Modern Treasury

Founded Year

2018Stage

Series C - II | AliveTotal Raised

$183.12MValuation

$0000Last Raised

$50M | 4 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-49 points in the past 30 days

About Modern Treasury

Modern Treasury operates in the financial technology sector, providing a platform for payment operations. It offers services that include Automated Clearing House (ACH), wire, Real-Time Payments (RTP), and stablecoin payments, along with ledgering and transaction tracking. The company serves various sectors that need payment infrastructure and integrations, such as benefits administration, investments, lending, marketplaces, payroll, and Software as a Service (SaaS). It was founded in 2018 and is based in San Francisco, California.

Loading...

ESPs containing Modern Treasury

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The transaction banking solutions market provides software platforms and technology solutions that enable banks and financial institutions to offer corporate banking services including cash management, payment processing, liquidity management, and treasury operations to business clients. These platforms facilitate real-time transaction processing, multi-currency operations, automated reconciliatio…

Modern Treasury named as Challenger among 15 other companies, including Oracle, Temenos, and Fiserv.

Modern Treasury's Products & Differentiators

Payments

For companies building money movement products, Payments provides a single API and web app to manage the entire cycle of money movement, from initiating and receiving payments to reconciliation and booking to the General Ledger. It lets customers manage multiple bank payment methods like ACH, Wire, RTP, SEPA, BACS, checks and any other method supported by their bank through one integration.

Loading...

Research containing Modern Treasury

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Modern Treasury in 4 CB Insights research briefs, most recently on Aug 23, 2024.

Aug 23, 2024

The B2B payments tech market map

Jan 4, 2024

The core banking automation market mapExpert Collections containing Modern Treasury

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Modern Treasury is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,297 items

SMB Fintech

2,003 items

Payments

3,277 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

9,809 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

249 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

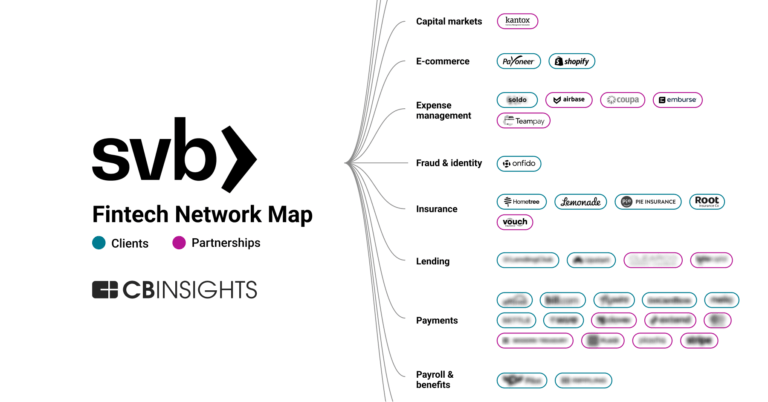

Silicon Valley Bank's Fintech Network

88 items

We mapped out some of SVB's biggest clients, partnerships, and sectors that it serves using CB Insights’ business relationship data from SVB’s profile to uncover just how important it is to the fintech universe. The list is not exhaustive.

