Huma

Founded Year

2011Stage

Series D | AliveTotal Raised

$367.6MValuation

$0000Last Raised

$80M | 1 yr agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+17 points in the past 30 days

About Huma

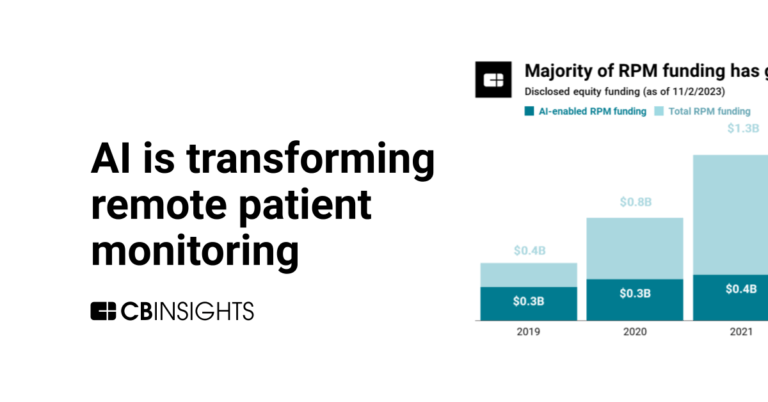

Huma is a healthcare AI company that provides digital health solutions for care and research. The company offers services including remote patient monitoring, hospital-at-home programs, virtual wards, and decentralized clinical trials. Huma's technology is used by hospitals and clinics globally and is integrated into clinical trials. Huma was formerly known as Huma Therapeutics GmbH. It was founded in 2011 and is based in London, United Kingdom.

Loading...

Huma's Product Videos

ESPs containing Huma

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The passive vital sign monitoring market offers solutions for accurately monitoring patient vitals, such as breathing patterns and heart rate, without the need for wearables, motion sensors, or cameras. The advantage of passive monitoring, as opposed to data collected from wearables, is that it doesn’t require patients to actively wear a device all of the time. Additionally, this approach enhances…

Huma named as Leader among 10 other companies, including Philips, FaceHeart, and Binah.ai.

Huma's Products & Differentiators

HumaWorkSpace

We have built the Huma Cloud Platform, a powerful tool that makes launching digital healthcare solutions 10x easier, faster, and more cost-effective. Think of the Huma Cloud Platform as Shopify for digital health a robust, customizable foundation that simplifies the complex landscape of digital health and regulated app development. With active registrations in 4 continents, HCP sets a new industry standard, ensuring that digital health applications can be deployed safely and efficiently across the US and global markets.

Loading...

Research containing Huma

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Huma in 15 CB Insights research briefs, most recently on Jul 3, 2025.

