Maven

Founded Year

2014Stage

Series F | AliveTotal Raised

$414.47MValuation

$0000Last Raised

$125M | 1 yr agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+13 points in the past 30 days

About Maven

Maven is a virtual clinic specializing in women's and family health across various life stages. The company offers digital programs that provide clinical, emotional, and financial support for fertility and family building, maternity and newborn care, parenting and pediatrics, as well as menopause and midlife health. Maven serves employers, health plans, and consultants. It was founded in 2014 and is based in New York, New York.

Loading...

Maven's Product Videos

ESPs containing Maven

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The virtual menopause care market provides solutions for individuals experiencing perimenopause and menopause. Companies in this market offer telehealth consultations, hormone replacement therapy (HRT) management, symptom tracking platforms, personalized care plans, and educational resources. These platforms connect patients with menopause specialists, provide prescription management, and deliver …

Maven named as Leader among 15 other companies, including Midi, Elektra Health, and Peppy.

Maven's Products & Differentiators

Fertility & Family Building

Maven’s comprehensive Fertility and Family Building program was built to address the full spectrum of family-building needs and offers inclusive, accessible care for every path to parenthood, from preconception and fertility treatments—egg freezing, IUI & IVF—to adoption and surrogacy. The program cares for members’ mental, emotional, financial, and physical wellbeing. Key components of the product include: -24/7 access to a provider network across 30+ specialties, including reproductive endocrinologists, mental health providers, surrogacy coaches and egg donor consultants -Support with choosing a fertility clinic, adoption or surrogacy agency - Significant Rx discounts and injection support for costly, complex fertility medications via MavenRx -Reimbursement management via Maven Wallet

Loading...

Research containing Maven

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Maven in 7 CB Insights research briefs, most recently on Oct 22, 2025.