Latest Modern Treasury News

Nov 10, 2025

investors — will use Modern Treasury's infrastructure to power its money movement and ledgering. With Modern Treasury, Anchorage Digital can automate money movement via multiple financial providers through a single platform, iterate on its financial infrastructure quickly, and automate payment flows across wires, ACH, and real-time rails. Anchorage Digital provides institutional-grade trading, staking, governance, custody, stablecoin issuance, and settlement for digital assets. With Modern Treasury, Anchorage Digital can automate money movement via multiple financial providers through a single platform, iterate on its financial infrastructure quickly, and automate payment flows across wires, ACH, and real-time rails. “Bridging traditional and digital finance isn't just about compatibility—it's about velocity,” notes Nathan McCauley, Co-Founder and CEO of Anchorage Digital. “With Modern Treasury, we're wiring the banking system directly into the digital asset economy so that institutions can move at crypto speed with bank-grade trust.” Anchorage Digital is leveraging Modern Treasury's Payments for money movement and Ledgers for tracking client balances and transactions. By using Modern Treasury, Anchorage Digital achieves faster interbank payments and automated settlements for fulfilling client redemptions. The platform also provides Anchorage Digital with real-time visibility into liquidity and centralized reconciliation. “Anchorage Digital represents the future of how companies connect their fiat and digital payment strategy for speed and growth,” said Matt Marcus, Co-Founder and CEO of Modern Treasury. “Our platform gives them the flexibility to move money across a variety of banks and payment rails, and expand as they grow, without rebuilding integrations every time." About Modern Treasury Modern Treasury provides trusted infrastructure for money movement. The company helps teams launch and scale payment experiences in days, not months. With best-in-class developer tools and a single API for fiat and stablecoins—plus built-in compliance, ledgering, and reporting—Modern Treasury enables businesses to move money instantly, reliably, and at scale. Backed by leading investors including Benchmark, Altimeter, and Salesforce Ventures, Modern Treasury powers hundreds of companies across industries, helping them build faster payment experiences with real-time visibility into every transaction. Learn more at: https://www.moderntreasury.com/ About Anchorage Digital Anchorage Digital is a global crypto platform that enables institutions to participate in digital assets through trading, staking, custody, governance, settlement, stablecoin issuance, and the industry's leading security infrastructure. Home to Anchorage Digital Bank N.A., the only federally chartered crypto bank in the U.S., Anchorage Digital also serves institutions through Anchorage Digital Singapore, which is licensed by the Monetary Authority of Singapore; Anchorage Digital NY, which holds a BitLicense from the New York Department of Financial Services; and self-custody wallet Porto by Anchorage Digital. The company is funded by leading institutions including Andreessen Horowitz, GIC, Goldman Sachs, KKR, and Visa, with its Series D valuation over $3 billion. Founded in 2017 in San Francisco, California, Anchorage Digital has offices in New York, New York; Porto, Portugal; Singapore; and Sioux Falls, South Dakota. Learn more at anchorage.com , on X @Anchorage , and on LinkedIn

Modern Treasury Frequently Asked Questions (FAQ)

When was Modern Treasury founded?

Modern Treasury was founded in 2018.

Where is Modern Treasury's headquarters?

Modern Treasury's headquarters is located at 315 Montgomery Street, San Francisco.

What is Modern Treasury's latest funding round?

Modern Treasury's latest funding round is Series C - II.

How much did Modern Treasury raise?

Modern Treasury raised a total of $183.12M.

Who are the investors of Modern Treasury?

Investors of Modern Treasury include Benchmark, Altimeter Capital, Quiet Capital, NewView Capital, Artisanal Ventures and 12 more.

Who are Modern Treasury's competitors?

Competitors of Modern Treasury include FinanceKey, Numeral, DirecFunds, Astra, Radar and 7 more.

What products does Modern Treasury offer?

Modern Treasury's products include Payments and 4 more.

Who are Modern Treasury's customers?

Customers of Modern Treasury include Pipe, Settle and Trip Actions.

Loading...

Compare Modern Treasury to Competitors

Dwolla operates within the financial services sector. The company provides a platform for businesses to integrate bank transfer technology into their systems, facilitating payment methods such as standard Automated Clearing House (ACH), same day ACH, and instant payments. Dwolla's services are used in industries like insurance, lending, real estate, manufacturing, and healthcare. It was founded in 2008 and is based in Des Moines, Iowa.

Moov provides a payment processing platform that enables money movement within the financial technology sector. The company offers services that allow businesses to accept, store, send, and spend money through one platform, focusing on financial transactions. It serves sectors such as digital banking, construction, fundraising, loan servicing, small businesses, and transport. It was founded in 2018 and is based in Cedar Falls, Iowa.

Sila operates as a financial technology company that focuses on providing a payment platform. The company offers a range of services including fast money transfers, identity verification, fraud prevention, and bank account linking. Its services are primarily targeted towards the fintech industry. It was founded in 2018 and is based in Portland, Oregon.

Trice specializes in off-core infrastructure and payment orchestration for account-to-account transfers within the financial services sector. The company offers a suite of APIs and a payment gateway to facilitate funding, settlement, and reporting for banks, fintechs, and other financial institutions. Trice's solutions are intended to support various real-time payments use cases across sectors including neo-banking, digital wallets, investing platforms, remittance services, banking-as-a-service, gaming, and payment service providers. It was founded in 2022 and is based in Austin, Texas.

VoPay is a fintech company that operates within the financial technology sector. The company provides a platform that allows businesses to integrate payments and financial services into their core operations through a scalable API. VoPay's main offerings include payments-as-a-service, compliance-as-a-service, and treasury-as-a-service. It was founded in 2014 and is based in Vancouver, British Columbia.

Alviere provides an embedded finance platform within the financial services industry. The company offers financial products, including accounts, payments, card issuance, and global money transfers, which can be integrated into existing business offerings. Alviere serves sectors such as retail, travel and hospitality, marketplaces, and financial services. It was founded in 2020 and is based in Denver, Colorado.

Loading...