May 23, 2025

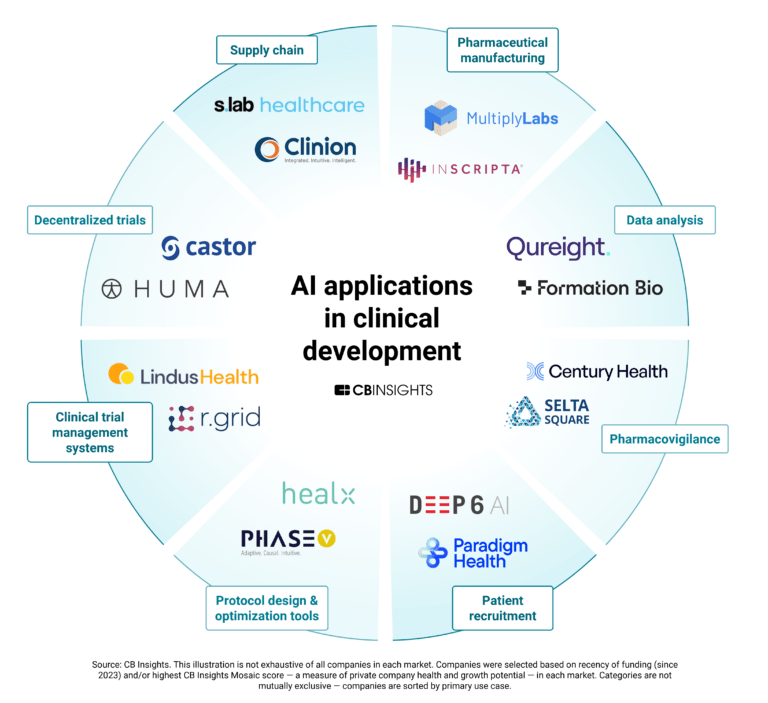

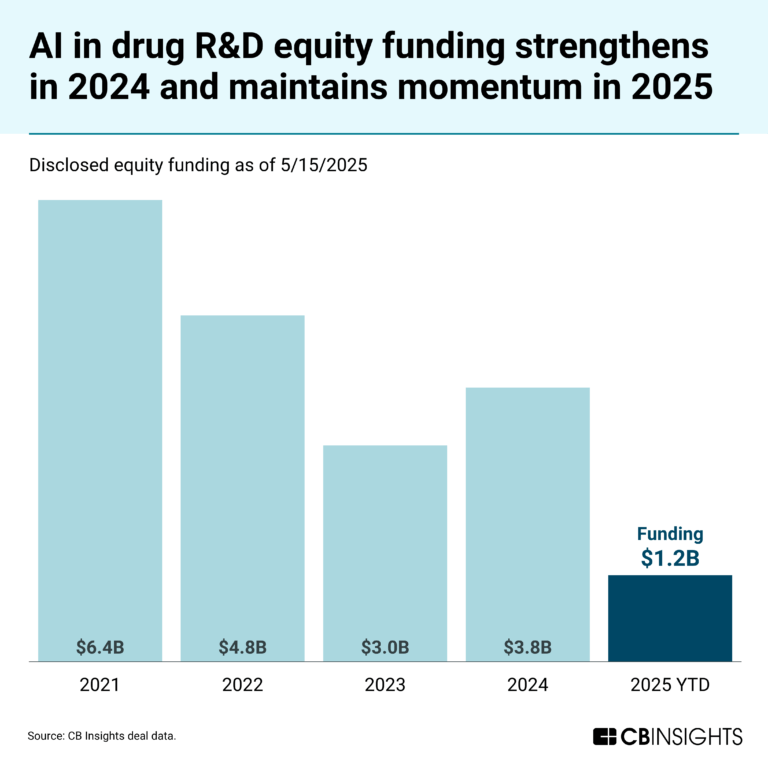

The AI in drug R&D market map

Oct 17, 2024 report

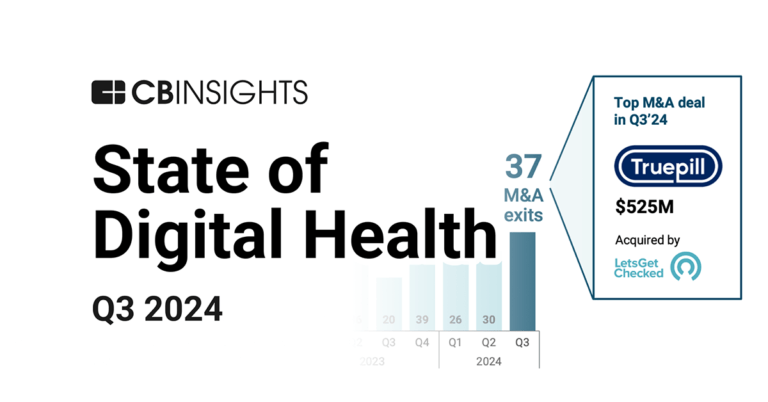

State of Digital Health Q3’24 Report

Aug 21, 2024

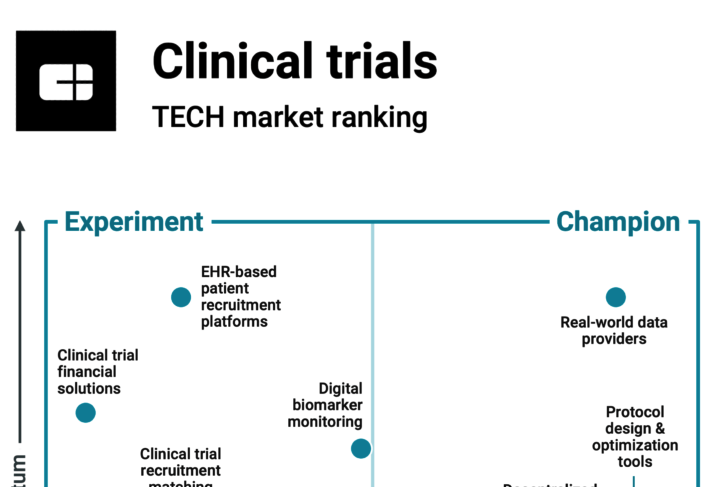

The clinical trials tech market mapExpert Collections containing Huma

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Huma is included in 7 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,309 items

AI 100 (All Winners 2018-2025)

100 items

Artificial Intelligence (AI)

16,704 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Value-Based Care & Population Health

1,069 items

The VBC & Population Health collection includes companies that enable and deliver care models that address the health needs for defining populations along the continuum of care, including in the community setting, through participation, engagement, and targeted interventions.

Digital Health

12,122 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Telehealth

3,123 items

Companies developing, offering, or using electronic and telecommunication technologies to facilitate the delivery of health & wellness services from a distance. *Columns updated as regularly as possible; priority given to companies with the most and/or most recent funding.

Huma Patents

Huma has filed 7 patents.

