Merck

Founded Year

1668Stage

IPO | IPODate of IPO

10/20/1995Market Cap

51.11BStock Price

117.55Revenue

$0000About Merck

Merck operates in the sectors of life science, healthcare, and electronics. The company offers products and services for scientific research, healthcare advancements, and electronic materials. Merck serves the life science, healthcare, and electronics industries. It was founded in 1668 and is based in Darmstadt, Germany.

Loading...

ESPs containing Merck

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The semiconductor raw materials market supplies essential materials including photoresists, specialty chemicals, high-purity gases, and specialty metals required for semiconductor fabrication. This market also includes critical components such as chemical mechanical polishing (CMP) slurries and dielectrics used in wafer processing and integrated circuit manufacturing. These materials are increasin…

Merck named as Leader among 15 other companies, including Honeywell, BASF, and Air Liquide.

Loading...

Research containing Merck

Get data-driven expert analysis from the CB Insights Intelligence Unit.

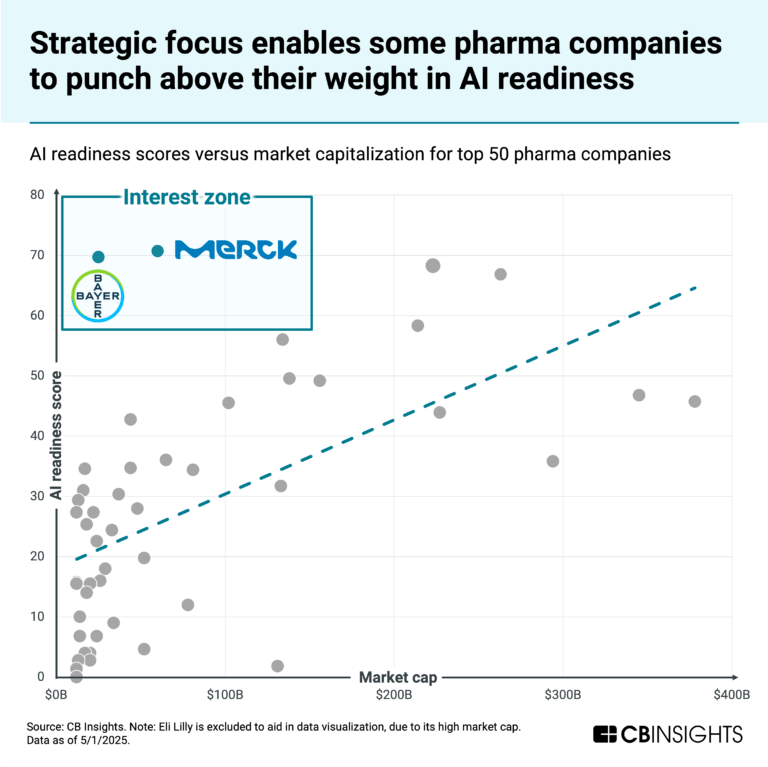

CB Insights Intelligence Analysts have mentioned Merck in 4 CB Insights research briefs, most recently on Aug 6, 2025.

Jul 2, 2024 team_blog

How to buy AI: Assessing AI startups’ potentialExpert Collections containing Merck

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Merck is included in 1 Expert Collection, including Conference Exhibitors.

Conference Exhibitors

5,302 items

Merck Patents

Merck has filed 612 patents.

The 3 most popular patent topics include:

- clusters of differentiation

- transcription factors

- monoclonal antibodies

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

11/26/2019 | 4/1/2025 | Clusters of differentiation, G protein coupled receptors, Immunology, Transcription factors, Adenosine receptor antagonists | Grant |

Application Date | 11/26/2019 |

|---|---|

Grant Date | 4/1/2025 |

Title | |

Related Topics | Clusters of differentiation, G protein coupled receptors, Immunology, Transcription factors, Adenosine receptor antagonists |