Oct 22, 2025

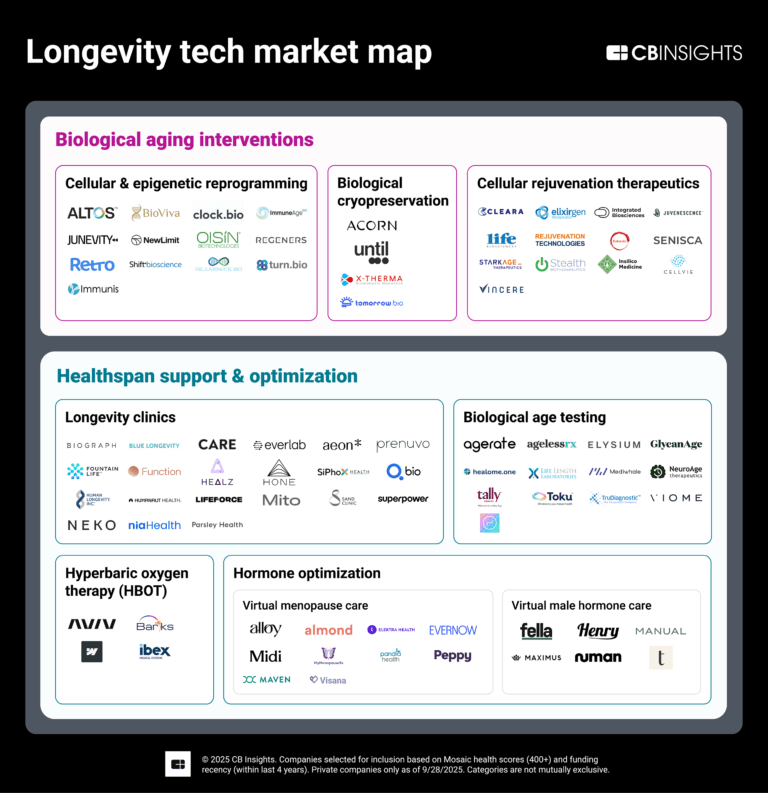

The longevity tech market map

Mar 28, 2024

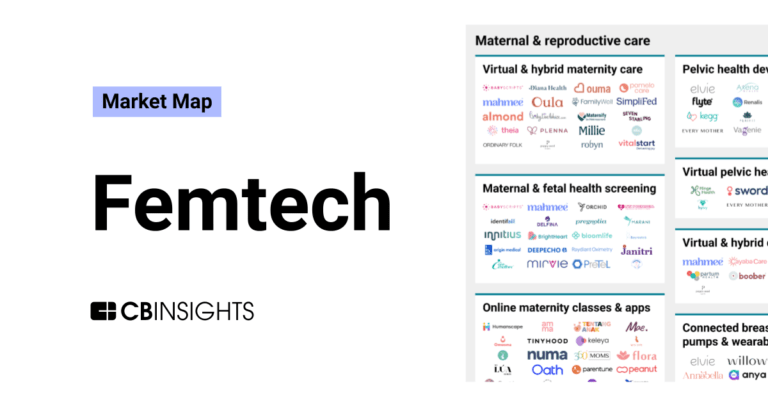

The femtech market mapExpert Collections containing Maven

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Maven is included in 7 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,309 items

Conference Exhibitors

5,501 items

HLTH is a healthcare event bringing together startups and large companies from pharma, health insurance, business intelligence, and more to discuss the shifting landscape of healthcare

Wellness Tech

1,370 items

We define wellness tech as companies developing technology to help consumers improve their physical, mental, and social well-being. Companies in this collection play across a wide range of categories, including food and beverage, fitness, personal care, and corporate wellness.

Digital Health 50

450 items

The most promising digital health startups transforming the healthcare industry

Digital Health

12,122 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Telehealth

3,123 items

Companies developing, offering, or using electronic and telecommunication technologies to facilitate the delivery of health & wellness services from a distance. *Columns updated as regularly as possible; priority given to companies with the most and/or most recent funding.

Maven Patents

Maven has filed 1 patent.

The 3 most popular patent topics include:

- digital photography

- display devices

- lighting

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

5/10/2022 | 7/23/2024 | Lighting, Transiting exoplanets, Display devices, Photometry, Digital photography | Grant |

Application Date | 5/10/2022 |

|---|---|

Grant Date | 7/23/2024 |

Title | |

Related Topics | Lighting, Transiting exoplanets, Display devices, Photometry, Digital photography |

