Mercury

Founded Year

2017Stage

Secondary Market | AliveTotal Raised

$455.84MValuation

$0000Revenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+107 points in the past 30 days

About Mercury

Mercury provides online business banking and financial workflows for startups and small businesses. The company offers services including business checking and savings accounts, corporate credit cards, expense management, invoicing, bill payments, accounting automation, and venture debt. Mercury serves the startup ecosystem by providing financial tools. It was founded in 2017 and is based in San Francisco, California.

Loading...

Mercury's Product Videos

Mercury's Products & Differentiators

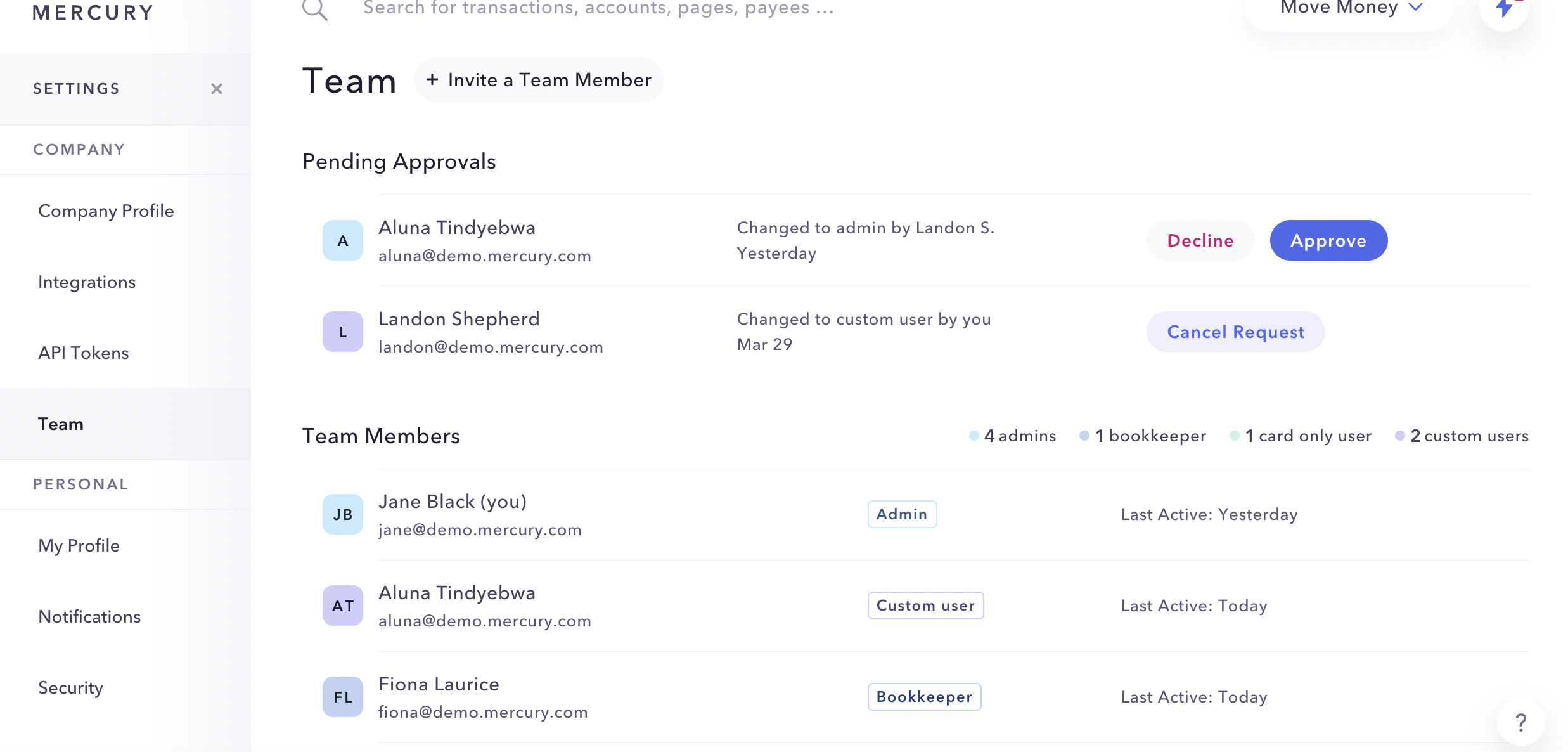

Business Checking Account

Designed with startups in mind, Mercury offers scalable digital tools — plus, every account provides read-write application programming interface access to truly customize your banking.