The 3 most popular patent topics include:

- smartwatches

- medical equipment

- psychiatric diagnosis

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

2/6/2019 | Blood pressure, Arteries of the upper limb, Arteries of the head and neck, Vascular diseases, Hypertension | Application |

Application Date | 2/6/2019 |

|---|---|

Grant Date | |

Title | |

Related Topics | Blood pressure, Arteries of the upper limb, Arteries of the head and neck, Vascular diseases, Hypertension |

Status | Application |

Latest Huma News

Sep 29, 2025

100 AI Unicorns Minted Since the Launch of ChatGPT Foundational infrastructure, including LLM developers and agentic AI development solutions, are the most represented categories among AI unicorns. However, robotics is gaining momentum, reflecting the rise of physical AI. Get the hottest Fintech Switzerland News once a month in your Inbox Since the launch of OpenAI’s artificial intelligence (AI)-powered chatbot ChatGPT in late 2022, 100 startups have reached unicorn status, reflecting the sector’s rapid growth and heightened interest from the technology and investor community. A new report by business analytics platform CB Insights looks at this landscape, analyzing these 100 billion-dollar companies to understand how the cohort stacks up, top exits, leading investors, and more. According to the report, large tech firms back a significant share of the AI ecosystem. 36% of these 100 unicorns have received investment from companies such as Nvidia, Google, and Microsoft, with Nvidia leading the group with stakes in 24 of the 100 ventures. This reflects the firm’s strategy of building an AI ecosystem through strategic investments. Notable Nvidia-backed AI unicorns include Skild AI, which develops a universal AI model for robotics, valued at US$4.5 billion; Imbue, which specializes in AI agents for reasoning and coding; and Ayar Labs, which builds optical I/O solutions to enhance data movement and compute efficiency for AI systems. Google follows Nvidia with investments in 15 AI unicorns, and Microsoft with seven. Top performing venture capital (VC) firms are also heavily involved, with Lightspeed leading the category with investments in 17 AI unicorns, followed by Andreessen Horowitz, and Sequoia. Top investors in AI’s 100 unicorns, Source: CB Insights, Aug 2025 AI exits So far, this landscape has witnessed three exits. These transactions all occurred over the past year or so: BioCatch, a digital fraud detection and financial crime prevention startup, was acquired in September 2024 by Permira, a global private equity firm; Windsurf, an AI coding company, was acquired by Cognition in July 2025. Cognition is best known for its AI coding agent named Devin, which is designed to help engineers build software faster. According to CB Insights, Beamery and Huma are next in line to exit and are the two AI unicorns most likely to be acquired in the near future. Beamery is a UK-based human resource management software company, which integrates skills and task intelligence to real-time workforce data. Its agentic talent advisor enables businesses to hire, redeploy, and reskill talent. Beamery reached unicorn status in December 2022 following a US$50 million Series D. It recently launched its Workforce Intelligence Suite, featuring Task Intelligence to break roles into tasks for AI automation, and introduced Ray, an embedded AI consultant helping enterprise leaders make talent decisions across the platform. Beamery has secured partnerships with prominent names like LinkedIn Recruiter and Workday Skills. The startup has also seen its revenue surge from US$4.6 million in fiscal 2020 to US$112.8 million in fiscal 2024, marking a 2,352% increase. Huma, based in London as well, develops AI-powered digital health platforms for remote patient monitoring and decentralized clinical trials. These platforms are currently used by more than 3,000 hospitals and clinics, with over 35 million screened users and 4 million registered users in healthcare. Huma, which reached unicorn status in July 2024 following a US$80 million Series D , has inked partnerships with the likes of AstraZeneca, Google Cloud, and Bayer, reflecting industry traction. AI exits to date, Source: CB Insights, Aug 2025 Robotics gains momentum One trend highlighted in the report is the rise of physical AI. This category currently includes three unicorns, namely Skild AI, Physical Intelligence, and World Labs, and 3 humanoid robot developers, which are Figure, Unitree Robotics, and Zhiyuan Robot. This signals strong investor confidence in AI’s transition from digital to physical applications. Morgan Stanley expects the humanoid robot market to exceed US$5 trillion by 2050, including sales from supply chains and networks for repair, maintenance and support. By then, the number of robots that resemble and act like humans is projected to reach nearly 1 billion, with 90% used for industrial and commercial purposes. China is likely to have the highest number of humanoid robots in use by 2050, at 302.3 million, trailed by the US at 77.7 million. This surge will be in part driven by increased accessibility of humanoids. Prices are expected to fall to about US$150,000 by 2028 and US$50,000 by 2050, down from US$200,000 in 2024 in high-income countries. In lower-income countries, which may take more advantage of the cheaper Chinese supply chain, prices could fall to as low as US$15,000 by 2050, the firm says. Foundational infrastructure leads AI unicorns Large language model (LLM) developers currently dominate AI unicorns, with 12 ventures. Prominent players include France’s Mistral AI, valued at US$6.2 billion; Cohere from Canada, valued at US$5.5 billion; and China’s Moonshot AI, valued at US$3.3 billion. This category also includes the most well-funded AI unicorns, such as xAI, which has secured US$22,4 billion; and Anthropic , which has raised US$18.5 billion. These companies are also among the most valuable AI startups, worth US$75 billion and US$61.5 billion, respectively. LLM developers are followed by AI agents, with eight ventures focusing on coding AI agents and copilots, and five specializing in AI agent development platforms. Notable examples include Seekr, an enterprise AI company focusing on enterprise AI for critical infrastructure markets; Helsing, which develops AI-powered defense systems for Western militaries; and Safe Superintelligence, which builds AI systems focused on safety and high capability. Together, LLM developers and AI agent development platforms form the foundational infrastructure of AI, providing the building blocks for AI. Code AI agents and copilots, meanwhile, represent one of the most successful applications layers built on top of this foundation to date. Most of today’s 100 AI startup unicorns emerged in 2024 (41 ventures), coinciding with the surge of interest following ChatGPT’s launch. Momentum has continued in 2025, with 31 unicorns minted so far. Launched in November 2022, ChatGPT is a AI-powered chatbot that allows users to ask questions and then answer these questions with human-like responses. The app, owned by OpenAI boasts 700 million weekly active users. OpenAI is valued at a staggering US$300 million, making it the third most valuable startup in the world. The startup recently signed a US$100 billion deal with Nvidia and has received a total of US$11 billion in investment from Microsoft. It is now reportedly in talks to raise up to US$40 billion in a new funding round.