Status | Grant |

Latest Maven News

Nov 13, 2025

Get 20% Off All Global Market Reports With Code ONLINE20 – Stay Ahead Of Trade Shifts, Macroeconomic Trends, And Industry Disruptors” — The Business Research Company LONDON, GREATER LONDON, UNITED ARAB EMIRATES, November 13, 2025 / EINPresswire.com Digital Therapeutics Endometriosis Market Growth Forecast: What To Expect By 2025? The digital therapeutics for endometriosis market size has seen a massive expansion recently. The market is forecasted to rise from $1.39 billion in 2024 to a sizeable $1.70 billion in 2025, demonstrating an impressive compound annual growth rate (CAGR) of 22.6%. The considerable increase during the historic period is credited to the escalating occurrence of endometriosis, heightened digital therapeutics awareness, an increasing appetite for non-invasive treatment approaches, growth of telehealth platforms, and a surge in use of mobile health applications. The market size of digital therapeutics for endometriosis is projected to experience substantial growth in the coming years, escalating to $3.81 billion in 2029, with a compound annual growth rate (CAGR) of 22.3%. This surge in the projected period can be ascribed to factors such as rising patient receptiveness towards digital treatment methods, increased use of artificial intelligence in therapy solutions, amplified governmental initiatives promoting digital health, broadening insurance provisions for digital therapeutics, and a growth in collaborations between pharmaceutical and technology companies. Significant trends identified for the forecasted period encompass advancements in wearable diagnostic devices, progress in AI-driven symptom monitoring, R&D in digital biomarkers, enlargement of cloud-based health information solutions, and the merger of telemedicine and digital therapeutics. Download a free sample of the digital therapeutics endometriosis market report: https://www.thebusinessresearchcompany.com/sample.aspx?id=29024&type=smp What Are Key Factors Driving The Demand In The Global Digital Therapeutics Endometriosis Market? The swift uptake of smartphones is anticipated to fuel the expansion of the digital therapeutics endometriosis market. These handheld devices blend communication, internet access, and computing capabilities into a single gadget. The rise in smartphones is linked to the growth of internet penetration, enabling a wider population to conveniently access online services, social media, and digital entertainment right from their devices. The widespread usage of smartphones bolsters digital therapeutics endometriosis by providing users immediate and consistent access to tailored therapeutic applications. This facilitates real-time symptom tracking, data monitoring, and guidance for evidence-based treatment, accessible anytime and anywhere. For example, a report by Uswitch Limited, a UK-based online and telephone comparison and switching service provider, revealed that there were 71.8 million active mobile connections in 2022. By 2025, it is predicted that 95% of the 68.3 million residents in the UK will possess smartphones. Consequently, the swift uptake of smartphones is anticipated to fuel the expansion of the digital therapeutics endometriosis market. Who Are The Leading Players In The Digital Therapeutics Endometriosis Market? Major players in the Digital Therapeutics Endometriosis Global Market Report 2025 include: • Bayer AG • Kissei Pharmaceutical Co. Ltd. • Abbott Laboratories • Luna Endoscore • Chugai Pharmaceutical Co. Ltd. • Sword health inc. • Charli • Maven Clinic Co. • Flo Health Inc. • Hinge Health Inc. What Are The Key Trends Shaping The Digital Therapeutics Endometriosis Industry? Prominent businesses in the digital therapeutics endometriosis sector are honing in on establishing strategic alliances to fast-track innovation by merging different viewpoints and expert capabilities. Collaborative initiatives are engagements in which multiple entities come together to fulfill common goals, pool resources, or leverage each other's proficiencies. For example, in March 2024, Endometriosis Australia, a nationally accredited charity in Australia, joined forces with CHARLI, a digital health enterprise in Australia, to launch a ground-breaking platform designed to assist thousands of Australians affected by endometriosis. This partnership led to the creation of an app developed collectively by medical and health professionals in conjunction with consumers. The app employs AI to aid women in tracking menstruation, fertility, sexual health, pregnancies, and peri/menopause. Moreover, the app assists in identifying pain or possible conditions such as endometriosis. In conjunction with Endometriosis Australia, the app offers support to the one in seven Australians impacted by the disease, facilitating faster diagnosis and simplified access to medical care. Analysis Of Major Segments Driving The Digital Therapeutics Endometriosis Market Growth The digital therapeutics endometriosismarket covered in this report is segmented – 1) By Product Type: Software, Devices, Services 2) By Deployment Mode: On-Premises, Cloud-Based 3) By Application: Pain Management, Symptom Tracking, Fertility Management, Education And Awareness, Other Applications 4) By End User: Hospitals And Clinics, Homecare, Research Institutes, Other End Users Subsegments: 1 By Software: Mobile Applications, Web-Based Platforms, Cloud-Based Solutions, Decision Support Tools 2) By Devices: Wearable Monitoring Devices, Smart Therapeutic Devices, Digital Diagnostic Tools, Connected Medical Devices 3) By Services: Remote Patient Monitoring Services, Teleconsultation Services, Therapy Management Services, Data Analytics And Support Services View the full digital therapeutics endometriosis market report: https://www.thebusinessresearchcompany.com/report/digital-therapeutics-endometriosis-global-market-report Which Region Is Expected To Lead The Digital Therapeutics Endometriosis Market By 2025? In the Digital Therapeutics Endometriosis Global Market Report 2025, North America emerged as the biggest market in 2024. However, the Asia-Pacific region is projected to witness the most rapid growth in the forecast period. The report explores various regions including Asia-Pacific, Western Europe, Eastern Europe, North America, South America, the Middle East, and Africa. Browse Through More Reports Similar to the Global Digital Therapeutics Endometriosis Market 2025, By The Business Research Company Endometriosis Global Market Report 2025 https://www.thebusinessresearchcompany.com/report/endometriosis-global-market-report Endometrial Cancer Treatment Global Market Report 2025 https://www.thebusinessresearchcompany.com/report/endometrial-cancer-treatment-global-market-report Endometrial Ablation Devices Global Market Report Global Market Report 2025 https://www.thebusinessresearchcompany.com/report/endometrial-ablation-devices-global-market-report Speak With Our Expert: Saumya Sahay Americas +1 310-496-7795 Asia +44 7882 955267 & +91 8897263534 Europe +44 7882 955267 Email: saumyas@tbrc.info The Business Research Company - www.thebusinessresearchcompany.com Follow Us On: • LinkedIn: https://in.linkedin.com/company/the-business-research-company Oliver Guirdham The Business Research Company info@tbrc.info Visit us on social media: LinkedIn Facebook X Legal Disclaimer: EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Maven Frequently Asked Questions (FAQ)