Loading...

Research containing Mercury

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Mercury in 2 CB Insights research briefs, most recently on Jul 17, 2025.

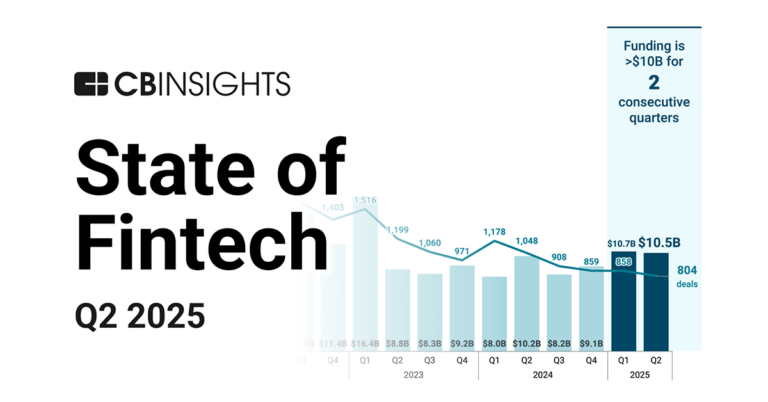

Jul 17, 2025 report

State of Fintech Q2’25 Report

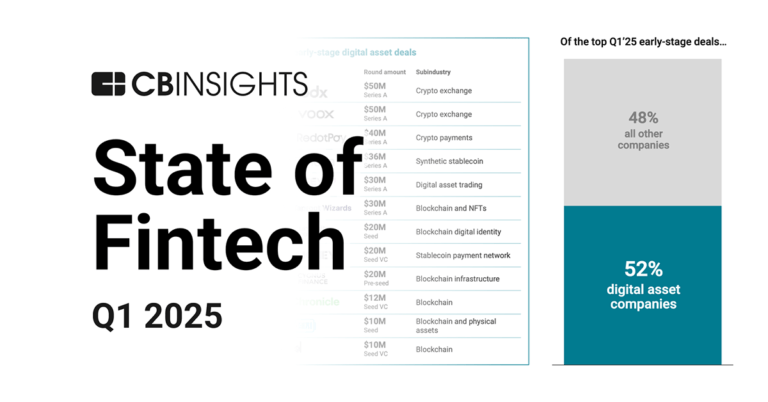

Apr 10, 2025 report

State of Fintech Q1’25 ReportExpert Collections containing Mercury

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Mercury is included in 7 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,297 items

SMB Fintech

1,586 items

Future Unicorns 2019

50 items

Fintech

9,809 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Digital Banking

1,182 items

Challenger bank offer digitally native banking products (checking and savings account at the most basic) and either leverage partner banks or are fully-licensed banks themselves.

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Mercury Patents

Mercury has filed 51 patents.

The 3 most popular patent topics include:

- videotelephony

- display devices

- electromagnetic radiation

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

2/13/2023 | 3/4/2025 | Videotelephony, Teleconferencing, Association football forwards, Groupware, Qualitative research | Grant |

Application Date | 2/13/2023 |

|---|---|

Grant Date | 3/4/2025 |

Title | |

Related Topics | Videotelephony, Teleconferencing, Association football forwards, Groupware, Qualitative research |