Status | Grant |

Latest Merck News

Nov 17, 2025

WILMINGTON, DE, UNITED STATES, November 17, 2025 / EINPresswire.com / -- According to a new report published by Allied Market Research Environmental Monitoring Market Size, Share, Competitive Landscape and Trend Analysis Report, by Component (Particulate Detection, Chemical Detection, Biological Detection, Temperature Sensing, Moisture Detection and Noise Measurement) and Applications (Air Pollution Monitoring, Water Pollution Monitoring, Soil Pollution Monitoring and Noise Pollution Monitoring): Global Opportunity Analysis and Industry Forecast, 2021-2030, The global environmental monitoring market size was valued at USD 19.89 billion in 2020, and is projected to reach USD 43.48 billion by 2030, growing at a CAGR of 8.2% from 2021 to 2030. The environmental monitoring market is gaining strong momentum as governments and industries prioritize pollution control, climate tracking, and ecosystem protection. Rapid urbanization and rising industrial activity have heightened the need for continuous monitoring of air, water, soil, and noise levels to ensure compliance with environmental standards. This shift has led to increased investments in advanced sensor networks, automated data collection systems, and IoT-enabled monitoring platforms. Technological advancements—including miniaturized sensors, cloud-based analytics, and satellite monitoring—are transforming the way environmental data is captured, analyzed, and utilized. These innovations are enabling more accurate, real-time insights that help organizations optimize operations, reduce environmental impact, and support sustainable development initiatives. Download PDF Brochure: https://www.alliedmarketresearch.com/request-sample/A00962 Market Dynamics One of the primary drivers of market growth is the increasing stringency of environmental regulations across sectors such as manufacturing, energy, chemicals, and wastewater management. Governments are enforcing tighter emission norms, compelling industries to adopt advanced monitoring tools to ensure regulatory compliance. Another major factor fueling market expansion is the growing public concern regarding environmental degradation and climate change. Rising awareness of air pollution, water contamination, and resource depletion has created strong demand for high-quality monitoring systems in both industrial and residential sectors. Technological innovation is also significantly influencing market dynamics. The integration of IoT, AI-driven analytics, machine learning, and remote sensing capabilities is enabling automated monitoring, predictive analysis, and early detection of environmental risks. These technologies improve operational efficiency and reduce costs related to manual sampling. However, high installation and maintenance costs of advanced systems may restrain adoption, particularly among small and medium enterprises. Limited technical expertise and infrastructure in developing regions also pose challenges to widespread deployment. Despite these challenges, the market presents substantial opportunities as industries embrace sustainability goals, governments strengthen environmental protection frameworks, and digital monitoring technologies become more affordable. Continuous R&D investments and cross-industry collaboration are expected to accelerate market growth. Connect to Analyst: https://www.alliedmarketresearch.com/connect-to-analyst/A00962 Segment Overview The environmental monitoring market is segmented into product types (sensors, monitors, software, and services), sampling methods (active, passive, continuous, and intermittent), and applications (air, water, soil, and noise monitoring). Air quality monitoring holds the largest share due to rising concerns over pollution and urban emissions, while water monitoring is growing rapidly in response to increasing contamination issues and wastewater management needs. By product type, the environmental monitoring sensors segment led the market in 2020 and is expected to maintain its dominance in the coming years. This growth is driven by rising public awareness about the health risks associated with indoor pollution and the increasing need for accurate, continuous environmental data. Meanwhile, the wearable environmental monitors segment is poised for the fastest growth during the forecast period, supported by the growing adoption of wearable technologies that track environmental pollutants and even detect biomarkers related to health conditions. Regional Analysis Regionally, North America held the largest share of the environmental monitoring market in 2020 and is projected to maintain its lead throughout the forecast period. The presence of major technology providers, including companies such as 3M and Danaher, continues to strengthen the regional market. However, Asia-Pacific is expected to record substantial growth, fueled by rising pollution levels and increasing adoption of monitoring technologies across major countries such as China, Japan, and India. For Purchase Inquiry: https://www.alliedmarketresearch.com/purchase-enquiry/A00962 Competitive Analysis: The key players operating in the global environmental monitoring industry include 3M, Danaher, Emerson Electric Co., General Electric , Honeywell International Inc., Merck KGaA , Siemens AG, Teledyne Technologies Incorporated, TE Connectivity Ltd. and Thermo Fisher Scientific Inc. These players have adopted various strategies to increase their market penetration and strengthen their foothold in the environmental monitoring industry. Key Findings of the Study • By component, the particulate detection segment accounted for the environmental monitoring market share in 2020. • By region, North America generated the highest revenue in 2020. • By product type, the environmental monitoring sensors segment generated the highest revenue in 2020. Trending Reports in Industry: In-memory Database Market https://www.alliedmarketresearch.com/in-memory-database-market-A31497 Industrial Cloud Market https://www.alliedmarketresearch.com/industrial-cloud-market Warehouse Automation Systems Market https://www.alliedmarketresearch.com/warehouse-automation-systems-market-A31490 Blockchain-as-a-Service Market https://www.alliedmarketresearch.com/blockchain-as-a-service-market-A31496 Advanced Analytics Market https://www.alliedmarketresearch.com/advanced-analytics-market-A31538 Hyperautomation Market https://www.alliedmarketresearch.com/hyperautomation-market-A31470 David Correa Allied Market Research email us here Visit us on social media: LinkedIn Facebook YouTube X Legal Disclaimer: EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Merck Frequently Asked Questions (FAQ)

