainstream. Importantly, these interventions aren’t marketing stunts. They are ways of embedding insurance into daily life, culture and public consciousness. But realising that potential depends on insurers identifying the right conversations to influence. And that means triangulating three factors. First, is there a current conversation that authentically aligns with your mission and purpose, rather than simply the category at large? Second, is it a conversation that matters to your audience, where your brand can play a concrete role – whether that’s solving a problem or raising awareness of an issue? And finally, it’s about taking the creative leap that brings those answers together in a way that feels salient, distinctive and meaningful. If the industry remains silent, it will remain commoditised, with price as the only differentiator. That’s a fragile and short-sighted position for a sector built on resilience. So the challenge is simple, but urgent: step out of the shadows, claim the cultural conversation, and redefine what insurance means to people. Otherwise, insurers risk being remembered only as the cheapest option at the point of purchase – and forgotten at every other moment that matters. Share this:

Marshmallow Frequently Asked Questions (FAQ)

When was Marshmallow founded?

Marshmallow was founded in 2017.

Where is Marshmallow's headquarters?

Marshmallow's headquarters is located at 66 City Road, London.

What is Marshmallow's latest funding round?

Marshmallow's latest funding round is Series C.

How much did Marshmallow raise?

Marshmallow raised a total of $225.46M.

Who are the investors of Marshmallow?

Investors of Marshmallow include BlackRock, Portage Capital, Columbia Lake Partners, Triple Point Investment Management, Halo Business Angel Network and 14 more.

Who are Marshmallow's competitors?

Competitors of Marshmallow include Urban Jungle and 8 more.

Loading...

Compare Marshmallow to Competitors

RAC provides motoring services, focusing on breakdown assistance, insurance, and vehicle maintenance within the automotive industry. The company offers services including car insurance, breakdown cover, and mobile mechanics for servicing and repairs. RAC caters to both private and business drivers, offering solutions for various driving needs. It was founded in 1897 and is based in Walsall, United Kingdom.

Cuvva is a provider of short-term car insurance solutions in the automotive insurance sector. The company offers insurance policies for cars and vans, as well as coverage for learner drivers, international license holders, and motorhomes, with options ranging from 1 hour to 28 days. Cuvva primarily serves individual drivers and vehicle owners in need of temporary insurance coverage. It was founded in 2015 and is based in London, England.

Verti is a digital insurance provider specializing in offering online and telephonic insurance solutions within the insurance industry. The company provides a range of insurance products including coverage for automobiles, motorcycles, homes, and pets, designed to meet the diverse needs of its customers. Verti's insurance offerings are characterized by their innovative pricing models and the ability to personalize coverage to individual customer requirements. It was founded in 2011 and is based in Madrid, Spain.

Volkswagen Financial Services specializes in financial solutions, servicing, insurance, and mobility products within the automotive industry. The company offers vehicle financing options, service plans, insurance coverage, and vehicle rental services to both personal and business customers. Volkswagen Financial Services primarily caters to the automotive industry, providing financial and related services to customers of the Volkswagen Group brands. It was founded in 1993 and is based in Milton Keynes, England.

Klinc provides an insurance platform for home, device, mobility, life, engine and more. It was founded in 2018 and is based in Barcelona, Spain.

Locket is a SaaS platform focused on the insurance industry, offering solutions to prevent and reduce claims. The company provides tools and services designed to protect customers' assets and generate upsell and cross-sell opportunities. Locket's primary clientele includes insurance providers looking to integrate smart technology into their offerings. It was founded in 2020 and is based in London, England.

Loading...