Status | Grant |

Latest Mercury News

Nov 7, 2025

“It's been a real roller coaster,” he said. “Fintech was super hot in 2020, 2021, and by the end of 2022, 2023, it was kind of dead…I feel like this year has seen a big resurgence, and so many companies and ideas from the 2020 era have reached significant maturity.” Akhund points out that some of 2025's most successful IPOs, from Circle to Chime, were fintechs, adding: “I think excitement is back.” That's certainly evident not only in the public markets performance of companies like Chime, but in the private markets, where a number of fintech unicorns like Mercury are once again attracting capital. (In March, Mercury raised its Sequoia-led $300 million Series C at a $3.5 billion valuation.) The company now tells Fortune it's reached a key financial milestone: At the end of Q3, Mercury hit $650 million in annualized revenue, a nice jump from $500 million by the end of 2024. In a world where startups sometimes hide behind squishy financial metrics, Akhund is refreshingly clear about its numbers. This annualized revenue calculation isn't a software-as-a-service-era ARR calculation (as Akhund notes, historically ARR refers to predictable long-term contracts, but that doesn't align with fintech's model). Mercury's annualized revenue figure takes monthly revenue, multiplies it by 12, Akhund said. The company added that it has now been GAAP profitable on both net-income and EBITDA for three consecutive years. “As a general philosophy, I like being profitable,” Akhund said. “The point of building software companies is that we're supposed to have high margins…I think it's especially important in banking. There's a lot of trust involved in banking, where we're asking people to trust us with millions of dollars, the hard-won money they've raised. We have several companies on Mercury that have more than $100 million on our systems. That's very high trust, and if they feel like we're some crazy, cash-burning, irresponsible startup, that's not something they'll think of as a reliable platform.” Trust is, indeed, hard to win and easy to lose in fintech, which has seen a number of scandals in recent years, including the seismic collapse of Synapse and Evolve . Mercury was tangled in that collapse, which reportedly triggered regulatory scrutiny of the unicorn. Asked about regulatory concerns, Akhund told Fortune that Mercury is investing heavily in compliance as the company grows, bringing in key compliance hires, including chief compliance officer Steve Pearlman. “What you have to do as a fintech at different scales is just different,” he said. “So, when we launched, we had nine people working with an external compliance consultant—and that was fine, because no one was using Mercury yet. Over time, as we've scaled, we've invested a lot more. At this stage, about 20% of our company is our risk and compliance teams.” One of the key features of Mercury's story is that it's a startup whose story is inextricably tied to other startups. The company's customers include ascendant startups—including Supabase, ElevenLabs, Lovable, Linear, Phantom, and Tempo—and that customer base is growing: Mercury's seen 40% growth in customers through 2025, the company said. Additionally, Akhund himself has proven he has an eye for backing startups as an investor in his own right, including Rippling, Airtable, Rappi, Applied Intuition, and Substack. (He's backed more than 350 startups since 2016 and in May announced he'd raised a $26 million venture fund of his own.) Investing on his own served as a reminder for Akhund of where he's been, and where he's going. “It's easy when you're 1,000 people to start thinking a little slower,” he said. “It's really always good to meet an entrepreneur: They have a team of three people, they're going so hard, really trying to build something big with very few resources…Obviously, it's harder to do things instantly when you have 200,000-plus customers. But it does give you the drive to go faster and explore things more.” See you Monday, Allie Garfinkle X: @agarfinks Email: alexandra.garfinkle@fortune.com Submit a deal for the Term Sheet newsletter here Joey Abrams curated the deals section of today's newsletter. Subscribe here Venture Deals Armis , a San Francisco-based cybersecurity company, raised $435 million in funding. Growth Equity at Goldman Sachs Alternatives led the round and was joined by CapitalG and others. Synchron , a Brooklyn, N.Y.-based developer of non-surgical brain-computer interface technology, raised $200 million in Series D funding. Double Point Ventures led the round and was joined by ARCH Ventures Khosla Ventures Bezos Expeditions , and others. EdgeCortix , a Tokyo-based developer of AI processors, raised $110 million in Series B funding from TDK Ventures Jane Street Global Trading , and others. Amae Health , a San Francisco-based care platform for severe mental illness, raised $25 million in funding. Altos Ventures led the round and was joined by Quiet Capital Bling Capital Cedars-Sinai Ventures Healthier Capital , and 8VC fomo , a New York City-based social-first crypto trading app, raised $17 million in Series A funding. Benchmark led the round. Flint , a New York City-based AI-powered education platform, raised $15 million in Series A funding. Basis Set Ventures and Patron led the round and were joined by others. Subtle Computing , a Palo Alto, Calif.-based voice-first computing platform, raised $6 million in seed funding. Entrada Ventures led the round and was joined by Amplify Partners Abstract Ventures , and angel investors. Private Equity Ardian agreed to acquire a 90% stake in centrotherm international , a Blaubeuren, Germany-based developer, manufacturer, and seller of high-temperature thermal processing equipment. Financial terms were not disclosed. Five Arrows acquired a majority stake in NetVendor , a Tualatin, Ore.-based vendor credentialing and maintenance operations platform. Financial terms were not disclosed. JLL Partners acquired Parks Medical Electronics , an Aloha, Ore.-based manufacturer of Doppler ultrasound and vascular diagnostic systems. Financial terms were not disclosed. This is the web version of Term Sheet, a daily newsletter on the biggest deals and dealmakers in venture capital and private equity. Sign up for free. About the Author Allie Garfinkle Senior Finance Reporter and author of Term Sheet Allie Garfinkle is a senior finance reporter for Fortune , covering venture capital and startups. She authors Term Sheet Fortune 's weekday dealmaking newsletter. SEE FULL BIO