Huma Frequently Asked Questions (FAQ)

When was Huma founded?

Huma was founded in 2011.

Where is Huma's headquarters?

Huma's headquarters is located at 21-24 Millbank, London.

What is Huma's latest funding round?

Huma's latest funding round is Series D.

How much did Huma raise?

Huma raised a total of $367.6M.

Who are the investors of Huma?

Investors of Huma include Leaps by Bayer, AstraZeneca, Hitachi Ventures, HAT, SBRI Healthcare and 18 more.

Who are Huma's competitors?

Competitors of Huma include Albert Health, Amalgam Rx, Current Health, Dawn Health, Verily and 7 more.

What products does Huma offer?

Huma's products include HumaWorkSpace and 2 more.

Who are Huma's customers?

Customers of Huma include UCB.

Loading...

Compare Huma to Competitors

Lindus Health focuses on clinical trials for the life sciences sector, providing services that include trial design, patient recruitment, data management, and study monitoring. The company operates with fixed-price quotes and milestone-based payments. Lindus Health serves biotech and pharmaceutical companies, using its software platform and access to a database of electronic health records. It was founded in 2021 and is based in New York, New York.

BrightInsight operates as a digital health company that offers a cloud-based platform for biopharma and medtech industries. The company provides software as a medical device (SaMD), disease management solutions, and digital health services. The platform is utilized for creating companion apps, algorithms, and healthcare provider interfaces. BrightInsight was formerly known as Flex Digital Health. It was founded in 2017 and is based in Alviso, California.

Doccla is a virtual hospital that specializes in the healthcare technology sector. The company offers remote patient monitoring services, utilizing medical IoT devices to monitor patients outside of traditional hospital settings, and integrates with electronic health records to streamline patient data management. Doccla primarily serves the healthcare industry, providing solutions to hospitals, clinics, and other medical institutions. It was founded in 2019 and is based in London, United Kingdom.

Validic is a technology platform focused on healthcare, specializing in the integration of digital health data from various clinical and remote-monitoring devices. The company offers a solution that includes a health IoT platform and EHR-integrated remote patient care, enabling health systems and organizations to utilize patient-generated health data for clinical decision-making and personalized care. Validic's services are designed to support the healthcare sector by improving population health programs, clinical workforce efficiency, and patient care outcomes. It was founded in 2010 and is based in Durham, North Carolina.

Medable specializes in the development of decentralized clinical trial software and electronic Clinical Outcome Assessment (eCOA) solutions within the healthcare technology sector. The company's platform provides tools for remote monitoring, data collection, and trial management, utilizing artificial intelligence (AI) to improve processes in clinical research. Medable serves the pharmaceutical and biotechnology industries, including mid to large pharma, emerging biotech firms, and contract research organizations (CROs). Medable was formerly known as Dermatrap. It was founded in 2012 and is based in Palo Alto, California.

Evidation is involved in measuring health in everyday life within the digital health sector. The company provides a platform for individuals to track health activities, participate in research, and manage their data privacy. Evidation serves the life sciences, government, and non-profit organizations. It was founded in 2012 and is based in San Mateo, California.

Loading...