When was Merck founded?

Merck was founded in 1668.

Where is Merck's headquarters?

Merck's headquarters is located at Frankfurter Strasse 250, Darmstadt.

What is Merck's latest funding round?

Merck's latest funding round is IPO.

Who are Merck's competitors?

Competitors of Merck include Novartis, Thermo Fisher Scientific, Entegris, Agilent Technologies, AstraZeneca and 7 more.

Loading...

Compare Merck to Competitors

Servier operates as a pharmaceutical company, engages in the research, development, and production of medications for various diseases, including targeted therapies for cancer, cardiovascular treatments, diabetes, and drugs for immuno-inflammatory and neuropsychiatric conditions. The company also produces generic drugs. It was founded in 1954 and is based in Suresnes, France.

Novartis develops and offers a range of medicines aimed at treating serious diseases, providing support for patients and healthcare professionals, and conducting research to discover new therapies. The company also focuses on environmental sustainability and ethical practices in the pharmaceutical industry. It was founded in 1996 and is based in Basel, Switzerland.

Boehringer Ingelheim operates within the pharmaceutical and animal health sectors. The company conducts research and development of products for humans and animals. Boehringer Ingelheim serves the healthcare industry with an emphasis on pharmaceutical products. It was founded in 1885 and is based in Ingelheim am Rhein, Germany.

PerkinElmer operates a biotechnology company. It offers a diagnostics portfolio that focuses on reproductive health, infectious disease screening, and genomics offerings for oncology and other molecular tests through its range of instruments, reagents, assay platforms, and software offerings. The company was founded in 1937 and is based in Shelton, Connecticut.

Swiss Labs focused on consulting and distribution in the field of laboratory supplies for chromatography, chemical analysis, biological analysis, oenology, and food analysis. The company offers products including gas chromatography (GC) and high-performance liquid chromatography (HPLC) columns, flash chromatography columns, analytical standards, consumables, accessories, caps, bottles, and kits for wine and food analysis. Swiss Labs serves research universities, major laboratories, and independent winemakers. Swiss Labs was formerly known as Laubscher Labs. It was founded in 2000 and is based in Mulhouse, France.

Eppendorf is a life science company that specializes in developing and selling laboratory instruments, consumables, and services. The company offers a wide range of products, including pipettes, centrifuges, and ultra-low temperature freezers, designed to facilitate liquid, sample, and cell handling in various laboratory settings. It was founded in 1945 and is based in Hamburg, Germany.

Loading...