Mercury Frequently Asked Questions (FAQ)

When was Mercury founded?

Mercury was founded in 2017.

Where is Mercury's headquarters?

Mercury's headquarters is located at 333 Bush Street, San Francisco.

What is Mercury's latest funding round?

Mercury's latest funding round is Secondary Market.

How much did Mercury raise?

Mercury raised a total of $455.84M.

Who are the investors of Mercury?

Investors of Mercury include Andreessen Horowitz, Charles River Ventures, Coatue, Spark Capital, Sequoia Capital and 73 more.

Who are Mercury's competitors?

Competitors of Mercury include Jiko, Limited, Grasshopper, Found, Treasure and 7 more.

What products does Mercury offer?

Mercury's products include Business Checking Account and 4 more.

Who are Mercury's customers?

Customers of Mercury include and undefined.

Loading...

Compare Mercury to Competitors

Novo provides online business banking solutions for small businesses. Its services include a checking account, a small business credit card, and access to financing. Novo also offers bookkeeping, invoicing, budgeting, and integrations with various business tools. It was founded in 2016 and is based in New York, New York.

Lili focuses on providing business finance solutions. The company offers a range of services, including business banking, smart bookkeeping, invoice and payment management, and tax planning tools. It primarily serves the fintech industry. The company was founded in 2018 and is based in New York, New York.

Bluevine is a financial technology company providing banking solutions and services for small businesses. The company offers products including business checking accounts, accounts payable automation, business loans, and credit cards. Bluevine serves the small business sector with tools for banking, lending, and payment processing. It was founded in 2013 and is based in Jersey City, New Jersey.

Oxygen is a financial technology company. It offers services such as cashback rewards, virtual cards, early payroll access, and tools for business incorporation and invoicing. Oxygen primarily serves consumers, freelancers, solopreneurs, and small to medium-sized businesses with its financial products. It was founded in 2017 and is based in Princeton, New Jersey.

Relay is a financial technology company that provides a platform for small business banking and money management tools. The platform includes features like expense tracking and accounts payable management, aiming to help businesses organize their finances and integrate with accounting software such as QuickBooks Online and Xero. It was founded in 2018 and is based in Toronto, Ontario.

Arival Bank is a digital banking platform operating in the financial technology sector. The company offers enterprise-level banking tools designed to simplify complex business banking needs, including multi-currency accounts, international payments, and advanced security measures. Arival Bank primarily serves tech startups, blockchain and web3 businesses, and digital SMEs. It was founded in 2017 and is based in Singapore.

Loading...