When was Maven founded?

Maven was founded in 2014.

Where is Maven's headquarters?

Maven's headquarters is located at 160 Varick Street, New York.

What is Maven's latest funding round?

Maven's latest funding round is Series F.

How much did Maven raise?

Maven raised a total of $414.47M.

Who are the investors of Maven?

Investors of Maven include Sequoia Capital, Oak HC/FT, Icon Ventures, Lux Capital, Dragoneer Investment Group and 35 more.

Who are Maven's competitors?

Competitors of Maven include SteadyMD, Lemonaid Health, Thirty Madison, K Health, Gotcare and 7 more.

What products does Maven offer?

Maven's products include Fertility & Family Building and 4 more.

Who are Maven's customers?

Customers of Maven include Microsoft and Blue Cross Blue Shield of Michigan.

Loading...

Compare Maven to Competitors

Rezilient provides healthcare services. It combines telehealth services with in-person care capabilities. The company offers primary and urgent care services, accessible through both virtual and physical examinations, including labs and imaging. It provides individuals and families with convenient healthcare solutions. Rezilient was formerly known as DynamicSurgical. It was founded in 2016 and is based in Saint Louis, Missouri.

Transcarent provides health and care services. The company offers a suite of services, including healthcare navigation, virtual and in-person care, pharmacy care, and health programs, designed to guide members through health journeys. Transcarent primarily serves members, employers, consultants, and labor unions. It was founded in 2020 and is based in Denver, Colorado.

Ro provides telehealth services and healthcare products across various sectors. The company offers online consultations and treatments for weight loss, sexual health, hair loss, fertility, and skin care, using Food and Drug Administration (FDA) approved medications. Ro serves individuals seeking healthcare solutions without the need for insurance. Ro was formerly known as Roman. It was founded in 2017 and is based in New York, New York.

Medcase operates within the telehealth and medical data sectors. It connects organizations with healthcare professionals for virtual care services and offers data solutions, including medical data annotation and labeling. Medcase serves the pharmaceutical, biotechnology, telehealth infrastructure, clinical staffing, and medical device industries. Medcase was formerly known as Edgecase AI. It was founded in 2021 and is based in Hingham, Massachusetts.

Firefly Health provides integrated healthcare services and health plans within the healthcare sector. It offers a virtual experience that includes medical support, preventive care, and a digital application for health management. It serves the healthcare industry with a focus on employer-sponsored health coverage and virtual care. It was founded in 2016 and is based in Watertown, Massachusetts.

98point6 Technologies specializes in digital health solutions and focuses on telehealth and healthcare technology. The company offers a virtual care platform that provides asynchronous and real-time telehealth services, designed to streamline administrative tasks for clinicians and enhance patient-provider interactions. Their platform serves the healthcare industry by increasing provider efficiency and patient satisfaction through technology that supports various care modalities. 98point6 Technologies was formerly known as 98point6. It was founded in 2017 and is based in Seattle, Washington. 98point6 Technologies operates as a subsidiary of Transcarent.

Loading...